Surgical Imaging Market Key Insights:

Get More Information on Surgical Imaging Market - Request Sample Report

The Surgical Imaging Market was valued at USD 148 billion in 2023 and is expected to reach USD 340.5 billion by 2032 and grow at a CAGR of 9.7% over the forecast period 2024-2032.

Several key growth factors support the constantly developing global surgical imaging market. The increasing prevalence of chronic diseases, including cardiovascular conditions, cancer, orthopedic disorders, and neurological ailments, as well as a growing population of elderly patients, are among the major contributors to increased demand for advanced surgical imaging technologies. The demand is rising day-to-day as age-related conditions are usually tackled by surgery, and improvement in imaging solutions will make such surgeries more accurate. According to the WHO, a substantial 80% of the aged population will be residing in low- and middle-income economies by 2050, thus heavily increasing the requirement for medical procedures and advanced imaging.

Progress in technologies in the area is further propelling the market. Innovations in actual-time imaging, 3D visualization, and image-guided surgery improve the results of surgeries for better navigation, enhanced visualization, and more informed decision-making by surgeons. Of interest, this June, GE Healthcare's OEC 3D Imaging System made further strides in portable CBCT imaging that has continued accuracy in spine surgeries and its use in a broader anatomical range. Growing demand for surgical imaging systems in the general trend toward MIS offers benefits from fewer complications to shorter recovery periods. For instance, Joseph Spine Institute launched the MaxView 4K Video Imaging Platform in July 2023, which will improve visualization in MIS procedures and further enhance efficiency and clinical outcomes.

Advances in healthcare expenditure, particularly from developed economies, combined with increased healthcare infrastructure in developed and emerging economies, have encouraged the adoption of such advanced technologies. In addition to this, the market for surgical imaging is driven continuously by innovation and finds a constantly increasing number of acquisition deals, as companies look to make their offerings more complete and answer the ever-evolving needs of health professionals. For example, the acquisition of NXC Imaging by Canon Medical Systems in July 2022 reflects the dynamism of the industry and the emphasis on technological advancements. Surgeons are increasingly demanding minimum invasive procedures with advanced high-quality solutions, and all this can only mean one thing - constant growth in the surgical imaging market over the next decade.

Table 1: Parent Markets Related to the Surgical Imaging Market

| Parent Market | Description |

|---|---|

| Medical Imaging Market | Encompasses technologies for capturing images of the human body for clinical purposes. |

| Surgical Equipment Market | Includes all tools and devices used during surgical procedures, including imaging systems. |

| Healthcare IT Solutions Market | Focuses on software and IT solutions that support healthcare delivery and management, including imaging data management. |

| Radiology Services Market | Involves services related to diagnostic imaging, such as X-rays, MRIs, and CT scans. |

| Endoscopy Devices Market | Covers imaging devices specifically designed for minimally invasive procedures and diagnostics. |

Table 2: Trends and Innovations in the Surgical Imaging Market

| Trend/Innovation | Description |

|---|---|

| Miniaturization of Imaging Devices | Development of smaller, portable imaging devices for use in various surgical settings. |

| Integration of Imaging with Surgical Systems | Seamless integration of imaging modalities with surgical instruments and tools for enhanced visualization. |

| Enhanced Imaging Quality | Advancements in imaging technology led to higher resolution and faster image acquisition. |

| Regulatory Changes | New regulations and standards impacting the approval and use of surgical imaging devices. |

| Focus on Patient Safety | Innovations aimed at reducing radiation exposure and improving patient outcomes in surgical imaging. |

Surgical Imaging Market Dynamics

Drivers

-

Digital Flat-Panel Detectors Transform Surgical Imaging with Enhanced Precision and Safety

The shift from the conventional image intensifiers used in X-ray from film-based principles to digital flat-panel detectors promotes progressive surgical imaging. FPDs, therefore, are the driving force of market growth: much more advantageous than image intensifiers, with a flat design and lower radiation dose, thus better safe for patients. Furthermore, as opposed to gradually being degraded with usage over time in traditional image intensifiers, FPDs allow for high-quality digital images even after years of usage. They also offer a wider and far more dynamic range of imaging, without field of vision loss associated with intensifiers during higher magnifications.

FPD C-arms also offer a larger bore that provides more room for physicians to operate comfortably and easily maneuver instruments. They reduce distortion of the generated image and increase sensitivity, thereby enhancing patient coverage, which enhances efficiency in surgery. These features of FPDs make them maintain image quality while reducing radiation exposure. It has made them preferred tools in hospitals, which increased adoption to foster growth in the surgical imaging market. In addition, as more and more companies begin to offer FPD C-arms, these systems become less expensive, thus making them even more available for quick assimilation into healthcare facilities.

