Microwave Devices Market Size:

Get more information on Microwave Devices Market - Request Sample Report

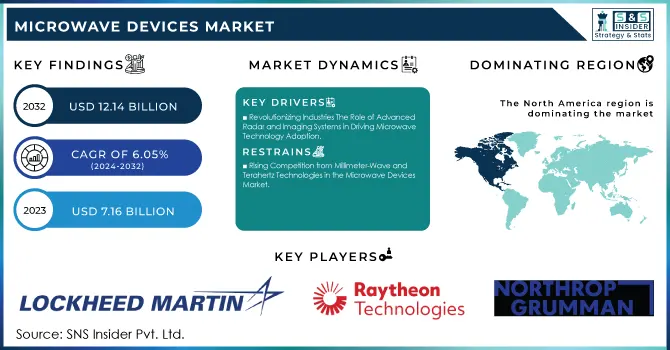

The Microwave Devices Market Size was valued at USD 7.16 billion in 2023 and is expected to reach USD 12.14 billion by 2032 and grow at a CAGR of 6.05% over the forecast period 2024-2032.

The microwave devices market is experiencing remarkable growth, driven by advancements in semiconductors, RF amplifiers, and integrated circuits. These technological improvements have enhanced the performance, reliability, and efficiency of microwave technologies, making them indispensable in industries such as telecommunications, defense, aerospace, and healthcare. The rapid evolution of 5G networks and satellite communication systems has further fueled the demand for high-frequency microwave devices, necessitating greater bandwidth, reduced latency, and improved data transmission capabilities. Advanced manufacturing innovations, such as Ku-band broadband power amplifier monolithic microwave integrated circuits and dual-broadband antennas, reflect the industry’s focus on compact, energy-efficient solutions tailored to modern technological requirements.For example, a Ku-band broadband power amplifier microwave monolithic integrated circuit, sized at 3.3 × 1.2 mm² and based on 0.15 µm GaAs pHEMT technology, delivers a peak power of 30.8 dBm at 16 GHz, with over 30 dBm output power and efficiency exceeding 30% across 15–17.5 GHz.

Similarly, a single-port planar dual-broadband antenna designed for mobile communication bands (0.64–1 GHz and 1.59–2.82 GHz) achieves gains of 1 and 2.2 dB, respectively, addressing the demand for compact and high-performance solutions. Emerging technologies, such as programmable multi-functional meta surfaces for microwave imaging and sensing at 6.2 GHz, and textile HMSIC antennas with bandwidth-enhanced polarization reconfigurability, highlight the versatility of microwave applications across telecommunications, healthcare, and defense. These innovations enable advanced communication, non-invasive medical diagnostics, and enhanced radar systems.

Microwave Devices Market Dynamics

Drivers

-

Revolutionizing Industries The Role of Advanced Radar and Imaging Systems in Driving Microwave Technology Adoption

The microwave devices market is experiencing substantial growth, largely driven by the increasing demand for advanced radar and imaging systems. These systems are crucial in sectors such as automotive, weather forecasting, and remote sensing, where they enhance performance, safety, and accuracy. In the automotive industry, radar systems are pivotal for advanced driver-assistance systems and autonomous vehicles, where they provide high-precision data for features like collision avoidance, adaptive cruise control, and parking assistance. As the automotive industry continues to shift towards autonomous vehicles, the need for more sophisticated radar systems is escalating, leading to higher demand for microwave technologies. In weather forecasting, microwave radar systems, such as dual-polarization Doppler radar, are essential for providing accurate weather data. These systems allow for real-time monitoring of precipitation, wind speeds, and storm intensity, aiding in more precise forecasting and disaster management. The ability to detect severe weather patterns and predict natural disasters is increasingly critical, especially as climate change intensifies extreme weather events. Microwave devices, with their ability to operate effectively in harsh conditions, make them indispensable for modern meteorological applications. Similarly, in remote sensing, technologies like Synthetic Aperture Radar provide high-resolution images of the Earth's surface, enabling critical applications such as environmental monitoring, military surveillance, and resource management. The microwave devices used in SAR systems allow for all-weather, day-and-night imaging, making them crucial for global monitoring efforts. As these industries continue to prioritize accuracy, reliability, and real-time data, the demand for advanced microwave devices is set to rise, driving significant market growth. This trend highlights the expanding role of microwave technologies in shaping the future of radar and imaging systems across multiple sectors.

