Automated Fingerprint Identification System Market Report Scope & Overview:

Get More Information on Automated Fingerprint Identification System Market - Request Sample Report

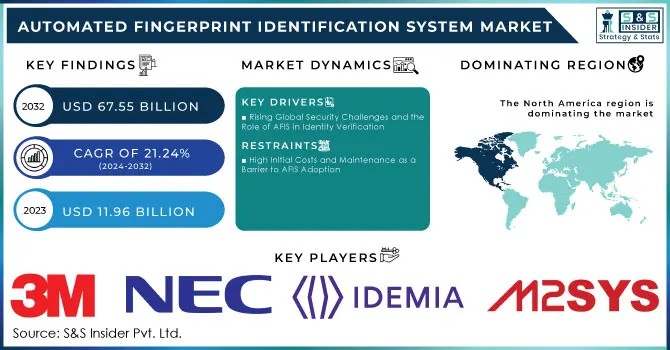

The Automated Fingerprint Identification System Market Size was valued at USD 11.96 Billion in 2023 and is expected to reach USD 67.55 Billion by 2032 and grow at a CAGR of 21.24% over the forecast period 2024-2032.

Global security issues have fueled the need for such strong identification and verification systems as well as automated fingerprint identification systems. AFIS is a collection of electronic components that uses computer systems to capture, store, and analyze a person's biometric information. Because of this, there are many reasons why governments and law enforcement would be attracted to the system.

Mainly, online and mobile banking, the demand for secure financial transactions has been another significant drive for the adoption of AFIS. For instance, the same ATM can be fitted with this technology to withdraw cash instead of debit cards, which then just needs a PIN to draw money regardless of whether a person carrying it or not. Fingerprint authentication provides more security as compared to any traditional password because there is less chance of fraud. According to the periodic reviews conducted by the National Institute of Standards and Technology, FNIR is 1.9%. The False Positive Identification Rate (FPIR) is reported at 0.1% for rolled and slap print matching. As compared to the above, Rank-1 Identification Rate, searching 1114 latent prints against 100,000 reference images is 67.2% according to the NIST-performed evaluation of ELFT-EFS on latent fingerprints.

Risks associated with illegal immigration, terror activities, and the increasing crime rate have also prompted the government to invest in border security and law enforcement. AFIS will enable quicker identification of criminals with its vast database and minimal technical expertise, which has catalyzed market growth over the last few years. For instance, in Bengaluru, India, the local police force has installed MCCTNS since September 2023. It has a fingerprint scanner that is connected to a criminal database; a scan of any individual will show if the person has any records. As of May 2024, around 1.7 million people have been scanned in this technology, and nearly 15,000 people have criminal backgrounds. This brings out efficiency, and there is a need for these solutions to be allowed to allow preventive policing, hence aiding in industry growth.

AFIS Market Dynamics

Key Drivers:

• Rising Global Security Challenges and the Role of AFIS in Identity Verification

The increasing demand for secured systems of identity and verification globally has contributed to the high growth in the Automated Fingerprint Identification System (AFIS) market, especially with the rising crime of identity theft and fraud. According to reports in 2023, U.S. consumers alone suffered around USD 10 billion in losses due to fraud. Data breaches impacted more than 422 million people, up 41.5% compared to the preceding year. These striking statistics denote a need for stronger security measures in all sectors which include government and law enforcement, finance, and healthcare. For instance, AFIS plays an important role in the situation by providing accurate, automated solutions to fingerprint verification. For example, it is used in the management of one of the vast fingerprint data the United States FBI's Integrated Automated Fingerprint Identification System, IAFIS holds in terms of supporting criminal investigations and preventing identity fraud. Similarly, Eurodac, which is the fingerprint database of the European Union making it easier to handle asylum applications and control cross-border crime, cannot work without AFIS.

AFIS helps financial institutions ensure online banking and reduce risks of fraud. Healthcare institutions use it to safeguard sensitive patient data from unauthorized access. As identity theft cases increase by 15% in the United States during 2022, the demand for AFIS solutions will only continue to grow. AFIS helps organizations handle security risks in a better manner and positions itself as the key technology in identity fraud mitigation, access control, and sensitive information security. This overall growth based on trends involving biometric solution usage along with AI and cloud-based technologies is driving this market forward.

