Surface Inspection Market Size & Overview:

The Surface Inspection Market Size was valued at USD 3.98 Billion in 2023 and is expected to reach USD 8.03 Billion by 2032 and grow at a CAGR of 8.14% over the forecast period 2024-2032.

Technologies have evolved in recent times with greater demand for the automation of quality control in several industries. It is worth mentioning that during 2023 and 2024, the industries covered include automotive, electronics, aerospace, and packaging, with much higher uptake on surface inspection systems to maintain accuracy, enhance the quality of product, and follow strict standards at the regulatory end. Governments around the globe have adopted high-quality control rules, which in developed regions, including North America and Europe, are necessary in terms of complying with standards in safety and reliability. This is, in fact the reason that fastens the uptake of more complex inspection technologies.

Get more information on Surface Inspection Market - Request Sample Report

The most recent technological changes played a critical role in revolutionizing the Surface Inspection Market. The new innovations of AI-driven inspection systems, machine learning algorithms, high-resolution imaging, and edge computing have enabled manufacturers to detect and rectify defects with unparalleled accuracy. For instance, in 2023, Basler and MVTec have partnered with Siemens to integrate machine vision into factory automation, enhancing surface inspection and improving product quality control. Their collaboration streamlines the integration of visual inspection within Siemens' automation technology, addressing labour shortages and enabling end-to-end anomaly detection. Cloud-based solutions launched in 2024 also facilitated remote monitoring and data analysis, thus improving operational efficiency.

Governments and the industrial sector have also been investing in initiatives that foster research and development in the area. For instance, the EU Horizon Europe initiative and India's "Make in India" campaign encourage companies to design cost-effective and scalable inspection systems. Such policies are expected to make industries competitive globally while ensuring high standards of production.

The future of the Surface Inspection Market is full of opportunities because industries are embracing IoT-enabled surface inspection systems. These systems can predict maintenance and monitor quality in real time, which minimizes downtime and optimizes resource utilization. Another promising development is the integration of augmented reality (AR) and virtual reality (VR) for defect visualization. Moreover, as sustainability becomes a core focus, surface inspection technologies are being leveraged to minimize waste and meet environmental goals.

The Surface Inspection Market is slated for transformative growth, with persistent innovation and facilitating government policies ushering in vast adoption. Continued convergence of advanced technologies and regulatory compliance will further build the market strength across diverse industrial applications worldwide.

Surface Inspection Market Dynamics

KEY DRIVERS:

-

Increase in the demand for automatic quality control solutions.

The need for automation in manufacturing has driven the growth of surface inspection systems. As labour costs continue to increase around the world and attention is drawn to minimizing human error, industries are looking towards automated quality control systems. The International Federation of Robotics, in a 2023 report, said that most of the world's manufacturers would be implementing automation by 2024.

Automated surface inspection systems provide speed and precision like no other system, thus guaranteeing quality products. For industries such as electronics and automotive, where minor defects can cause major losses, these systems are highly beneficial. The integration of machine vision and AI technologies has enhanced their capabilities and made them irreplaceable for modern manufacturing processes.

-

Increasing focus on sustainability and waste reduction.

Governments and industries have started to prioritize sustainability, and waste reduction has become a very important aspect in the optimization of resources. The surface inspection system is used in identifying defects during the early production cycle, reducing material wastage to a considerable extent. A 2023 European Commission report set out a 30% waste reduction goal by 2030, spurring manufacturers to invest in the latest inspection technologies.

These systems detect imperfections in real time, thus limiting rework and optimizing resource usage. The packaging industry has especially seen a strong interest in surface inspection systems because companies are pushing to meet challenging sustainability targets while making their products more attractive to consumers.

RESTRAIN:

-

High initial costs and inadequate financial support hinder SMEs from adopting surface inspection systems

According to a 2023 report by the U.S. Department of Commerce, about one third of SMEs pointed to cost as the major impediment to the adoption of advanced manufacturing technologies. Further escalating costs are incurred by customizing inspection systems according to specific industrial requirements, and this becomes very difficult for the smaller manufacturers to compete with larger counterparts.