Restraints

-

Rising Competition from Millimeter-Wave and Terahertz Technologies in the Microwave Devices Market

The microwave devices market is increasingly facing competition from millimeter-wave and terahertz technologies, which are gaining traction in high-performance communication, sensing, and imaging applications. MMW technology, operating between 30 GHz and 300 GHz, offers higher bandwidth and faster data transmission speeds compared to traditional microwave devices, which typically operate below 30 GHz. MMW systems are ideal for ultra-fast communication, such as 5G and autonomous vehicle sensors, providing enhanced performance in densely populated areas where spectrum is limited. MMW is being integrated into radar and imaging systems, further driving its adoption. Similarly, THz technology, operating between 100 GHz and 10 THz, delivers exceptional bandwidth, enabling ultra-high-speed data transfer with minimal interference. THz devices are especially promising for applications in medical imaging, security scanning, and high-resolution imaging, offering advantages over traditional microwave systems in terms of resolution and non-invasive diagnostics.

Both MMW and THz technologies provide key benefits such as higher data transfer rates, greater bandwidth, and superior imaging resolution, making them attractive for next-generation applications. In comparison, microwave devices struggle with issues like signal attenuation over long distances and bandwidth limitations. As MMW and THz technologies continue to evolve, they present a challenge to the microwave devices market, particularly in sectors like telecommunications, automotive, and healthcare. The growing adoption of these alternatives may reduce reliance on microwave technologies, potentially limiting the market share of traditional microwave devices.

Microwave Devices Market Segment Outlook

by Band Frequency

In 2023, the Ka-band segment dominated the microwave devices market, capturing 39% of the total revenue. Operating in the frequency range of 26.5 GHz to 40 GHz, Ka-band is highly favored for its ability to deliver high-speed data transmission and increased bandwidth, making it ideal for advanced communication applications. This band is particularly crucial in satellite communications, providing high-throughput for broadband services, including direct-to-home (DTH) television, internet access, and military communications. The Ka-band's higher frequency allows for smaller antennas and greater data capacity, making it highly efficient for modern communication needs. It’s growing adoption in 5G networks, aerospace, and defense applications further cements its position as a key segment in the microwave devices market.

by Application

In 2023, the Communication segment held the largest share of the microwave devices market, accounting for 55% of the total revenue. This dominance is driven by the increasing demand for high-speed, reliable communication systems across various industries. Microwave devices play a crucial role in satellite communications, mobile networks, and broadband systems, offering high-frequency signals that enable faster data transmission over long distances. The rise of 5G networks, which require advanced microwave technologies for low-latency and high-bandwidth performance, has further propelled growth in this segment. Additionally, microwave devices are essential in military and defense communication systems, where secure and uninterrupted communication is paramount. As global connectivity continues to expand, the communication segment is expected to remain the largest contributor to the microwave devices market.

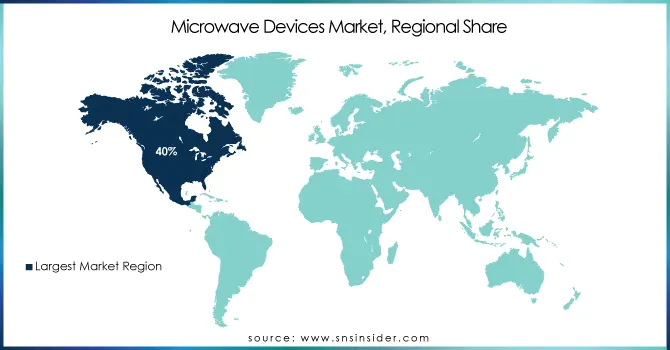

Microwave Devices Market Regional Analysis

In 2023, North America dominated the microwave devices market, accounting for approximately 40% of the total revenue. This region's leadership can be attributed to several factors, including advanced technological infrastructure, significant investments in research and development, and the presence of major players in the telecommunications, defense, and aerospace sectors. The rapid adoption of 5G networks and the increasing demand for high-speed communication systems have driven the demand for microwave devices in North America. Additionally, the defense industry’s reliance on microwave technologies for radar, surveillance, and secure communication systems has bolstered market growth. Government initiatives and defense spending further support the demand for advanced microwave devices, particularly in satellite communication and radar systems. With continuous innovations and strong industrial growth, North America is expected to maintain its leading position in the microwave devices market.

