Sensor Bearing Market Size & Overview:

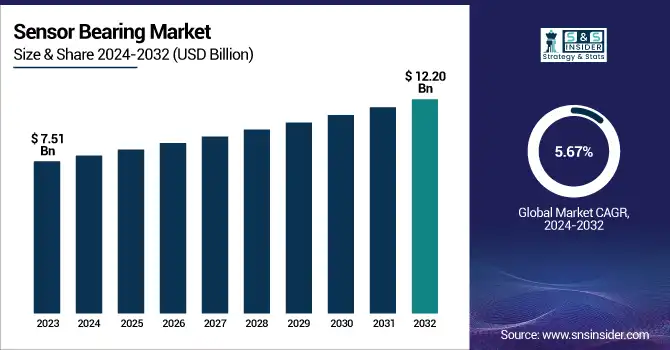

The Sensor Bearing Market Size was valued at USD 7.51 Billion in 2023 and is expected to reach USD 12.20 Billion by 2032 and grow at a CAGR of 5.67% over the forecast period 2024-2032.

To Get more information on Sensor Bearing Market - Request Free Sample Report

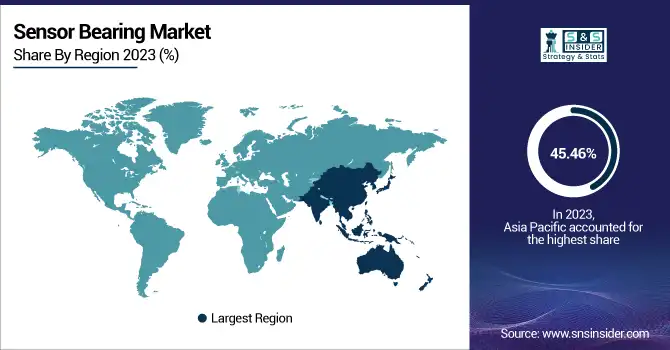

The rising adoption of sensors in automation and IoT applications will further propel demand in the sensor-bearing market from 2023 to 2033. Combining efficiency with enhanced monitoring capabilities, these next-generation bearings come equipped with sensors used to track important parameters such as speed, temperature, vibration, and displacement—advantageous features that aid in minimizing downtime. Asia Pacific is the largest market due to the growing industrial base whereas North America and Europe are in close competition. Dominating players in the market are pouring into technology improvements, partnerships, and market expansion to ensure steady market growth.

The U.S. Sensor Bearing Market was valued at USD 1.42 Billion in 2023 and is projected to reach USD 2.42 Billion by 2032, growing at a CAGR of 6.22% from 2024 to 2032. The automotive industry continues to be a significant segment of the market, as sensor bearings improve the safety and efficiency of vehicles. The market growth is also driven by increasing adoption in the aerospace, industrial machinery, and renewable energy sectors. There is also demand for IoT-enabled smart bearings and Industry 4.0 initiatives. U.S. players emphasize tech innovation, R&D spending, and strategic alliances. Focusing on reliability, efficiency, and minimized downtime, the U.S. market continues to be a key region for sensor-bearing innovation and implementation.

Sensor Bearing Market Dynamics

Key Drivers:

-

Increasing Adoption of Predictive Maintenance and IoT-Enabled Smart Bearings Drives Sensor Bearing Market Growth

The increasing need for predictive maintenance in industrial automation and manufacturing processes also augments the growth of the sensor-bearing market. Companies are progressively using IoT-enabled smart bearings to improve operational efficiency, minimize downtime, and combat unforeseen failures. These smart bearings offer real-time monitoring of key parameters such as speed, vibration, and temperature, resulting in increased equipment lifespan. Recently, industry 4.0 and AI-driven analytics have helped speed up the adoption. Moreover, strict government regulations on workplace safety and energy efficiency in industrial segments such as aerospace, automotive, and heavy machinery compel manufacturers to utilize high-performance sensor bearings.

Restraint

-

High Initial Costs and Complex Installation Procedures Hinder Sensor Bearing Market Expansion

Although sensor bearings offer several advantages, they also come with high upfront costs for purchasing, installation, and integration into existing machines. High costs are a hindrance in many cases, particularly for SMEs Furthermore, sensor bearings can be challenging to implement into older systems, requiring particular technical talent, which can raise the total cost of installation and maintenance. In developing economies, industries with tight budgets refrain from adopting Advanced Sensor Bearings. The need for frequent calibration and services makes it more expensive to operate. The infusion of these cost-related worries can stifle market penetration, especially in price-sensitive sectors, effectively limiting market progress.

