The Smart Hospitality Market is anticipated to increase at a CAGR of 30% from 2024 to 2031, from a value of USD 17.55 billion in 2023 and expected to reach USD 143.16 billion by 2031.

The need for real-time optimal guest experience management, lower operational expenses, and growing interest in IoT are all on the rise, as is the demand for hospitality software and services. These are the main elements that are propelling the development of the smart hospitality market. Smart hospitality is a quickly developing sector that makes use of automated software, intelligent solutions, and mobile devices to enhance customer services. These technologies enable customers to select their rooms, room kinds, and room numbers using their mobile devices, greatly improving the guest experience.

Get more information on Smart Hospitality Market - Request Free Sample Report

Drivers

Increasing 5G adoption in the hospitality industry

A greater focus is being placed on individualized services to improve the client experience.

Increasing consumer desire for guest-focused, hyperconnected personalization and real-time tailored experiences will boost the market.

Hoteliers have the opportunity to establish a strong and meaningful connection with each guest, ensuring they have a memorable experience and increasing the likelihood of receiving positive reviews. By offering a more personalized and tailored travel experience, hoteliers can enhance their brand reputation, foster customer loyalty, and generate additional revenue. The advent of smart hospitality solutions has revolutionized the industry, providing hoteliers with valuable insights and data on guest behavior. This data can be utilized to gain a comprehensive understanding of each visitor, enabling hoteliers to improve their experience through enhanced customer care. With the help of integrated digital platforms such as Property Management System (PMS) and Customer Relationship Management (CRM), hoteliers can access a centralized dashboard that organizes data from various sources. This not only allows for a personalized view of each guest but also helps alleviate operational burdens. the utilization of these digital platforms can lead to a reduction in hotel operating expenses and an increase in guest retention rates. This, in turn, strengthens the hotel's brand positioning and overall success.

By providing a mobile-centric guest experience that enhances the guest's convenience and self-service, hotels are now also reaping benefits. Hoteliers may design a more connected and convenient stay for their customers by developing a mobile-centric booking experience, providing keyless entry using a mobile device, text-based communications, mobile concierge, etc.

Restrains

The high expense of implementation, upkeep, and training

The adoption of sophisticated hospitality systems, including Property Management Systems (PMS) and Guest Experience Management Systems, entails substantial expenses, regardless of whether they are implemented locally or online. The financial constraints imposed by the aftermath of the pandemic have made it particularly challenging for hotels to invest in smart hospitality solutions. The industry is still grappling with the colossal financial losses incurred during this period. Furthermore, hotels that have already embraced smart technologies have encountered significant maintenance costs. However, it is important to recognize that the cost of deployment is typically associated with the level of complexity involved in integrating these applications.

Opportunities

Real-time, ideal visitor experience management is becoming more and more popular.

Attractive revenue generation and affordable operating costs

expanding the usage of energy management systems with the Internet of Things (IoT)

Challenges

Challenges to data security and information sharing.

Need technical persons to effectively handle the software.

Conflict escalates and results in economic sanctions, disruptions to trade, or an overall economic downturn, it could lead to reduced consumer spending and business investments. This might cause hotels and other hospitality businesses to postpone or scale back their plans to invest in smart technologies. The conflict could lead to a shift in priorities for both governments and businesses, potentially diverting resources away from technological innovation and development. This might slow down the advancement of new smart hospitality technologies, as companies focus on adapting to the changing geopolitical and economic landscape.

The conflict could lead to increased cyber threats and attacks. As tensions rise, there might be a higher likelihood of cyberattacks targeting businesses, including those in the hospitality sector. This could undermine trust in smart technology solutions and raise concerns about data security and privacy. The uncertainty caused by the conflict might lead to a reduction in venture capital investments and funding for startups in the smart hospitality sector. Investors might become more cautious, and companies might struggle to secure the necessary funding for research, development, and expansion. conflict results in political instability or safety concerns, tourism could decline in the affected regions. This would directly impact the hospitality industry, potentially leading to reduced demand for smart technology solutions as hotel occupancy rates decrease. As geopolitical tensions rise, consumer sentiment and behavior can change. Travelers might become more cautious about sharing personal information through smart devices in hotels due to concerns about privacy and security.