Asia-Pacific is poised to be the fastest-growing region in the microwave devices market during the forecast period from 2024 to 2032. This rapid growth is driven by the increasing demand for advanced communication systems, the expansion of 5G networks, and a rising focus on defense and aerospace applications. Countries like China, Japan, and India are leading the adoption of microwave technologies, fueled by substantial investments in infrastructure, telecommunications, and government defense projects. The region is also experiencing a surge in satellite communication systems, automotive radar technologies, and consumer electronics, further contributing to market expansion. With a growing emphasis on innovation, the proliferation of smart devices, and increasing applications in healthcare and environmental monitoring. Asia-Pacific is expected to see a significant rise in demand for high-performance microwave devices. The region's strong manufacturing capabilities and cost-effective production further enhance its position as a key player in the global market.

Get Customized Report as per your Business Requirement - Request For Customized Report

Key Players

Some of the major key players with their product:

-

Lockheed Martin (Radar Systems, Satellite Communication Systems)

-

Raytheon Technologies (Radar Systems, Communications Satellites, Microwave Amplifiers)

-

Northrop Grumman (Microwave Radar, Communication Systems)

-

Thales Group (Satellite Communication Equipment, Radar Systems)

-

General Dynamics (Military Communications, Electronic Warfare Systems)

-

Huawei Technologies (5G Microwave Communication Equipment)

-

Samsung Electronics (Microwave Communication Equipment, Mobile Communication Systems)

-

STMicroelectronics (Microwave Semiconductors, Power Amplifiers)

-

Broadcom Inc. (Microwave Chips, Communication Devices)

-

Qorvo Inc. (Microwave Components, RF Power Amplifiers)

-

NXP Semiconductors (RF Amplifiers, Microwave Semiconductor Devices)

-

Analog Devices (Microwave Integrated Circuits, Communication Chips)

-

CommScope (Microwave Antennas, Wireless Communication Systems)

-

Viasat Inc. (Satellite Communication Systems, Broadband Services)

-

Teledyne Technologies (Microwave Instrumentation, Satellite Communication)

-

L3Harris Technologies (Microwave Communication Systems, Radar)

-

Rohde & Schwarz (RF Test Equipment, Satellite Communication Devices)

-

Cisco Systems (Microwave Communication Systems, Networking Equipment)

-

Ericsson (5G Network Solutions, Microwave Communication Devices)

-

Toshiba Corporation (Microwave Devices, Satellite Systems)

List of key suppliers provide a variety of microwave components such as semiconductors, RF amplifiers, microwave integrated circuits, antennas, and test equipment used in applications ranging from telecommunications to defense and medical devices.

-

Analog Devices

-

Broadcom Inc.

-

Qorvo Inc.

-

NXP Semiconductors

-

STMicroelectronics

-

Microchip Technology

-

TE Connectivity

-

Keysight Technologies

-

Rohde & Schwarz

-

M/A-COM Technology Solutions

-

Skyworks Solutions

-

Infineon Technologies

-

Toshiba Corporation

-

EPCOS (a TDK Group Company)

-

Macom Technology Solutions

-

Vishay Intertechnology

-

Toshiba Semiconductor & Storage

-

L3Harris Technologies

-

IHP Microelectronics

-

Comtech Telecommunications Corp.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 2.45 Billion |

| Market Size by 2032 | USD 13.82 Billion |

| CAGR | CAGR of 21.29%From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Near-To-Eye, Projection, Others) • By Technology (Liquid Crystal Display (LCD), Organic Light-emitting Diode (OLED), Digital Light Processing (DLP), Liquid Crystal on Silicon (LCoS)) • By Application (Consumer Electronics, Military & Defense, Medical Applications, Industrial Systems, Automotive, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia-Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia-Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Sony Corporation, LG Display, eMagin Corporation, , Himax Technologies, AU Optronics, Seiko Epson Corporation, Syndiant, MicroVision, Texas Instruments, Panasonic Corporation, Universal Display Corporation, Oculus VR, Vuzix Corporation, Google LLC, Apple Inc., Samsung Electronics, Microchip Technology Inc., Nikon Corporation, Sharp Corporation. |

| Key Drivers | • Augmented Reality in Automotive Driving Demand for Microdisplay. |

| RESTRAINTS | • Supply Chain Challenges in the Microdisplay Market Impacting Component Shortages and Rising Production Costs on Growth. |