Portable Battery Market Size

Get more information on Portable Battery Market - Request Sample Report

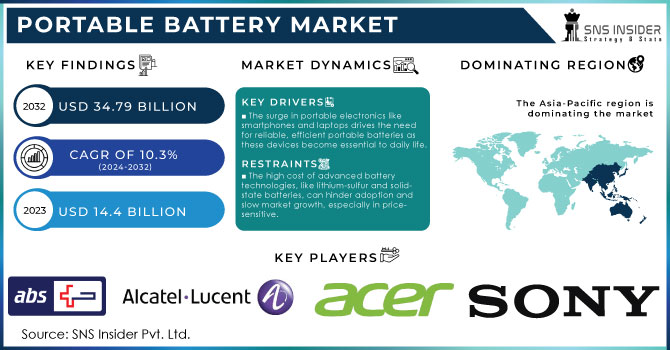

The Portable Battery Market Size was valued at USD 14.4 billion in 2023 and is expected to reach USD 34.79 billion by 2032 and grow at a CAGR of 10.3% over the forecast period 2024-2032.

The Portable Battery Market is experiencing robust growth driven by increasing demand for mobile and consumer electronics. Advancements in battery technology, such as lithium-ion and solid-state batteries, are enhancing performance and efficiency, fueling consumer interest. The surge in portable devices like smartphones, tablets, and wearable tech further accelerates market expansion. Additionally, the growing emphasis on sustainable energy solutions and renewable sources is pushing innovation in portable battery designs, aiming to offer longer life and quicker charging times. However, challenges such as supply chain constraints and environmental concerns related to battery disposal pose potential restraints. Despite these hurdles, the market's trajectory remains positive, with increasing investments in research and development anticipated to drive future advancements and meet evolving consumer needs.

Advances in technology have allowed portable batteries to be more compact and rugged and to have better power output, including the ability to charge high-power-draw devices. We have come to rely on our smartphones and tablets perhaps more than ever. The average person will spend 4.2 hours a day on their mobile device by the year 2023. By that time, the device’s battery will be powering our online lives. Modern smartphones are marvels of technology, boasting a huge, high-definition screen, powerful processor, and advanced cameras. However, all of these drains the battery quickly. Over 60% of smartphone users have experienced battery anxiety, the fear that the phone will run out of power before the day is over. This fear fuels the portable power market. Furthermore, our frenzied lifestyles have us constantly moving beyond the immediate reach of a plug. Commuting to work, going to a coffee shop for a meeting, or setting off on a weekend adventure with a bag full of gear but no power outlet–these are all aspects of our lives. A survey discovered that 85% of urban professionals pack a cord or portable charger to be sure they can always charge their device.

Portable Battery Market Dynamics

Drivers

- The surge in portable electronics like smartphones and laptops drives the need for reliable, efficient portable batteries as these devices become essential to daily life.

Portable batteries have become increasingly demanded with the rapid distribution of portable electronics such as smartphones and laptops. With smartphones becoming essential not only for everyday communication but also for navigation and entertainment as well as laptops for work and entertainment, their reliance on portable batteries becomes crucial. Additional to the new place of portable electronics in people’s everyday life, the simultaneous use for personal and professional needs furthers the increased need for these batteries. Moreover, these electronics are becoming increasingly popular in the form of tablets and other devices. These aspects contribute to the need for batteries that would provide a longer life for portable electronics and would be safe and high-efficiency.

Customers’ demands for portable batteries have significantly grown; the first factor is the life of the battery to support the usage of the device throughout the day. Another aspect that became essential for batteries is their efficiency: people require batteries that would be fast-charging and would be used for prolonged periods of time. The third major aspect that determines additional demands for batteries and the increased pressure is the tendency of developing new-in-demand high-tech applications, in particular, the precision of high-definition videos and applications and programs with high complexity. The need for batteries is provided by the rapid technologic progress. There are new types of batteries, such as lithium-ion and lithium-polymer batteries, which are more energy-storing, faster transferring, and less environment-polluting. With the increased demand in portable electronics on the market, the tendency towards the further development of batteries of the new generation will be required to become more widespread. These new batteries are the product of the demand acceleration that ensures people’s ability to remain connected in an increasingly rapid world around.

- Innovations in battery technology, such as lithium-ion and lithium-polymer, boost energy density, longevity, and efficiency, fueling market growth.

The development of batter technologies and the emergence of lithium-ion and lithium-polymer batteries have notably promoted the market growth. In particular, these batteries that provide high energy density are highly efficient and long-lasting. The high energy density of lithium-ion batteries enables the devices to store more power in more compact sizes ideal for portable electronics. These batteries last longer, or in other words, they can be charged and discharged more times and still retain their qualities, which is the other way of how they make devices last longer. One more type of lithium batteries that promote energy efficiency is lithium-polymer accumulators, whose design is more flexible due to the lighter and thinner profile. One of the features that advances the technological effects of this batteries is that their models differ in terms of power, voltage, and capacity, which meets the changing needs of producers and consumers of portable electronics.

Restraints

- The high cost of advanced battery technologies, like lithium-sulfur and solid-state batteries, can hinder adoption and slow market growth, especially in price-sensitive.

