Acoustic Wave Sensor Market Size & Growth:

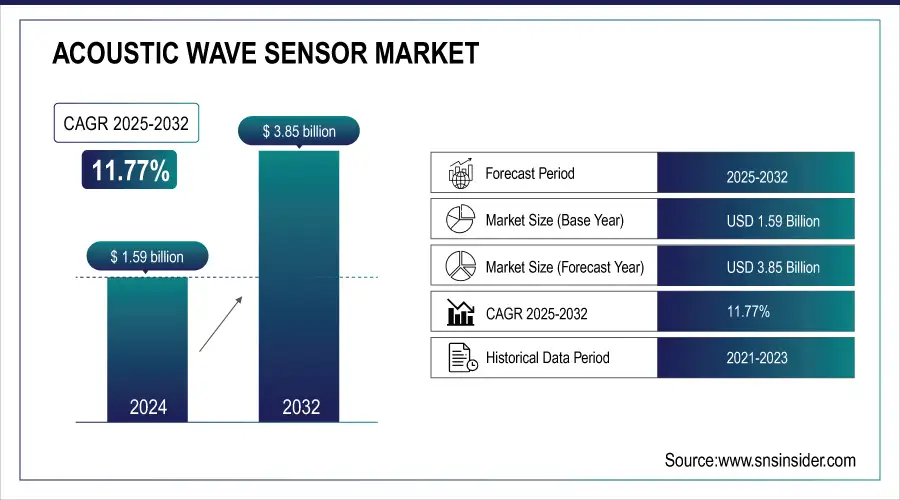

The Acoustic Wave Sensor Market Size was valued at USD 1.59 billion in 2024 and is expected to reach USD 3.85 billion by 2032 and grow at a CAGR of 11.77% over the forecast period 2025-2032.

The global Acoustic Wave Sensor Market is experiencing steady growth dynamically due to growing need for light-weight and low-cost sensors from different industries. Passive operation, small size, and high sensitivity make the acoustic wave sensors a good choice for wireless system, smart devices and industrial automation. Their increasing application in the automotive safety technology, environmental monitoring, and medical diagnosis is also contributing toward market penetration. Furthermore, progress in sensor materials and integration technologies is increasing the performance, allowing wider use in new fields such as IoT, healthcare, and aerospace.

According to research, acoustic sensors are used in over 70% of TPMS-equipped vehicles globally, with TPMS systems mandatory in most developed countries.

Acoustic Wave Sensor Market Size and Forecast

-

Market Size in 2024: USD 1.59 Billion

-

Market Size by 2032: USD 3.85 Billion

-

CAGR: 11.77% from 2025 to 2032

-

Base Year: 2024

-

Forecast Period: 2025–2032

-

Historical Data: 2021–2023

To Get more information on Acoustic Wave Sensor Market - Request Free Sample Report

Acoustic Wave Sensor Market Trends

-

Rising adoption of acoustic wave sensors in automotive, healthcare, and industrial applications is accelerating market expansion.

-

Demand for wireless, battery-free, and passive sensing technologies is boosting surface acoustic wave (SAW) and bulk acoustic wave (BAW) sensor deployment.

-

Growing use in automotive systems such as tire pressure monitoring, torque sensing, and engine management enhances vehicle safety and performance.

-

Increasing integration of acoustic sensors in smartphones, wearables, and IoT devices supports miniaturization and low-power operation.

-

Expanding healthcare applications, including biosensing, medical diagnostics, and patient monitoring, are driving innovation in biocompatible sensor materials.

-

Rising focus on environmental monitoring and industrial automation is promoting acoustic wave sensor usage for pressure, temperature, and humidity measurements.

-

Technological advancements in MEMS-based acoustic devices and improved frequency stability are enhancing sensitivity and reliability.

