Flash Memory Market Key Insights:

To get more information on Flash Memory Market - Request Free Sample Report

The Flash Memory Market Size was valued at USD 73.33 Billion in 2023 and is expected to grow to USD 107.09 Billion by 2032 and grow at a CAGR of 4.30% over the forecast period of 2024-2032.

The Flash Memory Market is experiencing substantial growth, fueled by the increasing demand for consumer electronics such as smartphones, tablets, laptops, and wearable devices, all of which heavily rely on Flash Memory. The surge in demand is expected to drive NAND and DRAM prices up by up to 60% by 2025 projections indicate a significant uptick in memory demand in 2024, particularly due to AI integration. Companies like Samsung and Kioxia predict that Flash Memory demand will triple by 2028 (New Electronics), and Micron and SK hynix are ramping up production to meet this demand. NAND Flash, widely used in consumer-grade SSDs and memory cards, is becoming increasingly popular due to its speed and reliability. As a nonvolatile memory, Flash Memory erases and rewrites data, making it an essential part of storage solutions. This growth is particularly evident in regions like North America, driven by the U.S., where factors such as the rising adoption of 5G, IoT, and AI technologies are boosting Flash Memory demand. The U.S. is predicted to have more than 195 million 5G subscriptions by 2026, with 5G expected to account for 71.5% of the total U.S. mobile market by 2029. Additionally, 22 million U.S. homes are already using IoT or smart technology, with the smart home market expected to generate USD 23.5 billion in 2023, up from USD 23.2 billion in 2021 (CTA). In the smartphone sector, more than 155 million units were supplied to the U.S. in 2022, reflecting nearly a 1% increase from 2021. As smartphone adoption rises, companies continue to incorporate advanced features and applications, further propelling the Flash Memory Market. The continued evolution of Flash Memory storage in smartphones and other devices will significantly shape the future of the market, with key drivers including low-cost storage solutions and the expanding IoT ecosystem.

Flash Memory Market Dynamics

Drivers

-

The rapid expansion of data centers and the increasing need for high-speed, high-capacity storage solutions are pivotal drivers of the Flash Memory market growth.

As data consumption continues to surge, especially with the integration of AI, IoT, and 5G technologies, the demand for fast, reliable storage solutions like SSDs and flash-based memory becomes more urgent. The shift toward all-flash data centers, championed by industry leaders like Huawei, Cisco, and Micron, underscores the critical role of flash storage in delivering high-performance, energy-efficient operations. Flash memory, especially NAND Flash, enables faster data retrieval and better scalability in data centers, crucial for supporting growing enterprise needs. Advanced memory expansion technologies, such as Compute Express Link (CXL), allow data centers to overcome memory bottlenecks and efficiently manage larger volumes of data. Companies like Pure Storage and SK hynix are developing cutting-edge flash storage solutions to meet the performance demands of next-gen data centers, ensuring higher throughput and improved system performance This highlights the immense influence of DRAM and NAND on the overall semiconductor industry. As AI-driven demand propels the data center market, that the U.S. accounts for about 40% of the global data center market, with substantial growth seen across Latin America, Europe, and Asia-Pacific. The global spending on data center construction is forecasted to hit USD 49 billion, with hyper scale data centers projected to grow 20% annually. Furthermore, demand for AI-ready data center capacity is expected to rise at an average rate of 33% per year between 2023 and 2030, with 70% of total demand for data center capacity by 2030 dedicated to supporting AI workloads. These trends underscore the critical role of flash memory in enabling high capacity, high-performance data storage solutions for next-gen AI and data-intensive applications.

Restraints

-

Addressing Key Performance Limitations in Flash Memory Market Growth with AI and 5G Expansion

Despite substantial progress in flash memory technologies, several key challenges continue to hinder the growth of the market. One significant restraint is the performance limitations of current technologies. While NAND flash memory has made notable advancements, it still faces performance bottlenecks, particularly in high-demand environments like AI-driven data centers. As data volumes continue to surge, driven by AI, 5G, and IoT applications, traditional NAND flash solutions struggle to meet the intense data processing needs required by next-generation applications. These challenges are further amplified by the growing demand for faster data retrieval, lower latency, and higher throughput in modern data infrastructures. Existing flash memory solutions are often inadequate in handling the massive parallel processing and computational power required for AI and 5G workloads. Without advancements in technologies like 3D NAND and Compute Express Link (CXL), flash storage may struggle to scale efficiently for next-gen workloads. Additionally, issues such as limited endurance, caused by wear and tear from frequent write operations, remain a persistent concern in high-performance environments. Market competition is fierce, with major players such as Micron, Samsung, and SK hynix continually pushing innovation. However, the sector’s reliance on NAND technology, which struggles to fully address the computational needs of AI and 5G, places pressure on manufacturers to drive continuous improvements. As demand for AI-driven data centers and 5G infrastructure grows globally, the need for faster, more durable, and efficient memory solutions will spur innovation.