Impact of Recession

Hospitality businesses might delay or cancel planned upgrades or implementations of smart technologies due to financial constraints. This delay can impact the market's growth and hinder the integration of new technologies that could improve customer experiences and operational efficiency. Recessionary periods often lead to changes in consumer behavior, including reduced spending on travel and leisure activities. This can directly impact the demand for smart hospitality services, such as automated check-ins, smart room controls, and personalized services, as fewer guests might be willing to pay premiums for these features. Hospitality businesses may prioritize cost-cutting measures during a recession, which could lead to a decreased emphasis on technology investments. This might result in a slowdown in the adoption of innovative solutions that improve operational efficiency and guest satisfaction. During tough economic times, hospitality businesses might shift their priorities away from long-term technological advancements to short-term survival strategies. This could result in a reduced focus on integrating new smart technologies and a greater emphasis on maintaining core operations. Economic downturns can lead to consolidation within the hospitality industry as weaker players may merge or go out of business. This could impact the adoption of smart hospitality technologies, as consolidation might disrupt ongoing technology implementations or deter investment in new solutions. Hospitality businesses may become more cautious when evaluating the return on investment (ROI) of smart technology implementations. They might demand quicker and more tangible results from these technologies, which could affect the willingness to invest in longer-term projects.

By Offering

Solution

Property Management System

Guest Experience Management System

Integrated Security Management

Facility Management Software

Network Management Software

Point of Sale Software

Services

Professional Services

Consulting

Integaration and Development

Support and Maintenance

Managed Services

By Deployment Mode

Cloud

On-premises

By End User

Hotel

Cruise

Luxury Yatches

Others

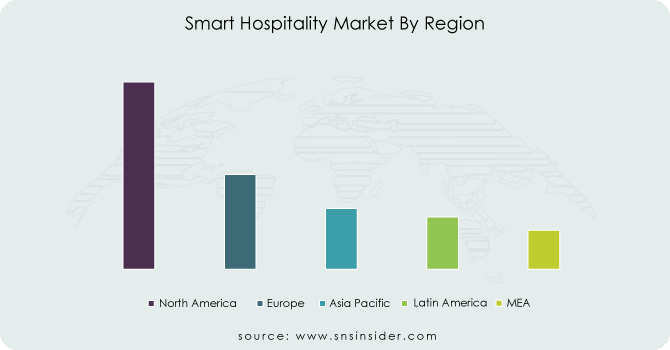

North America is the leading in the smart hospitality market, and it is anticipated that it will continue to hold that position throughout the forecast period. This is due to the region's strong demand for high-quality smart services, cloud-based platforms, and top-notch security that goes above and beyond industry standards. The Internet of Things allows hotel staff to remotely control electronic devices in "smart hotels," giving them access to real-time data about their operational state. Asia Pacific, on the other hand, is predicted to experience significant growth during the forecast period. Because of these factors, the smart hospitality market is anticipated to increase significantly throughout the forecast period.

Over the next five years, the smart hospitality industry will increase in this region due to factors like supportive government initiatives and legislation to stimulate the expansion of the hotel sector. The region's smart hotel sector continues to flourish as a result of greater technological advancements, internet infrastructure, expanded IoT applications, and efficient energy use. The market in the region will be driven by a booming tourism sector, a more modern hotel infrastructure, and a high rate of new hotel openings in numerous Asia-Pacific nations like Thailand, Malaysia, and Indonesia.

