Oxygen Flow Meters Market Report Scope & Overview:

The Oxygen Flow Meters Market size was valued at USD 1.21 billion in 2023 and is expected to reach USD 2.07 billion by 2032 and grow at a CAGR of 6.18% over the forecast period 2024-2032. This report identifies increased incidence and prevalence of respiratory conditions, driving the demand for oxygen therapy and associated equipment. The research discusses the influence of an aging population and the increasing transition towards homecare solutions, fueling the uptake of portable and easy-to-use oxygen flow meters. It further analyzes trends in oxygen therapy prescriptions by region, indicating differences in treatment protocols and accessibility. The report also offers a detailed breakdown of healthcare expenditure on oxygen flow meters, categorized by government, commercial, private, and out-of-pocket spending, highlighting investment trends and affordability issues. In addition, it analyzes regulatory approvals and compliance trends, highlighting the influence of changing safety standards and certification requirements on market entry and product innovation.

Get more information on Oxygen Flow Meters Market - Request Sample Report

Market Dynamics

Drivers

-

Rising Respiratory Disorders and Expanding Healthcare Infrastructure

The growth in demand for oxygen flow meters is fueled by the rising incidence of respiratory conditions like COPD, asthma, and pneumonia, which together afflict more than 500 million individuals globally. The growing population of elderly people, especially in developed and developing countries, has also increased the demand for oxygen therapy and respiratory care devices. Furthermore, the rising uptake of homecare oxygen therapy is driving market growth, with patients opting for in-home treatment of chronic respiratory diseases. Technological innovation, including digital and intelligent oxygen flow meters with greater accuracy and remote monitoring features, has further underpinned demand. The other significant driver is the growing healthcare infrastructure, especially in developing economies, where governments are heavily investing in upgrading medical facilities and respiratory care services. The COVID-19 pandemic has also heightened awareness regarding oxygen therapy considerably, which has resulted in greater uptake of oxygen flow meters among hospitals, ambulatory care centers, and home use. Further, the increasing uses of oxygen flow meters outside healthcare, like industrial, aerospace, and chemical industries, where accurate measurement of oxygen is imperative, are also contributing to market growth. These, combined with stringent health regulations requiring precise oxygen delivery, are likely to underpin steady market growth.

Restraints

-

The oxygen flow meters market faces significant restraints, primarily due to the high cost of advanced digital and smart oxygen flow meters.

Affordability is a problem for many hospitals and homecare consumers in low- and middle-income countries, preventing widespread adoption. Additionally, non-standardization of oxygen flow meters results in compatibility problems with various oxygen therapy systems, which makes universal adoption difficult. Regulatory approval inconsistencies among countries also cause product delays and higher compliance costs for manufacturers. Also, device calibration and variations in accuracy affect reliability, a point of concern in medical use where accurate flow of oxygen is paramount. Restrictive reimbursement policies on respiratory care equipment in certain markets also discourage hospitals and homecare suppliers from adopting high-end oxygen flow meters. Dependence on skilled people for the correct operation and maintenance of the device is another hindrance. In industrial usage, safety issues related to the mismanagement of oxygen flow, including the risks of fire in chemical and manufacturing facilities, are also regulatory obstacles. Though technology is overcoming some of these issues, the prohibitively high upfront investment and maintenance expenses of advanced oxygen flow meters remain market growth inhibitors.

Opportunities

-

The increasing shift toward smart and digital oxygen flow meters presents a lucrative opportunity for manufacturers.

Combining IoT and AI-powered monitoring systems offers real-time oxygen flow regulation, remote monitoring, and automated control, enhancing patient outcomes and device efficiency. This trend is especially useful in homecare environments, where remote patient monitoring is increasingly common, cutting hospital visits and overall healthcare management. Another significant opportunity is in emerging markets, where the fast-paced development of healthcare infrastructure is fueling demand for low-cost and high-accuracy oxygen flow meters. Government programs, including grants to public hospitals and respiratory care initiatives, also create opportunities for market growth. The industrial market also presents growth opportunities, as industries such as aerospace, manufacturing, and chemical processing need oxygen flow meters for numerous safety and operational applications. Further, the growing demand for portable oxygen concentrators among travelers and high-altitude climbers has raised the demand for small and lightweight oxygen flow meters. With mounting research on automated and AI-based oxygen therapy products, companies can leverage innovation that improves accuracy, minimizes human intervention, and enhances device efficiency. Strategic acquisitions and collaborations between medical device manufacturers are also poised to fuel market growth in the coming years.

Challenges

-

The Supply chain disruptions, especially in sourcing raw materials and electronic components required for advanced digital flow meters.

The COVID-19 pandemic exposed weaknesses in global medical supply chains, with subsequent production and distribution delays. Manufacturers still run low on semiconductor chips and precision sensors, slowing the manufacture of smart oxygen flow meters. A further significant challenge is stringent regulatory approval processes, which can differ enormously between regions. For example, FDA (United States), CE (Europe), and NMPA (China) all have different requirements, and it becomes challenging for producers to get global distribution approvals. Adherence to medical safety and precision standards, such as calibration requirements, further delays market access. Counterfeit and low-quality oxygen flow meters that flood the market are also a challenge because they undermine patient safety and taint the image of certified manufacturers. Further, volatile raw material prices and elevated production costs stemming from inflationary pressures and political tensions have resulted in financial pressure on producers. Inadequate awareness and manpower in certain geographical areas further restrain adoption, especially in industries where accurate measurement of oxygen is vital. Sustaining all these will take strong supply chain management, regulation harmonization, and investment in high-quality low-cost production technology.

