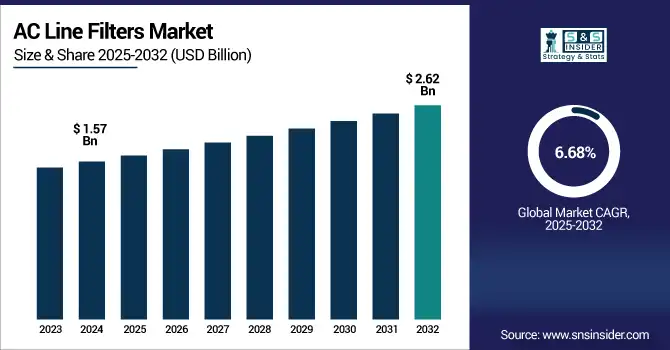

AC Line Filter Market Size Analysis:

The AC Line Filter Market Size was valued at USD 1.57 billion in 2024 and is expected to reach USD 2.62 billion by 2032 and grow at a CAGR of 6.68% over the forecast period 2025-2032. The global market for AC Line Filters encompasses valuable growth details, growth rates, key drivers, restraints, opportunities, and regional trends. Market expansion will be attributed to rising stringent electromagnetic interference (EMI) regulations along with growing industrial automation coupled with demand for power quality. The report also shows the segmentation of the AC Line Filter Market shine by division into type, application, and region as well as the competitive environment and new trends affecting the growth of the AC Line Filter Market.

To Get more information on AC Line Filter Market - Request Free Sample Report

Over 70% of industrial equipment failures are linked to poor power quality, highlighting the growing need for AC line filters.

Over 40% of electronic malfunctions in critical systems are caused by unmanaged electromagnetic interference.

The U.S. AC Line Filter Market size was USD 0.28 billion in 2024 and is expected to reach USD 0.45 billion by 2032, growing at a CAGR of 6.21% over the forecast period of 2025–2032.

The U.S. market is expected to witness significant growth owing to factors such as expansion of renewable energy systems, significant growth of the consumer electronics market, and stringent laws that mandate compliance to EMI related standards. Various industrial verticals are experiencing rapid adoption of AC line filters, attributed to leading filter manufacturers and continued spending on smart grid infrastructure.

Renewables accounted for nearly 22% of total U.S. electricity generation in 2023, increasing the need for EMI-compliant systems.

More than 60% of U.S. manufacturers have adopted industrial automation solutions that require EMI suppression components like AC line filters.

AC Line Filter Market Dynamics:

Key Drivers:

-

Global AC line filter market is driven by increasing demand for EMI suppression in commercial and industrial applications.

With an increasing dependence of industries like healthcare, telecommunications and industrial automation on sensitive electronic equipment, effective electromagnetic interference (EMI) suppression has also become all the more important AC line filters ensure equipment dependability and safety by stopping EMI-induced disruptions, voltage swings, and signal deterioration. With the increasing number of electronic devices, rules such as the FCC and/or CE compliance became more stringent. Industries are increasingly investing in power quality solutions to meet these standards. This drives the usage of AC line filters in high-reliability environments such as manufacturing, data centers, and energy systems.

Over 60% of global factories are adopting smart automation systems that require EMI filtering to maintain operational integrity.

Restraints:

-

Market scope in the developing economies are limited owing to the unawareness of EMI regulations and power quality solutions.

Power quality management and EMC regulations are still not well known in many developing countries, especially parts of Africa, Southeast Asia and Latin America. A lot of enterprise use very outdated electrical infrastructure or low EMI shielding. The compliance standards are set out internationally, but the adoption of AC line filters is delayed because there is a lax in enforcement. Even though this market has witnessed its growth slowly in these areas, the slow growth is primarily due to poor training, absence of local knowledge and lenient regulatory framework, which greatly hinders the market growth.

Opportunities:

-

Government initiatives promoting smart grid upgrades and clean energy infrastructure drive market growth of AC Line Filters.

Many national governments have also made massive investments in electrifying transport infrastructure, installing new clean energy, and modernizing smart grids. As these programs require better power reliability and quality, both high-power and low-power electrical distribution, transmission, and EV charging systems in turn require increased usage of AC line filters. Programs such as the EU Green Deal and U.S. Infrastructure Investment and Jobs Act are making significant funding available for grid improvements. Due to this financial support and regulatory pressure, manufacturers of AC line filters can expect their product lines to grow with the US government-sponsored energy modernization initiatives.

For Instance, Global EV charging stations are projected to exceed 15 million units by 2030, requiring advanced EMI and power quality solutions.

Challenges:

-

Technological complexity and compatibility issues with advanced power systems limit the seamless integration of AC line filters.

It has been building power systems require variable frequency drives, devices that output high speed digital drives to load and renewable energy inverter which reside at high frequency, large input voltage disturbance. Traditional AC line filters have performance and compatibility issues when dealing with such complex systems. The need for bespoke or custom filters is driving up the cost and complexity of the engineering. In addition, poor integration can cause circuit failures or thermal overloads. Because of the rapid evolution of power electronics, filter technology has always been a challenge for manufacturers to keep up to date and flexible enough for new electromagnetic standards and system specifications.