Opportunity

-

Expansion of Electric Vehicle and Renewable Energy Sectors Creates New Growth Avenues for Sensor Bearing Market

The booming EV and renewables sectors present a big opportunity for the sensor-bearing market. Mushtaq says, "EV manufacturers are embedding sensor bearings into powertrains, motors, and wheel hubs to boost performance, improve efficiency, and monitor vehicle health in real-time. Advancing wind and solar energy also hinges on the use of sensor-based bearings within wind turbines and solar tracking systems for efficient energy yield and minimized mechanical failures. With sustainability now at the forefront of the global agenda, investments in clean energy and smart mobility solutions fuel demand for advanced, integral, and high-performance sensor bearings unlocking immense marketplace potential.

Challenge

-

Technical Limitations and Data Accuracy Issues Pose Challenges in Sensor Bearing Market Growth

Challenges in sensor accuracy, signal interference, and durability continue to plague the sensor-bearing market despite advances in sensor technology. Because sensor-based bearings are used in extreme environments subject to extreme temperatures, high pressure, and contaminants, it can introduce uncertainty to the accuracy and reliability of their measurement. Moreover, EMI or mechanical noise can introduce data inconsistencies that result in false readings, impacting operational efficiency. Additionally, ensuring seamless connectivity and compatibility with existing monitoring systems further complicates deployment. As a key challenge for market expansion, manufacturers need to constantly innovate for improved sensor durability, accuracy, and integration capabilities.

Sensor Bearing Market Segment Analysis

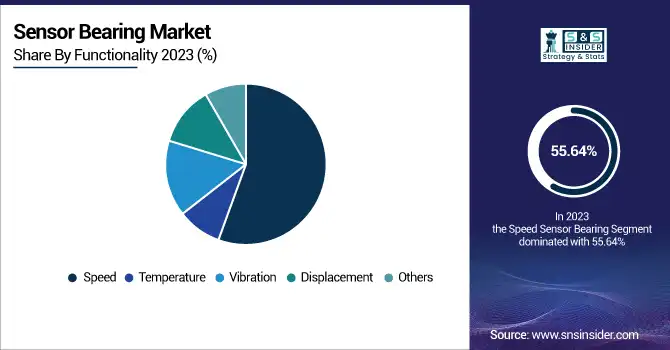

By Functionality

Speed sensor bearing segment accounted for the highest share of 55.64% of the total revenue in 2023 in the sensor bearing segment across various applications, including automotive, industrial, and aerospace segments. In EVs, high-performance machines, and smart automation systems, these bearings improve safety and efficiency by precisely monitoring rotational speed. Advancements in speed sensor-integrated components from firms like SKF, Schaeffler, and NTN Corporation have been developed to complement predictive maintenance and real-time monitoring capabilities.

For example, sensor bearings from SKF for electric powertrains increase efficiency within vehicles, while Schaeffler’s smart sensor bearings allow for increased optimization of robotics and industrial automation. Every factor has contributed to further advancing development towards Industry 4.0, IoT-enabled smart bearings, etc. Regional Analysis

The temperature sensor bearing segment is expected to grow at the highest CAGR of 7.53%, as the need for heat-resistant and self-monitoring bearings is on the rise in the industrial and automotive industries. They are essential for reducing overheating, and energy loss, and promoting machinery longevity. Key players including Timken, NSK, and JTEKT Corporation have introduced sophisticated temperature-sensing bearings for heavy-duty applications. Timken® high-temperature sensor bearings for wind turbines and aerospace applications that are built for extreme conditions. Likewise, NSK's thermal sensor bearings boost automotive engines' capabilities.

By Application

The Anti-lock Braking System (ABS) segment captured the highest revenue of 40.38% in 2023, owing to growing Vehicle safety needs and regulatory requirements regarding braking systems. To enhance ABS efficiency and hence braking performance and vehicle stability, major automotive manufacturers such as Bosch, SKF, NTN Corporation, etc. have developed advanced sensor-integrated bearings. Innovation in this segment is also being accelerated by the rise of electric and autonomous vehicles, with automakers looking for low-friction, high-durability bearings. This is a significant market driver as there is a strong correlation between ABS advancements and sensor-bearing adoption.

The Electric Motors segment is projected to register the highest CAGR of 6.59% from 2018 to 2024, owing to rapid electrification across industries, including electric vehicles (EVs), industrial automation, and robotics. Industry leaders like Schaeffler, NSK, and Timken have introduced high-performance sensor bearings for electric motors that go beyond condition monitoring to encompass speed, temperature, and vibration monitoring capabilities. The sensor-equipped ball bearings from Schaeffler, The growing demand around smart bearings embedded with IoT-based predictive maintenance solutions, to aid industries in moving to energy-efficient motor technologies, ensures that the growth trajectory of the sensor-bearing market will remain solid in the longer future.

