Microtome Market Size Overview

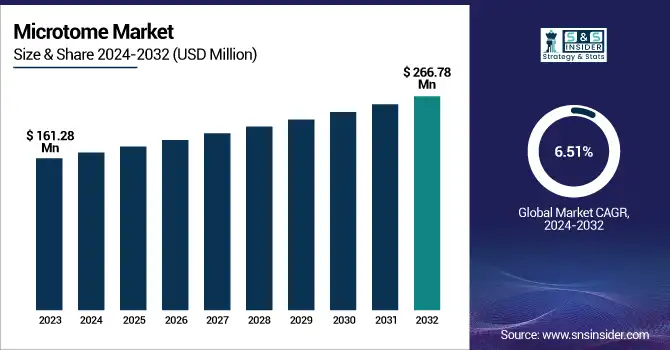

The Microtome Market size was valued at USD 161.28 million in 2024 and is expected to reach USD 266.78 million by 2032, growing at a CAGR of 6.51% over the forecast period of 2025-2032.

The microtome market is experiencing a significant demand owing to the rise in the need for precision diagnosis in histopathology and oncology. The increasing prevalence of cancer has drastically increased the demand for precise tissue sampling and processing, which in turn is projected to generate demand for advanced microtomes. Unprecedented R&D investments by key institutions and companies, including Leica Biosystems and Sakura Finetek, for the development of semi-automatic to fully automatic microtomes have played a significant role in driving technological progress. Increasing use of cryostats in microtomes in intraoperative diagnostics, and increased financial incentives for cancer research and tissue engineering, are also responsible for the market growth.

To Get More Information on Microtome Market - Request Sample Report

A 2024 Phys.org paper introduces a new genome sequence, revealing the work of high-resolution microtomy and the role of microtomes in new genetic applications. These developments highlight the transition of the microtome market through high-end applications.

For instance, the American Cancer Society acknowledges that tissue preparation is key for early detection and highlights the importance of microtomes. It is these strict specimen handling and pathology guidelines from regulatory organisations such as CAP and SEER that have encouraged the adoption of high precision sectioning tools. Rising supply chain expansion, particularly by Fisher Scientific, is providing greater access to products, supporting a greater microtome market share. Moreover, increasing penetration in biotech and academic labs, supported by developments in life science research, is further contributing to product demand. There is also rising patent activity in advanced microtome blades and safety devices on display, indicating a high degree of investment by the industry.

For instance, Singapore scientists discovered something I believe is very important – how to maintain live cancer tumor cultures so that they can be daintily sliced up with microtomes and tested later on with chemicals.

Microtome Market Dynamics

Drivers:

-

Technological Innovation, Rising Healthcare Demand, and Institutional Support Propel the Market Expansion

High incidence of health issues, technological advancements, and growing investments in life sciences are the major factors driving the growth of the microtome market. From a high-level, a driving force is the increasing global burden of chronic diseases, especially cancer, and the need for precision tissue diagnostics. Cancer caused almost 10 million deaths in 2020, the World Health Organization says, pushing pathology labs to invest in high-precision equipment, such as rotary and cryostat microtomes. Innovation is another significant factor, with the likes of Thermo Fisher Scientific and Medite GmbH investing heavily in automation and blade safety developments.

The global increase in R&D investment up to USD 220B in biomedicine by 2023 has led to increasingly complex histological analyses, driving demand. Furthermore, the general rules for histopathology developed by the College of American Pathologists (CAP) and the National Cancer Institute’s SEER Program recommend the application of approved and controlled microtomy devices. On the supply side, a growing number of academic research projects, public–private partnerships, and an increase in diagnostic laboratories’ procurement all beget robustness. Ease of access and global distribution are further facilitated by the availability of microtome accessories on cost-effective e-commerce sites, e.g., VWR, Thomas Scientific. Together, these forces are sculpting a robust and innovative landscape for increasing microtome market share in the pathology and life sciences sectors.

