Molded Interconnect Device Market Size & Overview:

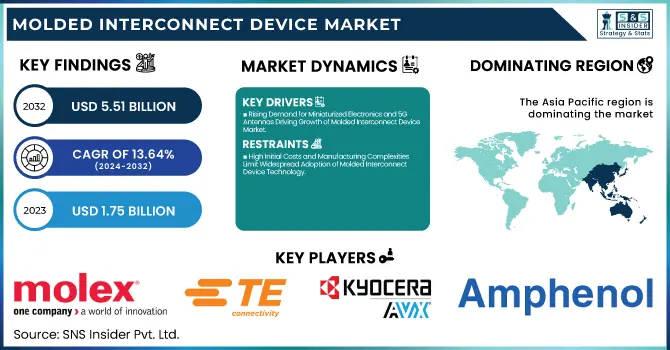

The Molded Interconnect Device Market Size was valued at USD 1.75 billion in 2023 and is expected to reach USD 5.51 billion by 2032, growing at a CAGR of 13.64% over the forecast period 2024-2032. The growth of the market for Molded Interconnect Devices (MID) is majorly driven by the adoption of MID in various applications across automotive, consumer electronics, medical & industrial applications to provide compact and multi-functional design. The maximum utilization shows the adjustment of MID in 5G antennas, automotive sensors and medical devices as a result of its slim, cost-effective, and lightweight features.

To Get more information on Molded Interconnect Device Market - Request Free Sample Report

Durability in adverse conditions is ensured by reliability testing that confirms extreme temperature, vibration, and moisture resilience. Electrical performance characteristics evaluate signal integrity, conductivity, and EMI shielding, improving high-frequency application efficiencies. To keep up with improvements in production processes such as Laser Direct Structuring (LDS) and Two-Shot Molding, MID Technology has also evolved and is becoming more remarkable as an industrial presence.

Molded Interconnect Device Market Dynamics

Key Drivers:

-

Rising Demand for Miniaturized Electronics and 5G Antennas Driving Growth of Molded Interconnect Device Market

One of the key factors driving the growth of the molded interconnect device (MID) market is the growing demand for miniaturized and lightweight electronic components in various industries such as automotive, consumer electronics, and telecommunications. The fast-growing 5G technology is increasing the demand for advanced antennas which in turn is gaining momentum in MID acceptance. Furthermore, the transition of the automotive sector toward electric vehicles (EVs) and ADAS-related EVs and ADAS is increasing the demand for MID-based sensor housings and connectors. Market growth is further complemented by the increased penetration of smart lighting solutions and touch-sensitive interfaces within the automotive interiors. In addition, the increasing focus on sustainable and green manufacturing processes such as laser direct structuring (LDS) and two-shot molding, along with the growing demand for cost-efficient and eco-friendly production is prompting industries to use MID technology.

Restrain:

-

High Initial Costs and Manufacturing Complexities Limit Widespread Adoption of Molded Interconnect Device Technology

A major challenge is the expensive initial cost of MID fabrication, especially for processes such as Laser Direct Structuring (LDS) and two-shot molding. Production is less attractive for smaller and medium-sized manufacturers since it requires specialized equipment and materials which increases production costs. Furthermore, the complexity of incorporating MID technology into high-volume, electronic manufacturing presents a hindrance, because integrating these solutions efficiently requires skilled labor and expertise. In addition, hassled durability and reliability for higher-pressure software environments like automotive and commercial applications may constrain enterprising adoption.

Opportunity:

-

Expanding Healthcare Wearables and Industrial Automation Driving Growth Opportunities in Molded Interconnect Device Market

MID market opportunities are emerging in the areas of increasing healthcare, wearable devices, and industrial automation usage. Smart wearables and IoT-enabled devices represent a rapidly growing market with significant growth opportunities for MID technology, which allows the integration of complex circuits into compact designs. The growing investments in advanced manufacturing technologies, such as 3D-MID and additive manufacturing, are anticipated to improve production efficiency and design versatility, creating new opportunities for market participants. In addition, Asia-Pacific, which is an emerging market for MID, is also providing profitable opportunities with the help of the electronics manufacturing hubs of China, Japan, and Korea.

