CNC Fiber Laser Market Key Insights:

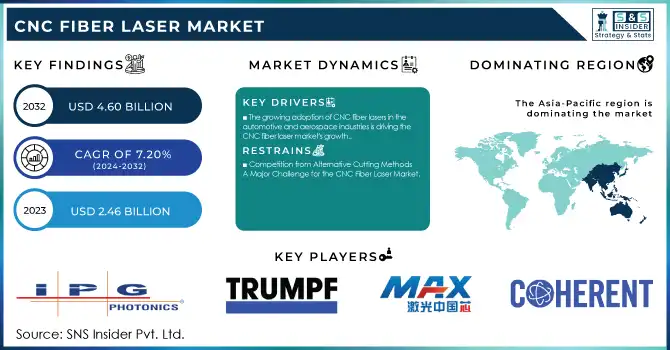

The CNC Fiber Laser Market Size was valued at USD 2.46 Billion in 2023 and is expected to grow to USD 4.60 Billion by 2032 and grow at a CAGR of 7.20% over the forecast period of 2024-2032.

To get more information on CNC Fiber Laser Market - Request Free Sample Report

The CNC Fiber Laser Market is witnessing robust growth, fueled by the widespread adoption of automation across key industries such as automotive, aerospace, and metalworking. As businesses increasingly embrace automated production lines, CNC fiber lasers are pivotal in enhancing productivity, reducing labor costs, and improving cutting precision. Industries are demanding high-speed, precise, and cost-effective laser cutting solutions, which has significantly boosted the demand for CNC fiber lasers. These systems are gaining popularity due to their ability to efficiently process a diverse range of materials, making them suitable for both mass production and custom manufacturing needs. Technological advancements in fiber laser technology are driving this demand further, with innovations that increase cutting speeds, accuracy, and energy efficiency, particularly when compared to traditional cutting methods. Industry reports indicate that CNC fiber lasers can improve production efficiency by 20-30% and cut energy consumption by up to 30% in automated environments. Additionally, these systems reduce human error and enhance operational efficiency by reducing manual intervention, making them ideal for high-volume production. As manufacturing practices shift towards sustainability, the demand for fiber lasers is further accelerating. Their low energy consumption and minimal waste generation make them a more environmentally friendly alternative to conventional cutting technologies. The competitive pricing of fiber laser cutting in regions such as China, where the cost can be as low as USD 15-20/hour, makes it a cost-effective option compared to the higher costs found in markets like the US and Europe. These advantages are driving global demand and positioning CNC fiber lasers as an essential tool in modern manufacturing, contributing significantly to the market's growth and reinforcing their role in future automated and sustainable production.

CNC Fiber Laser Market Dynamics

Drivers

-

The increasing adoption of CNC fiber lasers in the automotive and aerospace industries is significantly boosting the growth of the CNC fiber laser market.

These sectors require high-precision cutting and welding to manufacture essential components, and CNC fiber lasers have emerged as the preferred solution. In aerospace, CNC machining is transforming the production of complex parts by enhancing efficiency, reducing lead times, and ensuring the precise part geometry required to meet demanding performance standards. CNC fiber lasers are gaining traction in the automotive industry as well, where they are used for cutting metal sheets, tubes, and other components with high precision. This technology enables the production of lightweight, durable, and high-performance parts, offering design flexibility and the ability to use advanced materials like carbon fiber and aluminum alloys. The automotive sector has increasingly adopted CNC fiber lasers for cutting and welding applications, resulting in faster manufacturing speeds and improved precision. Laser welding in both industries provides high-quality joints with minimal heat distortion, improving overall strength and making it ideal for critical parts. Technological advancements in CNC fiber lasers, such as faster cutting speeds, better material compatibility, and enhanced energy efficiency, are further driving their adoption. For instance, laser additive manufacturing (AM) in aerospace eliminates the need for expensive tooling, such as sheet metal forming and friction stir welding fixtures, which can cost up to USD 2 million. This enables greater access to space and more flight opportunities. The widespread adoption of CNC fiber lasers in both automotive and aerospace sectors reflects their growing role in modern manufacturing, contributing to increased market demand and solidifying their place as a vital tool in industrial automation. These advancements and cost benefits are integral to the ongoing expansion of the CNC fiber laser market across these key industries.