By End Use

The sensor-bearing market was dominated by the automotive sector in 2023 and is expected to continue to be the largest contributor in the coming years due to factors such as increasing vehicle production, rising demand for advanced driver-assistance systems (ADAS), and growing adoption of electric vehicles (EVs). Manufacturers are introducing smart components like SKF, NTN Corporation, and Schaeffler Group that have smart sensor-integrated bearings to improve efficiency, safety, and performance. As restrictions are being tightened on vehicle safety and emissions, demand for sensor bearings in powertrains, wheels, and transmissions from OEMs and aftermarket players drives the market growth.

By end user, the transportation sector will certainly witness the highest CAGR in the sensor-bearing market, thanks to the expansion of railways, aviation, and logistics industries. This is driven by the increased demand such as high-speed trains, electric buses, and autonomous transportation systems for sensor-mounted bearings for condition monitoring and predictive maintenance. Railroad-specific sensor bearings have been introduced along with other technologies, including by companies like Timken and NSK Ltd., in a search for a greater level of safety and operational efficiency With the expansion of smart mobility solutions and logistics automation, the demand for intelligent sensor bearings will continue booming in market demand.

Sensor Bearing Market Regional Outlook

The Asia Pacific sensor-bearing market is anticipated to dominate in 2023, with 45.46% market share, and the dominance is due to continued industrialization, high automotive production, and growing manufacturing activities in China, Japan, and India. Rising demand for predictive maintenance solutions and IoT-powered smart bearings hastens market growth. Therefore, various key players including SKF, NTN Corporation, and Schaeffler have developed integrated bearings with advanced sensors for automotive and industrial applications. SKF introduced sensor-bearing solutions for electric vehicles (EVs) to improve efficiency and durability, for example. Now, as automation, particularly smart manufacturing, draws more and more attention, it makes the Asia Pacific area dominant in sensor bearing market.

North America sensor-bearing market is growing with the fastest CAGR of 6.60% due to developments in automotive, aerospace, and industrial automation. The focus on Industry 4.0, smart factories, and predictive maintenance in the region is pushing up the demand for integrated sensor bearings. Timken, NSK Americas, and ABB are investing in next-generation sensor bearings, for example, to increase efficiency. Timken, for instance, created high-performance sensor bearings for electric vehicle powertrains that improve reliability. Industrial IoT sensor-enabled bearings also were introduced by NSK Americas. Sensor Bearing Market: Regional Overview North America is anticipated to be a major growth hub for the sensor-bearing market owing to the growing adoption of automation, industrial robotics, and sustainable energy solutions.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

Some of the major players in the IoT in the Smart Cities Market are:

-

Harbin Bearing Manufacturing Co., Ltd – (Deep Groove Ball Bearings, Tapered Roller Bearings)

-

Schaeffler Technologies AG & Co. KG – (FAG SmartCheck Sensor Bearing, INA Axial Angular Contact Roller Bearings)

-

Wafangdian Bearing Co. Ltd – (Spherical Roller Bearings, Cylindrical Roller Bearings)

-

The Timken Company – (Timken Sensor-Powered Bearings, Tapered Roller Bearings)

-

ABB Group – (ABB Ability Smart Sensors, High-Performance Ball Bearings)

-

NTN Corporation – (NTN Sentinel Series Bearings, NTN Sensor Integrated Bearings)

-

JTEKT Corporation – (Koyo Sensor Bearings, JTEKT Tapered Roller Bearings)

-

Fersa Bearings – (Fersa Smart Bearings, Wheel Hub Bearings)

-

Mageba SA – (Structural Bearings, Pot Bearings)

-

NSK Corporation – (NSK Condition Monitoring Bearings, Deep Groove Ball Bearings)

-

Nachi Europe GmbH – (Nachi Precision Bearings, Hydraulic Roller Bearings)

-

Homson Industries Inc. – (Automotive Bearings, Industrial Ball Bearings)

-

BRTEC – (Heavy-Duty Truck Bearings, Hub Assembly Bearings)

Recent Trends

-

February 2024 - Schaeffler unveiled its new-generation SmartCheck Sensor Bearings, which use AI-powered predictive maintenance for industrial applications.

-

January 2024 - Wafangdian Bearing introduced specialized sensor bearings for high-speed railway systems in China, ensuring real-time monitoring of temperature, speed, and wear.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 7.51 Billion |

| Market Size by 2032 | US$ 12.20 Billion |

| CAGR | CAGR of 5.67% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Functionality – (Speed, Temperature, Vibration, Displacement, Others) • By Application – (Anti-lock Braking System, Material Handling Equipment, Electric Motors, Others) • By End Use – (Automotive, Transportation, Metal & Mining, Oil & Gas, Aerospace & Defense, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Harbin Bearing Manufacturing Co., Ltd, Schaeffler Technologies AG & Co. Kg, Wafangdian Bearing Co. Ltd, The Timken Company, ABB Group, NTN Corporation, Jtekt Corporation, Fersa Bearings, Mageba SA, NSK Corporation, Nachi Europe GmbH, Homson Industries Inc, BRTEC, SKF |