Thermal Camera Market Size & Overview:

Get more information on Thermal Camera Market - Request Sample Report

The Thermal Camera Market Size was valued at USD 3.86 Billion in 2023 and is expected to reach USD 6.76 Billion by 2032, growing at a CAGR of 6.44% over the forecast period 2024-2032.

The thermal camera market has experienced significant growth in recent years, driven by advancements in infrared technology and an increasing demand for non-contact temperature measurement solutions across various industries. Thermal cameras help identify hot spots in machines, electrical systems, and mechanical equipment, enabling the early detection of faults or potential failures. This proactive approach prevents unplanned downtimes, reduces maintenance costs, and improves overall operational efficiency, driving the market's expansion.

In the healthcare industry, thermal cameras are playing an increasingly vital role in diagnostic applications, particularly for fever detection and screening for infectious diseases. For example, the Verbalia Breast Cancer Center in the US saw a rise in breast cancer detection accuracy, from 84% with traditional X-ray detection to 95% using infrared thermal imaging technology. Thermal cameras provide a fast and effective way to detect elevated body temperatures, a common symptom of infection. As global health concerns continue to rise, the adoption of thermal cameras in healthcare is expected to grow, fueling the expansion of the thermal camera market.

The rise of consumer electronics has also contributed to the growth of the thermal camera market, particularly with the increasing integration of thermal imaging in smart devices. With over 7.5 billion smartphones and 10.47 billion IoT connections worldwide, smartphone manufacturers are incorporating thermal imaging capabilities into their devices. This allows users to detect heat sources and assess energy efficiency in buildings, among other applications. As the demand for home automation, security, and personal health monitoring devices continues to grow, the adoption of thermal cameras in consumer electronics is expected to drive further market growth.

Thermal Camera Market Dynamics

Drivers

-

The ongoing progress of infrared sensor technology has greatly contributed to the expansion of the thermal camera market.

Technological advancements are essential in meeting the rising demand for high-resolution, precise, and affordable infrared imaging systems. In the past, thermal cameras were costly and unwieldy, restricting their usage to specific sectors like the military and industry. Yet, advancements in sensor technology have allowed for the creation of thermal cameras that are smaller, cost-effective, and precise. Enhanced sensor clarity and improved image quality, like transitioning from low to high-resolution infrared sensors, have broadened the usefulness of thermal cameras in the automotive, healthcare, and security industries. Advanced infrared sensors now provide enhanced sensitivity, enabling thermal cameras to detect minor temperature changes, greatly benefitting tasks such as building inspections, spotting electrical malfunctions, and fighting fires. These technological advancements have led to the creation of lighter and more portable devices, significantly broadening the range of potential uses for thermal cameras. Additionally, with the increasing affordability and availability of infrared sensors, industries that previously could not afford thermal imaging technologies due to cost limitations can now integrate them into their operations. The increased accessibility of thermal imaging technology is an important driver of the growing market.

-

The increased demand for measuring temperature without contact has played a major role in the growth of the thermal camera market.

In industries like healthcare, manufacturing, and industrial maintenance, thermal cameras offer a dependable, non-intrusive way to measure temperature remotely. This is especially crucial in sectors that prioritize safety, like power plants, oil refineries, and chemical processing plants, where equipment overheating can result in disastrous outcomes. Thermal cameras are commonly used to check people for fever, a typical sign of infection, particularly in airports, hospitals, and public areas. The benefits of measuring temperature without contact go beyond healthcare to include uses in manufacturing and maintenance. Thermal cameras are used for predictive maintenance, enabling operators to detect hot spots or overheating equipment before failure. This proactive strategy decreases the amount of time equipment is out of order and the expenses related to maintenance, ultimately enhancing efficiency and safety in operations. As businesses worldwide acknowledge the importance of non-contact temperature monitoring, the use of thermal cameras is increasing.

Restraints

-

Portable thermal cameras, in particular, are frequently restricted by the duration of their battery life and their power consumption.

