Waste Sorting Equipment Market Report Scope & Overview:

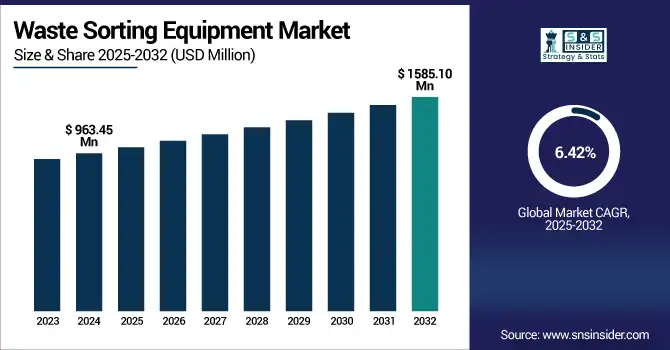

The Waste Sorting Equipment Market size was valued at USD 963.45 million in 2024 and is expected to reach USD 1585.10 million by 2032, growing at a CAGR of 6.42% over the forecast period of 2025-2032.

To Get more information on Waste Sorting Equipment Market - Request Free Sample Report

The growth of the Waste Sorting Equipment Market is being propelled due to increasing global focus on sustainable waste management practices, along with the introduction of strict environmental regulations. These variations of waste sorting equipment are vital to improving the efficiency of recycling processes by sorting materials, including plastics, metals, paper, and organic waste. Escalating urbanization, industrialization, and rising municipal solid waste generation are driving the demand for advanced sorting technologies for waste. Automation, AI, sensor-based systems, and robotic sorting solutions development and upgradation serve as a key Waste Sorting Equipment Market Trend, increasing accuracy and lowering operational costs.

Moreover, stringent government regulations contribute positively to the growth of the market, and rising investments in smart city projects and circular economy initiatives are expected to boost the market growth during the forecast period. With the growing need for effective material recovery and resource optimization, the Waste Sorting Equipment Industry is also closely associated with the Recycling Equipment Market and Waste Management Equipment Market. This, in turn, is driving the Waste Sorting Equipment Market Growth as the private players are involved, along with the governments, to upgrade the waste infrastructure. Driven by sustainability, innovation, and regulatory compliance, the market is continuing on its growth path and is anticipated to present numerous opportunities for innovations and scalability in both developed as well as emerging economies.

In May 2025, Vogue Business reported that the U.K. is taking major steps toward becoming a global leader in circular textiles. Project Reclaim, the nation’s first large-scale polyester recycling plant, processes 2,500 tonnes annually and aims to double capacity. The Circular Fashion Innovation Network is rolling out a nationwide plan for automated sorting and chemical recycling. However, challenges remain, including weak infrastructure, slow legislation, and the urgent need for Extended Producer Responsibility (EPR) policies.

Waste Sorting Equipment Market Dynamics:

Drivers:

-

Urbanization and Rising Waste Volumes Propel Demand for Advanced Waste Sorting Equipment

The increasing volume of waste generation and rapid urbanization are the major factors contributing to the overall growth of the global advanced waste sorting equipment market. With increasing population and growing industrial establishments, the tonnage of municipal solid waste and industrial by-products is ever-increasing. This poses a serious challenge for urban centers, which are under growing pressure to handle larger masses of waste efficiently. Consequently, this has heightened the demand for automated sorting systems that can process massive volumes of commingled waste faster and accurately. They make it easier to recycle, keep tons of waste out of landfills, and recover valuable materials from the waste stream. The rising urban infrastructure upgrade, wise city implementations, are also fueling the high-tech sorting solutions to capitalize on recycling targets and regulatory compliance.

Restraints:

-

High Costs and Rapid Tech Evolution Limit Adoption of Automated Waste Sorting Equipment

Capital and operational expenditure for waste-sorting equipment is high, and this is a major challenge in the waste sorting equipment space. These advanced machines with artificial intelligence, robotics, and sensor-based technologies (optical or NIR sorters) can require significant investment to install. Implementing these systems can be too expensive for smaller and mid-sized operators and developing nations. Besides high purchasing costs, ongoing costs, including equipment service/maintenance, software updates, calibration, and operator training, all cause a long-term financial burden. In addition, the speed at which technology is advancing means shorter product life cycles and, as such, a need for frequent upgrades or replacements. Even given their long-term practical and environmental gains, the high upfront investment of capital, quarters, and human labor can prolong adoption and impede the scalability of automated waste segregation solutions.