Flash Memory Market Segment Analysis

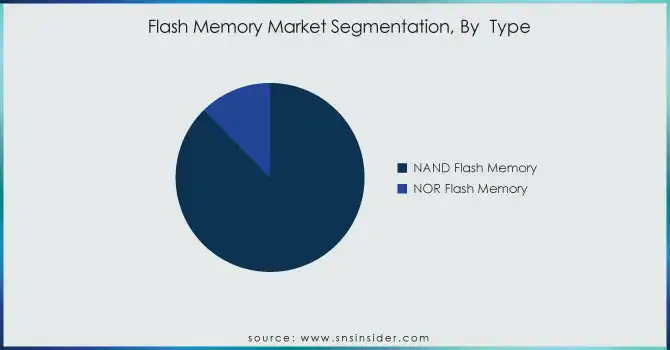

By Type

The NAND flash memory segment dominated the flash memory market with an impressive share of around 88% in 2023. This dominance is primarily driven by the increasing demand for high-capacity, high-performance storage solutions in applications like data centers, consumer electronics, AI, and 5G technologies. NAND flash is preferred due to its non-volatile nature, speed, and energy efficiency, making it ideal for storing large amounts of data while ensuring fast retrieval and durability. The widespread adoption of SSDs (solid-state drives) in both enterprise and consumer markets has further bolstered the growth of NAND flash. As the need for advanced memory solutions intensifies with the proliferation of AI and 5G networks, NAND flash continues to hold a central role in enabling scalable, high-performance storage systems across industries.

By Component

The memory chips segment dominated the flash memory market with a substantial share of approximately 82% in 2023. This segment's dominance is driven by the increasing demand for high-performance, energy-efficient, and reliable storage solutions in a variety of applications, including data centers, consumer electronics, AI-driven technologies, and 5G infrastructure. Memory chips, particularly NAND flash memory chips, are integral to modern storage devices like SSDs, smartphones, and laptops, offering fast data access speeds and durability. The rise of cloud computing, edge computing, and IoT has further fueled the need for memory chips capable of supporting large-scale data processing and storage. As demand for data storage continues to grow across industries, the memory chips segment remains a key driver of the flash memory market's expansion, with manufacturers constantly innovating to meet evolving market needs.

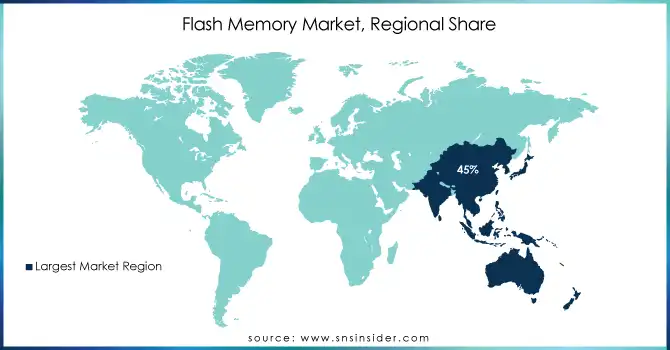

Flash Memory Market Regional Outlook

Asia-Pacific holds a dominant share of approximately 45% in the global flash memory market in 2023, driven by the region's rapid technological advancements, booming electronics industry, and increasing demand for data storage solutions. Key countries like China, Japan, South Korea, and Taiwan are at the forefront of flash memory production and innovation. China, with its massive manufacturing base, is a major consumer of flash memory, particularly in smartphones, consumer electronics, and data centers. South Korea and Japan, home to global leaders like Samsung and Toshiba, are key players in NAND flash production, contributing significantly to the market's growth. Additionally, Taiwan's prominence as a semiconductor manufacturing hub, with companies like TSMC, further strengthens the region's position in the flash memory market. The ongoing expansion of 5G networks, AI-driven applications, and IoT technologies in the Asia-Pacific region is also boosting the demand for high-performance storage solutions, ensuring the region's continued dominance in the flash memory market.

North America is the fastest-growing region in the Flash Memory Market due to a surge in demand driven by AI, 5G infrastructure, and cloud computing. As industries increasingly rely on high-speed, low-latency storage for AI and machine learning applications, flash memory plays a pivotal role in meeting these needs. The U.S., home to major players like Micron Technology, is investing heavily in R&D to improve memory performance. Government initiatives like the CHIPS and Science Act are boosting domestic semiconductor production, ensuring a robust supply chain and further accelerating market growth. Additionally, the expansion of data centers and 5G networks in the region is creating a strong demand for advanced flash storage solutions. These factors contribute to North America’s rapid market expansion and its position as the fastest-growing region in the forecast period from 2024 to 2032.

