Direct Attach Cable Market Size & Trends:

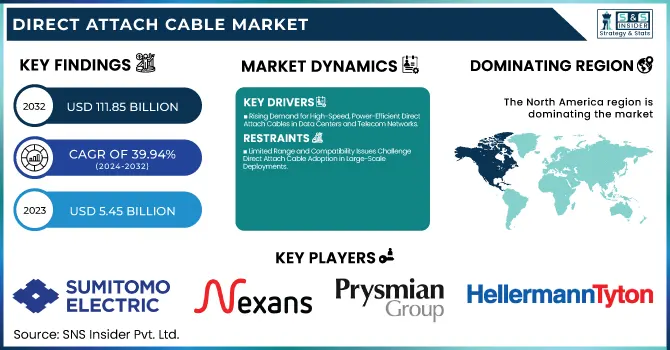

The Direct Attach Cable Market was valued at USD 7.63 billion in 2024 and is expected to reach USD 112.17 billion by 2032, growing at a CAGR of 39.94% from 2025-2032.

To Get more information on Direct Attach Cable Market - Request Free Sample Report

The Direct Attach Cable Market is driven by the increased adoption from end-user segments including data centers, telecom, and HPC environments where high-speed, low-latency connectivity is essential for operations. Adopting 400G-800G DAC, Progressing in the QSFP, CFP, and 800G DAC Segment Customer-wise segmentation is majorly led by large enterprises and cloud service providers who require extensive networking expansion.

Networking and telecommunications provide the most revenue again, driven by growing 5G and cloud infrastructure investments. Hyperscale data centers and AI-driven computing environments are where DAC adoption is poised to drive the next chapter in the evolution of the industry as energy efficiency and cost-effectiveness become key considerations in any new technology.

Market Size and Forecast

-

Market Size in 2024: USD 7.63 Billion

-

Market Size by 2032: USD 112.17 Billion

-

CAGR: 39.94% from 2025 to 2032

-

Base Year: 2024

-

Forecast Period: 2025–2032

-

Historical Data: 2021–2023

Direct Attach Cable Market Trends

-

Rising demand for high-speed data transmission in data centers and telecom networks is driving the direct attach cable (DAC) market.

-

Adoption in cloud computing, high-performance computing, and enterprise networking is boosting growth.

-

Expansion of 10G, 25G, 40G, 50G, and 100G network infrastructures is fueling cable deployment.

-

Advancements in copper and active optical DAC technologies are enhancing signal integrity and energy efficiency.

-

Increasing focus on low-latency, cost-effective, and scalable interconnect solutions is shaping market trends.

-

Growth of hyperscale data centers and edge computing infrastructure is accelerating adoption.

-

Collaborations between cable manufacturers, networking solution providers, and data center operators are driving innovation and deployment.

Direct Attach Cable Market Growth Drivers:

-

Rising Demand for High-Speed, Power-Efficient Direct Attach Cables in Data Centers and Telecom Networks

Increasing demand for high-speed data transmission in various applications such as networking, cloud computing, and telecommunication is expected to drive the growth of the Direct Attach Cable (DAC) market. Hyperscale data center growth: Hyperscale data centers are growing exponentially alongside the growth of 5G networks, both of which help drive demand for fiber. DAC adoption continues accelerating as enterprises modernize their network infrastructure to power AI, IoT, and big data applications. Moreover, when compared to optical transceivers, DACs are more economical and power efficient, making DACs attractive solutions for short-distance interconnects in data center applications. Free-Space Optics (FSO) comes under the category of high-capacity, long-distance secure transmission technology. High-performance computing (HPC) and cloud-based services have also increased demand for high-bandwidth, low-latency interconnects, which propelled demand growth.

Direct Attach Cable Market Restraints:

-

Limited Range and Compatibility Issues Challenge Direct Attach Cable Adoption in Large-Scale Deployments

An important challenge facing the DAC market is that transmission distance is very limited compared to optical fiber solutions. DACs have a limited range of only meters, but if the distance is small enough, DACs can be used efficiently for short-range interconnects. This is a limitation for large-scale data centers and telecom deployments that require high-speed connectivity over long distances. The fact that different DAC types and networking equipment from different vendors may not be compatible presents integration headaches for enterprises as they either have to purchase vendor-specific solutions or spend a fortune on adaptors.

Direct Attach Cable Market Opportunities:

-

Next-Generation Direct Attach Cables Drive Growth with AI Networking Edge Computing and High-Speed Connectivity

The category includes technological progress, such as the creation of new-generation DACs (400G & 800G) to deal with growing bandwidth requirements. Widespread acceptance of CFP and QSFP-based DACs in next-generation telecom and networking applications offers tremendous growth opportunities. Additionally, the overlapping of DACs with new applications such as AI-based networking and the trends toward edge computing and consumer electronics open up new sectors for market penetration. The rapid pace of economic and social transition and the continued efforts to achieve high-performance and energy-efficient connectivity solutions will further boost market growth.

