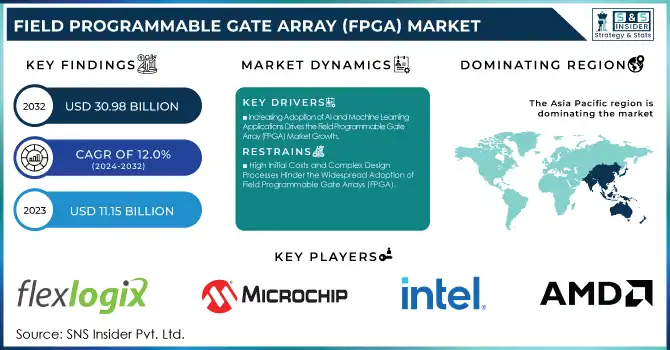

Field Programmable Gate Array (FPGA) Market Size & Overview:

The Field Programmable Gate Array (FPGA) Market Size was valued at USD 11.15 Billion in 2023 and is expected to reach USD 30.98 Billion by 2032 and grow at a CAGR of 12.0% over the forecast period 2024-2032.

The Field Programmable Gate Array (FPGA) market has experienced significant growth in recent years, driven by the increasing demand for high-performance, customizable, and efficient hardware solutions across a variety of industries.

To get more information on Field Programmable Gate Array (FPGA) Market - Request Free Sample Report

FPGAs are semiconductor devices that allow users to configure hardware circuits according to specific application requirements, offering unique flexibility compared to traditional integrated circuits. This adaptability is a key factor behind the rising adoption of FPGAs in diverse applications, including telecommunications, automotive, consumer electronics, industrial automation, and more.

FPGAs are characterized by their ability to be programmed post-manufacturing, making them versatile and suitable for rapidly evolving technological environments. They provide high-speed processing, parallel computing, and low latency, all while offering power efficiency. This combination of features has made FPGAs indispensable in industries that require real-time data processing and large-scale computational capabilities, such as artificial intelligence (AI), machine learning, and high-performance computing (HPC).

This growth is attributed to the rising adoption of AI and machine learning applications, the expansion of 5G networks, and the increasing need for customizable hardware in various industries. For instance, the automotive sector's shift towards autonomous vehicles and advanced driver-assistance systems (ADAS) is driving the demand for FPGAs capable of handling complex algorithms and high data throughput. Similarly, the industrial sector's move towards smart manufacturing and Industry 4.0 is fueling the need for customizable hardware solutions that can process large volumes of data in real-time. These trends underscore the pivotal role of FPGAs in enabling technological advancements across multiple sectors.

Field Programmable Gate Array Market Dynamics

Key Drivers:

-

Increasing Adoption of AI and Machine Learning Applications Drives the Field Programmable Gate Array (FPGA) Market Growth

The growing demand for artificial intelligence (AI) and machine learning (ML) applications is one of the key drivers of the FPGA market. AI and ML technologies require extensive computational power to handle large datasets, complex algorithms, and real-time data processing. FPGAs, with their parallel processing capabilities, provide the necessary performance and flexibility to execute AI and ML tasks efficiently. Unlike traditional processors, FPGAs can be customized to meet the specific needs of AI applications, offering lower latency and high throughput for tasks such as data analytics, deep learning, and natural language processing. The ability to reprogram FPGAs after deployment makes them ideal for rapidly evolving AI workloads, enabling companies to adapt to new algorithms and models without having to replace hardware. As industries such as healthcare, automotive, finance, and manufacturing increasingly leverage AI for advanced automation and predictive analytics, the demand for FPGAs to support these technologies is expected to rise, thereby driving the growth of the FPGA market.

-

Rising Demand for High-Speed Connectivity and 5G Networks Promotes the Field Programmable Gate Array (FPGA) Market

The roll-out of 5G networks is driving the demand for FPGAs in telecommunications and networking applications. 5G technology promises ultra-fast data speeds, low latency, and improved connectivity, all of which are essential for supporting the growing number of connected devices and data-heavy applications. FPGAs play a crucial role in 5G infrastructure by enabling flexible, high-performance processing of data in real time. They are used in base stations, network interfaces, and signal processing units to handle tasks such as data encoding/decoding, modulation/demodulation, and routing of data packets.

Additionally, FPGAs are highly valued for their ability to be customized, allowing network equipment providers to optimize hardware for specific 5G use cases, such as enhanced mobile broadband (eMBB) and massive machine-type communications (mMTC). As the global demand for 5G services increases, telecom companies are turning to FPGAs to ensure their networks meet the performance and scalability requirements of 5G, driving the expansion of the FPGA market.