Restraints

-

Competition from Alternative Cutting Methods - A Major Challenge for the CNC Fiber Laser Market

While CNC fiber lasers are known for their high precision, efficiency, and speed, alternatives still hold a strong position in the market, particularly due to their lower initial costs and suitability for specific applications. For instance, CO2 lasers are often preferred for cutting non-metallic materials, as they tend to be more cost-effective in such cases. Plasma cutting, on the other hand, remains a popular choice for cutting thicker metals, as it can offer lower operating costs despite sacrificing some precision. Additionally, water jet cutting is highly valued for its ability to cut through a wider range of materials, including thick and heat-sensitive materials, without generating heat-affected zones (HAZ), which is a common issue with laser cutting. While fiber lasers excel at high-speed and high-precision cuts, these other technologies remain relevant due to their versatility, lower operating costs, and ability to handle specific materials better. According to industry insights, plasma cutting can be as much as 40% cheaper for cutting thicker materials compared to fiber laser cutting, making it a preferred option in certain industries. Furthermore, water jet cutting has the advantage of no heat distortion, which is ideal for materials sensitive to temperature changes. Despite the superior energy efficiency of fiber lasers, which can reduce energy consumption by up to 30% compared to traditional CO2 lasers, the cost-effectiveness of competing technologies limits the widespread adoption of CNC fiber lasers, especially in applications where cost reduction is a priority. As a result, this competition continues to present a barrier to the market's growth, limiting fiber laser adoption in price-sensitive sectors.

CNC Fiber Laser Market Segment Analysis

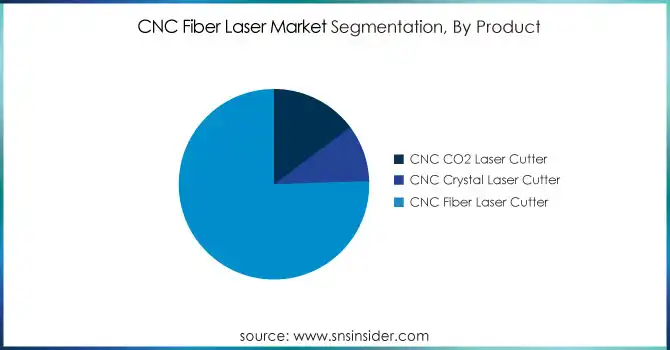

By Product

The CNC Fiber Laser Cutter segment is the dominant player in the CNC Fiber Laser market, accounting for approximately 76% of the market share in 2023. This dominance is attributed to the widespread adoption of fiber laser cutting technology due to its high precision, speed, and efficiency. CNC fiber laser cutters are ideal for industries such as automotive, aerospace, and metalworking, offering unparalleled accuracy for cutting a variety of materials, including metals, plastics, and composites. Their ability to cut intricate designs with minimal material waste makes them a preferred choice for manufacturers seeking cost-effective, high-quality production. As advancements in fiber laser technology continue to improve cutting speeds, energy efficiency, and material compatibility, the CNC Fiber Laser Cutter segment is expected to maintain its strong market presence in the coming years. This segment's growth is also driven by industrial automation and demand for sustainable manufacturing solutions.

By Type

The Stationary Gantry Type segment is leading the CNC Fiber Laser market, holding approximately 59% of the market share in 2023. This segment's dominance is driven by the high precision, stability, and versatility that stationary gantry systems offer, making them ideal for heavy-duty applications. These systems are widely used in industries such as aerospace, automotive, and metalworking, where accurate and efficient cutting of large and thick materials is crucial. The stationary gantry design, with its robust frame and precision control, ensures consistent cutting quality, even in high-volume production environments. The ability to handle complex tasks with minimal downtime has contributed to the popularity of this type of CNC fiber laser system. Additionally, advancements in technology, including increased cutting speeds and energy efficiency, further strengthen the segment’s market position.