Restraints

-

High Cost of Advanced Mobile C-arms

-

Decreasing Hospital Budgets

Surgical Imaging Market Segmentation Analysis

By Modality

The C-arm surgical imaging segment held a market share of 42.5% in 2023. Mobile fluoroscopy units become an essential part of the surgical procedure, enabling surgeons to have real-time imaging, which helps enhance the visualization and patient outcome through proper guidance. The popularity of minimal interventions and advancing technologies such as flat-panel detectors and 3D imaging capabilities have helped to make C-arm systems widely popular across specialties, including orthopedics, cardiology, and trauma surgery. Portable compact C-arm development increases its accessibility in ambulatory surgical centers and smaller settings for health care. For instance, In February 2024, Royal Philips launched the Zenition 90 Motorized mobile C-arm system for image-guided therapy at the European Congress of Radiology's annual meeting, empowering surgeons to deliver superior care to a larger patient base.

Conversely, X-ray will gain the highest compound annual growth rate in the forecast period. Portable digital X-ray machines now come with high-level features, that enable technologists to rapidly obtain high-quality images. Such systems use cassettes or phosphor plates instead of film; these also afford more scope for the enhancement of image quality at an offsite workstation linked with the portable unit. Portable X-ray machines also offer results within less than 20 minutes that can be watched in real-time and thus facilitate both procedures as much as diagnostic processes.

By Application

The market was captured at 25.7% by the orthopedic and trauma segment in 2023. Orthopedic imaging technologies like X-rays, CT scans, and MRIs are essential for the diagnosis of fractures, joint injuries, and degenerative conditions, therefore allowing for accurate treatment planning and monitoring. According to the American Association for the Surgery of Trauma, injuries in the United States account for more than 150,000 deaths and nearly 3 million nonfatal injuries each year. The global industry for trauma causes more than 5 million deaths annually with hundreds of thousands more injured persons.

Key players in the market are seen to be highly investing in new product development to continue market penetration. For example, in January 2024, Orthofix Medical Inc. announced a collaboration agreement with MRI Guidance to introduce Orthofix's BoneMRI image software into the U.S. Already, this software has assisted in the completion of eight cases in conjunction with 7D's FLASH Navigation System, which uses visible light to quickly produce 3D surgical guidance images. Its camera-based technology and machine-vision algorithms make it only and uniquely faster and more efficient for spinal surgeries.

However, the cardiovascular surgeries segment is expected to achieve the highest CAGR across the forecast period. The rising incidence of cardiovascular conditions, such as cardiac arrest, and the increasing number of cardiovascular surgeries are expected to be fueling this trend. According to the American Heart Association, 23.6 million people are expected to die of cardiovascular disease in the next 10 years. This increased cardiovascular surgery is going to create a demand for surgical imaging equipment such as CT scanners, ultrasound devices, and C-arms.

By End-use

Hospitals were the largest contributor in terms of revenues, with a 39.2% share in 2023, primarily due to the incidence and prevalence of patients who suffered from ischemic and hemorrhagic stroke, brain aneurysms, traumatic brain injuries, arteriovenous malformations, cataracts, and cancer. These figures are likely to continue driving the growth of this segment. Of course, one of the most common attacks on the brain is a stroke. According to an estimate by the World Stroke Organization, one in four people who are 25 years or older would face the reality of the event at some point in their life. 13.7 million will experience their first-ever stroke each year, and the deaths that accrue from this are at 5.5 million. And this death toll is envisioned to rise without intervention to 6.7 million annually.

The growing hospital admission rates contribute positively toward the increasing surge for surgical imaging solutions. Increasing patient numbers along with new advanced technologies that are introduced into the market cause the increase in demand for hospital-based treatments. On the other hand, the ambulatory surgical centers segment is expected to achieve the highest CAGR over the projected period. This growth is based on advancements in portable and cost-effective imaging technologies, which are expanding the availability of imaging services in ASCs, particularly with an increasing number of minimally invasive surgeries being performed in these facilities. Going forward, this trend should continue to sustain the growth of the segment.