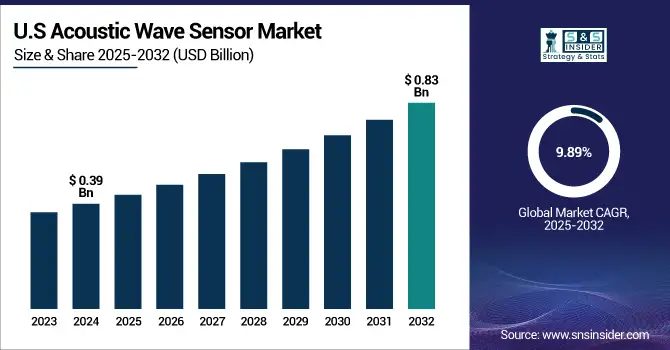

The U.S. Acoustic Wave Sensor Market size was USD 0.39 billion in 2024 and is expected to reach USD 0.83 billion by 2032, growing at a CAGR of 9.89% over the forecast period of 2025–2032.

The US acoustic wave sensor market growth is driven by increasing use of wireless sensor networks in automotive and industrial segment, coupled with increasing concern for smart infrastructure and stringent safety & monitoring regulation. Moreover, the rising application in defense and medical diagnostics in the country is also for the growth of acoustic wave sensor market in the U.S. market applications.

According to research, 68% of U.S. factories had adopted wireless sensor automation by 2024, reflecting widespread industrial integration.

Acoustic Wave Sensor Market Growth Drivers:

-

Growing use of acoustic wave sensors in automotive safety systems is significantly enhancing demand across collision detection and TPMS applications.

The automotive industry is increasingly adopting acoustic wave sensors due to their high reliability, low cost, and passive operation. In advanced driver assistance systems (ADAS) and tire pressure monitoring systems (TPMS), these sensors enable real-time data collection without requiring a power supply, making them ideal for harsh environments. Rising global emphasis on vehicle safety, alongside regulatory mandates and consumer demand for smarter vehicles, is accelerating the integration of these sensors into modern automotive platforms, thus driving substantial market growth. Their role in electric vehicle systems and autonomous driving technologies further reinforces their expanding presence in next-generation automotive innovations.

According to research, the automotive segment represents around 24% of BAW sensor utilization and contributes significantly to acoustic wave sensor growth.

Acoustic Wave Sensor Market Restraints:

-

Limited operability in extreme environmental conditions restricts the applicability of acoustic wave sensors in certain high-demand sectors.

Despite their many advantages, acoustic wave sensors face performance degradation in extreme temperature or high-humidity environments. Such limitations hinder their effectiveness in aerospace, heavy industrial, or deep-sea applications, where environmental stability is critical. Additionally, sensitivity to contaminants and mechanical vibrations can result in signal distortion or failure, especially in harsh settings. These technical constraints limit broader adoption, especially when alternative sensor technologies offer more robust operability in extreme or demanding application scenarios. The lack of advanced packaging and protective coatings further exacerbates durability issues, making them less suitable for mission-critical or long-term deployments.

Acoustic Wave Sensor Market Opportunities:

-

Development of next-generation biomedical sensors presents strong potential for acoustic wave technology in advanced healthcare solutions.

With increasing emphasis on personalized healthcare and remote patient monitoring, acoustic wave sensors are gaining traction in the biomedical field. Innovations in sensor materials and bio-compatible designs are making these sensors suitable for implantable and wearable applications. They provide high sensitivity and stability for detecting specific biomolecules, enabling early diagnosis and continuous monitoring. As the healthcare industry continues to integrate smart technologies, acoustic wave sensors offer a promising path for non-invasive, real-time medical diagnostics and therapeutic monitoring. Their low power consumption and wireless capabilities further support long-term patient care and integration into advanced telehealth systems.

According to research, over 70% of healthcare providers in developed countries are adopting remote patient monitoring (RPM) solutions, many of which rely on advanced biosensors, including SAW-based systems.