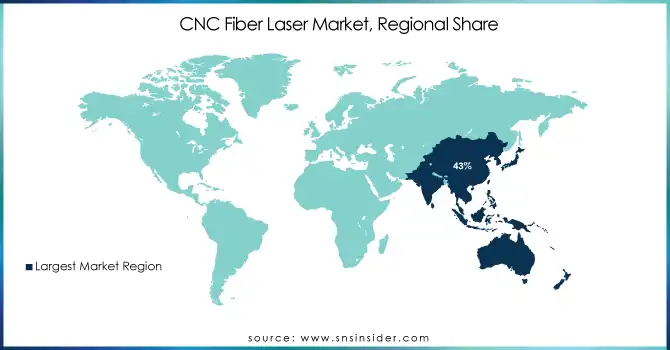

CNC Fiber Laser Market Regional Outlook

Asia-Pacific is the leading region in the CNC Fiber Laser market, holding a dominant share of around 43% in 2023. This growth is driven by the rapid industrialization, technological advancements, and increasing demand for automation in key countries like China, Japan, South Korea, and India. China, in particular, is the largest contributor, with a robust manufacturing sector and the adoption of advanced fiber laser technologies across industries such as automotive, aerospace, and electronics. Japan and South Korea are also significant players, driven by their high-tech industries and demand for precision in automotive and semiconductor manufacturing. Additionally, India is experiencing growth in CNC fiber laser adoption due to its expanding manufacturing and automotive sectors. The region's focus on enhancing production efficiency, reducing labor costs, and improving manufacturing capabilities has positioned Asia-Pacific as the leader in CNC fiber laser technologies. Moreover, the availability of cost-effective solutions and increased investments in automation have further fueled this region’s dominance in the market.

North America is the fastest-growing region in the CNC Fiber Laser market during the forecast period of 2024-2032, driven by the rapid industrial adoption of automation and advanced manufacturing technologies. The U.S. is a key player, with sectors like aerospace, automotive, and electronics fueling demand for high-precision cutting and welding solutions. The automotive industry, in particular, benefits from CNC fiber lasers for producing lightweight, high-performance parts, while the aerospace sector relies on these technologies for complex, precision components. Canada is also witnessing growth, especially in advanced manufacturing for sectors such as automotive, energy, and defense. Moreover, the region’s focus on energy efficiency and sustainability further boosts the adoption of CNC fiber lasers, as they reduce energy consumption and waste. This trend positions North America for significant market growth through 2032.

Get Customized Report as per Your Business Requirement - Enquiry Now

KEY PLAYERS

Some of the Major Players CNC Fiber Laser Market with their product:

-

IPG Photonics Corporation (High-power fiber lasers, pulsed fiber lasers)

-

TRUMPF GmbH + Co. KG (Industrial laser cutting systems, marking lasers)

-

Maxphotonics Co., Ltd. (Single-mode fiber lasers, multi-mode fiber lasers)

-

Coherent Inc. (Fiber laser modules, laser cutting solutions)

-

Newport Corporation (Precision laser optics, fiber laser systems)

-

Wuhan Raycus Fiber Laser Technologies Co., Ltd. (Continuous wave fiber lasers, MOPA fiber lasers)

-

Lumentum Operations LLC (High-precision fiber lasers, semiconductor lasers)

-

Fanuc Corporation (Laser systems for robotics, fiber laser cutting machines)

-

Furukawa Electric Co., Ltd. (High-power fiber lasers, specialty fiber lasers)

-

Keopsys S.A. (Custom fiber lasers, telecom lasers)

-

Fujikura Ltd. (Compact fiber lasers, high-performance splicing systems)

-

nLIGHT Inc. (Advanced industrial fiber lasers, compact high-power lasers)