The high cost of advanced battery technologies, such as lithium-sulfur and solid-state batteries, can impede their widespread adoption and slow market growth, particularly in price-sensitive segments. These advanced batteries offer superior performance characteristics, such as higher energy density and improved safety, but their production involves complex and costly materials and processes. This elevated cost can be a significant barrier, especially for consumers and industries that prioritize affordability. In price-sensitive markets, where cost is a major consideration, the premium price of these advanced technologies may deter potential buyers and limit their integration into mainstream products. Consequently, while the benefits of these cutting-edge batteries are evident, their high price can restrict their accessibility and delay the broader market penetration needed for significant growth. As a result, the transition to these advanced technologies remains gradual, constrained by economic factors and cost considerations.

| Report Attributes | Details |

|---|---|

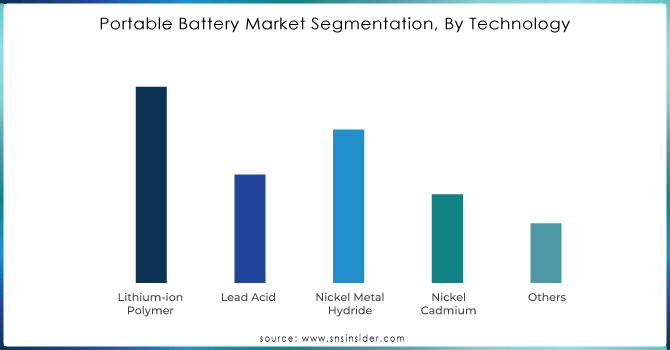

| Key Segments | • By Technology (Lithium-ion Polymer, Lead Acid, Nickel Metal Hydride, Nickel Cadmium, Others) • By Battery Capacity (0-3,000mAh, 3,100-5,000mAh, 5,100-10,000mAh, Other) • By Application (Tablets, Automotive, Smartphones, Others) |

| Regional Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Advanced Battery Systems, Sony Corporation, Acer Inc, Alcatel-Lucent, Casio Computer Co.Ltd, Dell Inc, Sharp Electronics Corporation, Nikon Corporation, Seiko Holdings Corporation. Siemens, TESLA, SAMSUNG, BYD, PANASONIC CORPORATION, JOHNSON CONTROLS |

By Technology

The lithium-ion polymer segment dominated the market, with a share of 34.2% in 2023, contributing to the global sales revenue of portable batteries. With the rapid growth of technology and innovation, the use of portable batteries has increased. The market is growing due to the rapid invention and development of portable consumer electronics technologies as well as favorable government regulations for the adoption of electric cars in developed and developing countries

Need any customization research on Portable Battery Market - Enquiry Now

By Battery Capacity

The 3100-5000mAh segment dominated the market, with a share of 42.04% in 2023. Due to its Rapid technological development and innovation has increased the use of portable batteries in many industries. In addition, the rise of border conflicts and terrorist operations around the world has given rise to surveillance robots and drones with modest payloads.

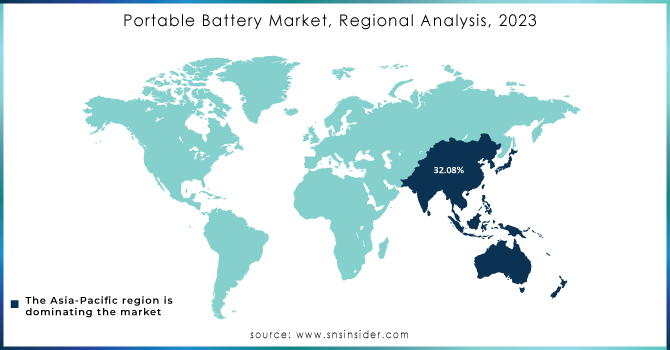

Portable Battery Market Regional Analysis

The Asia-Pacific dominated the market with a share of 32.08% in 2023, due to the presence of developing countries such as India and China. The presence of a large number of people also serves as an important factor in driving the market. The recent Indian Government investment in the lithium-ion battery manufacturing industry in Gujarat and the growing demand for portable electronic gadgets in the country due to the availability of large sums of money is driving market growth. In addition, increased public awareness of health care associated with increased use and benefits of portable medical devices during a pandemic has had a positive impact on the growth of the mobile battery market.

KEY PLAYERS :

The key players for Portable Battery are Advanced Battery Systems, Sony Corporation, Acer Inc, Alcatel-Lucent, Casio Computer Co.Ltd, Dell Inc, Sharp Electronics Corporation, Nikon Corporation, Seiko Holdings Corporation. Siemens, TESLA, SAMSUNG, BYD, PANASONIC CORPORATION, JOHNSON CONTROLS, and other key players.

RECENT DEVELOPMENT

- In February 2024, In a move to expand its party speaker offerings in India, Sony launched the all-new SRS-XV500. This portable speaker packs a punch with powerful sound, built-in lighting effects, and a long-lasting battery – perfect for keeping the party going all night long.

- In May 2024, Xiaomi unveiled a new addition to its portable battery lineup – a power bank boasting an impressive 100W fast charging output. This development caters to the growing demand for faster charging solutions, allowing users to quickly recharge their devices on the go.

- In December 2023: Atlas Copco unveiled the B-Air 185-12, the world's first battery-powered portable screw air compressor. This innovative product marks a significant step towards sustainability in the industrial sector by offering a greener alternative to traditional air compressors. By adding this model to their range of electric-powered portables, Atlas Copco has not only expanded their product offerings but also set a new benchmark in global industrial sustainability.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 14.4 Billion |

| Market Size by 2032 | USD 34.79 Billion |

| CAGR | CAGR of 10.3% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Drivers | •The surge in portable electronics like smartphones and laptops drives the need for reliable, efficient portable batteries as these devices become essential to daily life. •Innovations in battery technology, such as lithium-ion and lithium-polymer, boost energy density, longevity, and efficiency, fueling market growth. |

| Restraints | •The high cost of advanced battery technologies, like lithium-sulfur and solid-state batteries, can hinder adoption and slow market growth, especially in price-sensitive. |