Key Segmentation

By Type

The plug-in type segment held the largest market share in the global oxygen flow meters market in 2023, with a revenue share of 54.5%. This is mainly due to its simplicity in installation, low maintenance, and extensive adoption in hospitals, home care, and manufacturing industries. The superior convenience and reliability of the plug-in form make it the most sought-after solution for hospitals, home care, and manufacturing units where accurate oxygen flow regulation is a concern.

The double flange type segment is projected to experience the most rapid growth throughout the forecast period. Growth in this type of segment is promoted by surging adoption across industrial and chemical usage, wherein leak-proof and safe oxygen flow management is mandatory. The escalating requirement for precise flow meters for special healthcare establishments and oxygen therapy segments is further promoting its utilization.

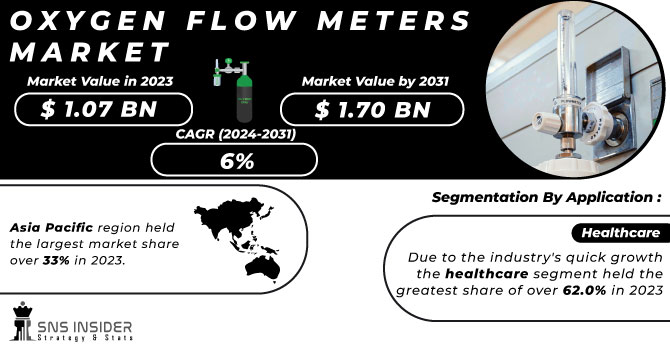

By Application

The Healthcare segment dominated the oxygen flow meters market in 2023 and accounted for a major share of overall revenue. The extensive application of oxygen flow meters in hospitals, clinics, and homes for respiratory therapy, critical care, and emergency treatments has been the key driver of its dominance. The increasing prevalence of respiratory diseases like COPD, asthma, and pneumonia has further stimulated demand, making healthcare the most prominent application segment for oxygen flow meters.

The aerospace segment is expected to be the fastest-growing market for oxygen flow meters. This is driven by the rising need for advanced oxygen regulation systems in commercial and military planes, providing maximum oxygen supply for passengers and pilots. Space exploration initiatives and advances in aviation technology are also fueling the increasing use of oxygen flow meters in this industry.

Regional Analysis

North America dominated the oxygen flow meters market in 2023 owing to its superior healthcare infrastructure, high prevalence of respiratory diseases such as COPD and asthma, and the predominant presence of prominent industry players. The United States has the greatest share in the region, buoyed by beneficial government healthcare regulations and an increasing preference for home-based oxygen therapy. Europe comes next as an important market with Germany, the United Kingdom, and France making major contributions. The region has access to innovative medical technologies, stringent regulatory mechanisms, and mounting demand for accurate oxygen flow measurement in hospitals and specialty clinics.

The Asia-Pacific market is growing at the fastest rate, driven by a fast-growing population of aged people, an expanding incidence of respiratory diseases, and growing healthcare expenditures in nations like China, India, and Japan. Efforts by governments to improve access to healthcare, as well as the growth of medical tourism, are also driving market growth. Industrial uses of oxygen flow meters are also on the rise, especially in manufacturing and aerospace industries, where precise regulation of oxygen flow is paramount.

Key Players

-

Heyer Medical AG

-

HERSILL

-

Megasan Medical

-

Ohio Medical

-

Precision Medical, Inc.

-

Penlon Ltd.

-

AmcareMed Medical Gas System

-

Flowmetrics

-

Dwyer Instruments LTD.

-

DZ Medicale

-

SHANGHAI AMCAREMED TECHNOLOGY Co., LIMITED

-

Smiths Medical

-

Sumukha Meditek

-

Ashish Engineering

-

Deluxe Industrial Gases

Recent Developments

In Jan 2022, ICU Medical Inc. successfully acquired Smiths Medical from Smiths Group plc, integrating its syringe and ambulatory infusion devices, vascular access, and vital care products. This merger strengthens ICU Medical’s position as a leading infusion therapy company, with an estimated pro forma combined revenue of approximately USD 2.5 billion.

| Report Attributes | Details |

| Market Size in 2023 | USD 1.21 billion |

| Market Size by 2032 | USD 2.07 billion |

| CAGR | CAGR of 6.18% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Double Flange Type, Plug-In Type, Others) • By Application (Healthcare, Industrial, Aerospace, Chemical, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Burak Metering Pvt Ltd, Oxyone Medical Devices, Heyer Medical AG, HERSILL, Megasan Medical, Ohio Medical, Precision Medical, Inc., Penlon Ltd., AmcareMed Medical Gas System, Flowmetrics, Dwyer Instruments LTD., DZ Medicale, SHANGHAI AMCAREMED TECHNOLOGY Co., LIMITED, Smiths Medical, Sumukha Meditek, Ashish Engineering, Deluxe Industrial Gases. |