Restrain:

-

High Initial Costs and Complex Design Processes Hinder the Widespread Adoption of Field Programmable Gate Arrays (FPGA)

Despite their numerous advantages, one of the significant challenges facing the FPGA market is the high initial cost and complex design process associated with FPGA development. FPGAs are more expensive than traditional fixed-function integrated circuits, primarily due to their reconfigurability and the advanced semiconductor technology used in their manufacturing. The upfront cost of FPGA hardware, combined with the need for specialized tools and software for programming and configuration, can make them an expensive choice for companies with limited budgets.

Furthermore, FPGA design requires a high level of expertise in hardware description languages (HDL) and custom logic development. The complexity of the design process, which involves a deep understanding of the application requirements and hardware capabilities, can delay time-to-market for product development. These factors, coupled with the learning curve associated with FPGA development, may deter smaller businesses or those with limited technical resources from adopting FPGAs, thus slowing the growth of the market.

FPGA Market Segmentation Analysis

By Type

The low-end segment of the Field Programmable Gate Array (FPGA) market accounted for the largest share, 43%, in 2023. This dominance is driven by the increasing demand for affordable and customizable solutions in applications such as consumer electronics, industrial automation, and automotive. Low-end FPGAs offer cost-effective solutions with sufficient performance for non-high-end applications, making them ideal for industries with budget constraints.

For example, low-end FPGAs are used in electronic control units (ECUs) and sensor integration, providing critical support for low-cost vehicle models. The affordability and performance of low-end FPGAs continue to drive their adoption in smaller, cost-conscious applications.

The Mid-Range segment of the Field Programmable Gate Array (FPGA) market is witnessing the fastest growth, with a projected compound annual growth rate (CAGR) of 13.19% during the forecast period. This segment appeals to a wide range of industries that require a balance between performance and cost.

Furthermore, these devices are often chosen for their scalability, offering manufacturers the flexibility to develop solutions with higher processing speeds and more complex functions while keeping costs reasonable. As industries shift toward more sophisticated yet affordable FPGA solutions, the mid-range segment is positioned to grow rapidly, contributing significantly to the overall FPGA market expansion.

By Technology

The SRAM segment of the Field Programmable Gate Array (FPGA) market holds the largest revenue share, accounting for 42% in 2023. SRAM-based FPGAs are favored for their high speed, flexibility, and reconfigurability, making them ideal for demanding applications that require real-time processing and high-performance capabilities. These FPGAs offer lower latency and faster operation, making them suitable for industries such as telecommunications, aerospace, defense, and automotive.

The continued demand for high-performance solutions in complex applications is driving the growth of the SRAM segment, as it offers the optimal combination of speed and flexibility. As industries continue to prioritize performance in their FPGA-based solutions, SRAM-based FPGAs are expected to remain dominant in the market, contributing significantly to overall market growth.

The Flash segment of the Field Programmable Gate Array (FPGA) market is expected to experience the highest growth, with a compound annual growth rate (CAGR) of 13.77% during the forecasted period. Flash-based FPGAs offer significant advantages, including non-volatile memory, lower power consumption, and fast configuration times, making them suitable for applications that require persistent data retention and efficient power management.

The adoption of Flash-based FPGAs is rapidly increasing due to their ability to store configuration data without the need for external memory, resulting in reduced overall system complexity. As industries move toward more energy-efficient and flexible solutions, especially in IoT and edge applications, Flash-based FPGAs are gaining significant traction.

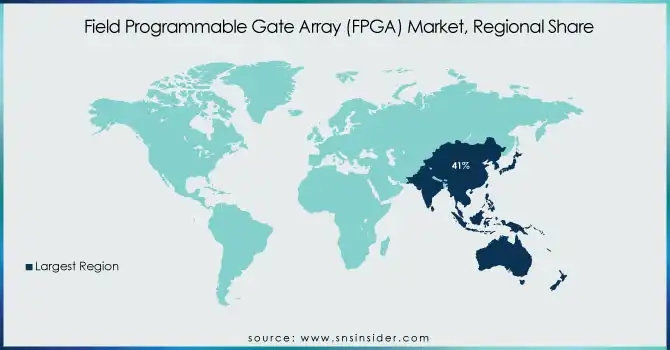

Field Programmable Gate Array (FPGA) Market Regional Outlook

In 2023, the Asia Pacific region dominated the Field Programmable Gate Array (FPGA) market with a significant share, accounting for approximately 41% of the global market. This dominance is attributed to the high adoption of FPGAs in key industries such as telecommunications, consumer electronics, automotive, and industrial automation, which are growing rapidly in the region. Countries like China, Japan, South Korea, and India are leading the way in FPGA utilization, driven by the demand for low-cost yet high-performance solutions.

For example, GOWIN Semiconductor (China) is a key player in the FPGA market, providing cost-effective FPGA solutions for consumer electronics and telecommunications.

