Smart Smoke Detector Market Size & Growth:

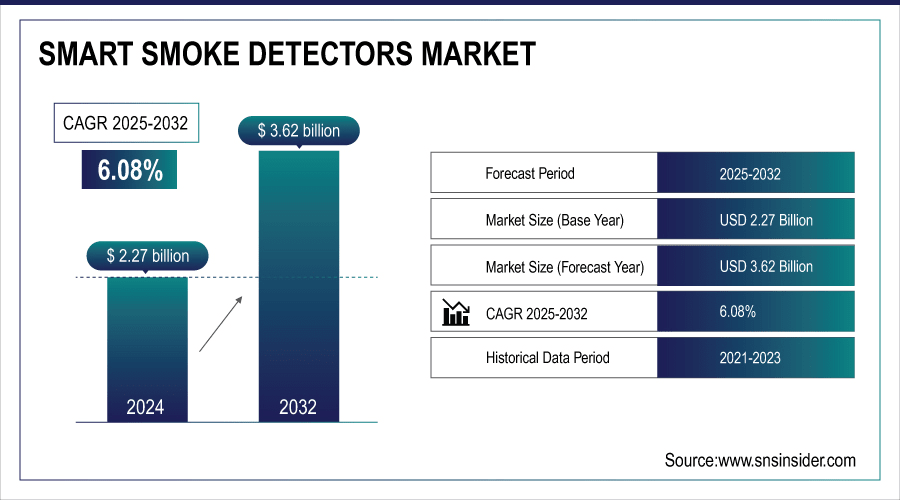

The Smart Smoke Detector Market size was valued at USD 2.27 Billion in 2024 and is projected to reach USD 3.62 Billion by 2032, growing at a CAGR of 6.08% during 2025-2032.

The Smart Smoke Detector Market is growing with the increasing adoption of smart home technology and increasing awareness of sophisticated fire safety systems. Growing demand from residential application, accompanied by strict government regulations and building safety codes, is boosting the wider adoption. Integration into IoT ecosystems and voice assistants adds convenience to make connected detectors more appealing to homeowners and property managers. In addition, dropping sensor prices, and technologies such as multi-sensor detection and AI-based false alarm reduction, are contributing to fast market growth.

Over 60% of smart smoke detectors launched in 2023 support integration with IoT platforms like Apple HomeKit, Google Home, or Amazon Alexa.

Smart Smoke Detector Market Size and Forecast:

-

Market Size in 2024: USD 2.27 Billion

-

Market Size by 2032: USD 3.62 Billion

-

CAGR: 6.08% from 2025 to 2032

-

Base Year: 2024

-

Forecast Period: 2025–2032

To Get More Information On Smart Smoke Detector Market - Request Free Sample Report

Key Smart Smoke Detector Market Trends

-

Smart smoke detectors are now being used along with other IOT devices and voice assistants to receive on demand connectivity to your house for real time alerts of just about anything in your home.

-

AI- powered multi-sensor detectors are becoming popular as they can decrease the number of false alarms and enhance the operational accuracy of fire detection. These smart systems adapt to environmental patterns, ensuring reliability and user confidence in homes, buildings and commercial applications.

-

Tight government regulations that prescribe interconnected alarms in newly-built and renovated structures are fuelling the adoption of smart detectors. Standards such as NFPA 72 and the UK’s Building Safety Act are driving adoption of wireless intelligent solutions.

-

Discounts on premiums like 5% - 20% for connected safety systems by insurers to incentivize adoption of smart detectors. These programs are driving consumer uptake and advancing fire response preparedness.

-

Growing awareness and urbanization in the Asia-Pacific, Latin America and Middle East are opening up newer options. With smart home penetration below 10% in most markets, there remains a vast opportunity for continued growth in residential and commercial applications.

