Advanced Insulation Materials Market Report Scope & Overview:

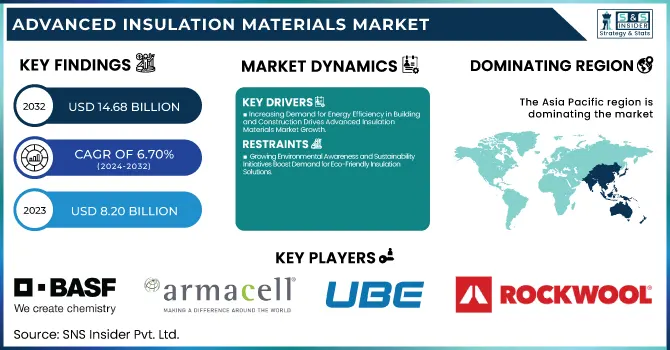

The Advanced Insulation Materials Market size was valued at USD 8.20 billion in 2023 and is expected to reach USD 14.68 billion by 2032, growing at a CAGR of 6.70% over the forecast period 2024-2032.

To Get more information on Advanced Insulation Materials Market - Request Free Sample Report

Advanced insulation materials are experiencing significant growth as consumers increasingly become aware of energy savings and government regulations promote the use of green construction methods. The growth is further augmented by increased investments in infrastructure in developing markets, such as Asia Pacific and Latin America. However, the market faces challenges, including fluctuating raw material prices, which impacts the cost of production and pricing strategies. Cutting-edge technologies that have appeared lately include, inter alia, aerogel products, vacuum insulating panels, and ceramic fiber substances; they advanced functionality and applicational range for materials of the given type of construction. As part of latest sector trends, leading players engaged tactical efforts towards improvements in the position on a particular market.

For instance, SIG, which is a construction material major provider in the UK and Europe, is planning to raise as much as £150 million from investors in a bid to recover from its recent financial challenges and get set for potential market rebound. On the other hand, there was the Kingspan scandal whereby, following investigations after the fire incident in the Grenfell Tower, there was the issue discovered relating to their insulation products. Despite these challenges, the company is still committed to innovation and market growth. These highlights changing trends in the high-performance insulation materials market, where companies are accelerating strategic performances to overcome challenges as well as capitalize on growth opportunities.

Advanced Insulation Materials Market Dynamics

Drivers

-

Increasing Demand for Energy Efficiency in Building and Construction Drives Advanced Insulation Materials Market Growth

The global focus of energy efficiency continues to drive demand in the building and construction market. Buildings absorb the largest single share of all energy consumed, and efforts continue to reduce costs and usage associated with energy expenditure. Advanced materials such as aerogels and vacuum insulation panels offer better performance than traditional material-based insulation compared to high-performance foams. This leads to a better performance in maintaining the temperatures within the room stable, less heating and cooling, and this saves huge amounts of energy. Governments in every country enforce very strict building codes and regulations with respect to energy efficiency by demanding effective insulation in new construction as well as renovations. For instance, the Energy Performance of Buildings Directive from the European Union imposes minimum standards of energy performance for buildings that promote member countries to adopt advanced high-level insulations. On the other hand, it gives fiscal incentives, in the form of tax credits and rebates, for energy-efficient building material use. These regulatory frameworks and incentives are driving the demand for advanced insulation materials as builders and owners of properties look to meet the regulations and drive down the cost of operations. Increasing consumer and business awareness of environmental sustainability and longer-term cost-saving benefits from efficient buildings continues to support this demand, thus solidifying the role of advanced insulation materials in modern construction practice.

-

Growing Environmental Awareness and Sustainability Initiatives Boost Demand for Eco-Friendly Insulation Solutions

Restraints

-

High Initial Costs of Advanced Insulation Materials Limit Widespread Adoption in Cost-Sensitive Markets

The primary disadvantage of advanced insulation materials is that they are much more expensive at the point of initial cost, which presents a significant barrier to their adoption on a wide scale, particularly in cost-sensitive markets. Aerogels and vacuum insulation panels are difficult to manufacture and require raw materials that are specialized, hence more expensive to produce than conventional insulation options like fiberglass or mineral wool. This cost disadvantage deters builders, house owners, and industries from opting for more advanced insulation solutions. Their initial budget may be a major problem, especially if they require the best services at once. To this, additional benefits like the return of savings on energy might be very far in terms of return as they never come or materialize into each consumer's pocket right away to help them adopt these materials. The cost of these materials may reduce over the near future through economies of scale or further developments in manufacturing technologies, opening markets for a wider segment of society.