Restrain:

• High Initial Costs and Maintenance as a Barrier to AFIS Adoption

Another reason that discourages many people from adopting AFIS widely is the huge cost incurred mainly on installed infrastructure, software, and hardware. Micro-enterprises and developing nations cannot afford such gigantic initial investments. Some of the costs of establishing an AFIS are biometric scanners, connecting systems to previously established databases, and securing safe and secret storage facilities for sensitive data. In addition to this, maintaining a system, the need for software updates, and cybersecurity costs are added expense that falls on institutions with inadequate budgets.

Majority of African states and smaller economies of Latin America, find themselves in situations whereby AFIS presents a challenge due to their limited technological infrastructure and budget constraints. This means that countries will have to choose between what will be first: service or security systems. In many cases, service always takes precedence over expensive security systems, and hence, penetration of the AFIS market is slow. To address these expensive costs, some resellers are now considering cloud-based AFIS solutions that demand fewer hardware and infrastructure, and, therefore, are more feasible for smaller institutions. However, the continuous investment in terms of system upgradation and maintenance provides key constraints on the growth of the AFIS market, particularly in less financially endowed regions.

Automated Fingerprint Identification System Market Segmentation Overview

By Component Type

Hardware Segment Hardware comprised the largest share of revenues in the global market by 43.9% during 2023. Major hardware components of AFIS consist of fingerprint scanners, cameras, and computer systems. These capture, store, and process fingerprint information, hence, heart parts of operations in the system. The initial deployment of an AFIS solution involves a massive investment in these hardware components. The various innovative products in hardware technology have made it necessary for organizations to upgrade their systems, thus driving growth in the segment. Market demand is likely to increase with the emergence of the automated biometric identification system (ABIS) as it will help the authorities increase their efficiency in identification processes by implementing and utilizing a much more advanced database.

The Service Segment is expected to grow at the highest CAGR of 23.89% during the forecast period. AFIS systems are always being upgraded and are being developed with advanced algorithms as well as by using artificial intelligence (AI) so that the system can accurately be deployed in the market. Such complexity has increased the demand for specialized services, enabling the integration of existing security infrastructure and maintaining the system without delay so that the system functions at its optimal level. An ever-growing awareness of the benefits associated with the use of AFIS created a huge demand in underdeveloped and emerging economies for this technology for law enforcement and public service purposes, consequently creating an equivalent demand for the installation and scheduled maintenance of the product.

By End-Use Type

The Banking & Finance Sector dominated the market share in 2023. The institutes deal with crucial customer information and large amounts of money. Therefore, an advanced security system has emerged as the new basic necessity in their operations. There is always a potential for security breaches which may cost these institutes significant monetary and reputational losses. AFIS technology makes for safe user authentication with little or no fraud and unauthorized access. This is the reason why the banking and finance sector has invested a lot in these automated systems.

The Government Sector is expected to expand at the highest CAGR of 24.11% through the forecast period 2024-2032 the AFIS market. Government agencies always seek opportunities to strengthen public safety and national security by implementing advanced solutions. AFIS offers a much faster and more reliable method of criminal identification, border control, and access to government facilities. Governments have also ensured that they digitize their operations and have improved their citizen identification structures, which is a given situation when one has numerous identification mechanisms. These tools also have wide application in situations like natural disasters as they can quickly identify the victims and missing persons by checking their database, this thus helps governments to implement expedited initiatives for rejuvenation and relief.

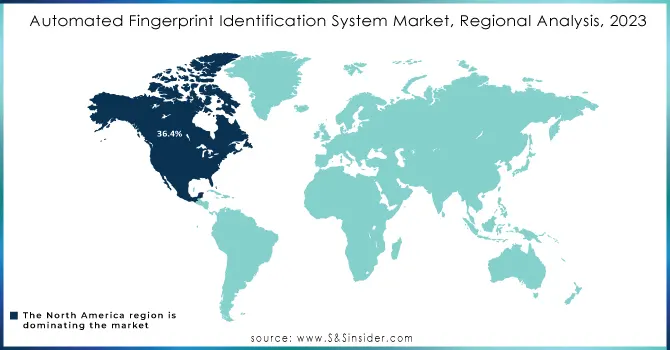

Automated Fingerprint Identification System Market Regional Analysis

The North American region was dominant in the market, accounting for 36.4% of the world market share in 2023. The region has a fully developed technological infrastructure, which has driven the development and deployment of advanced AFIS solutions. Hence, in the way innovation is approached, there has always been a competitive edge kept by companies in North America in the global market. In addition, the governments and businesses in the region are always looking to implement strong security practices. This means that the demand for AFIS solutions would be quite high across various sectors of the market, such as government offices, financial institutions, and private organizations.

