Vacuum Truck Market Key Insights:

Get More Information on Vacuum Truck Market - Request Sample Report

The Vacuum Truck Market Size was valued at USD 2.0 Billion in 2023 and is expected to reach USD 3.7 Billion by 2032, growing at a CAGR of 7.1% over the forecast period 2024-2032.

The vacuum truck market is driven by a confluence of regulatory initiatives and increased industrial demand. Government bodies globally are strengthening waste management regulations, particularly for hazardous waste handling, which has elevated the demand for advanced vacuum trucks. For instance, recent data from the U.S. Environmental Protection Agency (EPA) highlights a 15% increase in spending on waste disposal and remediation services, underscoring a higher budget allocation toward environmental clean-up efforts. Additionally, EU regulatory frameworks under the Waste Framework Directive are mandating tighter controls on waste treatment and transportation, directly fueling demand for liquid and solid waste suction vehicles. In the Asia-Pacific region, emerging economies are intensifying their investments in urban infrastructure and sanitation, with China allocating $20 billion in 2023 towards urban environmental services. This push aligns with the government's "Blue Sky Action Plan," which includes provisions for efficient waste removal technologies. These government-driven initiatives not only incentivize the adoption of vacuum trucks but also catalyze innovations in multi-functional suctioning capabilities, making vacuum trucks integral to sustainable waste management.

The global vacuum truck market is growing rapidly, driven by new partnerships among construction equipment vendors to enhance vacuum truck efficiency and capabilities across industries such as construction, municipal services, oil and gas, and environmental cleanup. These alliances focus on providing integrated waste management and environmental solutions, which align with the rising demand for versatile and efficient equipment. For instance, in December 2022, Heritage Transport, part of Heritage Environmental Services, acquired Frank’s Vacuum Truck Service, expanding its capabilities. Such partnerships facilitate innovation by integrating advanced technologies like telematics, automation, and remote monitoring into vacuum trucks, optimizing performance. By pooling resources, partners can access new markets, reach broader customer bases, and strengthen their competitive edge, especially in high-growth sectors like construction, mining, and oil and gas. Through these collaborations, vacuum trucks are increasingly recognized as essential for modern waste management and environmental sustainability.

Vacuum Truck Market Dynamics

Drivers

-

Rapid urbanization and infrastructural expansion worldwide are driving demand for vacuum trucks for efficient waste management. Increasing investments in construction and municipal projects require reliable vacuum trucks for debris and hazardous waste removal.

-

Governmental regulations promoting sustainable waste management are pushing industries to adopt vacuum trucks for safe hazardous waste handling. The increased focus on environmental compliance has led to a rise in vacuum truck usage across sectors such as oil & gas, mining, and construction.

-

Innovations like automation and enhanced suction technology are improving efficiency and safety, making vacuum trucks more appealing

The mounting requirement for effective waste management combined with the rapid expansion of automation worldwide will augment the growth of vacuum trucks drastically over the projected period. With an increasing population, the demand for specific equipment to manage waste, sewerage, and rubble is growing along with the expansion of cities and the construction of infrastructure, especially in developing areas. The United Nations has predicted that 55 percent of the world population will live in urban areas in 2018 and that this figure will rise to 68 percent in 2050. Urbanization is mainly associated with both hazardous and non-hazardous waste due to the increased generation of waste, hence this increase poses landscaping challenges for the municipality to address.

Furthermore, vacuum trucks also play an important role in keeping hygienic operations running at construction sites, infrastructure projects as well as within urban centers. The pace of urbanization is diverse across geographies, for instance, in India, the Smart Cities Mission, which has projects worth more than USD 20 billion in the pipeline has increased demand for reliable waste and sludge management solutions. In these cities, vacuum trucks are used to keep silted sewers clean and to remove industrial effluent, helping to maintain public health and safety and preserving the environment. At the same time, advanced economies are renewing their aging infrastructure, special upgrading sewer systems which requires removing debris and sludge with vacuum trucks. Many cities in the U.S., for example, are implementing extensive infrastructure renewal programs, spurring a greater need for vacuum trucks to remove debris in a safe, effective way. This increase in urban and infrastructural projects is one of the most prominent reasons that will drive the growth of the vacuum truck market over the forecast period.

Restraints

-

The significant initial investment required for purchasing advanced vacuum trucks limits adoption, especially for small to mid-sized businesses.

