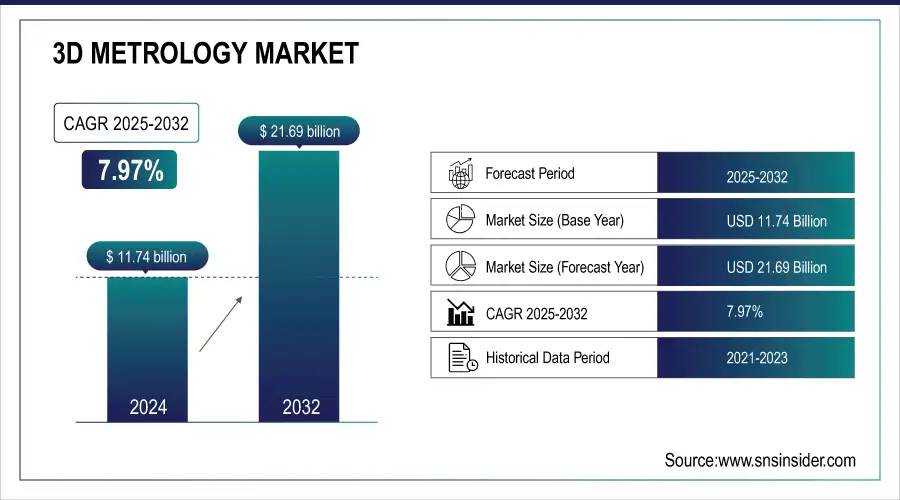

3D Metrology Market Size & Growth:

The 3D Metrology Market Size was valued at USD 11.74 Billion in 2024 and is expected to reach USD 21.69 Billion by 2032 and grow at a CAGR of 7.97% over the forecast period 2025-2032.

The 3D Metrology Market is witnessing robust growth as industries increasingly adopt high-precision measurement technologies for quality control and manufacturing optimization. Rising demand in automotive, aerospace, electronics, and healthcare is accelerating adoption of advanced 3D scanning, CMMs, and optical systems. Innovations in automation, software integration, and real-time inspection are further enhancing accuracy and operational efficiency.

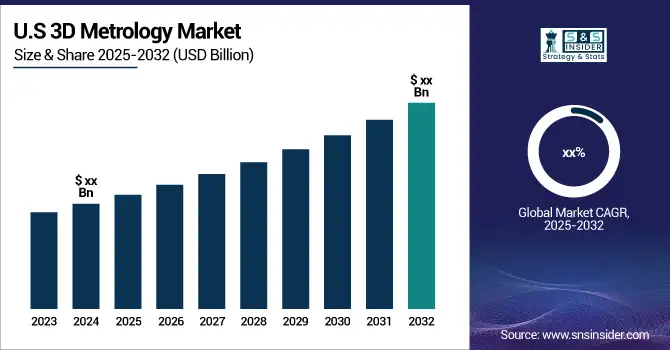

3D Metrology Market Size and Forecast:

-

3D Metrology Market Size in 2024: USD 1.41 Billion

-

3D Metrology Market Size by 2032: USD 2.55 Billion

-

CAGR: 7.68% from 2025 to 2032

-

Base Year: 2024

-

Forecast Period: 2025–2032

-

Historical Data: 2021–2023

Get more information on 3D Metrology Market - Request Sample Report

Key 3D Metrology Market Trends

-

-

Increasing demand for high-precision measurement solutions is accelerating the adoption of 3D scanning, CMMs, and optical metrology across manufacturing industries.

-

Integration of automation and robotic systems is enabling faster, contactless, and fully automated inspection workflows.

-

Rising use of digital twins and simulation tools is boosting the need for accurate 3D measurement data.

-

Growing adoption of inline metrology solutions is improving real-time quality control and reducing production defects.

-

Advancements in AI-driven data processing are enhancing measurement accuracy, analytics, and predictive quality monitoring.

-

Expanding use of portable and handheld 3D devices is increasing flexibility for on-site industrial inspections.