Need any customization research on Smart Hospitality Market - Enquiry Now

REGIONAL COVERAGE:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

The major players are IBM, Huawei, Schneider Electric, NEC, Cisco, Honeywell, Sabre, Legrand, Siemens AG, Global Business Solutions, Oracle, Infor, Johnson Controls, Samsung, Leviton, Control4, Wisuite, Stayntouch, Qualsoft Systems, Hospitality Network, Springler-Miller Systems, Guestline, Frontdesk Anywhere, Chris Lewis Group, BuildingIQ, Cloudbeds, and others players.

In May 2022, Oracle and Orient Jakarta collaborated to develop a cutting-edge property management system. This collaboration proved to be invaluable, especially during the challenging times of the COVID-19 pandemic, as it allowed them to bolster their online presence and provide remote staff training through the use of Oracle Digital Learning technologies.

In January 2022, Johnson Controls made a significant acquisition by purchasing FogHorn, a renowned manufacturer of edge AI solutions. This strategic merger is set to revolutionize the development of sustainable and highly efficient autonomous spaces.

Another notable partnership formed in January 2022 was between Infor and Seven Feathers Casino. This collaboration aims to elevate customer service within the hospitality sector by integrating specialized applications tailored specifically for this industry.

To enhance its digital building offering, which already includes cloud-based building operations and its smart building management platform Desigo CC, Siemens purchased EcoDomus' digital twin software in December 2021.

| Report Attributes | Details |

| Market Size in 2023 | US$ 17.55 Bn |

| Market Size by 2031 | US$ 143.16 Bn |

| CAGR | CAGR of 30% From 2024 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | By Offering[Solution(Property Management System,Guest Experience Management System,Integrated Security Management,Facility Management Software, Network Management Software, Point of Sale Software),Services(Professional Services, Consulting, Integaration and Development, Support and Maintenance, Managed Services)], By Deployment Mode[Cloud, On-premises],By End User[Hotel, Cruise, Luxury, Yatches, Others] |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]). Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | IBM, Huawei, Schneider Electric, NEC, Cisco, Honeywell, Sabre, Legrand, Siemens AG, Global Business Solutions, Oracle, Infor, Johnson Controls, Samsung, Leviton, Control4, Wisuite, Stayntouch, Qualsoft Systems, Hospitality Network, Springler-Miller Systems, Guestline, Frontdesk Anywhere, Chris Lewis Group, BuildingIQ, Cloudbeds |

| Key Drivers | • Increasing 5G adoption in the hospitality industry • A greater focus is being placed on individualized services to improve the client experience. • Increasing consumer desire for guest-focused, hyperconnected personalization and real-time tailored experiences will boost the market. |

| Market Restraints | • High expense of implementation, upkeep, and training |

Ans: Three segments are covered in the Smart Hospitality Market Report, By offerings, By Deployment Mode, By End User.

Ans. The forecast period of the Smart Hospitality Market is 2024-2031.

Ans: The value of the Smart Hospitality Market is 17.55 billion in 2023.

Ans: Yes, you can ask for the customization as pas per your business requirement.

Ans. The CAGR of the Smart Hospitality Market is 30%.

