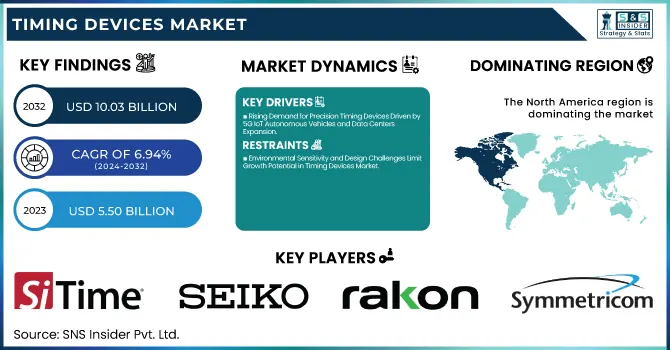

Timing Devices Market Size & Growth:

The Timing Devices Market Size was valued at USD 5.50 billion in 2023 and is expected to reach USD 10.03 billion by 2032, growing at a CAGR of 6.94% over the forecast period 2024-2032. Innovation and Technology Metrics in the Timing Devices Market focus on shifts like MEMS oscillators, silicon-based solutions, and integrated clock systems to drive performance and miniaturization. Critical customer and usage metrics outline increasing demand in applications like 5G, IoT, automotive, and consumer electronics, with precision and efficient use of energy at the center of it all. Accuracy, reliability, and longevity in extreme conditions are essential for industries like aerospace and industrial automation; these factors fall under Quality and Reliability Metrics. Market Sentiment & Competitive Intelligence Track strategic moves, product launches, and customer perception to understand competition and emerging market trends.

To Get more information on Timing Devices Market - Request Free Sample Report

Timing Devices Market Dynamics:

Key Drivers

-

Rising Demand for Precision Timing Devices Driven by 5G IoT Autonomous Vehicles and Data Centers Expansion

The increasing requirement for accuracy and dependability in various industries including consumer electronics, telecommunications, and automotive is driving this market. The growing proliferation of technologies such as 5G, IoT, and autonomous vehicles depends on precision timing and is creating a boom in demand for oscillators, atomic clocks, and resonators. Furthermore, growing miniaturization and integration trends in electronic devices are also supporting the demand for compact and power-efficient timing devices. High-performance clocking solutions are also needed to efficiently process large amounts of data, which are key requirements driven by the expansion of data centers and the proliferation of cloud computing, also driving the market growth.

Restrain

-

Environmental Sensitivity and Design Challenges Limit Growth Potential in Timing Devices Market

The high sensitivity of timing components to environmental factors (for example, temperature, vibration, and electromagnetic interference) is one of the major restraints in the Timing Devices Market, as unpredictable changes can affect performance and accuracy. In particular for automotive and aerospace applications, maintaining stability and reliability under different conditions is still a challenge. Furthermore, timing devices in modern electronic systems pose design limitations, as they produce energy that must be closely coupled to other circuit components. It can also limit adoption by introducing compatibility issues with advanced semiconductor processes because devices are shrinking.

Opportunity

-

Digitalization of Renewable Energy and Aerospace drives lucrative Growth Opportunities in the Timing Devices Market

Due to the fast transition towards digitalization in the BFSI sector, there are lucrative growth prospects for timing devices in highly secured & speedy finance transactions. The increasing demand for timing solutions based on silicon due to innovations in semiconductor technology is also providing profiting opportunities for market growth. The adoption of new applications in military and aerospace due to high-precision navigation and communication systems in commercial use can also be seen as a factor contributing to the growth of this market shortly. Furthermore, the rising emphasis on renewables and smart grids intends to open new opportunities for these timing devices to cater to grid stability and swiftly manage the generation and associated power. The timing device manufacturers that invest in research and development to develop innovative, low-power, and high-precision timing devices are expected to surpass competitors in the coming years.