Direct Attach Cable Market Challenges:

-

Direct Attach Cables Face Challenges from Optical Fiber Adoption Thermal Management and Regulatory Compliance

The other big problem is that everything is moving to optical fiber solutions and ever-faster raw data transmission. As 400G and 800G, high-speed networking emerges, fiber-based interconnects become more favorable due to their capable distance and data rates. In addition to this, faster DACs need to manage thermal dissipation and signal integrity within high-density environments, otherwise they experience compromised performance. In addition, the DAC market is also limited by end-use standards and regulatory compliance, as DAC manufacturers must deploy DACs based on stringent technical and environmental regulations.

Direct Attach Cable Market Segment Analysis

By Type, Active Optical Cables (AOCs) dominate the market, while Direct Attach Copper (DAC) cables are projected to grow fastest

In 2024, the Active Optical Cable managed to dominate the market with a share of 53.2% due to the better performance of this superior mode of data transmission, at high speed and over higher distances. AOCs find wider usage in data centers, high-performance computing (HPC), and telecommunications owing to their reduced electromagnetic interference (EMI) levels and support for high-bandwidth applications. Cloud computing, artificial intelligence (AI), and 5G networks are growing increasingly, and thus the ambitious implementation of IT infrastructures supporting cloud computing and AI continues to expand, creating a demand for today`s agile data centers that utilize AOCs for effective high-speed connectivity. Their lightweight, flexible design also makes them perfect for high-density cabling conditions, which further optimizes network scalability and performance.

Direct Attach Copper (DAC) cables are projected to register the highest CAGR over the forecast period (2025- 2032) due to high cost-effectiveness, lesser demand for electrical power, and high reliability for short-distance interconnects. DACs are also in demand among operators looking for energy-efficient solutions because DACs passively do not require any energy to run additional power functions, making them more attractive. Meanwhile, the increasing adoption of high-speed networking like 400G and 800G Ethernet is providing a good market for next-gen DACs as well, which have become the ideal interface for short-range applications in both enterprise and cloud domains.

By Form Factor, QSFP leads the DAC market, with CFP expected to register the fastest growth

QSFP led the DAC market in 2024 with a market share of around 38.6%, due to the large adoption of QSFP DACs in data centers, cloud, and high-speed networking applications. Ideal for high-density environments, QSFP-based DACs are the first choices due to their ability to drive data at high transfer rates, their tiny size, and low power consumption. Another factor that has helped Notebook QSFP to gain traction is that hyperscale data centers are increasingly demanding 100G, 200G, and 400G Ethernet solutions and QSFP supports multiple lanes for high bandwidth applications. The fact that it is capable of supporting optical and copper interconnects further enhances its versatility when dealing with the network infrastructures of the day.

CFP is expected to be the fastest-growing segment in terms of CAGR during the forecast period, owing to the rising demand for super ultra-high-speed data transmission in telecommunications and cloud networking. CFP-based DACs are emerging as a solution to enable high-speed optical interconnects when providers upgrade to 400G and beyond capabilities on their networks. The scalability and performance benefits of CFP will make it a mainstay in next-generation data centers and telecom networks, especially as 5G networks and edge computing proliferate.

By End Use, Telecommunication holds the largest DAC market share, whereas High-Performance Computing (HPC) centers are anticipated to grow fastest

The telecommunication sector held the largest share of 38.8% in the direct attach cable (DAC) market in 2024 with the rapid deployment of 5G networks, fiber-optic, and high-speed broadband infrastructure. Growing demand for high bandwidth connectivity for video streaming, IoT, and cloud-oriented applications has boosted the deployment of DAC for telecom networks. With telecom providers enhancing their infrastructure to enable higher data rates and lower latency, DACs are employed in data centers, central offices, and base stations for short-distance and high-speed interconnects. In addition, the increasing importance of software-defined networking (SDN) and network function virtualization (NFV) is creating the demand for high-bandwidth connectivity solutions with the highest scalability and lowest power consumption, intensifying the adoption of DAC in telecommunication applications.

The high-performance computing centers (HPC) are anticipated to register the fastest CAGR over the forecast period from 2025-2032, due to the rising demand for artificial intelligence (AI), big data analytics, and scientific research applications. DACs have become vital for providing high-speed interconnects between computing nodes, as HPC workloads demand ultra-fast, low-latency data transmission. The growth of exascale computing and next-generation supercomputers is accelerating investment in high-speed networking solutions such as 400G and 800G DACs. HPCs will remain an important DAC growth area with the rise of AI-driven simulations and mesh & machine learning-based workloads.