-

Operating vacuum trucks requires skilled personnel, but a shortage of trained operators is challenging market growth. The high skill demand increases training expenses for companies, adding an extra layer of operational costs.

High initial and recurring costs are one of the major obstacles for the vacuum truck market. These awesome machines are equipped with high-powered suction, a tank, and special features that allow them to handle both hazardous and non-hazardous materials like a true professional. Vacuum truck capital cost is the major restriction, especially in the case of small and medium-sized enterprises that have a low capital base. Furthermore, these trucks have to be maintained regularly to keep them operationally sound and safe, which increases ownership costs. Parts such as pumps, hoses, and filtration systems all experience the wear and tear of the daily grind and many times in tough environments like construction and waste management need to be repaired and replaced often. The negative impact of such high ownership costs is that some companies find it difficult to purchase new or additional vacuum trucks which can ultimately slow the overall market adoption rate and growth.

Vacuum Truck Market Segmentation Overview

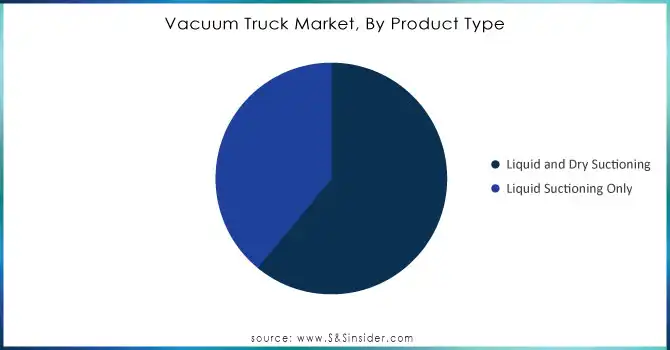

By Product Type

In 2023, the liquid & dry suctioning segment dominated the vacuum truck market with a 62% market share. This dominance is primarily credited to the ability of those trucks to manage various forms of waste, which is a stipulation from most governments. As per the latest statistics from the U.S. Department of Transportation (DOT), almost 70% of industrial waste removal projects require one that can process both liquid and dry waste streams, which in turn is boosting the demand for liquid & dry suction trucks. Moreover, since many industrial processes are being subjected to environmental audits at both national and international levels, and growing need for the equipment necessary for integrated management of mixed waste has surged. Liquid & dry suctioning vacuum trucks operate operational flexibility with the ability to service sectors varying from petrochemical facilities to municipal waste plants, securing their status as one of the leading choices in the industry.

Need Any Customization Research On Vacuum Truck Market - Inquiry Now

By Application

In 2023, the highest share (59%) of the vacuum truck market was held by the industrial application segment. This is due to the constant cleaning and waste removal required from the oil and gas, petrochemicals, and construction industry as stringent cleaning protocols are vital for safety in that sector. According to government data provided by the Bureau of Labor Statistics (BLS), industrial clean-ups performed in the oil and gas industry by year have increased 12% in the past two years due to the use of vacuum trucks to empty and process hazardous materials. The increasing number of industrial facilities complying with rigorously defined Environmental, Health, and Safety (EHS) standards also drives the need for industrial-grade vacuum trucks. These trucks provide the significant power and capacity needed to process heavy-duty waste efficiently, which has reinforced their market presence among various key industrial sectors.

By Fuel Type

Internal combustion engine (ICE) vacuum trucks held the largest share of 71% of the vacuum truck market in 2023. While electric vehicles (EVs) are garnering a greater focus on the larger global automotive stage, ICE models are still the mainstay in terms of range and reliability, particularly in heavy-duty and remote applications where the EV charging infrastructure is often lacking. ICE vehicles made up more than 80% of heavy-duty applications, as compelling in construction as industrial waste hauling, reported the U.S. Department of Energy in a 2023 report. The strong power performance of ICE trucks renders them an ideal match for high-demand operations in high-utilization industries, as these trucks require continuous operational time across several hours of each working day to maintain their top-ranking position in the vacuum truck market.