-

3D Metrology Market Growth Drivers

-

Upgrade In 3D Scanning Technologies That Further Improve On Inspection Capabilities.

The intersection of artificial intelligence and machine learning with 3D scanning technologies helps facilitate automated fault detection and predictive maintenance thus further improving on the inspection. This means more industries tend to embrace these advanced technologies in 3D scans to simplify quality control issues, thereby having better results in product quality and operational functionality.

The inspection and quality control process have been hugely influenced by the advancements in the technology of 3D scanning. Developments in high-resolution laser scanners, structured light scanners, and photogrammetry have allowed the acquisition of higher speed data at improved accuracy. It has enhanced the quality of measurements more efficiently and with a greater number of detailed analysis of complicated geometries and intricate parts, critical to industries like aerospace and automotive, for which precision is paramount.

-

Growth in Demand For Accurate Measurement In Manufacturing Companies.

With rapid growth in manufacturing worldwide, the requirement for precision measurement has been increased, making 3D metrology indispensable. The advanced manufacturing sectors, including automotive, aerospace, and electronics, mainly depend on accurate dimensional analysis in ensuring product quality and performance.

The recent trend of miniaturization in electronics, and the aerospace industry demand for lightweight material, also raises the urgency for higher-precision metrology tools. With industries pushing themselves for better standards and higher tolerances, the need for 3D metrology technologies will continue to be adopted because they have to be competitive and meet certain quality standards.

3D Metrology Market Restraints

-

High Initial Investment Costs Limiting Adoption Of 3D Metrology Solutions.

The cost of high-end 3D scanners, software, and training is too high for small and medium-sized enterprises. This is one of the reasons why it cannot be adopted widely because the business may not want to invest a large amount of capital without guaranteed returns. Ongoing expenses on maintenance, upgrade requirements, and personnel skilled are also part of the financial implication.

Companies need to trade off the advantages of greater accuracy and efficiency with upfront as well as recurring costs that might deter investments. Besides these, the rate at which technologies upgrade makes the investment outdate rapidly and encourages companies not to stick in the long run with any kind of metrology solution for a particular time. To overcome this constraint, manufacturers and technology suppliers need to provide more economical options, flexible financing options and scalable technologies that can align themselves with the budgetary constraints of smaller businesses. Affordable accessibility of 3D metrology systems will be more vital for the wider market penetration as well as long-term growth.

3D Metrology Market Segmentation Analysis

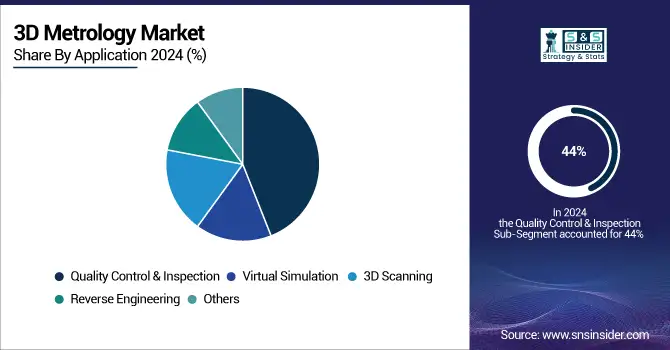

By Application

In 2024, the Quality Control & Inspection segment accounted for an impressive 44% market share-the most critical application in maintaining standards in production and product integrity. This dominance is due to the growing interest of companies in defect detection and process optimization in industries like automotive, aerospace, and electronics. Quality control with precision ensures that products meet specifications. It reduces waste and increases customer satisfaction.

The 3D Scanning segment is also projected to grow with the fastest CAGR of 11.77% in the forecast period 2024-2032. This is because of the increasing adoption of advanced scanning technologies. 3D scanning facilitates in-depth analysis of complex geometries, thus making industries work with greater precision and efficiency. Integration with digital twin technologies and IoT platforms further pushes its growth because real-time monitoring and optimization of the manufacturing process are made possible.