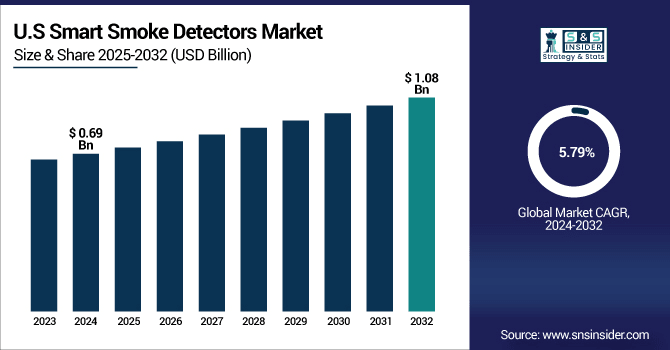

U.S. Smart Smoke Detector Market size was valued at USD 0.69 Billion in 2024 and is expected to reach USD 1.08 Billion by 2032, growing at a CAGR of 5.79% during 2025-2032. Smart Smoke Detector Market Expansion is Being Challenged by Consumer Awareness for Home Safety & Integration with Smart Home Technologies. By the same token, rigid fire safety rules and building codes are also promoting the installation of new and the modification of existing advanced smoke detection systems.

Integration with IoT platforms, voice assistants, and mobile apps on smart smoke detectors adds convenience, as well as the ability for real-time monitoring. Increasing adoption of battery powered and multi-sensor devices and insurance discounts offered for connected safety devices are also driving market growth.

Smart Smoke Detector Market Growth Drivers:

-

Rising smart-home adoption, fire safety awareness, IoT integration, multi-sensor technology, and regulatory compliance.

The Smart Smoke Detector Market driven by growing concern towards home and property security from consumers. Compatibility with IoT platforms and voice-based assistants makes it easy to use and provides options of real-time tracking. False alarm reducing multi sensor detectors are increasingly being employed everywhere. Municipal standards and fire safety requirements are fueling adoption within new builds and at the replacement level. On the whole, technology breakthroughs and the burgeoning smart-home trend are driving market growth throughout the world.

Multi-sensor detectors (combining smoke, heat, CO, and sometimes humidity sensors) now account for over 40% of smart detector sales globally.

Smart Smoke Detector Market Restraints:

-

High device cost, complex installation, limited interoperability, privacy concerns, and reliance on stable connectivity.

The Smart Smoke Detector Market is hindered by the expensive cost of the product. The installation of wired or built-in system may be so labor-intensive that some customers would rather not even bother. There is not enough compatibility between the various smart-home platforms for seamless connectivity/interoperability and broader market adoption. Confidentiality and security issues relating to connected devices can cause consumers lose confidence. On top of that, dependency on a consistent Wi-Fi -> network connection will greatly hinder performance in some locations.

Smart Smoke Detector Market Opportunities:

-

Growing smart-home adoption, EV integration, AI-enabled sensors, insurance incentives, and emerging markets expansion.

Smart Smoke Detector Market – Opportunities The Smart Smoke Detector Market is a rapidly growing market with increasing penetration of the smart home across the globe. The addition in electric vehicles and connected mobility solutions paves the way for new applications segments. Multi-sensor detectors enabled with AI for greater accuracy and fewer false alarms translate to greater consumer attraction. Connected devices are being pushed by insurers with the promise of lower premiums and bonus for safety.

Smart smoke detectors are now included in over 35% of mid-to-high-end smart home security bundles (e.g., Google Nest, Amazon Ring, ADT Command).

Key Smart Smoke Detector Market Segment Analysis

-

By Product Type, Photoelectric Smoke Detectors led with ~ 41.78% share in 2024; Smart Battery-Operated Smoke Detectors fastest growing (CAGR 7.35%).

-

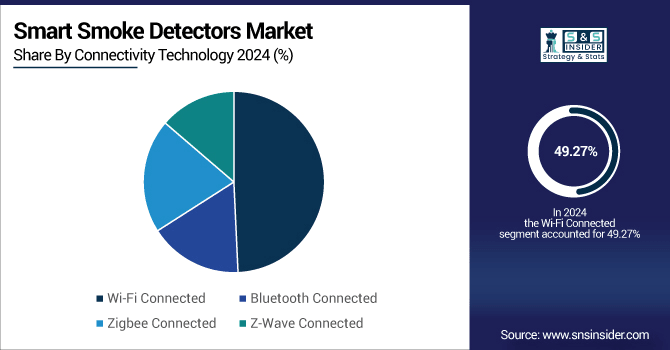

By Connectivity Technology, Wi-Fi Connected dominated ~ 49.27% in 2024; Z-Wave Connected fastest growing (CAGR 7.26%).