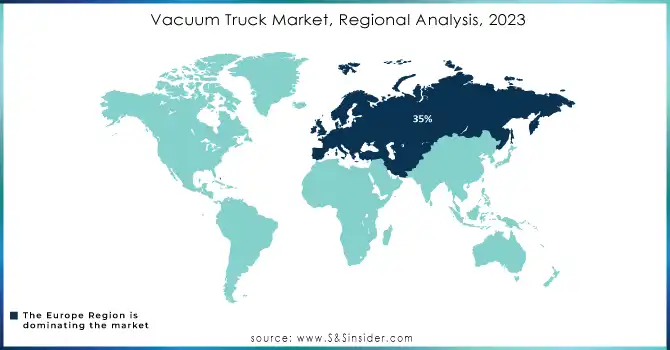

Vacuum Truck Market Regional Analysis

Europe held the leading position with a 35% share. This growth is due to the strict environmental regulations and advanced waste disposal infrastructure in the region. The European countries have a very strong foundation regarding waste disposal and waste disposal safety, however, the framework for environmental preservation is well operational in the foremost countries in Europe such as Germany, France, and, the UK, which creates a sizeable demand for vacuum truck suppliers in the region. Better waste management and pollution control regulations imposed by the European Union force many industries to implement effective waste collection and treatment solutions, which will support vacuum truck market growth. Additionally, Europe’s focus on technological advancements in waste management equipment and increasing investments in urban sanitation systems have further solidified its market dominance.

On the contrary, the vacuum truck market is expected to grow fastest in Asia-Pacific over the forecast period. This growth is driven by rapid urbanization, expanding industrial sectors, and enhanced awareness around environmental protection. Moreover, robust regulations and government investments in infrastructure development in emerging nations such as China and India are expected to drive the demand for vacuum trucks in waste management. The expanding oil and gas and construction sectors in Asia-Pacific are focusing on modern waste-handling solutions owing to stringent environmental regulations contributing to the potential growth of the market. The high CAGR of the Asia-Pacific can be attributed to the increasing emphasis on sustainability in the region, coupled with the need for enhanced municipal and industrial waste management.

Key Players in Vacuum Truck Market

Key Service Providers/Manufacturers:

-

Federal Signal Corporation (Elgin Crosswind, Guzzler CL)

-

Vac-Con, Inc. (X-Cavator, Titan Hydro Excavator)

-

KOKS Group B.V. (MegaVac, EcoVac)

-

Sewer Equipment Co. of America (RamJet, Model 747)

-

GapVax, Inc. (HV Series, MC Series)

-

Super Products LLC (Mud Dog, Camel Maxx)

-

Keith Huber Corporation (Titan, Huber Hammerhead)

-

Vactor Manufacturing, Inc. (Vactor 2100i, Paradigm)

-

Hi-Vac Corporation (Aquatech B-10, X-Vac XR)

-

Ledwell & Son Enterprises, Inc. (Ledwell Hydrovac, Ledwell Vacuum Trucks)

Key Users of Vacuum Truck Services and Products

-

Veolia North America

-

Waste Management, Inc.

-

Clean Harbors, Inc.

-

Fluor Corporation

-

Bechtel Corporation

-

Skanska USA

-

Republic Services, Inc.

-

BASF Corporation

-

ExxonMobil Corporation

-

Shell Oil Company

Recent Developments

-

Vac-Con showcased its non-CDL Titan 3-yard combination sewer cleaning truck, which offers a manageable and user-friendly cleaning solution for the needs of small municipalities and contractors, at the WWETT Show in Indianapolis, in February 2023.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 2.0 Billion |

| Market Size by 2032 | USD 3.7 Billion |

| CAGR | CAGR of 7.1% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type (Liquid and Dry Suctioning, Liquid Suctioning Only) • By Fuel Type (Electric, ICE) • By Application (Industrial, Excavation, Municipal, General cleaning, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Federal Signal Corporation, Vac-Con, Inc., KOKS Group B.V., Sewer Equipment Co. of America, GapVax, Inc., Super Products LLC, Keith Huber Corporation, Vactor Manufacturing, Inc., Hi-Vac Corporation, Ledwell & Son Enterprises, Inc. |

| Key Drivers | • Rapid urbanization and infrastructural expansion worldwide are driving demand for vacuum trucks for efficient waste management. Increasing investments in construction and municipal projects require reliable vacuum trucks for debris and hazardous waste removal. • Governmental regulations promoting sustainable waste management are pushing industries to adopt vacuum trucks for safe hazardous waste handling. The increased focus on environmental compliance has led to a rise in vacuum truck usage across sectors such as oil & gas, mining, and construction. |

| Restraints | • The significant initial investment required for purchasing advanced vacuum trucks limits adoption, especially for small to mid-sized businesses. |