Acoustic Wave Sensor Market Segment Analysis

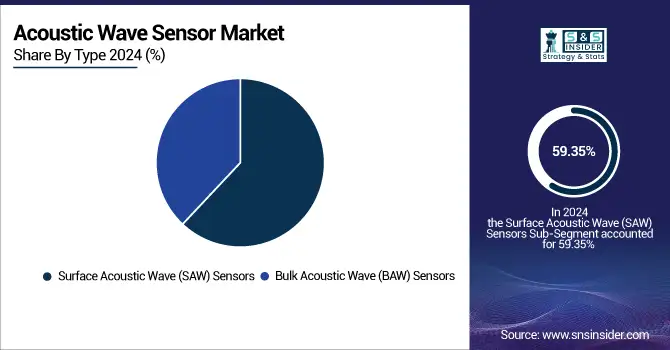

By Type, Surface Acoustic Wave (SAW) sensors dominate the Market, Bulk Acoustic Wave (BAW) sensors are expected to grow fastest

The Surface Acoustic Wave (SAW) sensors segment dominated the market in 2024 with a revenue share of 59.35%, driven by their widespread application across industries such as automotive, telecommunications, and industrial monitoring. Their cost-effectiveness, ease of fabrication, and strong performance in wireless and passive operations have made them a preferred choice.

The Bulk Acoustic Wave (BAW) sensors segment is projected to grow at the fastest CAGR of 12.60% from 2025 to 2032, fueled by rising demand in advanced communication and sensing technologies. Qorvo Inc., a key player in this space, is continuously innovating BAW-based RF filters for 5G and IoT applications. BAW sensors offer high performance at elevated frequencies and temperatures, making them ideal for compact and mission-critical systems. These characteristics are accelerating their uptake in healthcare and mobile communication sectors.

By Frequency Range, Mid-Frequency (1 GHz to 3 GHz) sensors dominate the Acoustic Wave Sensor Market, High-Frequency (above 3 GHz) sensors are expected to grow fastest

Mid-Frequency (1 GHz to 3 GHz) sensors dominated the acoustic wave sensor market share of 53.23% in 2024, supported by their extensive use in mobile communication, industrial monitoring, and automotive systems. These frequencies offer a strong balance of performance, sensitivity, and cost, making them versatile for many applications. Their compatibility with existing platforms further accelerates adoption, ensuring continued leadership in the acoustic wave sensor market.

High-Frequency (above 3 GHz) sensors are expected to grow at the fastest CAGR of 13.09% from 2025 to 2032, as they gain traction in aerospace and high-speed data communication sectors. Teledyne Technologies is actively developing high-frequency acoustic solutions for defense and satellite-based sensing systems. These sensors deliver higher sensitivity and better resolution, crucial for complex environments.

By Sensing Parameter, Temperature sensing dominates the Acoustic Wave Sensor Market, Humidity sensing is expected to grow fastest

Temperature segment dominated for the highest revenue share of 32.80% in 2024, driven by its critical role across sectors like automotive, electronics, and industrial equipment. Acoustic wave sensors offer stable, wireless, and passive temperature measurements, making them highly reliable in challenging environments. Their use in preventive maintenance, thermal management, and device safety contributes to sustained demand in both legacy and emerging applications.

Humidity sensing is projected to register the fastest CAGR of 12.97% from 2025 to 2032, due to increasing use in smart buildings, agriculture, and healthcare environments. Acoustic wave sensors companies such as Honeywell International Inc. is expanding its acoustic humidity sensor portfolio for HVAC and cleanroom applications. These sensors provide long-term reliability, compact size, and precise humidity readings, supporting better environmental control.

By End-use Industry, Consumer Electronics dominates the Acoustic Wave Sensor Market, Automotive is expected to grow fastest

Consumer Electronics segment dominated the highest revenue share of 29.17% in 2024, supported by the proliferation of smartphones, wearables, and smart home devices. Acoustic wave sensors are integrated for detecting motion, pressure, and environmental conditions. Their compact size, low power requirement, and high accuracy make them a perfect fit for modern electronics.