Challenges

-

Technology Advancements Supply Chain Disruptions and Cybersecurity Challenges Impact Timing Devices Market Growth

Rapid developments in technology are another culprit in this challenge, as manufacturers are forever driven to adapt and innovate to meet changing standards and customer expectations. Government support for particular industries in many countries, combined with corporate investment in R&D and the capital costs for silicon-based timing solutions and emerging technologies like MEMS oscillators tend to limit competition as only larger players with the resources needed for R&D can stay in the game. Moreover, uneven supply chain disruptions along with the availability of high-quality raw materials are also hindering the market growth. Another growing concern is ensuring cybersecurity for timing devices, especially in critical applications within the telecommunications and banking, financial services, and insurance (BFSI) sectors, whereby threats to timing devices can result in severe operational risk. However, we learn that achieving the right performance vs. power efficiency vs. security grip remains a difficult challenge for the industry to navigate.

Timing Devices Market Segmentation Outlook:

By Type

Oscillators accounted for the largest share of the Timing Devices Market 24.7% in 2023, owing to their extensive use in consumer electronics, telecommunications, and automotive applications. They have been widely used for frequency control and timing as they are relatively inexpensive, convenient, reliable, and compatible with various electronic systems. This is also one of the factors that have helped them maintain their dominance as the need for compact and low-power devices is increasing.

Atomic Clocks are projected to achieve the fastest Compound Annual Growth Rate (CAGR) between 2024 and 2032 due to rising needs for high-precision timing solutions in telecommunications, aerospace, and defense sectors. Due to their unsurpassed accuracy and stability, they are used for applications with strict synchronization requirements, including GPS systems and data centers. We may expect that their implementation will rapidly increase as the innovation matures and the costs gradually come down.

By Material

Crystal with a 54.8% share in the Timing Devices Market in 2023, was the largest market segment in 2023, as it is used in most consumer electronics, telecommunications, and automotive applications. It is the most widely used reference source for frequency control and timing solutions due to its high stability, reliability, and inexpensive to manufacture. Moreover, its established manufacturing processes and raw materials also made it stay on top of the ladder.

Silicon will hold the highest CAGR from 2024-2032, owing to its demand for increasingly miniaturized and smart devices with power efficiency. With its advanced level of integration with high-performance semiconductor technologies and the requirement of being integrated into modern electronic systems, silicon photonics is well suited for high-performance applications including 5G, the Internet of Things (IoT), and also wearable devices. Improving silicon-based solutions is poised to become the most cost-effective option for high-throughput genomic analysis, leading to a significant increase in their adoption.

By Application

In 2023, the Timing Devices Market was led by the Consumer Electronics segment with a 30.2% share, owing to high demand for smartphones, wearables, and smart home devices. It became the leader because great features like high-refresh-rate displays and GPS and wireless are impossible without accurate timings and synchronizations. Marketing forces also aided by the lightning expansion of technology and the increasing connection of devices.

The BFSI segment is projected to experience the highest CAGR from 2024 to 2032, which is attributed to the rapid expansion of digital banking, and financial transactions and the acceptance of cutting-edge technologies such as blockchain. High-precision timing solutions are needed due to the demand for secure and accurate time-stamping in financial operations for compliance requirements. With the ongoing expansion of digitalization and the development of threats related to cybersecurity, the demand for precise timing devices is expected to witness a significant rise in the BFSI sector.

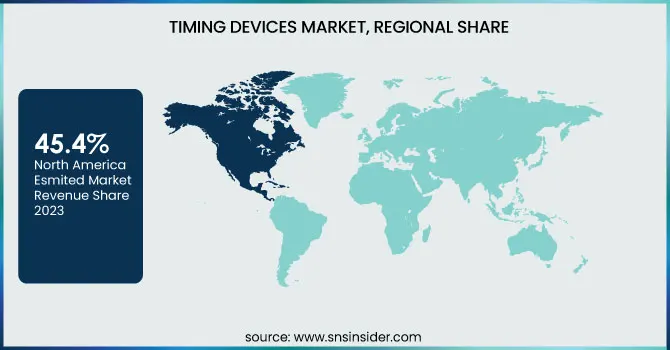

Timing Devices Market Regional Analysis:

In 2023, North America held the largest share of 45.4% in the Timing Devices Market, owing to the early adoption of advanced technology and the presence of established key players in the region. Strong demand from sectors like telecommunications, aerospace, and defense that need accurate timing solutions for 5G networks, GPS, and military communication systems, helped keep the region’s leadership fortified. US multinational corporations (MNCs) dominate timing devices for high-performance electronic systems (e.g. Texas Instruments and Qualcomm).