TABLE OF CONTENTS

1. Introduction

1.1 Market Definition

1.2 Scope

1.3 Research Assumptions

2. Industry Flowchart

3. Research Methodology

4. Market Dynamics

4.1 Drivers

4.2 Restraints

4.3 Opportunities

4.4 Challenges

5. Impact Analysis

5.1 Impact of Russia-Ukraine Crisis

5.2 Impact of Economic Slowdown on Major Countries

5.2.1 Introduction

5.2.2 United States

5.2.3 Canada

5.2.4 Germany

5.2.5 France

5.2.6 UK

5.2.7 China

5.2.8 Japan

5.2.9 South Korea

5.2.10 India

6. Value Chain Analysis

7. Porter’s 5 Forces Model

8. Pest Analysis

9. Smart Hospitality Market Segmentation, By Offering

9.1 Introduction

9.3 Solution

9.3.1Property Management System

9.3.2 Guest Experience Management System

9.3.3 Integrated Security Management

9.3.4 Facility Management Software

9.3.5 Network Management Software

9.3.6 Point of Sale Software

9.4 Services

9.4.1Professional Services

9.4.2 Consulting

9.4.3 Integaration and Development

9.4.4 Support and Maintenance

9.4.5 Managed Services

10. Smart Hospitality Market Segmentation, By Deployment Mode

10.2 Trend Analysis

10.3 Cloud

11. Smart Hospitality Market Segmentation, By End User

11.1 Introduction

11.3 Hotel

11.4 Cruise

11.5 Luxury Yatches

11.6 Others

12. Regional Analysis

12.1 Introduction

12.2 North America

12.2.1 Trend Analysis

12.2.2 North America Smart Hospitality Market by Country

12.2.3 North America Smart Hospitality Market By Offering

12.2.4 North America Smart Hospitality Market By Deployment Mode

12.2.5 North America Smart Hospitality Market By End User

12.2.6 USA

12.2.6.1 USA Smart Hospitality Market By Offering

12.2.6.2 USA Smart Hospitality Market By Deployment Mode

12.2.6.3 USA Smart Hospitality Market By End User

12.2.7 Canada

12.2.7.1 Canada Smart Hospitality Market By Offering

12.2.7.2 Canada Smart Hospitality Market By Deployment Mode

12.2.7.3 Canada Smart Hospitality Market By End User

12.2.8 Mexico

12.2.8.1 Mexico Smart Hospitality Market By Offering

12.2.8.2 Mexico Smart Hospitality Market By Deployment Mode

12.2.8.3 Mexico Smart Hospitality Market By End User

12.3 Europe

12.3.1 Trend Analysis

12.3.2 Eastern Europe

12.3.2.1 Eastern Europe Smart Hospitality Market by Country

12.3.2.2 Eastern Europe Smart Hospitality Market By Offering

12.3.2.3 Eastern Europe Smart Hospitality Market By Deployment Mode

12.3.2.4 Eastern Europe Smart Hospitality Market By End User

12.3.2.5 Poland

12.3.2.5.1 Poland Smart Hospitality Market By Offering

12.3.2.5.2 Poland Smart Hospitality Market By Deployment Mode

12.3.2.5.3 Poland Smart Hospitality Market By End User

12.3.2.6 Romania

12.3.2.6.1 Romania Smart Hospitality Market By Offering

12.3.2.6.2 Romania Smart Hospitality Market By Deployment Mode

12.3.2.6.4 Romania Smart Hospitality Market By End User

12.3.2.7 Hungary

12.3.2.7.1 Hungary Smart Hospitality Market By Offering

12.3.2.7.2 Hungary Smart Hospitality Market By Deployment Mode

12.3.2.7.3 Hungary Smart Hospitality Market By End User

12.3.2.8 Turkey

12.3.2.8.1 Turkey Smart Hospitality Market By Offering

12.3.2.8.2 Turkey Smart Hospitality Market By Deployment Mode

12.3.2.8.3 Turkey Smart Hospitality Market By End User

12.3.2.9 Rest of Eastern Europe

12.3.2.9.1 Rest of Eastern Europe Smart Hospitality Market By Offering

12.3.2.9.2 Rest of Eastern Europe Smart Hospitality Market By Deployment Mode