The Automotive segment is projected to grow at the fastest CAGR of 13.59% from 2025 to 2032, as vehicles become more sensor-reliant for safety and connectivity. Infineon Technologies AG is integrating acoustic sensors in electric vehicles for pressure and gas detection systems. The segment is being driven by rising adoption of electric and autonomous vehicles, where durable, wireless, and compact sensors are essential.

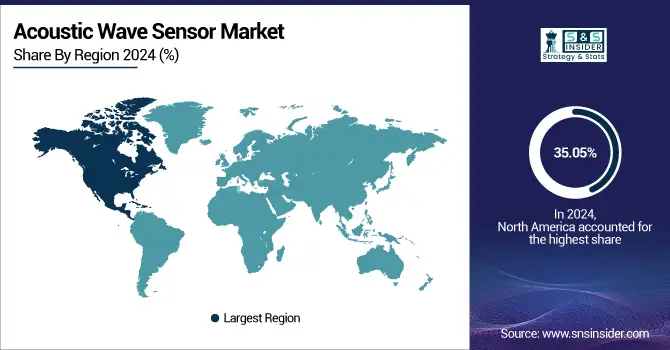

Acoustic Wave Sensor Market Regional Analysis

North America Acoustic Wave Sensor Market Insights

North America dominated the global acoustic wave sensor market in 2024 with a revenue share of 35.05%, driven by strong industrial infrastructure, advanced R&D capabilities, and early technology adoption across sectors. The region benefits from a mature automotive and aerospace ecosystem and widespread integration of IoT technologies. Additionally, government support for industrial automation and defense innovation contributes to the ongoing demand for high-performance sensing solutions.

Get Customized Report as per Your Business Requirement - Enquiry Now

-

The U.S. dominates the North American acoustic wave sensor market due to its strong defense sector, advanced healthcare infrastructure, and early adoption of wireless sensor technologies.

Asia Pacific Acoustic Wave Sensor Market Insights

Asia Pacific is projected to grow at the fastest CAGR of 13.20% from 2025 to 2032, supported by the rapid expansion of manufacturing, consumer electronics, and smart infrastructure projects. High demand in emerging economies, along with strong investments in 5G, electric vehicles, and automation technologies, is fueling market growth. Furthermore, favorable government policies and rising awareness of energy-efficient systems are accelerating adoption of advanced sensor solutions across the region.

-

China leads the Asia Pacific market owing to its large-scale electronics manufacturing base, rapid industrial automation, and aggressive 5G deployment.

Europe Acoustic Wave Sensor Market Insights

Europe holds a substantial share in the acoustic wave sensor market, driven by strong automotive, aerospace, and industrial sectors across countries like Germany, France, and the UK. The region emphasizes sustainable technologies and precision engineering, fueling demand for advanced sensors. Ongoing investments in Industry 4.0, healthcare modernization, and environmental monitoring further support growth of acoustic wave sensor adoption across Europe.

-

Germany dominates the European acoustic wave sensor market due to its advanced automotive industry, strong manufacturing infrastructure, and leadership in Industry 4.0 adoption.

Middle East & Africa and Latin America Acoustic Wave Sensor Market Insights

The Middle East & Africa acoustic wave sensor market is led by the UAE, driven by its smart city projects, advanced infrastructure, and digital transformation initiatives. In Latin America, Brazil holds dominance due to rising industrial automation, automotive growth, and increasing adoption of IoT-based sensing technologies across various sectors.

Acoustic Wave Sensor Market Competitive Landscape:

TDK Corporation

TDK Corporation is a global leader in electronic components, sensors, and energy solutions, with a strong focus on innovation across power electronics, wireless technologies, and acoustic systems. The company consistently advances sensor integration, miniaturization, and energy efficiency to serve automotive, industrial, and communication markets. Through its expertise in materials science and acoustic technology, TDK continues to pioneer next-generation connectivity and sensing solutions for challenging environments.