High-end thermal imaging systems need a lot of power, especially when used in high resolution or for long periods. This problem may pose a limitation, especially in situations that are far from civilization or in outdoor settings, where opportunities to connect to power are scarce. Frequent recharging or reliance on large, weighty battery packs can diminish the convenience and ease of carrying thermal cameras. This matter is particularly important in fields like firefighting, policing, or military operations, where thermal cameras are utilized in difficult conditions for prolonged periods. For continued market growth, it will be essential to address the power consumption and battery life limitations as the need for portable and efficient thermal imaging systems increases.

Thermal Camera Market Segmentation Outlook

by Product

The handheld segment led the thermal camera market in 2023, holding a 43% market share. These tools are frequently utilized in sectors like construction, electrical assessments, firefighting, surveillance, and upkeep. Handheld thermal cameras offer professionals a quick way to identify problems with their easy usability, small design, and ability to provide real-time imaging, eliminating the need for complex setup or infrastructure. For instance, the FLIR E8-XT model is utilized in building inspections, electrical upkeep, and safety measures, providing high-quality thermal images in a compact design.

The mounted segment is expected to become the fastest-growing segment during 2024-2032. Thermal cameras that are mounted are commonly placed on stationary buildings or vehicles and are utilized for surveillance, monitoring, and constant functionality across different industries. In the security and defense fields, mounted systems are widely used for their ability to provide continuous surveillance and detect targets from afar. As an example, FLIR's SeaFLIR systems are utilized for maritime security and surveillance, offering live thermal imaging for monitoring ships and offshore activities.

by Technology

In 2023, the cooled segment dominated the thermal camera market, with 59% of the market share. These cameras use a cooled infrared detector, which greatly enhances their sensitivity, allowing them to identify subtle temperature variations. Cooled thermal cameras can still capture high-resolution thermal images in low-thermal contrast surroundings. For example, FLIR Systems offers cooled thermal cameras designed for military use, providing superior thermal resolution for detecting and monitoring targets. In the industrial sector, corporations such as Raytheon Technologies employ cooled thermal imaging to examine vital infrastructure such as pipelines and electrical systems, identifying temperature irregularities that may suggest defects or dangers.

The uncooled segment is projected to have the fastest CAGR during 2024-2032 in the thermal camera market. Uncooled thermal cameras, in contrast to cooled ones, utilize infrared detectors that do not need cooling mechanisms, resulting in a lighter, smaller, and more affordable product. For instance, FLIR Systems and Opgal offer uncooled thermal cameras for uses such as smart home security and automotive safety. Uncooled cameras are incorporated into Advanced Driver Assistance Systems (ADAS) in the automotive sector for night vision and obstacle detection, as showcased in cars made by brands such as BMW and Mercedes-Benz.

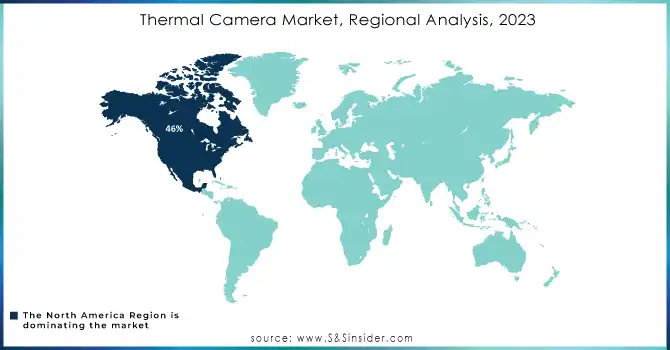

Thermal Camera Market Regional Analysis

North America dominated the thermal camera market in 2023 with a market share of 46%. Technological advancements, broad industry adoption, and major investments in defense, security, and healthcare are driving this dominance. The United States plays a major role in this area, with its strong defense and security industry driving the need for thermal cameras for surveillance, military activities, and border security. Moreover, thermal cameras are also used in the healthcare sector for diagnostic purposes like identifying fevers. Key players such as FLIR Systems (now under Teledyne Technologies) and Raytheon Technologies offer a diverse selection of thermal imaging solutions for different industries.