Restraints:

-

Cost Sensitivity, Training Gaps, and Safety Concerns are Major Limitations And Barriers Affecting The Microtome Market

The expensive purchase price and maintenance, especially for automated and cryostat microtomes, can discourage usage in smaller labs and healthcare facilities. The cost of a complete, fully automated microtome system can be as high as USD 15,000 to USD 25,000, which represents a limitation for low-budget departments. Furthermore, the availability of trained personnel restricts the broad adoption of handling and sectioning are demanding histology tasks, and how they are managed can easily harm the sample or the blade. A risk of injury with exposed microtome blades is noted in the Cornell University Biosafety Manual, illustrating the risks present when not used according to strict guidelines.

In addition, strict regulations such as biosafety certificates or environmental standards for cryostat use can be cumbersome to fulfill. Low selling awareness in the underdeveloped nations about the advanced microtomy equipment further hinders market growth. In addition, a piecemeal supplier base can result in variable levels of aftersales support and part availability, particularly in non-OECD markets. These are the operational and systemic problems that together may partially stifle the penetration of the microtomes market in some areas and slow down the adoption curve of the technology despite its diagnostic worth.

Microtome Market Segmentation Analysis

By Product

Microtomes were the largest type of product in the market in 2024, because they are a key tool used in histopathology and biomedical research. These instruments are commonly used in diagnostic labs, academic settings, and pharmaceutical R&D to create thin, even slices of tissue for microscopy. Rotary and cryostat microtomes are known from the art because of their reliability, accuracy, and versatility, and scope of applications as standard instruments in numerous medical and research institutions, which has enabled these lines to remain well-established in the market.

On the other hand, accessory-type accessories are expected to be the fastest-growing segment during the forecast period. Growing volumes of work in clinical laboratories, together with the ongoing focus on safety and efficiency, are driving the demand for high-precision disposable blades, specimen holders, blade guards, and lubricants. With the increasing requirements for fast response time and cross-contamination prevention, demand for high-quality accessories remains robust.

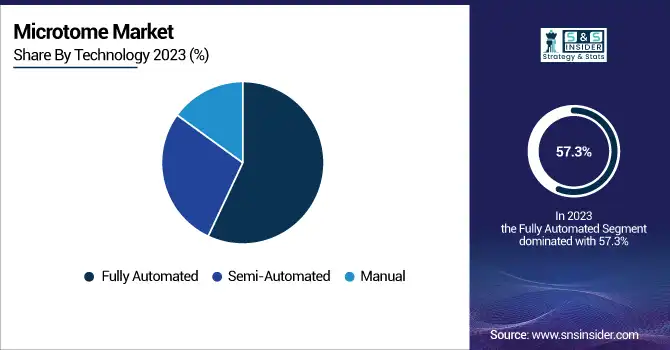

By Technology

Fully automated microtomes were the largest product segment in 2024, accounting for a share of 57.3 % in terms of revenue as a result of their consistently high-throughput sectioning and minimum need for operator involvement. They are becoming more widely adopted in high-throughput diagnostic environments where standardization and swiftness are of paramount importance. Their interoperability with digital images and the smart histology workflow they are a part of has also helped bring them to dominate this market.

The semi-automated segment is projected to witness the fastest growth over the forecast period. Overall, these systems offer a compromise between manual labour and full automation and represent an economical choice for medium-sized laboratories. There is increasing demand for semi-automated microtomes as organizations under budgetary constraints consider replacing manual systems but do not wish to commit to an extremely high-end automated system.