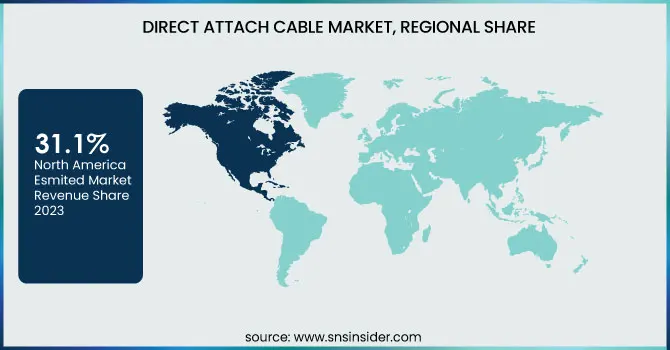

Direct Attach Cable Market Regional Analysis

North America Direct Attach Cable Market Insights

North America accounted for the largest share of 31.1% in the Direct Attach Cable (DAC) market in 2024, attributable to the presence of large-scale data centers, cloud service providers, and sophisticated telecom infrastructure in the region. High penetration of AI, big data, and IoT in the region has resulted in rising demand for high-speed and low-latency connectivity solutions. DAC has also continued to be driven by the constant expansion of the data centers of companies such as AWS, Microsoft Azure, and Google Cloud for high-speed interconnects. Moreover, telecommunication behemoths such as AT&T and Verizon have expedited their networks, boosting demand for DACs in networking applications. This is another factor fueling the interest in next-generation DAC technologies in North America, where investments in energy-efficient and high-performance computing solutions are increasing as well.

Asia Pacific Direct Attach Cable Market Insights

Asia-Pacific region is likely to witness maximum CAGR over upcoming years from 2025 to 2032 on account of the rapid growth of data centers, increasing internet penetration, and government initiatives in digital transformation. Extreme DAC demand is being fuelled by large cloud infrastructure investments in the DAC space by countries such as China, Japan, and India from giants like Alibaba Cloud, Tencent, and Reliance Jio. Moreover, the types of 5G network rollouts being made by China Mobile, NTT (Japan), and Bharti Airtel (India) will further accelerate the demand for high-speed connectivity solutions. DAC adoption in Asia-Pacific will be further accelerated with the growth of AI, smart cities, and edge computing in the region.

Europe Direct Attach Cable Market Insights

Europe holds a significant position in the Direct Attach Cable (DAC) market, driven by rapid data center expansion, growing cloud adoption, and high-speed connectivity demand. The region’s focus on 5G deployment, AI, and IoT applications is fueling DAC adoption. Key investments in hyperscale and enterprise data centers, along with strong presence of major network equipment manufacturers, are supporting market growth and technological advancements across Europe.

Middle East & Africa and Latin America Direct Attach Cable Market Insights

The Middle East & Africa and Latin America DAC markets are witnessing steady growth due to increasing data center investments, expanding IT infrastructure, and rising cloud adoption. Demand for high-speed connectivity, network modernization, and support for digital transformation initiatives is driving market expansion. Additionally, government-led smart city projects and telecom upgrades in these regions are boosting the deployment of Direct Attach Cables, fostering improved network efficiency and scalability.

Get Customized Report as per Your Business Requirement - Enquiry Now

Direct Attach Cable Market Competitive Landscape:

Sumitomo Electric Industries, Ltd.

Sumitomo Electric, founded in 1897 and headquartered in Osaka, Japan, is a global leader in advanced materials, power transmission, and electrical equipment. The company specializes in high-voltage cables, optical fibers, and automotive systems, supporting energy infrastructure and industrial applications worldwide. Sumitomo Electric emphasizes innovation in HVDC and renewable energy technologies, contributing to global energy transition efforts while expanding production capacity and technological capabilities to meet growing demand for sustainable power transmission solutions.

-

June 2024: Sumitomo Electric acquired a 90% stake in Germany’s Südkabel to enhance HVDC cable production and support Germany’s energy transition initiatives.

Nexans S.A.

Nexans, founded in 1897 and headquartered in Paris, France, is a global leader in cable technologies for power, telecom, and industrial applications. The company focuses on high-voltage, subsea, and offshore cables that enable renewable energy integration and grid modernization. Nexans invests in large-scale energy projects, innovative cable solutions, and partnerships with transmission operators to facilitate reliable and sustainable electricity delivery, supporting the transition to low-carbon energy systems and strengthening infrastructure for wind, solar, and hybrid networks worldwide.

-

January 2025: Nexans secured a EUR 1 billion project with TenneT to deliver the LanWin2 offshore grid connection, transmitting 2 GW of wind energy, with commissioning planned for 2030.

Key Players

Some of the major players in the Direct Attach Cable Market are:

-

Nexans

-

HellermannTyton

-

Molex

-

TE Connectivity

-

Cisco Systems

-

Arista Networks

-

Finisar Corporation

-

Intel Corporation

-

Brocade Communications Systems

-

Juniper Networks

-

Dell Technologies

-

Hewlett Packard Enterprise (HPE)

-

Volex

-

Legrand

-

Tripp Lite (Eaton)

-

ENET Solutions

-

Edgeium

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 7.63 Billion |

| Market Size by 2032 | USD 112.17 Billion |

| CAGR | CAGR of 39.94% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Direct Attach Copper Cable, Active Optical Cable) • By Form Factor (SFP, QSFP, CXP, Cx4, CFP, CDFP) • By End Use (Networking, Telecommunications, Data Storage, High Performance Computing Centers (HPCs), Others (Consumer Electronics)) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Sumitomo Electric Industries, Nexans, Prysmian Group, HellermannTyton, Amphenol Corporation, Molex, TE Connectivity, Cisco Systems, Arista Networks, Finisar Corporation, Intel Corporation, Brocade Communications Systems, Juniper Networks, Dell Technologies, Hewlett Packard Enterprise (HPE). |