12.3.2.9.3 Rest of Eastern Europe Smart Hospitality Market By End User

12.3.3 Western Europe

12.3.3.1 Western Europe Smart Hospitality Market by Country

12.3.3.2 Western Europe Smart Hospitality Market By Offering

12.3.3.3 Western Europe Smart Hospitality Market By Deployment Mode

12.3.3.4 Western Europe Smart Hospitality Market By End User

12.3.3.5 Germany

12.3.3.5.1 Germany Smart Hospitality Market By Offering

12.3.3.5.2 Germany Smart Hospitality Market By Deployment Mode

12.3.3.5.3 Germany Smart Hospitality Market By End User

12.3.3.6 France

12.3.3.6.1 France Smart Hospitality Market By Offering

12.3.3.6.2 France Smart Hospitality Market By Deployment Mode

12.3.3.6.3 France Smart Hospitality Market By End User

12.3.3.7 UK

12.3.3.7.1 UK Smart Hospitality Market By Offering

12.3.3.7.2 UK Smart Hospitality Market By Deployment Mode

12.3.3.7.3 UK Smart Hospitality Market By End User

12.3.3.8 Italy

12.3.3.8.1 Italy Smart Hospitality Market By Offering

12.3.3.8.2 Italy Smart Hospitality Market By Deployment Mode

12.3.3.8.3 Italy Smart Hospitality Market By End User

12.3.3.9 Spain

12.3.3.9.1 Spain Smart Hospitality Market By Offering

12.3.3.9.2 Spain Smart Hospitality Market By Deployment Mode

12.3.3.9.3 Spain Smart Hospitality Market By End User

12.3.3.10 Netherlands

12.3.3.10.1 Netherlands Smart Hospitality Market By Offering

12.3.3.10.2 Netherlands Smart Hospitality Market By Deployment Mode

12.3.3.10.3 Netherlands Smart Hospitality Market By End User

12.3.3.11 Switzerland

12.3.3.11.1 Switzerland Smart Hospitality Market By Offering

12.3.3.11.2 Switzerland Smart Hospitality Market By Deployment Mode

12.3.3.11.3 Switzerland Smart Hospitality Market By End User

12.3.3.1.12 Austria

12.3.3.12.1 Austria Smart Hospitality Market By Offering

12.3.3.12.2 Austria Smart Hospitality Market By Deployment Mode

12.3.3.12.3 Austria Smart Hospitality Market By End User

12.3.3.13 Rest of Western Europe

12.3.3.13.1 Rest of Western Europe Smart Hospitality Market By Offering

12.3.3.13.2 Rest of Western Europe Smart Hospitality Market By Deployment Mode

12.3.3.13.3 Rest of Western Europe Smart Hospitality Market By End User

12.4 Asia-Pacific

12.4.1 Trend Analysis

12.4.2 Asia-Pacific Smart Hospitality Market by Country

12.4.3 Asia-Pacific Smart Hospitality Market By Offering

12.4.4 Asia-Pacific Smart Hospitality Market By Deployment Mode

12.4.5 Asia-Pacific Smart Hospitality Market By End User

12.4.6 China

12.4.6.1 China Smart Hospitality Market By Offering

12.4.6.2 China Smart Hospitality Market By Deployment Mode

12.4.6.3 China Smart Hospitality Market By End User

12.4.7 India

12.4.7.1 India Smart Hospitality Market By Offering

12.4.7.2 India Smart Hospitality Market By Deployment Mode

12.4.7.3 India Smart Hospitality Market By End User

12.4.8 Japan

12.4.8.1 Japan Smart Hospitality Market By Offering

12.4.8.2 Japan Smart Hospitality Market By Deployment Mode

12.4.8.3 Japan Smart Hospitality Market By End User

12.4.9 South Korea

12.4.9.1 South Korea Smart Hospitality Market By Offering

12.4.9.2 South Korea Smart Hospitality Market By Deployment Mode

12.4.9.3 South Korea Smart Hospitality Market By End User

12.4.10 Vietnam

12.4.10.1 Vietnam Smart Hospitality Market By Offering

12.4.10.2 Vietnam Smart Hospitality Market By Deployment Mode

12.4.10.3 Vietnam Smart Hospitality Market By End User

12.4.11 Singapore