Microtome Market Regional Insights

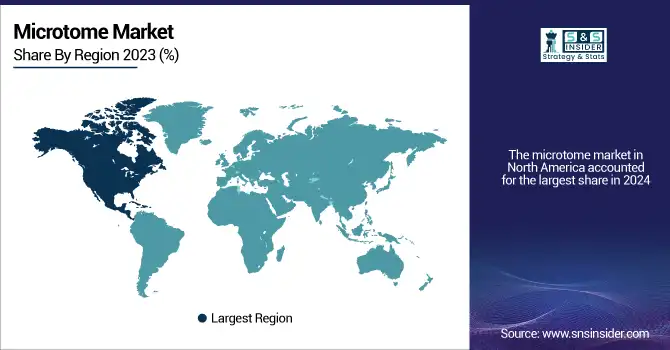

The microtome market in North America accounted for the largest share in 2024, primarily due to the well-established healthcare system, high volume of diagnostic procedures, and increasing investments in pathology automation. The U.S. microtome market size was valued at USD 58.49 million in 2024 and is expected to reach USD 89.05 million by 2032, growing at a CAGR of 5.45% over the forecast period of 2025-2032. The US is the largest country in the region, owing to its high number of clinical laboratories and the presence of major players such as Thermo Fisher Scientific and Leica Biosystems, as well as high usage of fully automated microtomes in hospitals and research institutes. The CDC calculates that nearly 14,073,000,000 lab tests are conducted in the U.S. each year, many of which are related to histopathology procedures. And in Canada, adoptions are increasing as well, as cancer is also on the rise here, and the government is modernizing healthcare by pushing for the use of technology. Mexico is slowly developing its diagnostic infrastructure, and this has facilitated the availability of microtomy tools. EMEA benefits robust regulatory backing and advanced training programmes, which help to keep the market expanding.

The European market is the second largest market and is a growing market because of strong diagnostics standards, key pathology networks, and early adoption of advanced histology technologies. Germany holds the largest share in the European microtome market owing to its well-established base for biomedical research and the presence of Leica Biosystems and SLEE medical GmbH in the region. Market growth is also aided by high levels of automation adoption and innovation in digital histopathology made by German pathology laboratories. France and the UK are also major contributors, with greater emphasis on cancer screening campaigns and personalised medicine. The growth is also driven by strong E U regulations for the monitoring process of high-quality laboratory tests, as well as investment in modernizing diagnostic laboratories in countries such as Poland and Italy. Spain and Turkey have observed an increase in healthcare reforms that encourage better pathology services, thereby stimulating local demand for microtomes.

Asia Pacific is the fastest-growing market for microtomes, driven mainly by the burgeoning healthcare industry, increasing burden of cancer, and investments in clinical diagnostics and life sciences research. China leads the market in the region as a result of a gigantic investment in pathology infrastructure, government-supported research at the local level, and histopathology instruments that are now locally manufactured. China’s National Health Commission announced in 2023 that the country had conducted more than 3.3 billion tests in that year, driving the need for tissue sectioning instruments. India has emerged as a significant force with its growing diagnostic lab network and public-private partnerships for cancer diagnostics being one of the focus areas. So, Japan and South Korea are not easing investments in research automation and the upgrade of the healthcare market by medical technology.

Get Customized Report as per Your Business Requirement - Enquiry Now

Major Companies in the Microtome Market Include

Leading microtome companies operating in the market comprise Diapath S.P.A., Leica Biosystems Nussloch GmbH, Sakura Finetek Europe B.V., MEDITE GmbH, SLEE medical GmbH, Boeckeler Instruments, Nanolytik, S.M. Scientific Instruments Pvt. Ltd., AGD Biomedicals, Alltion, Amos Scientific Pvt. Ltd., and Thermo Fisher Scientific.

Recent Developments:

In August 2024, StatLab Medical Products, a prominent global developer and manufacturer of medical diagnostic supplies and equipment, announced its agreement to acquire Diapath S.p.A., a leading Italian manufacturer of histology and cytology products.

In March 2023, Roche announced a collaboration with Eli Lilly and Company to support the development of companion diagnostics, including advanced solutions like the Elecsys microtome platform, aimed at improving precision medicine in oncology. This partnership highlights a significant step toward enhancing diagnostic accuracy and personalized treatment strategies.

| Report Attributes | Details |

| Market Size in 2024 | USD 161.28 million |

| Market Size by 2032 | USD 266.78 million |

| CAGR | CAGR of 6.51% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Microtome devices (Rotary microtome, Vibrating microtome, Other microtome), Accessories) • By Technology (Fully automated, Semi-automated, Manual) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Diapath S.P.A., Leica Biosystems Nussloch GmbH, Sakura Finetek Europe B.V., MEDITE GmbH, SLEE medical GmbH, Boeckeler Instruments, Nanolytik, S.M. Scientific Instruments Pvt. Ltd., AGD Biomedicals, Alltion, Amos Scientific Pvt. Ltd., and Thermo Fisher Scientific. |