Vertiports Market Report Scope & Overview:

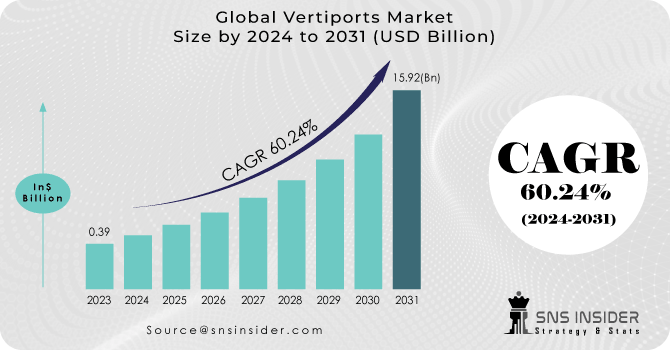

The Vertiports Market Size was valued at USD 0.4 billion in 2023, and is expected to reach USD 27.2 billion by 2032, and grow at a CAGR of 60.2% over the forecast period 2024-2032.

The concept of urban air mobility has gained significant attention due to the increasing congestion in urban areas, the need for efficient transportation solutions, and advancements in electric aviation technology. VTOL vehicles promise to provide faster, more convenient, and less congested transportation options, especially for short to medium distances within urban environments. Vertiports play a crucial role in making this vision a reality by providing the necessary infrastructure.

To get more information on Vertiports Market - Request Free Sample Report

A vertiport is simply a landing and take-off infrastructure for VTOL aircraft such as air taxis, freight aerial vehicles, passenger aerial vehicles, and air ambulances. The name vertiport is formed from the terms vertical & airport, and it refers to a specified area constructed expressly to handle the unique demands of VTOL aircraft. Sustainability is a primary priority in the UAM business, with electric propulsion and the usage of renewable energy sources being prioritised to reduce environmental effects. Collaboration and partnerships are being developed between firms and organisations in the UAM sector to advance technology and bring goods to market.

The idea behind vertiports is to construct dedicated spaces in urban areas where VTOL (vertical take-off & landing aircraft) vehicles may safely take off and land. They are intended to facilitate the integration of air taxis and eVTOLs into existing transportation networks, allowing urban commuters to transfer smoothly from ground-based transportation to air travel. The next generation of VTOLs will need specialised transportation hubs that are linked to traditional forms of transit like trains, buses, and existing airports.

A slew of firms across the world, many of which are backed by major airlines, are competing to be the first to build an eVTOL (electrical vertical take-off & landing) vehicle suitable for passenger flights. Flying taxi services might be available as early as 2024 or 2025 when the first eVTOLs are planned to be certified safe for operation. Looking ahead to the future of urban transit, it is clear that the design and development of vertiports will be crucial in the construction of tomorrow's cities. Finally, the development of vertiports represents a significant stride forward in the evolution of urban mobility.

MARKET DYNAMICS

DRIVERS:

-

The development of electric propulsion systems has opened up new possibilities for vertical takeoff and landing (VTOL) vehicles.

-

Urban Congestion and Traffic Woes is the driver of the Vertiports Market.

Increasing urbanization has led to severe traffic congestion in many cities, causing significant time wastage and environmental pollution. Vertiports and urban air mobility (UAM) solutions offered a potential way to alleviate congestion by providing an additional mode of transportation for short to medium distances.

RESTRAIN:

-

Building vertiports and the associated infrastructure requires substantial investments.

-

Regulatory Hurdles are the restraint of the Vertiports Market.

Integrating urban air mobility (UAM) vehicles into existing airspace and establishing safety regulations for VTOL operations posed a significant challenge. Regulators are needed to ensure the safety of these vehicles in densely populated urban environments.

OPPORTUNITY:

-

The vertiports market drives innovation in various technologies, including electric propulsion systems.

-

Urban Air Mobility (UAM) Ecosystem Development is an opportunity for the Vertiports Market.

Vertiports are a critical component of the UAM ecosystem, which aims to revolutionize urban transportation. Creating a network of vertiports could enable efficient and seamless point-to-point travel within urban areas.

CHALLENGES:

-

Designing, building, and maintaining vertiport infrastructure required substantial investment and careful planning.

-

Regulatory and Legal Hurdles are the challenges of the Vertiports Market.

Integrating urban air mobility (UAM) vehicles and vertiports into existing airspace regulations presented a complex challenge. Establishing safety standards, and air traffic management protocols, and securing necessary regulatory approvals were critical but intricate tasks.

IMPACT OF RUSSIAN UKRAINE WAR

Prices for a variety of goods, and food, including fertilisers, oil and gas, rose as a result of the Russia-Ukraine conflict. Supply chain interruptions have raised freight rates, caused container shortages, and reduced warehouse space available. Several ports have been shuttered, and orders are being rescinded due to cargo delays and congestion. The Russia-Ukraine war has had a wide-ranging impact on the global logistics business. When the Russia-Ukraine war began to damage the sector, the impacts of the epidemic on storage capacity and container availability had only recently begun to fade. The conflict slowed the movement of products, fuelled price hikes and product shortages, and caused global food shortages. Natural gas prices in Europe have risen by roughly 120-130% in the six months since the start of the war, while coal prices have risen by 95-97% during the same period. Since the assault, the prices of soybeans, maize and crude oil, of which Russia is the top producer, have risen. In this Russian-Ukraine war, the Vertiports Market is increasing their product & services prices up to 4.21-5.10%.