12.4.11.1 Singapore Smart Hospitality Market By Offering

12.4.11.2 Singapore Smart Hospitality Market By Deployment Mode

12.4.11.3 Singapore Smart Hospitality Market By End User

12.4.12 Australia

12.4.12.1 Australia Smart Hospitality Market By Offering

12.4.12.2 Australia Smart Hospitality Market By Deployment Mode

12.4.12.3 Australia Smart Hospitality Market By End User

12.4.13 Rest of Asia-Pacific

12.4.13.1 Rest of Asia-Pacific Smart Hospitality Market By Offering

12.4.13.2 Rest of Asia-Pacific Smart Hospitality Market By Deployment Mode

12.4.13.3 Rest of Asia-Pacific Smart Hospitality Market By End User

12.5 Middle East & Africa

12.5.1 Trend Analysis

12.5.2 Middle East

12.5.2.1 Middle East Smart Hospitality Market by Country

12.5.2.2 Middle East Smart Hospitality Market By Offering

12.5.2.3 Middle East Smart Hospitality Market By Deployment Mode

12.5.2.4 Middle East Smart Hospitality Market By End User

12.5.2.5 UAE

12.5.2.5.1 UAE Smart Hospitality Market By Offering

12.5.2.5.2 UAE Smart Hospitality Market By Deployment Mode

12.5.2.5.3 UAE Smart Hospitality Market By End User

12.5.2.6 Egypt

12.5.2.6.1 Egypt Smart Hospitality Market By Offering

12.5.2.6.2 Egypt Smart Hospitality Market By Deployment Mode

12.5.2.6.3 Egypt Smart Hospitality Market By End User

12.5.2.7 Saudi Arabia

12.5.2.7.1 Saudi Arabia Smart Hospitality Market By Offering

12.5.2.7.2 Saudi Arabia Smart Hospitality Market By Deployment Mode

12.5.2.7.3 Saudi Arabia Smart Hospitality Market By End User

12.5.2.8 Qatar

12.5.2.8.1 Qatar Smart Hospitality Market By Offering

12.5.2.8.2 Qatar Smart Hospitality Market By Deployment Mode

12.5.2.8.3 Qatar Smart Hospitality Market By End User

12.5.2.9 Rest of Middle East

12.5.2.9.1 Rest of Middle East Smart Hospitality Market By Offering

12.5.2.9.2 Rest of Middle East Smart Hospitality Market By Deployment Mode

12.5.2.9.3 Rest of Middle East Smart Hospitality Market By End User

12.5.3 Africa

12.5.3.1 Africa Smart Hospitality Market by Country

12.5.3.2 Africa Smart Hospitality Market By Offering

12.5.3.3 Africa Smart Hospitality Market By Deployment Mode

12.5.3.4 Africa Smart Hospitality Market By End User

12.5.3.5 Nigeria

12.5.3.5.1 Nigeria Smart Hospitality Market By Offering

12.5.3.5.2 Nigeria Smart Hospitality Market By Deployment Mode

12.5.3.5.3 Nigeria Smart Hospitality Market By End User

12.5.3.6 South Africa

12.5.3.6.1 South Africa Smart Hospitality Market By Offering

12.5.3.6.2 South Africa Smart Hospitality Market By Deployment Mode

12.5.3.6.3 South Africa Smart Hospitality Market By End User

12.5.3.7 Rest of Africa

12.5.3.7.1 Rest of Africa Smart Hospitality Market By Offering

12.5.3.7.2 Rest of Africa Smart Hospitality Market By Deployment Mode

12.5.3.7.3 Rest of Africa Smart Hospitality Market By End User

12.6 Latin America

12.6.1 Trend Analysis

12.6.2 Latin America Smart Hospitality Market by country

12.6.3 Latin America Smart Hospitality Market By Offering

12.6.4 Latin America Smart Hospitality Market By Deployment Mode

12.6.5 Latin America Smart Hospitality Market By End User

12.6.6 Brazil

12.6.6.1 Brazil Smart Hospitality Market By Offering

12.6.6.2 Brazil Smart Hospitality Market By Deployment Mode

12.6.6.3 Brazil Smart Hospitality Market By End User

12.6.7 Argentina

12.6.7.1 Argentina Smart Hospitality Market By Offering