-

By Application, Residential led ~ 47.32% in 2024; Automotive fastest growing (CAGR 8.44%).

-

By End-User, Homeowners held ~ 57.31% in 2024; Insurance Companies fastest growing (CAGR 7.81%).

By Connectivity Technology, Wi-Fi Connected Dominate While Z-Wave Connected Shows Rapid Growth

Based on connectivity technology, Wi-Fi Connected smart smoke detectors are the leading segment in the market as they can be easily installed and can be directly connected to in-house network. So Wi-Fi cameras are very popular in home and business surveillance because they support real-time alerts and remote viewing. Z-Wave Connected sensors see a swift expansion, powered by ultra low power mesh networking and reliability, an level of security. They are becoming more common in professionally installed smart-home systems and multiunit buildings. Together, they're setting the direction for connectivity trends in the marketplace thanks to their convenience and feature set.

By Product Type, Photoelectric Smoke Detectors Leads Market While Maskless Lithography Registers Fastest Growth

In 2024, the Photoelectric Smoke Detectors segment dominated the Smart Smoke Detector Market with approximately 41.78% share, driven their high sensitivity to smoldering fires and lower false alarm rates. They are also well established in both residential and commercial smart-home installations to provide steady demand. Smart Battery-Operated Smoke Detectors is expected to witness the fastest growth over 2025–2032, with a CAGR of 7.35%, growth is driven by easy self installation, a steady rise of DIY users and the growing preference for wireless smart home safety solution.

By Application, Residential Lead While Automotive Registers Fastest Growth

The Smart Smoke Detector Market is dominated by the Residential application, mainly due to the wide adoption of smart homes and high level of awareness among consumers. Homeowners want smart existence detectors for their ease of installation, immediate alerts, and compatibility with IoT ecosystems. The Automotive sector is projected to be the fastest growing, albeit from a small base, driven by increasing orders for fire safety in electric vehicles and commercial fleets. Wide deployment of compact, low cost, multi static receivers for detection make automotive integration practical and reliable.

By End-User, Homeowners Lead While Insurance Companies Grow Fastest

By End-user, the Homeowners segment dominates the Smart Smoke Detector Market on account of growing demand for smart home technologies and growing inclination towards the safety of home. Easy do-it-yourself installation available through direct retail and e-commerce channels also helps fuel homeowner demand. Insurance Companies – currently a rounding error to both products, but expected to grow the most as they are planning to reward consumers for adopting smart devices through premium discounts and risk-reduction programs.

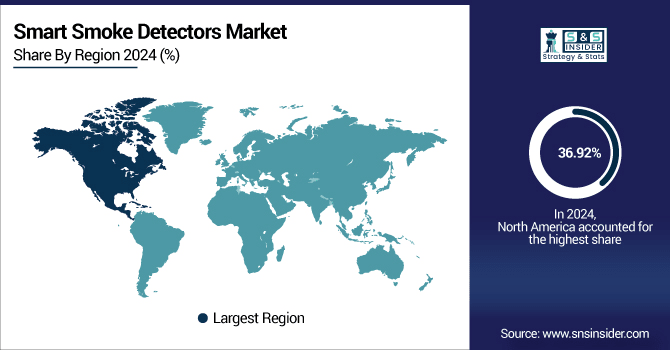

North America Smart Smoke Detector Market Insights

In 2024 North America dominated the Smart Smoke Detector Market and accounted for 36.92% of revenue share, this leadership is due to high smart-home adoption, stringent fire safety regulations, and widespread consumer awareness. Additionally, well-established retail channels and advanced IoT infrastructure support strong market penetration across residential and commercial segments.

Get Customized Report as Per Your Business Requirement - Enquiry Now

Asia-Pacific Smart Smoke Detector Market Insights

The Asia-Pacific is projected to be the fastest-growing market in the Smart Smoke Detector Market during the forecast period 2025-2032 with a CAGR of about 6.78% owing to rapid urbanization, growing smart homes, and escalating construction activities in residential and commercial sectors. Also increasing awareness of fire safety regulations, government schemes are propelling the growth of the market in the region.

Europe Smart Smoke Detector Market Insights

Europe, in 2024, witnessed substantial growth in the Smart Smoke Detector Market, led by stringent fire safety mandates and high penetration of smart-home systems. A high level of consumer awareness and government incentives for safety upgrades are spurring installations. Further, increasing penetration of leading companies and robust distribution network drive the market growth steadily.