The Asia Pacific segment is expected to witness the highest growth in terms of CAGR of 23.99% over the forecast period. The fast speed of economic growth and increasing disposable income levels in the Asia Pacific have driven the demand for enhanced security measures across various sectors, namely banking, immigration control, and access control. According to the data of ASI, the number of persons employed in manufacturing industries saw a 7.5 % hike to 1.85 crores in the year 2022-23 against 1.72 crores in the previous year. The estimated number of persons engaged in the sector in 2022-23 crossed 22.14 lakh above the pre-pandemic level, according to a statement by MoSPI, adding that average emolument also saw a hike over the. The governments in the region have initiated initiatives that promote the use of biometric identification systems, of which fingerprints are one. These policies are incentives for developing and rolling out AFIS solutions; hence, there are significant opportunities to launch AFIS products.

Need Any Customization Research On Automated Fingerprint Identification System Market - Inquiry Now

Key Players in Automated Fingerprint Identification System Market

Some of the major players in the Automated Fingerprint Identification System (AFIS) Market are:

-

3M (3M Cogent Fingerprint Biometrics, 3M Mobile ID Solutions)

-

NEC Corporation (NEC NeoFace, NEC AFIS)

-

IDEMIA (MorphoFingerprint, ID Check Mobile)

-

Fujitsu (Fujitsu Biometric Authentication System, Fujitsu PalmSecure)

-

HID Global Corporation (HID DigitalPersona, HID ActivID Authentication Server)

-

M2SYS Technology (M2SYS Bio-Plugin, M2SYS Cloud-based AFIS)

-

Biometrics4ALL (BioStore, BioLite)

-

DERMALOG Identification Systems GmbH (DERMALOG AFIS, DERMALOG Fingerprint Scanner)

-

Papillon Systems (Papillon AFIS, Papillon Biometric Solutions)

-

Sonda Technologies Ltd. (Sonda AFIS Solutions, Sonda Biometric Systems)

-

Cross Match Technologies (Cross Match SecureCapture, Cross Match DigitalPersona)

-

Gemalto (Gemalto AFIS, Gemalto BioSmart)

-

Suprema (Suprema BioStar, Suprema FaceStation)

-

ZKTeco (ZKTeco BioTime, ZKTeco Fingerprint Attendance)

-

Veridos (Veridos ID Solutions, Veridos Biometric Enrollment)

-

Bio-Key International (Bio-Key ID Director, Bio-Key WEB-key)

-

MorphoTrust (part of IDEMIA) (MorphoTrust Biometric Enrollment, MorphoTrust SmartID)

-

SYNAPSIS (SYNAPSIS AFIS, SYNAPSIS Identity Management)

-

Innovatrics (Innovatrics AFIS, Innovatrics SmartFace)

-

TBS (The Biometrics Company) (TBS AFIS Solutions, TBS Identity Management Systems)

RECENT TRENDS

-

In July 2024, the Japanese communications corporation SoftBank Corp. formed a strategic partnership with NEC Corporation to integrate NEC's Bio-IDiom biometric authentication technology into the security services and communication infrastructure of SoftBank. This collaboration is going to enhance the use of advanced security controls adapted to various industrial and application requirements.

-

In May 2024, IDEMIA Public Security North America announced that it would be rolling out its STORM ABIS Automated Biometric Identification System to the Volusia Sheriff's Office in Florida. The cloud-based system is designed to empower law enforcement agencies' ability to identify, analyze, compare, and document prints via a complex algorithm from a remote location, thereby increasing the effectiveness of the operations carried out by those individuals.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 11.96 Billion |

| Market Size by 2032 | US$ 67.55 Billion |

| CAGR | CAGR of 21.24 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component Type (Hardware, Software, Service) • By Search type (Tenprint Search, Latent Search) • By End-use Type (Banking & Finance, Consumer Electronics, Defense & Security, Government, Healthcare, Transport/Logistics, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | 3M, NEC Corporation, IDEMIA, Fujitsu, HID Global Corporation, M2SYS Technology, Biometrics4ALL, DERMALOG, Papillon Systems, Sonda Technologies Ltd., Cross Match Technologies, Gemalto, Suprema, ZKTeco, Veridos, Bio-Key International, MorphoTrust, SYNAPSIS, Innovatrics, TBS |

| Key Drivers | • Rising Global Security Challenges and the Role of AFIS in Identity Verification |

| Restraints | • High Initial Costs and Maintenance as a Barrier to AFIS Adoption |