\

\

Get Customized Report as per Your Business Requirement - Enquiry Now

KEY PLAYERS

Some of the major key players in Flash Memory Market with their product:

-

IM Flash Technologies (3D XPoint Memory, NAND Flash Solutions)

-

SK Hynix (3D NAND, Embedded Flash Memory)

-

Micron Technology, Inc. (NOR Flash, Crucial SSDs, 3D NAND)

-

Toshiba (now Kioxia) (BiCS Flash, FlashAir SD Cards)

-

Cypress Semiconductor Corporation (Serial NOR Flash, Embedded Flash Memory)

-

STMicroelectronics (Embedded Flash, Automotive NOR Flash)

-

Samsung Electronics (V-NAND SSDs, NAND Flash Storage Solutions)

-

Intel Corporation (Optane Memory, NAND Flash)

-

SanDisk (a Western Digital brand) (Ultra SD Cards, Extreme Portable SSDs)

-

Qimonda (now defunct) (DRAM and Flash Memory Technologies)

-

Western Digital Corporation (WD Blue SSDs, SanDisk Memory Cards)

-

Marvell Technology Group (Flash Controllers, SSD Storage Solutions)

-

Silicon Motion Technology Corporation (NAND Flash Controllers, SSD Solutions)

-

Kingston Technology (UV500 SSDs, USB Flash Drives)

-

Transcend Information, Inc. (JetDrive SSDs, CompactFlash Cards)

-

Phison Electronics Corporation (SSD Controllers, NAND Flash Solutions)

-

Greenliant Systems (Industrial NAND Flash, NANDrive Embedded SSDs)

-

GigaDevice Semiconductor Inc. (SPI NOR Flash, NAND Flash Memory)

-

Macronix International Co., Ltd. (Serial NOR Flash, Parallel NOR Flash)

-

ADATA Technology Co., Ltd. (XPG SSDs, USB Flash Storage Solutions)

List of Suppliers in Flash Memory Market that provide critical components, raw materials, or services necessary for flash memory production:

-

Applied Materials, Inc.

-

Lam Research Corporation

-

ASML Holding

-

Tokyo Electron Limited (TEL)

-

Sumitomo Chemical Co., Ltd.

-

Shin-Etsu Chemical Co., Ltd.

-

GlobalWafers Co., Ltd.

-

Edwards Vacuum

-

JSR Corporation

-

Honeywell International Inc.

-

Entegris, Inc.

-

Dow Inc.

-

BASF SE

-

Hitachi High-Tech Corporation

-

Cabot Microelectronics Corporation (CMC Materials)

-

SUMCO Corporation

-

MKS Instruments, Inc.

-

KLA Corporation

-

TSMC (Taiwan Semiconductor Manufacturing Company)

-

Brewer Science, Inc.

RECENT DEVELOPMENT

-

April 25, 2024 – Micron Technology announced the mass production of its 232-layer QLC NAND, which offers improved performance for mobile, client, edge, and data center storage. The new NAND features higher bit density, 2400 MT/s I/O speeds, and a 50% performance boost over the previous generation.

-

August 9, 2023 – SK Hynix unveiled a prototype of its groundbreaking 321-layer 4D NAND at the Flash Memory Summit 2023. This innovative 1Tb Triple Level Cell (TLC) NAND Flash demonstrates a 59% productivity boost over the previous 238-layer generation, marking a major milestone in NAND technology. SK Hynix plans to begin mass production of the 321-layer NAND in the first half of 2025.

-

September 12, 2024 – Samsung Electronics announced the mass production of its industry-first 1Tb QLC 9th-generation V-NAND, following the earlier launch of its TLC 9th-generation V-NAND. This advancement solidifies Samsung's leadership in high-capacity, high-performance NAND flash solutions for AI applications.

| Report Attributes | Details |

| Market Size in 2023 | USD 73.33 Billion |

| Market Size by 2032 | USD 107.09 Billion |

| CAGR | CAGR of 4.30% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (NAND Flash Memory, NOR Flash Memory) • By Component (Memory Chips, Flash Controller) • By Application (Smartphone, Digital Camera, USB Flash Drives, Solid-States Drives, Tablets & Laptops, Gaming Consoles, Media Player) • By End-User (Enterprise, Industrial, Individual/Personal) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | IM Flash Technologies, SK Hynix, Micron Technology, Inc., Toshiba (now Kioxia), Cypress Semiconductor Corporation, STMicroelectronics, Samsung Electronics, Intel Corporation, SanDisk (a Western Digital brand), Qimonda (now defunct), Western Digital Corporation, Marvell Technology Group, Silicon Motion Technology Corporation, Kingston Technology, Transcend Information, Inc., Phison Electronics Corporation, Greenliant Systems, GigaDevice Semiconductor Inc., Macronix International Co., Ltd., and ADATA Technology Co., Ltd. |

| Key Drivers | • The rapid expansion of data centers and the increasing need for high-speed, high-capacity storage solutions are pivotal drivers of the Flash Memory market growth. |

| Restraints | • Addressing Key Performance Limitations in Flash Memory Market Growth with AI and 5G Expansion |