Waste Sorting Equipment Market Segmentation Analysis:

By Waste Type

The plastic waste segment dominated the market and accounted for 36% of the Waste Sorting Equipment Market share. This is driven by the immense global pressure to tackle plastic pollution, especially single-use plastics. Governments and regulators are clamoring for improved plastic separation to facilitate circular economy models and are incentivizing capital expenditure on plastic sorting technology. Increasing consumer awareness and demand for cleaner recycling streams have also begun to push MRFs (Material Recovery Facilities) to utilize specialized optical sensors and near-infrared systems to identify and sort plastic types. In addition to that, potential recyclability and high economic value also play a significant role in the high volume of plastics over other materials in the sorting operation globally.

Organic waste is the fastest-growing segment in the waste sorting equipment market due to increasing awareness of composting and food waste management. As food waste comprises a significant share of global municipal waste, governments are launching programmes to divert organic materials from both landfills and incinerators. These initiatives are creating a need for equipment that is capable of sorting organic material for composting or anaerobic digestion quickly and effectively. In addition, growth in this segment is being fueled by increased investment in processing facilities for organic waste, driven by the growing role of sustainable agriculture and bioenergy.

By Operation Mode

Automatic waste sorting equipment held a dominant share of 62% in 2024, largely due to its high processing efficiency and minimal human intervention. They employ cutting-edge technology, such as AI, sensors, and conveyor automation, to rapidly and accurately sort through large amounts of waste. Particularly for cities where waste levels are high, they are all the more important. Automatic systems are increasingly seen as the answer to this problem, partly because of rising labor costs and partly due to rising health concerns related to handling human waste. The ability to provide consistently high-quality sorted materials increases uptake from public and private waste management facilities.

The semi-automatic operation mode is witnessing the fastest growth owing to its cost-effectiveness and flexibility for small and mid-scale operations. Although a fully automatic one requires large capital, semi-automatic machines provide a better compromise, where the machine automates a part of the process, but human also performs sorting tasks. This is well known, but very interesting in developing areas and small municipalities with lower budgets and rising needs for higher efficiency. Moreover, with governments encouraging basic mechanization to promote better waste management, semi-automatic equipment is also growing rapidly.

By Technology

With a 45% share in 2024, sensor-based sorting led the technology segment of the market. They are very successful with optical sensors, NIR (Near Infrared), X-ray, or hyperspectral, and are geared to detection and classification applications in product separation applications. This accuracy improves material purity, which is critical for recycling usages. In MRFs, sensor-based systems are preferred for their speed, precision, and ability to work across different types of waste, including plastic, paper, glass, and metals. Automation and scalability of smart waste management systems make them a crucial part of modern waste management strategy.

Robotic sorting is the fastest-growing technological segment due to its superior accuracy, speed, and labor-saving capabilities. With the latest AI and machine vision tools, robotic arms are capable of accurately identifying and sorting materials. It also provides real-time adjustment to changes in the waste stream, a vital characteristic in variable municipal and industrial environments. With safety and worker shortage issues not likely to change anytime soon, especially in harmful waste processing, robotics provides an effective long-term answer. Continuous advancements in robotics and AI are making robotic sorting a viable option for modern waste management with decreasing price categories.

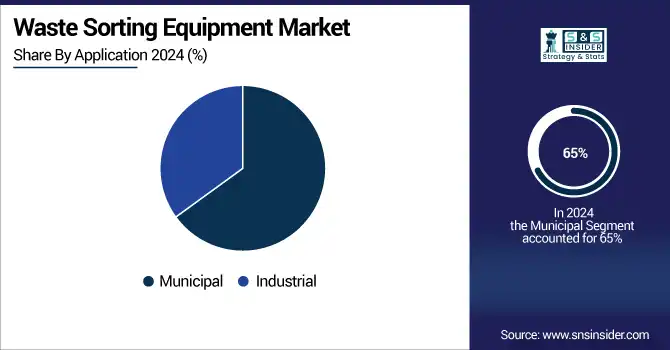

By Application

The municipal segment accounted for a dominant 65% share in 2024, owing to the rising waste volumes produced by households, commercial establishments, and public infrastructure in urbanized areas. Local municipalities are spending a lot of money on sort infrastructure as a prerequisite for sustainability mandates, landfill diversion targets, and recycling goals. Municipal waste comes in a variety of different materials, which means robust and high-capacity sorting systems are needed. The boom in municipal recycling activities, especially in the developed world, is another important driver boosting demand for advanced waste sorting technologies.

The industrial waste sorting segment is expanding rapidly due to the growing emphasis on sustainable manufacturing and waste minimization practices across industries. Due to the high variety of commonly used industrial metals, packaging, plastics, and other materials, large volumes of heterogeneous but valuable waste streams are produced that need sorting for recycling or re-use. Amidst stringent environmental regulations and ever-increasing prices of raw materials, industries are turning to on-site waste sorting solutions to improve resource recovery and cut down on disposal costs. Moreover, benefits associated with the implementation of efficient waste management systems, coupled with the growing adoption of ESG policies, are driving the growth of the segment.