APAC is expected to experience the highest CAGR in the thermal camera industry from 2024 to 2032, due to fast industrialization, greater use of advanced technologies, and increasing need for security solutions. Nations such as China, India, and Japan are seeing notable growth because of increasing defense and security demands, along with advancements in infrastructure. For example, India is making significant investments in defense, resulting in an increased need for thermal imaging in surveillance, border security, and military uses. Major firms in the region such as Hikvision and Panasonic, provide various thermal camera options for various purposes, such as monitoring, automotive, and industrial applications.

Get Customized Report as per your Business Requirement - Request For Customized Report

Key Players

The major key players in the Thermal Camera Market are:

-

Raytheon (Thermal Targeting Systems, R9 Series)

-

Seek Thermal (Seek CompactPro, Seek Reveal)

-

Testo (Testo 876, Testo 883)

-

Lepton (Lepton 3.5, Lepton 3.0)

-

Bosch Security Systems (Bosch Dinion IP Thermal, Bosch Flexidome IP Thermal)

-

Hikvision (DS-2TD2636-25, DS-2TD2636-35)

-

Opgal (EyeCGas 2.0, Therm-App TH)

-

L3 Technologies (Harris Thales, ThermoVision A320)

-

Xenics (Xenics Gobi, Xeva 1.7-640)

-

FLIR Boson (Boson 320x240, Boson 640x512)

-

Bullard (T4 Max, T3X)

-

ULIS (P6600, P3200)

-

Thermoteknix (TiCAM 1000, TiCAM 720)

-

Wuhan Guide Infrared (Guide IR21, Guide IR30)

-

InfraTec (VarioCam HD, ImageIR 9300)

-

Bae Systems (FLIR Ranger, BAE HDR-AR)

-

Ametek Land (ThermAlert, NIR-Broadband)

-

Fluke Corporation (Fluke TiX1000, Fluke Ti400)

-

Teledyne FLIR (Teledyne FLIR A400, Teledyne FLIR T1020)

Suppliers of raw materials/components to thermal camera manufacturers:

-

Teledyne Imaging

-

Raytheon

-

L3 Technologies

-

Bosch

-

Jenoptik

-

FLIR Systems

-

Sensors Unlimited

-

Wuhan Guide Infrared

-

Vigo System

-

OptoTech

Recent Developments

-

June 2024: Teledyne FLIR unveiled a brand-new thermal camera called the A6301. The camera is fitted with a chilled MWIR sensor, featuring a 640 x 512 resolution and a frame rate of 30 Hz.

-

July 2024: Teledyne FLIR, a division of Teledyne Technologies Incorporated, introduced advanced embedded software for the ITAR-free Boson+ thermal camera module, providing top-notch uncooled thermal imaging technology for defense, firefighting, automotive, security, and surveillance purposes.

-

April 2023: Raytheon Technologies announced the launch of RAIVEN, a revolutionary electro-optical intelligent-sensing capability, which will enable pilots to have faster and more precise threat identification.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 3.86 Billion |

| Market Size by 2032 | USD 6.76 Billion |

| CAGR | CAGR of 6.44% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Handheld, Mounted, Scopes and Goggles) • By Technology (Cooled, Uncooled) • By Application (Monitoring and Inspection, Security and Surveillance, Detection and Measurement, Search and Rescue Operations) • By End User (Military and Defense, Industrial, Commercial, Healthcare and Life Sciences, Residential, Automotive, Oil and Gas) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Raytheon, Seek Thermal, Testo, Lepton, Bosch Security Systems, Hikvision, Opgal, L3 Technologies, Xenics, FLIR Boson, Bullard, ULIS, Thermoteknix, Wuhan Guide Infrared, InfraTec, Bae Systems, Ametek Land, Fluke Corporation, Teledyne FLIR |

| Key Drivers | • The ongoing progress of infrared sensor technology has greatly contributed to the expansion of the thermal camera market. • The increased demand for measuring temperature without contact has played a major role in the growth of the thermal camera market. |

| RESTRAINTS | • Portable thermal cameras, in particular, are frequently restricted by the duration of their battery life and their power consumption. |