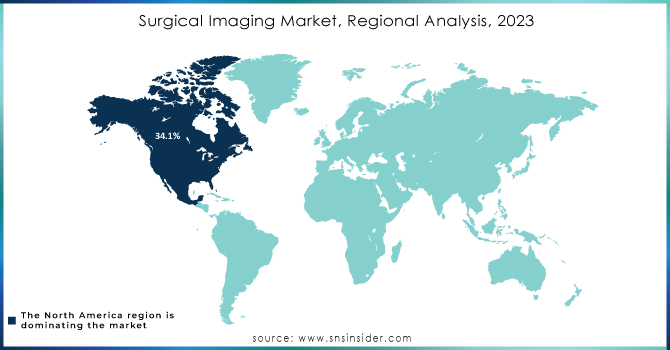

Surgical Imaging Market Regional Analysis

The North American surgical imaging market dominated with a global revenue share of 34.1% in 2023. High penetration of leading-edge surgical imaging technologies in primary care, easy access, and high healthcare expenditure widely propitiated by some positive reimbursement policies are the reasons behind this region's leadership. The incidence rates for chronic diseases, such as breast cancer, cardiovascular conditions, and neurological conditions, have led to increased demands for imaging analysis throughout the region. North America will also be dominating the market, with continuous technological advancements as well as rising chronic diseases following the forecast period. The U.S. is a big part of this market, as the trend indicated here ups the installations of ultrasound machines, which is gaining traction from huge deals such as that signed by GE Healthcare with St. Luke's University Health Network.

Europe also has good growth in the surgical imaging market through public as well as private investments in R&D. This increased demand for healthcare equipment, particularly due to chronic and pain-related conditions, has led to the growth of this market within the region. Growth for the market is seen in the UK, France, and Germany, mainly through factors such as healthcare reforms, government initiatives, and a good presence of SMEs in medical device manufacturing.

The region of Asia Pacific is expected to grow the fastest during the forecast period, led by the rapidly growing population and increased R&D activity in the region. Notable improvements in the demand for both traditional and advanced medical devices have been seen in countries like Japan, China, and India, where positive regulatory climates, government programs, and growth in local manufacturing capabilities are contributing factors.

Need Any Customization Research On Surgical Imaging Market - Inquiry Now

Key Players

-

Koninklijke Philips N.V. (Azurion)

-

GE Healthcare (LOGIQ Series)

-

Siemens Healthcare GmbH (ARTIS Series)

-

Ziehm Imaging GmbH (Ziehm Vision)

-

Shimadzu Corporation (Mobius Series)

-

Hologic Corporation (GYN surgical imaging products)

-

FUJIFILM Holdings America Corporation (Fujifilm's FDR D-EVO II)

-

CANON MEDICAL SYSTEMS CORPORATION (Aplio Series, Vantage Series)

-

SAMSUNG HEALTHCARE (UGEO PT60A)

-

Medtronic Plc (StealthStation Surgical Navigation System)

-

Shenzhen Mindray Bio-Medical Electronics Co., Ltd. (DC-70 Ultrasound System, M7 and M9 Portable Ultrasound Systems), and others.

Recent Developments

-

In January 2024, Probo Medical, an imaging services provider backed by private equity in Tampa, Florida, is rapidly expanding its operations through acquisitions. The company has recently reached an agreement to acquire Alpha Source Group, thereby enhancing its diagnostic imaging solutions platform.

-

In March 2024, SyntheticMR's new imaging solution, SyMRI 3D, received FDA clearance for clinical use in the U.S. This marks a significant advancement in quantitative MRI technology, delivering exceptional resolution and accuracy for brain imaging.

-

In April 2023, a medical technology company based in Seattle developed a groundbreaking surgical imaging device, which has become the first light-assisted navigation tool for spine surgery to receive FDA clearance.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 148 Billion |

| Market Size by 2032 | USD 340.5 billion |

| CAGR | CAGR of 9.7% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Modality (C-arms, Computed Tomography, X-ray, Ultrasound) • By Application (Neurosurgeries, Cardiovascular Surgeries, Orthopedic and Trauma, Gynecological Surgeries, Thoracic Surgeries, Urological Surgeries, Others) • By End-use (Hospitals, Specialty Clinics, Ambulatory Surgical Centers, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Koninklijke Philips N.V., GE Healthcare, Siemens Healthcare GmbH, Ziehm Imaging GmbH, Shimadzu Corporation, Hologic Corporation, FUJIFILM Holdings America Corporation, CANON MEDICAL SYSTEMS CORPORATION, SAMSUNG HEALTHCARE, Medtronic Plc, Shenzhen Mindray Bio-Medical Electronics Co., Ltd. and others. |

| Key Drivers | • Digital Flat-Panel Detectors Transform Surgical Imaging with Enhanced Precision and Safety |

| Restraints | •High Cost of Advanced Mobile C-arms •Decreasing Hospital Budgets |