Waste Sorting Equipment Market Regional Outlook:

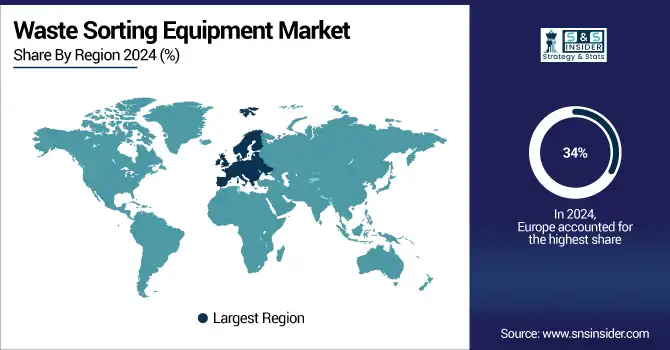

Europe led the waste sorting equipment market in 2024, accounting for 34% of the global share. The region’s dominance is driven by strict environmental regulations, strong circular economy initiatives, and widespread adoption of automated sorting systems. Countries including Germany, the Netherlands, and Sweden have advanced waste management infrastructures and high recycling rates, supporting the adoption of smart and efficient equipment. Additionally, the EU's Green Deal and various sustainability goals continue to push investments in modern waste sorting technologies, reinforcing Europe’s position as the market leader.

Germany is the dominant country, owing to its well-established recycling infrastructure, strict environmental regulations, and high waste recovery rates. The country leads in adopting advanced sorting technologies and has strong government and industrial support for circular economy initiatives.

Asia Pacific is projected to be the fastest-growing region in the waste sorting equipment market due to rapid urbanization, industrial growth, and increasing waste generation. Developing countries including India, China, and Southeast Asian nations are witnessing rising environmental awareness and government efforts to reduce landfill dependency. Major investments in smart city projects, recycling infrastructure, and waste-to-energy facilities are fueling demand for advanced sorting technologies. The region's large population base and growing middle class are further accelerating market expansion, positioning Asia Pacific as a key driver for future growth in this sector.

North America holds a significant share of the waste sorting equipment market owing to its mature waste management systems and strong emphasis on sustainability. The U.S. and Canada have established recycling programs and are increasingly adopting automated and sensor-based sorting technologies to enhance efficiency. Investments in circular economy models, along with government incentives for reducing landfill waste and boosting recycling rates, support the continued relevance of this region. While not the fastest growing or the largest, North America remains an important contributor to technological advancements in the market.

In 2024, the U.S. waste sorting equipment market is valued at USD 128.33 million and is projected to reach USD 210.01 million by 2032, growing at a CAGR of 6.35%. Growth is driven by strict recycling regulations, rising adoption of automation, and increasing investment in advanced sorting technologies. The U.S. leads the North American market due to strong infrastructure and corporate sustainability initiatives.

Get Customized Report as per Your Business Requirement - Enquiry Now

Waste Sorting Equipment Companies are:

Steinert GmbH, KK Balers Limited, TOMRA Systems ASA, CP Manufacturing Inc., Bühler Group, REDWAVE, BHS-Sonthofen, Beston (Henan) Machinery Co., Ltd., MSWsorting, and Fazzini Meccanica.

Recent Developments:

In May 2024: At IFAT 2024 in Munich, Steinert unveiled four new sorting systems, including PLASMAX LIBS for aluminum scrap and UniSort Finealyse for bulk plastics, emphasizing its advancement in sensor-based recycling technologies.

In September 2024: Steinert launched its upgraded KSS EVO 6.0 multi-sensor sorting system, now featuring AI-powered detection, easier maintenance access, and enhanced safety measures.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 963.45 Million |

| Market Size by 2032 | USD 1585.10 Million |

| CAGR | CAGR of 6.42% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Waste Type (Plastic Waste, Paper & Cardboard, Metal Waste, Organic Waste, Glass, Others) • By Operation Mode (Automatic, Manual, Semi-Automatic) • By Technology (Sensor-Based Sorting, Magnetic Separation, Mechanical Sorting, Robotic Sorting, Others) • By Application (Municipal, Industrial) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Steinert GmbH, KK Balers Limited, TOMRA Systems ASA, CP Manufacturing Inc, Bühler Group, REDWAVE, BHS-Sonthofen, Beston (Henan) Machinery Co., Ltd., MSWsorting, Fazzini Meccanica |