The Asia Pacific region is projected to hold the highest CAGR during the forecast period 2024-2032 due to fast industrialization, growing demand for consumer electronics manufacturing, and the growing automotive industry in the region. Geographically, the Timing Devices Market has been segmented into North America, Asia Pacific, Europe, and the Rest of the World. The region is hosting top electronics manufacturing centers such as China, Japan, and South Korea, where sales of timing devices are on the rise propelled by surging demand for smartphones, wearables, and IoT devices. Consider, for example, Seiko Epson and Murata Manufacturing, seen as the top Japanese suppliers of crystal oscillators and resonators. Moreover, the increasing Chinese investments in 5G infrastructure and electric vehicles continue to boost the demand for advanced timing solutions.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players:

Some of the major players in the Timing Devices Market are:

-

SiTime Corporation (SiT5543 MEMS Super-TCXO, Epoch Platform MEMS OCXO)

-

Seiko Group Corporation (Astron GPS Solar Watch, Spring Drive Movement)

-

Rakon Limited (Temperature-Compensated Crystal Oscillators (TCXO), Oven-Controlled Crystal Oscillators (OCXO))

-

Symmetricom (Cesium Atomic Clocks, Hydrogen Masers)

-

Gallet & Company (Multichron Petite Chronograph, Multichron Yachting Chronograph)

-

Impinj, Inc. (EPC Class 1 Gen 2 Passive UHF RFID Chips, RFID Readers)

-

Microchip Technology Inc. (Chip-Scale Atomic Clock (CSAC), Oven-Controlled Crystal Oscillators (OCXO))

-

Texas Instruments Incorporated (Programmable Crystal Oscillators, Clock Generators)

-

Abracon LLC (MEMS Oscillators, Real-Time Clock Modules)

-

IQD Frequency Products Ltd (Voltage-Controlled Crystal Oscillators (VCXO), Temperature-Compensated Crystal Oscillators (TCXO))

-

Epson Electronics America, Inc. (Real-Time Clock Modules, Quartz Crystal Units)

-

Vectron International (Voltage-Controlled Oscillators (VCO), Oven-Controlled Crystal Oscillators (OCXO))

-

NDK America, Inc. (Crystal Units, Crystal Oscillators)

-

CTS Corporation (Clock Oscillators, Quartz Crystals)

-

Bliley Technologies, Inc. (Low Phase Noise Crystal Oscillators, Precision Frequency Control Products)

Recent Trends:

-

In April 2024, SiTime launched the Chorus clock-system-on-a-chip portfolio for AI data centers, offering 10x higher performance in half the space. It also introduced the SiT5977 Super-TCXO to enhance synchronization in AI compute nodes.

-

In November 2024, Rakon launched the GNSS Receiver TIMING, the first COTS NewSpace GNSS receiver with an integrated GNSS Disciplined Oscillator.

| Report Attributes | Details |

|---|---|

|

Market Size in 2023 |

USD 5.50 Billion |

|

Market Size by 2032 |

USD 10.03 Billion |

|

CAGR |

CAGR of 6.94% From 2024 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2032 |

|

Historical Data |

2020-2022 |

|

Report Scope & Coverage |

Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

|

Key Segments |

• By Type (Oscillators, Atomic Clocks, Resonators, Clock Generators, Clock Buffers, Jitter Attenuators) |

|

Regional Analysis/Coverage |

North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

|

Company Profiles |

SiTime Corporation, Seiko Group Corporation, Rakon Limited, Symmetricom, Gallet & Company, Impinj, Inc., Microchip Technology Inc., Texas Instruments Incorporated, Abracon LLC, IQD Frequency Products Ltd, Epson Electronics America, Inc., Vectron International, NDK America, Inc., CTS Corporation, Bliley Technologies, Inc. |