Furthermore, the financial burden increases from maintenance and upgrading of software that discourages their adoption. The government incentives and subsidies that help to mitigate some of these costs are usually inadequate for the mass implementation among SMEs. This affordability gap should be filled through cost-effective solutions and financial support programs in order to tap into the market's full potential.

Surface Inspection Market Key Segments

BY SYSTEM

The Computer-Based System segment held the largest market share in 2023, at 51%, due to its advanced processing capabilities and flexibility in complex manufacturing environments. Such systems are very efficient when handling large data and give insights in real-time. Hence, such industries as automotive and electronics benefit the most. With integration of AI and machine learning, such defect detection and prediction can become much more accurate.

On the other hand, the Camera-Based System segment is expected to rise with the highest CAGR of 8.94% during the forecast period between 2024 and 2032. This system is growing due to the fact that they are cost-effective and easier to install. Camera-based systems use advanced imaging technologies of high resolution, hence they ensure very accurate defect detection and measurement. Industries like packaging and textiles opt for these systems due to the capability to manage high-speed production lines. The growth of camera-based systems reflects the increased demand for low-cost and scalable inspection solutions.

BY SURFACE TYPE

In 2023, the 3D segment led the market, accounting for 52% of the market share. This is attributed to its better capabilities in detecting complex surface defects and measuring surface topology. In industries like aerospace, automotive, and electronics, the high-precision 3D inspection system with intricate geometries has been extensively relied upon. Such systems make manufacturers achieve higher tolerance, hence reliability in products.

The 3D segment is projected to grow at the fastest rate of 8.52% from 2024 to 2032 as a result of improvements in technologies for 3D imaging, as well as growing adoption rates in emerging markets. Governments and industry players have been investing into R&D towards making the systems more performance-sensitive and affordable to the industries involved. This indicates a move to more complex solutions in inspection products that meet developing quality standards of the respective industry.

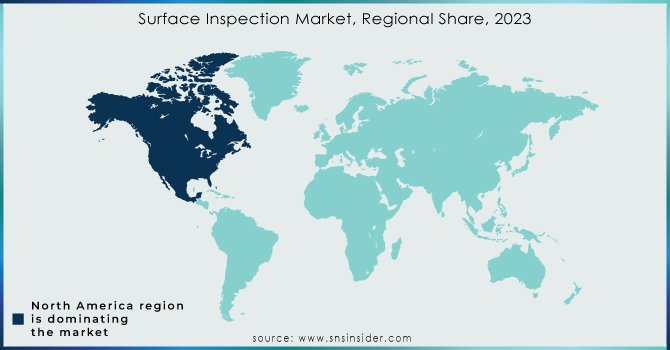

Surface Inspection Market Regional Analysis

The surface inspection market is characterized by strong regional dynamics, with North America being the leader in 2023, accounting for 43% of the market share. This is due to the high adoption of advanced manufacturing technologies and the stringent quality control regulations in the region. Automotive, aerospace, and electronics are some of the key industries that are driving demand for surface inspection systems. Initiatives by the U.S. government to strengthen domestic manufacturing have also further accelerated the growth of the market in the region.

Asia Pacific region is likely to grow at the fastest pace during the forecast period from 2024 to 2032 at a CAGR of 8.81%. In this region, rapid industrialization and a surge in interest for automation are seen in countries like China, India, and South Korea. Various government initiatives such as "Made in China 2025" and "Digital India" promote innovation and implementation of newer technologies. The region's strong manufacturing base along with cost advantages makes it a critical growth driver for the Surface Inspection Market.