By Offering

In 2024, Hardware segment accounted for the largest market share at 29% because the 3D scanners, coordinate measuring machines (CMMs), and laser trackers are considered highly vital instruments for the process of precision measurement and quality control. These hardware solutions are important in ensuring precision measurements in terms of dimensions, surface inspections, and intricate geometric measurements across all domains-from automotive and aerospace to electronics. Hardware continues to remain a dominant part due to advances in sensor technologies and continuous increasing demand for precise measurement instruments that couple hardware with sophisticated software to create increased functionality.

The Services segment is projected to grow with the fastest CAGR of 12.47% in the forecast period 2024-2032. The growth in the demand for specialized metrology services, including calibration, maintenance, training, and data analysis, drives this growth. Industry-wide need to optimize metrology processes without incurring the high costs of in-house expertise makes outsourcing to specialized service providers attractive. Increasing manufacturing process complexity and the continuous need for quality improvement call for expert support and sophisticated analytical services. The growing trend toward cloud-based solutions and data analytics also helps the services segment through the real-time monitoring and predictive maintenance of metrology equipment.

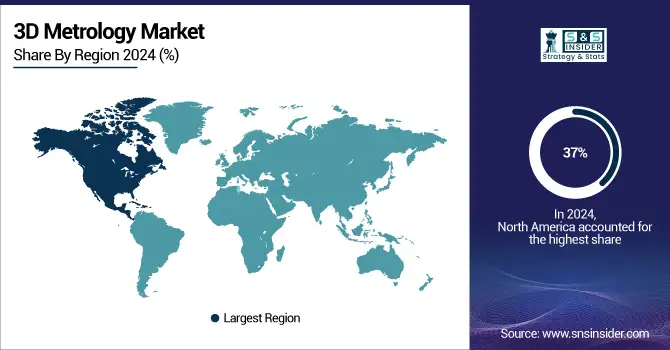

3D Metrology Market Regional Analysis

North America 3D Metrology Market Insights

North America dominated the 3D Metrology Market in 2024 with 37 percent of the market share due to high representation by key industries such as aerospace, automotive, and electronics. The country that leads within this region is the United States of America, considering their high adaptability towards highly advanced metrology solutions mainly due to significant investments within research and development as well as good government policies toward manufacturing excellence and innovation. The region's focus on Industry 4.0 and smart manufacturing further accelerates the integration of 3D metrology technologies that will ensure high precision and efficiency in production processes.

Get Customized Report as per your Business Requirement - Request For Customized Report

Asia Pacific 3D Metrology Market Insights

The Asia Pacific region is expected to be at the top of growth percentages with a CAGR of 8.35% for the forecast period of 2025-2032 as it has witnessed rapid industrialization, expanded manufacturing sectors, and investments in advanced technologies. Key countries driving this growth are China, Japan, and India due to their enormous manufacturing bases and advancement in technology. The biggest contributory factors behind the strong adoption of 3D metrology solutions in the region are China's government initiative, Made in China 2025, and Japan's emphasis on precision engineering.

In addition, the strengthening demand for quality products and the necessity of effective quality control in the emerging economies is driving the 3D metrology market forward. The dynamic economic environment in the Asia Pacific region along with increasing cooperation between technology providers and industrial players will accelerate the adoption and implementation of 3D metrology technologies, and thus forms one of the most important growth drivers in the 3D metrology market.

Europe 3D Metrology Market Insights

The Europe 3D Metrology Market is poised for steady growth in 2024, driven by rapid industrial automation and the region’s strong focus on precision manufacturing. Countries such as Germany, the U.K., and France are widely adopting advanced 3D scanning, CMMs, and optical inspection systems across automotive, aerospace, and electronics sectors. Increasing emphasis on digital twins, Industry 4.0 integration, and government-backed smart manufacturing initiatives is accelerating deployment of high-accuracy metrology tools. Moreover, the shift toward electric vehicles and lightweight materials is further strengthening demand for reliable and scalable 3D measurement solutions in the region.

