Tantalum Capacitors Market Report Scope and Overview:

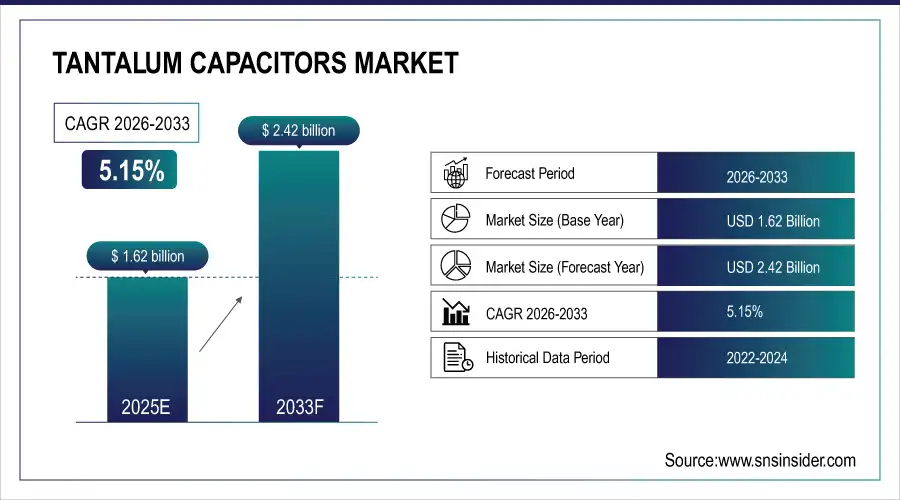

The Tantalum Capacitors Market size was valued at USD 1.62 Billion in 2025E and is expected to reach USD 2.42 Billion by 2033, growing at a CAGR of 5.15% over the forecast period of 2026-2033.

The tantalum capacitors market is experiencing significant changes as demand continues to rise in the telecommunication, automotive electronics, medical devices, and defense markets. There are both commercial, technical, and government initiatives related to tantalum capacitors that are responding to the shift toward high performance, miniaturized, and reliable new technologies, such as polymer tantalum and surface-mount capacitors. At the same time, supply chains are evolving to meet demand under the latest pressures surrounding the availability of raw materials, processing efficiency, and sustainability. Market stakeholders are collectively improving recycling, optimizing value added usage of materials, and evolving advanced manufacturing capabilities to lessen their reliance on primary raw material resources. The industry's competitive and technological advancements are facilitating changes that will lead to a more resilient and efficient ecosystem capable of supporting next-generation electronic devices around the world.

In 2023, the U.S. tantalum market saw key shifts as exports increased by 3%, scrap imports surged 24%, and ore prices declined by 8% to USD 190/kg Ta₂O₅. Additionally, in October, the U.S. strengthened export controls under revised EAR regulations, tightening restrictions on semiconductor manufacturing technologies and expanding oversight on technology transfers to countries like China.

Tantalum Capacitors Market Size and Forecast:

-

Market Size in 2025E: USD 1.62 Billion

-

Market Size by 2033: USD 2.42 Billion

-

CAGR: 5.15% from 2026 to 2033

-

Base Year: 2025E

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get More Information On Tantalum Capacitors Market - Request Free Sample Report

Tantalum Capacitors Market Highlights:

-

Strong demand for high‑reliability electronics is driven by growth in smartphones, EVs, aerospace, medical devices, and 5G/AI infrastructure, with tantalum capacitors providing high capacitance, thermal stability, and reliability in compact designs

-

Technological innovation by companies like Panasonic Industry is expanding applications with ultra‑low profile conductive polymer tantalum capacitors for power delivery in USB‑C and other high-performance systems

-

Price increases reflect supply and demand imbalances as major manufacturers such as Panasonic and KEMET raise tantalum capacitor prices due to raw material cost pressure and rising demand from AI servers and data centers

-

Miniaturization and surface‑mount trends are growing rapidly with OEMs seeking compact, high-performance passive components for consumer electronics, automotive infotainment, and telecommunications

-

Supply chain focus and sustainability opportunities are creating advantages through ethical sourcing, advanced recycling technologies, and reduced dependency on volatile regions, supporting circular economy goals

-

Market expansion in key application sectors is driven by consumer electronics, automotive electrification, industrial automation, and medical electronics, boosting demand for high-performance tantalum capacitors across diverse applications

The U.S Tantalum Capacitors Market size was valued at USD 0.31 Billion in 2025E and is expected to reach USD 0.44 Billion by 2033 and grow at a CAGR of 4.39% over the forecast period 2026-2033, driven by increasing demand for high-reliability components in aerospace, defense, and medical electronics. Advancements in miniaturization and the expanding adoption of polymer and surface-mount technologies are further accelerating market growth. Additionally, the rise in electric vehicles and 5G infrastructure is boosting the need for efficient, compact capacitor solutions.