AC Line Filter Market Segmentation Analysis:

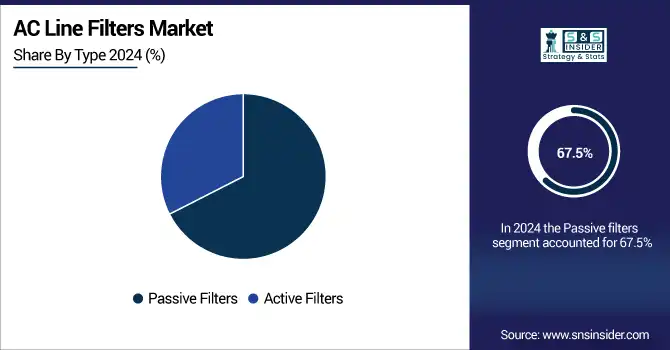

By Type

Passive filters accounted for a 67.5% revenue share of the AC Line Filter Market in 2024, owing to their low cost, ease of integration, and widespread use in general-purpose applications. In low to moderate EMI environments where cost-effectiveness is a high priority, these filters should definitely be considered. And companies like Schaffner Group continue to lead the world in offering OEMs standard passive filter solutions. Their reliability, minimal maintenance needs, and compatibility with numerous consumer and industrial electronics, particularly in non-adaptive filtering applications, make them the best choice.

Active filters segment is expected to grow at a rapid rate of 7.37% CAGR from 2024 to 2032, owing to its efficient performance in preventing high-frequency harmonics and real-time EMI disturbance. These filters are well fit for complex power environments like advanced manufacturing facilities and renewable energy systems. TDK Corporation is a world leader in active filter technology, offering precise harmonic mitigation and real-time load balancing. For high-efficiency and future-ready electrical systems, active filters are the standard solution, and they are becoming more broadly used in sectors demanding precise control over power quality.

By Application

The energy sector accounted for the largest revenue share of 34% of the AC Line Filter Market in 2024, driven by the increasing utilization of power electronics in grid-tied renewable energy systems and power networks. Consistent EMI suppression ensures system stability and regulatory compliance. Delta Electronics, Inc. is also a major player's role with its energy-grade filters supporting global infrastructure. The segment is expected to grow at the fastest compound annual growth rate (CAGR) of 7.65% during the forecast period of 2022-2032, owing to the increased adoption of clean energy, deployment of microgrids, and development of high-efficiency filters for solar, wind and battery applications, by companies such as EPCOS.

AC Line Filter Market Regional Insights:

North America commands a sizeable portion of the market for AC line filters due to strict EMI laws, sophisticated industrial infrastructure, and the extensive use of power quality solutions. Strong demand in the energy, telecommunications, and consumer electronics sectors benefits the area. The presence of major manufacturers, modernization of the smart grid, and ongoing investment in renewable energy all contribute to market expansion in the US and Canada.

-

The U.S. dominates the North American AC Line Filter Market due to its advanced manufacturing sector, strict EMI compliance standards, and early adoption of smart grid technologies. Strong presence of major filter manufacturers further enhances its leadership in the region.

Asia Pacific held a 32.5% revenue share in 2024, driven by its robust electronics manufacturing base, industrial automation, and growing EMI compliance requirements, dominating the AC Line Filter Market. Adoption is aided by the quick development of infrastructure in China, India, Japan, and South Korea. Clean energy, EV expansion, and smart grid investments are driving the region's fastest growth.

-

China leads the Asia Pacific AC Line Filter Market owing to its vast electronics manufacturing ecosystem, rapid industrialization, and significant investment in renewable energy and infrastructure. Government policies supporting EMI regulation and local component production contribute to China’s dominant market position.

Europe's dominance in the AC Line Filter Market is propelled by strong regulatory frameworks, sophisticated industrial automation, and a focus on power quality compliance. In the energy, automotive, and electronics sectors, nations like Germany, France, and the UK are at the forefront of implementing EMI suppression technologies. The region's market expansion is being sustained by ongoing investments in smart grid infrastructure, electric vehicles, and renewable energy.

-

Germany dominates the European AC Line Filter Market due to its strong industrial base, advanced automation, and strict EMI regulations. Its leadership in automotive, energy, and electronics manufacturing, along with continued investment in smart infrastructure, drives significant demand for line filters.

The UAE leads the Middle East and Africa market for AC line filters due to the smart infrastructure initiatives and fast industrial growth. Brazil leads Latin America thanks to its robust manufacturing sector, growing investments in renewable energy, and improvements in power quality across all industrial sectors.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players:

The AC Line Filters Companies are Schaffner Group, TDK Corporation, Delta Electronics, Inc., TE Connectivity Ltd., Panasonic Industry Co., Ltd., Murata Manufacturing Co., Ltd., OMEGA (Spectris plc), Astrodyne TDI, REO AG, Curtis Industries (Powersolv Inc.) and others.

Recent Developments:

-

In September 2024, Delta Electronics recognized for EMI performance in major OEM power supplies.

-

In December 2024, Murata introduced ultra-compact EMI chokes suited for vehicle differential interfaces (LVDS, USB, HDMI), strengthening AC line filtering in automotive and industrial electronics.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 1.57 Billion |

| Market Size by 2032 | USD 2.62 Billion |

| CAGR | CAGR of 6.68% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Passive Filters, Active Filters) • By Application (Telecommunications, Energy Industry, Consumer Electronics, Other) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia,Taiwan, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Schaffner Group, TDK Corporation, Delta Electronics, Inc., TE Connectivity Ltd., Panasonic Industry Co., Ltd., Murata Manufacturing Co., Ltd., OMEGA (Spectris plc), Astrodyne TDI, REO AG, Curtis Industries (Powersolv Inc.) |