Latin America (LATAM) 3D Metrology Market Insights

The LATAM 3D Metrology Market is experiencing moderate growth in 2024, supported by expanding automotive production, industrial modernization, and infrastructure development across Brazil, Mexico, and Argentina. Rising awareness of manufacturing accuracy, quality assurance, and process optimization is encouraging industries to adopt automated 3D metrology systems. Investments in mining, energy, and aerospace sectors—combined with collaborations between regional manufacturers and global technology providers—are boosting adoption of cost-effective and portable measurement solutions across the region.

Middle East & Africa (MEA) 3D Metrology Market Insights

The MEA 3D Metrology Market is witnessing robust growth in 2024, driven by large-scale industrial, aerospace, and oil & gas operations in Saudi Arabia, the UAE, and South Africa. Governments are prioritizing industrial diversification, digital transformation, and high-precision maintenance solutions, creating strong demand for advanced 3D inspection technologies. Expanding manufacturing zones, adoption of automation, and increasing use of portable 3D scanners for on-site inspections are supporting market expansion. Additionally, rising partnerships between global metrology providers and regional industries are enhancing technological adoption and aligning operations with international quality standards.

Competitive Landscape for 3D Metrology Market

Hexagon AB

Hexagon AB is a global leader in digital reality, metrology, and manufacturing technologies, offering advanced 3D measurement, inspection, and automation solutions for automotive, aerospace, energy, and industrial applications.

-

In May 2024, Hexagon introduced two portable 3D scanners Atlascan Max and Marvelscan designed for manufacturing and MRO inspection in the aerospace sector. These are the company’s first handheld 3D scanners, suitable for both indoor and outdoor use, enabling handheld scanning, automated inspection, and diverse reverse engineering applications.

Nikon Metrology NV

Nikon Metrology NV is a key provider of precision metrology technologies, offering 3D scanning, X-ray CT inspection, and shop-floor measurement systems widely used in automotive, aerospace, and electronics industries.

-

In September 2024, Nikon Metrology released a comprehensive update to Volume 5.1 of the German Association of the Automotive Industry (VDA) measurement standards. The expanded standards now include a broader set of automotive measurement applications, addressing the rising demand for diverse and sophisticated metrology solutions.

Top 3D Metrology Companies are:

-

Carl Zeiss AG

-

FARO Technologies, Inc.

-

Mitutoyo Corporation

-

Creaform Inc.

-

Keyence Corporation

-

GOM GmbH

-

Renishaw Plc

-

Perceptron Inc.

-

3D Systems Corporation

-

Wenzel Group

-

KLA Corporation

-

Trimble Inc.

-

Ametek Inc.

-

Leica Microsystems

-

Automated Precision Inc. (API)

-

Eley Metrology

-

InnovMetric Software Inc.

-

Photoneo

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 11.74 Billion |

| Market Size by 2032 | USD 21.69 Billion |

| CAGR | CAGR of 7.97 % From 2024 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Offering [Hardware, Software, Services (After Sales Service, Software-as-a-service, Storage-as-service, Measurement Services)], • By Product (Coordinate Measuring Machine, VMM, ODS, 3D Automated Optical Inspection System, Form Measurement, Others), • By Application (Quality Control & Inspection, Virtual Simulation, 3D Scanning, Reverse Engineering, Other), • By End-User (Aerospace & Defence, Automotive, Architecture & Construction, Medical, Semiconductors & Electronics, Energy & Power, Heavy Machinery, Mining, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, France, UK, Italy, Spain, Poland, Russsia, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia,ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia Rest of Latin America) |

| Company Profiles | Hexagon AB, Carl Zeiss AG, FARO Technologies, Inc., Nikon Metrology NV, Mitutoyo Corporation, Creaform Inc., Keyence Corporation, GOM GmbH, Renishaw Plc, Perceptron, Inc., 3D Systems Corporation, Wenzel Group, KLA Corporation, Trimble Inc., Ametek, Inc., Leica Microsystems, Automated Precision, Inc., Eley Metrology, InnovMetric Software Inc., Photoneo. |