Tantalum Capacitors Market Drivers:

-

Growing Demand for High-Reliability Electronics Drives Surge in Tantalum Capacitor Adoption Across Critical Industries

The rising demand for compact, high-performance electronic devices across sectors such as automotive, aerospace, medical, and telecommunications is driving growth in the tantalum capacitors market. As electronic systems become more complex and functionality increases, there is a growing need for capacitors that offer high capacitance, stability, and reliability under demanding conditions. Tantalum capacitors meet these requirements, making them ideal for applications in ADAS, EVs, 5G infrastructure, and medical implants. Their ability to operate at high temperatures with consistent performance is a critical factor behind their adoption. Additionally, the expansion of connected devices and IoT ecosystems is increasing the demand for advanced passive components, further accelerating the uptake of tantalum capacitors in next-generation electronic architectures.

As of May 13, 2025, The Telegraph reported Russia needs 4.5 tons of high-quality tantalum to meet near-term arms production but holds just over 2 tons in stock. Sanctions have reduced monthly supply to below the required 770 kg (1,700 lbs). Previously reliant on imports from Kazakhstan, Russia now struggles with low-quality supply from China, while dual-use components from non-sanctioned nations remain slow and costly.

Tantalum Capacitors Market Restraints:

-

Competitive Alternatives Undermine Tantalum Capacitor Demand in Cost-Sensitive Applications

The widespread availability of ceramic and aluminum capacitors poses a significant restraint to the growth of the tantalum capacitors market. These alternatives are not only more affordable but are also easier to source and integrate into a broad range of consumer and industrial electronics. In applications where extreme stability, high capacitance, or compact form factors are not critical, manufacturers often prefer ceramic or aluminum capacitors due to their cost-effectiveness and supply reliability. Moreover, continuous improvements in ceramic capacitor technology are narrowing the performance gap, further reducing the need for tantalum-based components in many sectors. As a result, the demand for tantalum capacitors faces pressure, particularly in price-sensitive or high-volume manufacturing environments.

On June 9, 2025, researchers at West Virginia University developed a microwave-based method to recycle tantalum capacitors with over 97% purity, offering a cleaner and energy-efficient alternative to traditional e-waste processing. Funded by DARPA, this innovation supports U.S. efforts to secure critical materials and reduce reliance on foreign tantalum sources.

Tantalum Capacitors Market Opportunities:

-

Sustainable Recovery Solutions Pave the Way for Tantalum Capacitor Market Expansion

A major opportunity in the tantalum capacitors market lies in the advancement of eco-efficient and cost-effective recovery methods. As demand for tantalum continues to rise across sectors such as consumer electronics, aerospace, and defense, industries are actively exploring new ways to reclaim this high-value metal from discarded devices. The ability to extract high-purity tantalum from electronic waste enhances material availability and reduces dependency on volatile global supply chains. This shift not only supports circular economy goals but also attracts investment in advanced recycling infrastructure. Companies that integrate sustainable recovery processes into their supply chains can gain a competitive edge, improve profit margins, and ensure consistent supply to meet the growing demand for high-performance capacitors in space-constrained, high-end applications.

On June 9, 2025, researchers at West Virginia University developed a microwave-based method to recycle tantalum capacitors with over 97% purity, offering a cleaner and energy-efficient alternative to traditional e-waste processing. Funded by DARPA, this innovation supports U.S. efforts to secure critical materials and reduce reliance on foreign tantalum sources.

Tantalum Capacitors Market Segment Analysis:

By Type

In 2025E, the Solid Tantalum Capacitors segment holds the largest Tantalum Capacitors market share of around 47%, driven by their proven reliability, long operational life, and stable electrical performance under harsh conditions, making them essential in defense systems, medical devices, aerospace applications, and industrial equipment where durability and precision are critical.

The Polymer Tantalum Capacitors segment is projected to witness the fastest growth in the Tantalum Capacitors market from 2026 to 2033, registering a CAGR of 7.73%, fueled by rising demand for compact, high-performance, and low-ESR components in consumer electronics, automotive infotainment systems, and telecommunications. Their enhanced safety features and stability under high ripple currents further boost their adoption across emerging electronic applications.

By Mounting

In 2025E, the Surface Mount segment holds the largest Tantalum Capacitors market share of around 64% is projected to witness the fastest growth in the Tantalum Capacitors market from 2026 to 2033, registering a CAGR of 6.90%, This growth is primarily driven by the increasing demand for compact, high-performance electronic devices in consumer electronics, automotive systems, and medical equipment. The segment's compatibility with surface-mount technology (SMT) and automated assembly lines further boosts its adoption, enabling higher efficiency, reduced production costs, and improved design flexibility for manufacturers.

By Application

In 2025E, the Consumer Electronics segment holds the largest Tantalum Capacitors market share of around 28%, driven by the growing demand for smartphones, tablets, laptops, and wearable devices. The need for compact, energy-efficient, and durable components in high-performance consumer gadgets fuels the adoption of tantalum capacitors due to their stability, reliability, and long lifecycle, supporting sustained market growth.

The Automotive segment is projected to witness the fastest growth in the Tantalum Capacitors market from 2026 to 2033, registering a CAGR of 10.68%, driven by the rising adoption of advanced driver-assistance systems (ADAS), electric vehicles (EVs), and in-vehicle infotainment systems. Tantalum capacitors are increasingly favored in automotive electronics for their stability under extreme conditions, compact size, and high reliability, making them ideal for mission-critical applications in safety, powertrain, and communication modules.