-

2025: Unveiled its Acoustic Data Link (ADL) technology enabling wireless power (up to 30 mW) and data (~10 kb/s) transmission through metal walls up to 50 mm thick, supporting sensors in sealed or metal-shielded environments.

-

2024: Showcased new passive component and sensor innovations at PCIM/Sensor+Test 2024, including embedded ultrasonic/acoustic sensor modules for EV drivetrain and mobility applications.

Murata Manufacturing Co., Ltd.

Murata Manufacturing Co., Ltd. is a leading Japanese developer of advanced electronic components, wireless modules, and sensors. Known for its expertise in surface acoustic wave (SAW) and ultrasonic technologies, Murata plays a critical role in enhancing connectivity, sensing, and power efficiency for industrial and mobility sectors. The company’s innovations in metamaterials and acoustic wave devices push the boundaries of miniaturization and performance for next-generation electronic systems.

-

2025: Granted U.S. Patent No. 12,413,200 for an “acoustic wave device” featuring a multilayer body structure with a support, piezoelectric layer, and cavity—advancing sensor miniaturization.

-

2024: Announced a compact WiFi-Extractor device utilizing its high-Q surface acoustic wave (SAW) element (I.H.P. SAW), demonstrating leadership in acoustic-wave component design.

-

2024: Developed an “ultrasound transmission metamaterial” technology expanding potential applications for sensors and acoustic-wave modules in industrial and mobility environments.

Kyocera Corporation

Kyocera Corporation is a global manufacturer of advanced materials, components, and electronic devices serving communication, automotive, and industrial markets. The company’s proprietary SAW and TC-SAW technologies enable high-frequency filtering and low-power operation in compact formats, supporting the growing demands of satellite and wireless communication systems. Kyocera continues to innovate in precision acoustic and RF components, reinforcing its position as a leader in advanced signal processing solutions.

-

2025: Launched a new SAW filter for 1.6 GHz satellite communications using its proprietary TC-SAW technology, offering high attenuation and low insertion loss in a compact design.

Acoustic Wave Sensor Companies are:

-

TDK Corporation (TDK Electronics)

-

Honeywell International Inc.

-

API Technologies Corp.

-

AVX Corporation (Kyocera AVX)

-

Vectron International (Microchip Technology)

-

Abracon LLC

-

Kyocera Corporation

-

Taiyo Yuden Co., Ltd.

-

Qorvo, Inc.

-

Broadcom Inc.

-

CTS Corporation

-

Teledyne

-

Raltron Electronics Corporation

-

Transense Technology Plc.

-

Brimrose Corporation of America

-

SENSeOR S.A.S

-

Knowles Corporation

-

Spectrum Control

-

Boston Piezo-Optics Inc.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 1.59 Billion |

| Market Size by 2032 | USD 3.85 Billion |

| CAGR | CAGR of 11.77% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Surface Acoustic Wave (SAW) Sensors, Bulk Acoustic Wave (BAW) Sensors) • By Frequency Range (Low-Frequency (below 1 GHz), Mid-Frequency (1 GHz to 3 GHz), High-Frequency (above 3 GHz)) • By Sensing Parameter (Temperature, Pressure, Humidity, Viscosity, Chemical/Gas, Others) • By End-use Industry (Aerospace & Defense, Automotive, Consumer Electronics, Healthcare, Industrial, Telecommunications, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia,Taiwan, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Murata Manufacturing Co., Ltd., TDK Corporation (TDK Electronics), Honeywell International Inc., API Technologies Corp., AVX Corporation (Kyocera AVX), Vectron International (Microchip Technology), Abracon LLC, Kyocera Corporation, Taiyo Yuden Co., Ltd., Qorvo, Inc., Broadcom Inc., CTS Corporation, Teledyne, Raltron Electronics Corporation, Transense Technology Plc., Brimrose Corporation of America, SENSeOR S.A.S, Knowles Corporation, Spectrum Control, Boston Piezo-Optics Inc. |