North America is the fastest growing region in the Field Programmable Gate Array (FPGA) market in 2023, with an estimated compound annual growth rate (CAGR) of 10.8% over the forecast period. The growth is driven by the increasing demand for high-performance computing, AI, and machine learning, all of which rely heavily on FPGA technology for acceleration.

For instance, Intel's Agilex FPGAs are increasingly used in AI workloads, high-performance computing, and 5G network deployments. The rise of edge computing and smart manufacturing in the region is also contributing to the increasing demand for FPGA-based solutions.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

Some of the major players in the Field Programmable Gate Array (FPGA) Market are:

-

Advanced Micro Devices, Inc. (Formerly Xilinx, Inc.) (Virtex UltraScale+ FPGA, Spartan-7 FPGA)

-

Intel Corporation (Stratix 10 FPGA, Arria 10 FPGA)

-

Microchip Technology Inc. (IGLOO2 FPGA, PolarFire FPGA)

-

Lattice Semiconductor Corporation (ECP5 FPGA, MachXO3D FPGA)

-

Achronix Semiconductor Corporation (Speedster7t FPGA, ACE FPGA)

-

QuickLogic Corporation (QuickLogic EOS S3, QuickFeather FPGA Development Kit)

-

Efinix, Inc. (Trion FPGA, Titanium FPGA)

-

FlexLogix (Flex Logix InferX X1, Flex Logix Edge AI Solutions FPGA)

-

GOWIN Semiconductor Corporation (GW1N-1 FPGA, GW2A-18 FPGA)

-

S2C (S2C FPGA-based Prototyping System, S2C HAPS FPGA Prototyping System)

-

AGM Micro (AGM1000 FPGA, AGM2000 FPGA)

-

Shanghai Anlu Information Technology Co., Ltd. (Anlu FPGA Series, Anlu IP Core Solutions)

-

Shenzhen Ziguang Tongchuang Electronics Co., Ltd. (ZT-FPGA-X1000, ZT-FPGA-Mini)

-

Xi'an Zhiduoji Microelectronics Co., Ltd. (ZDU-3000 FPGA, ZDU-5000 FPGA)

-

Renesas Electronics Corporation (R8C FPGA Series, Renesas RX FPGA)

-

LeafLabs, LLC (LeafLabs FPGA Development Board, LeafLabs Microcontroller Solutions)

-

Aldec, Inc. (HES 7 FPGA Development Board, Aldec FPGA Design Tools)

Recent Trends

-

In May 2023, Intel Corporation introduced its new Agilex 7 FPGAs with R-Tile. This innovative product is anticipated to be the first FPGA featuring CXL and PCIe 5.0 capabilities. These advancements are expected to drive significant growth in the field programmable gate array market during the forecast period.

-

In June 2023, Microchip Technology Inc. (US) unveiled the industry's first mid-range industrial edge stack, along with customizable cryptography and boot libraries of soft intellectual property (IP). The company also introduced new tools to assist in converting existing FPGA designs to PolarFire devices. These new development resources and design services are aimed at supporting the transition process.

-

In December 2023, Lattice Semiconductor (US) introduced the “Lattice CrossLinkU-NX FPGA family,” featuring integrated USB device functionality. These FPGAs are designed to improve USB-equipped system designs, offer reference designs, and enhance thermal management. Lattice has streamlined USB-based design to meet the rising demand in AI-related applications, thereby expanding their market potential across a wide range of industries, including Computing, Industrial, Automotive, and Consumer Electronics.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 11.15 Billion |

| Market Size by 2032 | USD 30.98 Billion |

| CAGR | CAGR of 12.0 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Low-End, Mid-Range, High-End) • By Technology (SRAM, EEPROM, Antifuse, Flash, Others) • By Application (Consumer Electronics, Automotive, Industrial, Data Processing, Military & Aerospace, Telecom, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Advanced Micro Devices, Inc. (Formerly Xilinx, Inc.), Intel Corporation, Microchip Technology Inc., Lattice Semiconductor Corporation, Achronix Semiconductor Corporation, QuickLogic Corporation, Efinix, Inc., FlexLogix, GOWIN Semiconductor Corporation, S2C, AGM Micro, Shanghai Anlu Information Technology Co., Ltd., Shenzhen Ziguang Tongchuang Electronics Co., Ltd., Xi'an Zhiduoji Microelectronics Co., Ltd., Renesas Electronics Corporation, LeafLabs, LLC, Aldec, Inc. |

| Key Drivers | • Increasing Adoption of AI and Machine Learning Applications Drives the Field Programmable Gate Array (FPGA) Market Growth. • Rising Demand for High-Speed Connectivity and 5G Networks Promotes the Field Programmable Gate Array (FPGA) Market. |

| Restraints | • High Initial Costs and Complex Design Processes Hinder the Widespread Adoption of Field Programmable Gate Arrays (FPGA). |