12.6.7.2 Argentina Smart Hospitality Market By Deployment Mode

12.6.7.3 Argentina Smart Hospitality Market By End User

12.6.8 Colombia

12.6.8.1 Colombia Smart Hospitality Market By Offering

12.6.8.2 Colombia Smart Hospitality Market By Deployment Mode

12.6.8.3 Colombia Smart Hospitality Market By End User

12.6.9 Rest of Latin America

12.6.9.1 Rest of Latin America Smart Hospitality Market By Offering

12.6.9.2 Rest of Latin America Smart Hospitality Market By Deployment Mode

12.6.9.3 Rest of Latin America Smart Hospitality Market By End User

13. Company Profiles

13.1 IBM

13.1.1 Company Overview

13.1.2 Financial

13.1.3 Offering/ Services Offered

13.1.4 SWOT Analysis

13.1.5 The SNS View

13.2 Huawei

13.2.1 Company Overview

13.2.2 Financial

13.2.3 Offering / Services Offered

13.2.4 SWOT Analysis

13.2.5 The SNS View

13.3 Schneider Electric

13.3.1 Company Overview

13.3.2 Financial

13.3.3 Offering / Services Offered

13.3.4 SWOT Analysis

13.3.5 The SNS View

13.4 NEC

13.4.1 Company Overview

13.4.2 Financial

13.4.3 Offering / Services Offered

13.4.4 SWOT Analysis

13.4.5 The SNS View

13.5 Cisco

13.5.1 Company Overview

13.5.2 Financial

13.5.3 Offering/ Services Offered

13.5.4 SWOT Analysis

13.5.5 The SNS View

13.6 Honeywell

13.6.1 Company Overview

13.6.2 Financial

13.6.3 Offering/ Services Offered

13.6.4 SWOT Analysis

13.6.5 The SNS View

13.7 Sabre

13.7.1 Company Overview

13.7.2 Financial

13.7.3 Offering/ Services Offered

13.7.4 SWOT Analysis

13.7.5 The SNS View

13.8.1 Company Overview

13.8.2 Financial

13.8.3 Offering/ Services Offered

13.8.4 SWOT Analysis

13.8.5 The SNS View

13.9 Siemens AG

13.9.1 Company Overview

13.9.2 Financial

13.9.3 Offering/ Services Offered

13.9.4 SWOT Analysis

13.9.5 The SNS View

13.10 Global Business Solutions

13.10.1 Company Overview

13.10.2 Financial

13.10.3 Offering/ Services Offered

13.10.4 SWOT Analysis

13.10.5 The SNS View

14. Competitive Landscape

14.1 Competitive Benchmarking

14.2 Market Share Analysis

14.3 Recent Developments

14.3.1 Industry News

14.3.2 Company News

14.3.3 Mergers & Acquisitions

15. Use Case and Best Practices

16. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

The Spinal Muscular Atrophy Treatment Market size was estimated USD 4.2billion in 2022 and is expected to reach USD 7.1 billion by 2030 at a CAGR of 6.9% during the forecast period of 2023-2030.

The Breast Implants Market Size was valued at USD 2.58 billion in 2023 and is expected to reach USD 4.63 billion by 2031 and grow at a CAGR of 7.6% over the forecast period 2024-2031.

The Blood Glucose Monitoring Device Market Size was valued at USD 13.53 billion in 2023, and is expected to reach USD 24.94 billion by 2031, and grow at a CAGR of 7.94% over the forecast period 2024-2031.

The Microcatheters Market Size was valued at USD 1.98 billion in 2022, and is expected to reach USD 2.71 billion by 2030 and grow at a CAGR of 4% over the forecast period 2023-2030.

The Cancer Diagnostics Market Size was valued at USD 114.6 billion in 2023 and is expected to reach USD 185.4 billion by 2031 and grow at a CAGR of 6.2% over the forecast period 2024-2031.

The Next Generation Sequencing Market size was estimated at USD 8.31 billion in 2023 and is expected to reach USD 40.97 billion by 2031 at a CAGR of 22.07% during the forecast period of 2024-2031.

Hi! Click one of our member below to chat on Phone