Challenges:

-

Raw Material Shortages and Alternative Technologies Challenge Growth of Molded Interconnect Device Market

The biggest issue is the lack of raw materials and the reliance on cone-specific polymers and metallization processes resulting in supply chain disruptions. Stricter manufacturing regulations, such as those being put in place for sustainable production across the globe, along with resin-related environmental concerns are also a concern for future plastic use in electronic manufacturing. In addition, alternative circuit integration technologies like flexible printed circuits (FPCs) and traditional PCB assemblies are much more mature and cost-effective than MID technology and offer competition to the MID market. However, overcoming these challenges, requires continuous innovation, reduction of process costs, and increased awareness of the long-term benefits of MID technology.

Molded Interconnect Device Market Segmentation Outlook

By Process

Laser Direct Structuring (LDS) continues to be the dominant technology in 2023, accounting for 45.2% of the Molded Interconnect Device (MID) market as a result of its precision and design flexibility and is widely adopted in consumer electronics, automotive, and medical applications. Rather than typical surface mount technology, LDS allows the embedding of complex circuits within 3D surfaces, it is then often used for the miniaturization of electronic components such as antennas and sensor housings.

Two-shot molding is projected to have the highest CAGR from 2024 to 2032, on account of its cost-effectiveness and improved durability. Providing an upgraded mechanical strength along with a better bond between both materials, this process is a good fit for such applications in high-performance automotive, industrial automation, and smart device segments. Increasing adoption of Two-Shot Molding is also accelerated by escalating the requirement for sustainable manufacturing and reducing the number of production steps.

By Product

In 2023, sensor housings are expected to dominate and generate around 26.1% of the market share owing to the growing demand for compact and high-performance electronic components in automotive, industrial automation, and medical devices among others. This is further exacerbated by the exploding number of electric vehicles (EVs) and advanced driver-assistance systems (ADAS), which require sensor housings with strong sealing performances and more durable properties to protect sensitive electronic components from environmental factors such as heat, moisture, and vibrations.

The antennas segment is projected to register the fastest CAGR between 2024 and 2032 due to the rapid growth of 5G technology, IoT devices, and smart connectivity solutions. The increasing use of MIDs-based antennas in smartphones, wearables and automotive telematics system is fuelling the market, as they have enhanced performance, are easily miniaturized, and are reliably integrated into complex designs.

By End-use

In 2023, the manufacturing sector held the largest share at 21.5%, owing to the high dependence of the sector on automated maintenance solutions to improve operational efficiency. CMMS is used by manufacturers to improve the management of their assets, minimize equipment downtime, and meet safety compliance requirements. Further, rising penetrations of Industry 4.0 technologies such as IoT and predictive maintenance have propelled the demand for CMMS in this sector. At the same time, high-volume manufacturing plants need modern maintenance strategies to increase efficiency and reduce expensive interruptions.

In 2023, the automotive sector accounted for 31.7% of the Molded Interconnect Device market, which can be attributed to the growing acceptance of technology for use in advanced driver-assistance systems (ADAS), electric vehicles (EVs), and in-vehicle connectivity solutions. MID is being employed by automotive firms to make lightweight and compact sensor housings, antennas, and smart lighting solutions for vehicle efficiency and performance improvement. Furthermore, MID adoption in automotive applications is also driven by the demand for autonomous driving and safety regulations regarding enhanced vehicle safety features.