Tantalum Capacitors Market Regional Analysis:

Asia-Pacific Tantalum Capacitors Market Trends:

Asia-Pacific dominated the tantalum capacitors market with a 36% share in 2025E and is expected to witness the fastest growth through 2033 at a CAGR of 7.69%. The region’s growth is primarily driven by the rapid expansion of the consumer electronics and automotive sectors, rising demand for compact and high-performance electronic components, and robust government support for semiconductor manufacturing. Additionally, increased investments in 5G infrastructure, EVs, and industrial automation are further accelerating the adoption of tantalum capacitors across the region.

Get Customized Report as Per Your Business Requirement - Enquiry Now

North America Tantalum Capacitors Market Trends:

North America is experiencing steady growth in the tantalum capacitors market, projected to register a CAGR of 5.83% during 2026–2033. This growth is driven by rising demand across aerospace, military, and medical sectors where high reliability and miniaturized electronics are essential. Increasing R&D investments and government focus on securing critical materials further support market expansion in the region.

Europe Tantalum Capacitors Market Trends:

In 2025E, Europe emerged as a promising region in the tantalum capacitors market, supported by growing demand in automotive electronics, industrial automation, and renewable energy applications. Rising focus on sustainability, along with investments in domestic manufacturing and recycling capabilities, is further driving regional growth. Technological advancements and regulatory support for energy-efficient components also contribute to Europe's expanding market potential.

Latin America and Middle East & Africa Tantalum Capacitors Market Trends:

Latin America and the Middle East & Africa (MEA) are experiencing steady growth in the tantalum capacitors market, driven by expanding telecommunications infrastructure, increased adoption of consumer electronics, and the gradual shift toward digitalization and smart technologies. Government initiatives to improve connectivity and industrial capabilities, along with rising demand for reliable energy storage solutions, are fostering market development across these emerging regions.

Tantalum Capacitors Market Competitive Landscape:

Samsung Electro-Mechanics, established in 1973 in South Korea, is a leading manufacturer of electronic components, including tantalum capacitors, MLCCs, and camera modules. The company focuses on high-reliability solutions for smartphones, automotive, and industrial applications, combining advanced technology, global R&D, and large-scale production to meet evolving electronics market demands efficiently.

- In May 2024, Samsung Electro-Mechanics has been supplying Apple with both MLCC and tantalum capacitors, enhancing device power stability and performance. Tantalum capacitors complement MLCCs by managing current fluctuations, ensuring long-term voltage stability in advanced electronics.

Panasonic Industry Co., Ltd., established in 1918 in Japan, is a global leader in electronic components, including tantalum capacitors, MLCCs, and sensors. The company provides high-quality, reliable solutions for automotive, industrial, and consumer electronics, leveraging extensive R&D, advanced manufacturing capabilities, and a strong global presence to support innovation and market growth.

- IN Feb 2024, Panasonic Industry begins mass production of the industry's first high-capacitance conductive polymer hybrid aluminum capacitors rated for 135°C, targeting EV ECUs. The new ZL series enables compact, heat-resistant designs, supporting increased ECU density and reduced environmental impact.

Tantalum Capacitors Market Key Players:

-

Samsung Electro-Mechanics

-

ROHM Co., Ltd.

-

Panasonic Industry Co., Ltd.

-

KEMET Corporation

-

AVX Corporation

-

Vishay Intertechnology

-

Nichicon Corporation

-

Kyocera Corporation

-

Murata Manufacturing Co., Ltd.

-

TDK Corporation

-

Taiyo Yuden Co., Ltd.

-

NEC Tokin Corporation

-

Rubycon Corporation

-

EPCOS AG

-

Fujitsu Component Limited

-

Hitachi Chemical Co., Ltd.

-

Soshin Electric Co., Ltd.

-

Cornell Dubilier Electronics, Inc.

-

Elna Co., Ltd.

-

United Chemi-Con, Inc.

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 1.62 Billion |

| Market Size by 2033 | USD 2.42 Billion |

| CAGR | CAGR of 5.15% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Solid Tantalum Capacitors, Wet Tantalum Capacitors, Polymer Tantalum Capacitors) • By Mounting (Surface Mount, Leaded/Through-hole) • By Application (Medical Devices, Consumer Electronics, Military & Aerospace, Automotive, Industrial) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Samsung Electro-Mechanics, ROHM Co., Ltd., Panasonic Industry Co., Ltd., KEMET Corporation, AVX Corporation, Vishay Intertechnology, Nichicon Corporation, Kyocera Corporation, Murata Manufacturing Co., Ltd., TDK Corporation, Taiyo Yuden Co., Ltd., NEC Tokin Corporation, Rubycon Corporation, EPCOS AG, Fujitsu Component Limited, Hitachi Chemical Co., Ltd., Soshin Electric Co., Ltd., Cornell Dubilier Electronics, Inc., Elna Co., Ltd., United Chemi-Con, Inc. |