-

Bystronic Laser AG (Laser cutting systems, fiber laser automation solutions)

-

Han’s Laser Technology Industry Group Co., Ltd. (Laser welding systems, fiber laser engravers)

-

Prima Industrie S.p.A. (Laser cutting and punching machines, fiber laser modules)

-

Trotec Laser GmbH (Small and medium-sized fiber laser engravers)

-

Amada Co., Ltd. (Fiber laser cutting systems, metal processing lasers)

-

Epilog Laser (Compact fiber lasers for engraving and marking)

-

Rofin-Sinar Technologies Inc. (Micro and macro material processing lasers)

-

Hypertherm Inc. (Industrial fiber laser cutters and plasma systems)

-

Mitsubishi Electric Corporation (Automated fiber laser systems, advanced optics)

-

Jenoptik AG (High-power laser sources, precision cutting systems)

List of suppliers for CNC fiber laser raw materials and components:

-

Corning Inc.

-

Thorlabs Inc.

-

II-VI Incorporated

-

Coherent Inc.

-

Lumentum Operations LLC

-

Furukawa Electric Co., Ltd.

-

IPG Photonics Corporation

-

Laserline GmbH

-

Polatis Ltd.

-

Fujikura Ltd.

-

SCHOTT AG

-

Sanken Electric Co., Ltd.

-

Mitsubishi Electric Corporation

-

Osram Opto Semiconductors

-

Acer Optoelectronics

-

Moxtek Inc.

-

Jenoptik AG

-

Nikon Corporation

-

Primes GmbH

-

Sumitomo Electric Industries, Ltd.

RECENT DEVELOPMENT

-

November 2024, TRUMPF unveiled the TruPrint 3000 at Formnext, featuring dual 700-watt lasers and integrated cooling for improved productivity and stronger parts. The upgrades enhance manufacturing for industries like automotive and aerospace, enabling faster, high-quality volume production.

-

December 2024, IPG Photonics Corp has launched the YLR-AMB series of dual-beam lasers for additive manufacturing, offering precision and efficiency with build rates exceeding 324cm³/hr. The lasers are optimized for materials like Ti-6Al-4V and feature a compact rack-mountable design, improving productivity and material efficiency.

-

October 2024, Coherent introduced a new CO₂ laser electro-optic modulator that enhances processing speeds and precision. This breakthrough enables higher power lasers, up to 1 kW, to accelerate cutting, drilling, and engraving processes in industries like microelectronics and medical device manufacturing.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 2.46 Billion |

| Market Size by 2032 | USD 4.60 Bllion |

| CAGR | CAGR of 7.20% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (CNC CO2 Laser Cutter, CNC Crystal Laser Cutter, CNC Fiber Laser Cutter) • By Type (Stationary Gantry Type, Movable Gantry Type) • By Application (Wood Working, Stone Working, Metal Working, Others) • By End User (Automotive, Building & Construction, Consumer Electronics, Aerospace & Defense, Medical, Energy & Power, Furniture, Transportation, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | IPG Photonics Corporation, TRUMPF GmbH + Co. KG, Maxphotonics Co., Ltd., Coherent Inc., Newport Corporation, Wuhan Raycus Fiber Laser Technologies Co., Ltd., Lumentum Operations LLC, Fanuc Corporation, Furukawa Electric Co., Ltd., Keopsys S.A., Fujikura Ltd., nLIGHT Inc., Bystronic Laser AG, Han’s Laser Technology Industry Group Co., Ltd., Prima Industrie S.p.A., Trotec Laser GmbH, Amada Co., Ltd., Epilog Laser, Rofin-Sinar Technologies Inc., Hypertherm Inc., Mitsubishi Electric Corporation, Jenoptik AG. |

| Key Drivers | • The increasing adoption of CNC fiber lasers in the automotive and aerospace industries is significantly boosting the growth of the CNC fiber laser market. |

| Restraints | • Competition from Alternative Cutting Methods - A Major Challenge for the CNC Fiber Laser Market. |