Opportunities

-

Integration with Smart Building Technologies Creates New Applications for Advanced Insulation Materials

Advantages of smart building technologies. A new opportunity emerges for the market of advanced insulation materials. This is because, in smart buildings, all processes are monitored by interconnected systems relating to heating and ventilation, and air conditioning as well as the lighting and the energy consumption functions. Advanced insulations can serve as a strategic input in terms of improving system efficiency. For instance, integrated sensors in insulation materials can provide real-time data on temperature and energy performance, allowing for more precise control of HVAC systems and further energy savings. Phase-change materials used in insulation can also help regulate indoor temperatures by absorbing and releasing heat as needed, complementing smart climate control systems. The synergy between advanced insulation materials and smart building technologies can lead to the development of innovative solutions that offer superior energy efficiency, comfort, and sustainability. As the adoption of smart building technologies grows, the demand for compatible advanced insulation materials is expected to increase, presenting a promising avenue for market expansion.

Challenge

-

Regulatory Compliance Challenges Due to Varying Standards Across Regions Hinder Global Adoption of Advanced Insulation Materials

The complexity of the regulatory standards in different regions makes it a challenge for the adoption of advanced insulation materials on a global scale. Building codes, energy efficiency requirements, and environmental regulations differ from one country to another and even within the same country in various regions. This diversity makes it challenging for manufacturers of advanced insulation materials to ensure that their products meet a wide range of standards, which is resource-intensive and complicated. For example, a material qualified for use in the European market may need to be tested and certified again for use in North America or Asia. The time-to-market of new products is likely to be increased, and costs are likely to be higher when obtaining multiple certifications. Further, it also demands continuous monitoring and adaptation of the evolving regulations to ensure continued compliance. Complexity in regulations could discourage companies from entering new markets or investing in the development of novel insulation solutions. Industry stakeholders must engage with regulatory bodies for standard harmonization where possible and invest in flexible product development strategies to have a variable approach to different regulatory environments.

Advanced Insulation Materials Market Segmental Analysis

By Type

In 2023, the Mineral Wool segment dominated the Advanced Insulation Materials market with a market share of approximately 35%. Mineral wool is widely utilized in building and construction as it offers excellent thermal and acoustic insulation properties, is non-combustible, and is environmentally friendly. Its popularity can be attributed to its ability to provide energy savings and enhance fire safety in residential, commercial, and industrial buildings. For example, mineral wool is used extensively in insulation for roofs, walls, and floors to meet building codes and energy efficiency standards. It also finds application in industrial insulation, including pipes and boilers, where high-temperature resistance is essential.

By Application

In 2023, the Building & Construction segment dominated and held the largest share of the global Advanced Insulation Materials market, at approximately 40% during the forecast period. This segment has grown significantly due to increasing demand for energy-efficient and sustainable buildings. In many regions, including the European Union's Energy Performance of Buildings Directive, which requires high-performance insulation in construction projects, energy-efficient buildings are getting strong regulatory support. New buildings and renovation projects utilize advanced insulation materials, including aerogels, vacuum insulation panels, and mineral wool, to achieve enhanced thermal performance and energy consumption reduction. The growth of this sector is further aided by consumer awareness and the push for green building certifications, fostering demand for advanced insulation safe solutions.

By End-use

In 2023, Industrial segment dominated and accounted for majority share of around 30% in the Advanced Insulation Materials market in 2023. A need to improve energy efficiency, enhance safety, and preserve high operating temperatures are some of the strongest drivers for advanced insulation materials demand in the global marketplace, making oil and gas, power generation, and manufacturing top consumers of the technology. For example, in oil and gas, insulation materials are used widely to protect the pipeline and reduce energy wastage. Likewise, the power generation industry needs these materials for turbine, boiler, and piping system insulation to maximize energy performance and operational efficiency while meeting sustainability objectives and regulatory compliance.