IMPACT OF ONGOING RECESSION

The summer of 2022 has been distinguished by a revival in travel for the travel and hospitality sector. However, a continued travel rebound until 2023 may not go as planned. Everyone has grown aware of the recent impact of inflation. However, experts believe that a rare condition known as stagflation is on the horizon. However, the travel industry does not need to be concerned just yet because inflation has not hindered tourism. In fact, despite cost rises of up to 42%, customers are returning to foreign summer holidays in addition to completing local flights. Unfortunately, there are growing fears that demand may drop, with some economists and financial experts anticipating a recession as early as 2023. There is also rising concern that a recession, defined as two or more quarters of negative GDP growth, may occur. This result, together with inflation, would produce a stagflation climate in the United States. In this recession the Vertiports Market grain profit up to 2.2-3.12%.

KEY MARKET SEGMENTATION

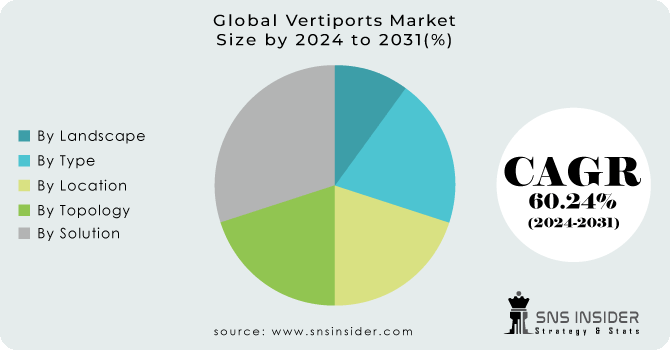

By Type

-

Vertibases

-

Vertihubs

-

Vertipads

By Solution

-

Terminal Gates

-

Landing Pads

-

Charging Stations

-

Ground Control Stations

-

Others

By Location

-

Ground-based

-

Floating

-

Rooftop / Elevated

By Landscape

-

Regional Vertiports

-

Urban Vertiports

By Topology

-

Single

-

Satellite

-

Linear

-

Pier

Need any customization research on Vertiports Market - Enquiry Now

REGIONAL COVERAGE:

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

REGIONAL ANALYSIS

North America: North America is expected to have the highest CAGR throughout the anticipated timeframe. The increased demand for sophisticated air mobility solutions, driven by traffic congestion and the necessity for speedier transit choices, is expected to drive market expansion in this area. Improvements in electric vertical takeoff and landing (VTOL) technology have facilitated the development of vertiport infrastructure, making it more financially and ecologically viable. The growth of vertiports in North America is also aided by favourable legal frameworks and public and private sector investments.

Asia Pacific: Vertiport is finding a profitable market in Asia Pacific, with Japan becoming as the world's biggest provider of this medicine. Vertiport manufacturing in India is also rising rapidly, benefiting the Asia Pacific Vertiport market. Leading manufacturers are aggressively expanding their activities in this region, which is projected to increase its worldwide market significance.

Key Players

The Major Players are Altaport Inc., Aeroauto, Anra Technologies, Siemens, Airbus, Sita, Bayards Vertiports, Skyports Infrastructure Limited, Ferrovial, Volocopter GmBH, Lilium Aviation GmBH, Skyways, Urban V S.P.A, Skyscape Inc., Skyportz and Other Players

Altaport Inc-Company Financial Analysis

RECENT DEVELOPMENT

In 2023: Groupe ADP has inked an agreement with AutoFlight to test Prosperity 1 VTOL flights at Pontoise Airport during the Paris Olympic Games 2024. Groupe ADP is driving the development of VTOL infrastructure in the Paris Region with five new vertiports.

In 2023: Urban S.p.A. and Lilium collaborated to enhance infrastructure for Advanced Air Mobility (AAM). The companies' collaboration to build vertiport infrastructure would enable VTOL networks for Lilium aircraft and clients, with an initial focus on Italy and the French Riviera, where Urban would begin operations, and the prospect of expanding into other regions.

In 2023: Lilium and Urban S.p.A have collaborated to enhance infrastructure for Advanced Air Mobility (AAM). The companies' collaboration to build vertiport infrastructure would enable VTOL networks for Lilium aircraft and clients, with an initial focus on Italy and the French Riviera, where Urban would begin operations, and the prospect of expanding into other regions.

| Report Attributes | Details |

| Market Size in 2023 | US$ 0.4 Bn |

| Market Size by 2031 | US$ 27.2 Bn |

| CAGR | CAGR of 60.2% From 2024 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Vertibases, Vertihubs, Vertipads) • By Solution (Terminal Gates, Landing Pads, Charging Stations, Ground Control Stations, Ground Support Equipment, Others) • By Location (Ground-based, Floating, Rooftop / Elevated) • By Landscape (Regional Vertiports, Urban Vertiports) • By Topology (Single, Satellite, Linear, Pier) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Altaport Inc., Aeroauto, Anra Technologies, Siemens, Airbus, Sita, Bayards Vertiports, Skyports Infrastructure Limited, Ferrovial, Volocopter GmBH, Lilium Aviation GmBH, Skyways, Urban V S.P.A, Skyscape Inc., Skyportz |

| Key Drivers | • The development of electric propulsion systems has opened up new possibilities for vertical takeoff and landing (VTOL) vehicles. • Urban Congestion and Traffic Woes is the driver of the Vertiports Market. |

| Market Restraints | • Building vertiports and the associated infrastructure requires substantial investments. • Regulatory Hurdles are the restraint of the Vertiports Market. |