Molded Interconnect Device Market Regional Analysis

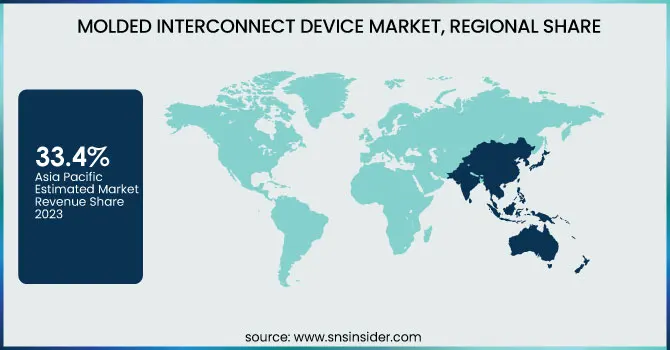

In 2023, Asia Pacific commanded a 33.4% share of the Molded Interconnect Device (MID) market due to many consumer electronics and automotive OEM manufacturing hubs present in China, Japan, South Korea, and Taiwan. The demand for MID-based antennas and miniaturized electronic components has been propelled by the swift rollout of 5G technology and IoT-enabled devices in the region. TOP smartphone makers like Samsung (South Korea) and Xiaomi (China) adopt MID technology in smartphones to save space dramatically, and to enable better communications between devices. Moreover, Toyota and Honda (Japan) are using MID-based sensor housings and lighting solutions to improve vehicle performance and safety. Moreover, the increased production of electric vehicles (EVs) and the development of smart manufacturing are other factors boosting market growth in the region.

Europe is expected to achieve the fastest growth during the forecast period from 2024-2032, owing to increasing investment in automotive development, industrial automation, and sustainable manufacturing. Strong emphasis on electric mobility and autonomous driving in Asia–Pacific is propelling the growth of MID in automotive applications. Global manufacturers including BMW & Volkswagen (Germany) are leveraging the MID-based components in EVs and ADAS technologies. German company Bosch & Siemens is also applying MID to industrial automation and smart home applications. Additionally, the MID market continues to be driven by the European Union's regulatory incentives promoting environmentally friendly manufacturing and a growing need for high-performance electronic solutions in various sectors throughout the region.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

Some of the major players in the Molded Interconnect Device Market are:

-

Molex (US) (LDS Antennas, MID LED Packages)

-

TE Connectivity (Switzerland) (LDS Antennas, MID Connectors)

-

KYOCERA AVX Components Corporation (Multilayer Ceramic Capacitors, Antenna Products)

-

Amphenol Corporation (Connectors, Cable Assemblies)

-

Taoglas (Antenna Solutions, RF Components)

-

HARTING Technology Group (Connectors, Network Components)

-

Sumitomo Electric Industries, Ltd. (Optical Fibers, Electronic Devices)

-

MID Solutions GmbH (3D Circuitry Solutions, MID Prototypes)

-

TEPROSA (MID Prototypes, Laser Direct Structuring Services)

-

Broadcom (PCIe Switches, Retimers)

-

MACOM Technology Solutions (RF Amplifiers, Semiconductors)

-

Fischer Connectors (Push-Pull Connectors, Hermetic Connectors)

-

MaxLinear (RF Transceivers, Broadband Modems)

-

LPKF Laser & Electronics (Laser Systems for MID Production, PCB Prototyping Equipment)

-

Philips-Medisize (Drug Delivery Devices, Diagnostic Devices)

Recent Trends

-

In February 2025, Molex unveiled a new range of EMI-filtered interconnects and RF components, enhancing signal integrity and electromagnetic compatibility for critical aerospace and defense applications.

-

In May 2024, Amphenol Corporation completed the acquisition of Carlisle Interconnect Technologies, strengthening its position in aerospace, defense, and industrial interconnect solutions.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 1.75 Billion |

| Market Size by 2032 | USD 5.51 Billion |

| CAGR | CAGR of 13.64% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Process (Laser Direct Structuring (LDS), Two-Shot Molding, Others) • By Product (Sensor Housings, Antennas, Connectors & Switches, Lighting, Others) • By End-use (Healthcare, Automotive, Consumer Electronics, Telecommunication, Aerospace and Defense, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Molex, TE Connectivity, KYOCERA AVX Components Corporation, Amphenol Corporation, Taoglas, HARTING Technology Group, Sumitomo Electric Industries, Ltd., MID Solutions GmbH, TEPROSA, Broadcom, MACOM Technology Solutions, Fischer Connectors, MaxLinear, LPKF Laser & Electronics, Philips-Medisize. |