Need any customization research on Gaming Hardware Market - Inquiry Now

KEY PLAYERS

Some of the major players in the Surface Inspection Market are

-

Cognex Corporation (Machine Vision Systems, Barcode Readers)

-

Keyence Corporation (Machine Vision Systems, Optical Sensors)

-

Omron Corporation (Industrial Automation, Machine Vision Systems)

-

Basler AG (Industrial Cameras, Vision Software)

-

Teledyne Technologies (Cameras, Image Sensors)

-

ISRA VISION AG (Surface Inspection Systems, 3D Machine Vision Systems)

-

AMETEK Surface Vision (Inspection Systems, Process Monitoring Solutions)

-

National Instruments (Data Acquisition Systems, Machine Vision Software)

-

Baumer Group (Cameras, Image Processing Solutions)

-

Datalogic S.p.A (Barcode Readers, Machine Vision Systems)

-

Panasonic Corporation (Industrial Cameras, Inspection Systems)

-

Sick AG (Optical Sensors, Machine Vision Systems)

-

Hitachi Ltd. (Inspection Systems, Measurement Instruments)

-

Bosch Rexroth AG (Automation Solutions, Inspection Technologies)

-

Microscan Systems (Barcode Readers, Vision Inspection Systems)

-

Allied Vision Technologies (Industrial Cameras, Embedded Vision Systems)

-

Jenoptik AG (Optical Metrology, Vision Systems)

-

Surface Inspection Ltd. (Inspection Systems, Process Control Solutions)

-

3D Systems Inc. (3D Imaging, Inspection Software)

-

Ametek Land (Thermal Imaging Cameras, Process Monitoring Systems)

MAJOR SUPPLIERS (Components, Technologies)

-

Sony Semiconductor Solutions (Image Sensors, Processors)

-

ON Semiconductor (CMOS Sensors, Processors)

-

Intel Corporation (Processors, Embedded Systems)

-

Nikon Corporation (Optics, Lenses)

-

Edmund Optics (Optics, Optical Components)

-

Hamamatsu Photonics (Image Sensors, Optoelectronics)

-

Schott AG (Glass Components, Optics)

-

Zeiss Group (Optics, Lenses)

-

Analog Devices (Signal Processing Solutions, Controllers)

-

Coherent Inc. (Laser Systems, Optical Components)

RECENT TRENDS

-

April 2024: Basler has introduced a new model to its ace 2 camera line, the ace 2 X UV. Featuring a Sony IMX487 global shutter, this new UV spectrum monochrome area scan camera offers 8.1 MPixel resolution at 2840 x 2840 with a 2.74 μm pixel size and reaches 14 fps frame rate. What this camera is supposed to do is capture images of invisible light coming from the wavelengths of 200 – 400 µm.

-

September 2024: OMRON Automation has proven itself as the leading player in Surface Mount Technology (SMT) and Through-hole Inspection solutions. At Productronica India 2024, it demonstrated these competencies with its AXI Automated X-ray Inspection, AOI Automated Optical Inspection, SPI Solder Paste Inspection solutions.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 3.98 Billion |

| Market Size by 2032 | USD 8.03 Billion |

| CAGR | CAGR of 8.14% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Frame Grabbers, Lighting Equipment, Software, Cameras, Optics, Processors, Other) • By System (Camera-Based System, Computer-Based System) • By Surface Type (2D, 3D) • By Vertical (Semiconductor, Electrical & Electronics, Food & Packaging, Plastic & Rubber, Automotive, Glass & Metal, Healthcare, Printing) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Cognex Corporation, Keyence Corporation, Omron Corporation, Basler AG, Teledyne Technologies, ISRA VISION AG, AMETEK Surface Vision, National Instruments, Baumer Group, Datalogic S.p.A, Panasonic Corporation, Sick AG, Hitachi Ltd., Bosch Rexroth AG, Microscan Systems, Allied Vision Technologies, Jenoptik AG, Surface Inspection Ltd., 3D Systems Inc., Ametek Land. |

| Key Drivers | • Increase in the demand for automatic quality control solutions. • Increasing focus on sustainability and waste reduction. |

| Restraints | • High initial costs and inadequate financial support hinder SMEs from adopting surface inspection systems |