Advanced Insulation Materials Market Regional Outlook

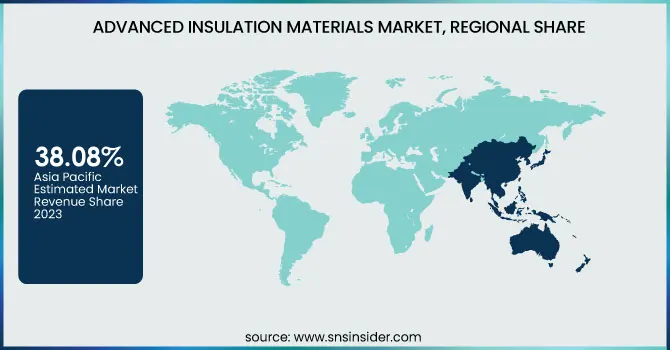

In 2023, Asia Pacific region dominated the Advanced Insulation Materials market and accounted for approximately 38.08% of the market in 2023. This dominance is due to fast industrialization, urbanization, and massive infrastructure development in countries like China, India, and Japan. Additionally, the Belt and Road Initiative led to large scale construction projects in China which promoted the demand for sophisticated insulation materials for energy efficiency and building codes. In a similar vein, the expansion of the manufacturing sector and urbanization in India has resulted in a construction boom, which has increased demand for high-performance insulation solutions. The growth of Japan's energy-saving and disaster-proof construction has also driven the market in the region. These key driving aspects also highlight APAC's top status in the worldwide advanced insulation materials industry.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

-

BASF SE (Neopor, Styropor)

-

Armacell International S.A. (Armaflex, ArmaGel)

-

UBE Industries, Ltd. (UBE Aerogel, UBE Insulation Materials)

-

Owens Corning (EcoTouch Insulation, FOAMULAR Insulation)

-

Rockwool International A/S (Rockflow, Rockwool Insulation)

-

Saint-Gobain S.A. (Isover Insulation, Gyproc Plasterboard)

-

Kingspan Group plc (Kingspan Insulation, Kooltherm)

-

Cabot Corporation (Sylvania Aerogel, Cabot Insulation Materials)

-

Knauf Insulation (Knauf Insulation Glass Mineral Wool, Earthwool)

-

Evonik Industries AG (Aerogel Insulation, Silica-based Insulation Materials)

-

Thermal Ceramics (Kaowool, Insulfrax)

-

Unifrax I LLC (Thermofiber, FyreWrap)

-

Promat International N.V. (Promat Insulation Boards, Promat Pyrogel)

-

Aerogel Technologies, LLC (Aerogel Insulation, Aerogel Blanket)

-

Shandong Luyang Share Co., Ltd. (Luyang Insulation, Luyang Refractory Materials)

-

Advanced Insulation Limited (Thermocure, Heatguard)

-

YUBASE (Yubase Insulation, Yubase Aerogel)

-

Nitto Denko Corporation (Nitto Thermal Insulation, Nitto Heat Resistance Materials)

-

MASTERGLASS (Masterglass Insulation, Glass Wool Insulation)

-

AFGlobal (AFG Insulation Materials, Thermal Insulation Solutions)

Recent Development:

-

January 2025: Aspen Aerogels settled its patent dispute with AMA, resolving issues regarding aerogel-based insulation materials and securing licensing agreements for both companies to continue their operations.

-

October 2024: BASF expanded its production of energy-efficient insulating materials at its Ludwigshafen plant, addressing the rising demand for sustainable construction solutions to reduce carbon emissions.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 8.20 Billion |

| Market Size by 2032 | US$ 14.68 Billion |

| CAGR | CAGR of 6.7% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Material Type (Aerogels, Vacuum Insulation Panels, Fiberglass, Mineral Wool, Polyurethane Foam, Others) •By Application (Building & Construction, Industrial, Oil & Gas, Automotive, Aerospace, Others) •By End-Use (Residential, Commercial, Industrial) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Aspen Aerogels, Inc., BASF SE, Armacell International S.A., Owens Corning, Johns Manville Corporation, 3M Company, Rockwool International A/S, Saint-Gobain S.A., Kingspan Group plc, Morgan Advanced Materials plc and other key players |