Latin America (LATAM) and Middle East & Africa (MEA) Smart Smoke Detector Market Insights

Smart Smoke Detector Market in Latin America (LATAM) and Middle East & Africa (MEA) is at a developing stage due to rising urbanization and growing adoption of smart-home technologies. The increased awareness about fire safety with government-led building safety drives installation. But lower disposable incomes and not many people already have the smart-home infrastructure needed that is holding the pace back. However, growing construction activities and stringent regulations in these regions continue to provide opportunities for growth.

Smart Smoke Detector Market Competitive Landscape:

HONEYWELL International Inc. has long been a worldwide leader in fire safety products, providing various smart smoke detectors for the home and businesses. The DFS8M Wireless Smoke Sensor was launched by Honeywell in April 2025, it is a Wi-Fi photoelectric smoke sensor. This product works with the Impact by Honeywell Mobile App to provide real time alerts and remote monitoring.

-

In March 2023, features UL-approved self-testing detectors, automating the testing process and enhancing system reliability

Siemens AG is also a key market participant, providing smart smoke detectors for advanced fire detection systems for different applications. These detectors offer enhanced smoke detection, modular design for longer lifetime and an easy commissioning app for efficient and reliable fire safety management.

-

In April 2025, Siemens introduced the FDA261 and FDA262 aspirating smoke detectors (ASD+), designed for large protection areas such as data centers and industrial sites.

Johnson Controls has developed sophisticated smart smoke detectors that not only are designed for the home, but commercial use also. Their alarm systems utilize both photoelectric and ionization sensing technologies to help ensure that you detect a fire but keep false alarms at a minimum. These detectors are equipped with host features which makes it easier to identify and maintain each device. They also include predictive diagnostics that can alert users to problems before they occur.

-

In December 2023, Motorola Solutions acquired IPVideo, the creator of the HALO Smart Sensor, an all-in-one intelligent sensor that detects real-time health and safety threats.

Robert Bosch GmbH has developed intelligent fire alarms for domestic and commercial use. The-models use both photoelectric and ionization technology and respond quickly to fast flaming fires while providing a false alarm resistance. These units are available with addressable technology to accurately locate and maintain each detector. They also offer predictive diagnostics, warning users when issues arise before they become urgent.

-

In December 2023, Bosch has introduced the HALO Smart Sensor, which not only detects smoke but also monitors air quality by alerting for pollutants like particulates, VOCs, CO, and NO₂. This device integrates with video systems and supports control via third-party apps and relays, enhancing situational awareness in various environments.

Smart Smoke Detector Companies are:

-

Honeywell International Inc.

-

Siemens AG

-

Robert Bosch GmbH

-

United Technologies Corporation

-

Kidde

-

Nest Labs

-

Schneider Electric SE

-

ABB Ltd.

-

Hochiki Corporation

-

Gentex Corporation

-

Xtralis Pty Ltd

-

Halma plc

-

Tyco International plc

-

Apollo Fire Detectors Ltd

-

Panasonic Corporation

-

Samsung Electronics Co., Ltd.

-

LG Electronics Inc.

-

Bosch Security Systems

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 1.83 Billion |

| Market Size by 2032 | USD 2.91 Billion |

| CAGR | CAGR of 6.09% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Single-Sided COF, Double-Sided COF, Multilayer COF, and Rigid-Flex COF), • By Material (Polyimide (PI), Polyester (PET), Liquid Crystal Polymer (LCP), and Others) • By Application (Consumer Electronics, Automotive, Industrial Equipment, and Medical Devices) • By End-User (Electronics Manufacturers, Automotive OEMs, Medical Device Manufacturers, and Industrial System Integrators) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Taiwan, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | LG Innotek, Samsung Electro-Mechanics, Nippon Mektron, Sumitomo Electric Industries, Fujikura, Flexium Interconnect, Career Technology, Zhen Ding Technology, Daeduck GDS, Interflex, NewFlex Technology, Ichia Technologies, Mekoprint, MFS Technology, Eltek, MFLEX, Flex PCB, All Flex Solutions, Cistelaier, Fine Circuit. |