AI Dash Cams Market Size & Trends:

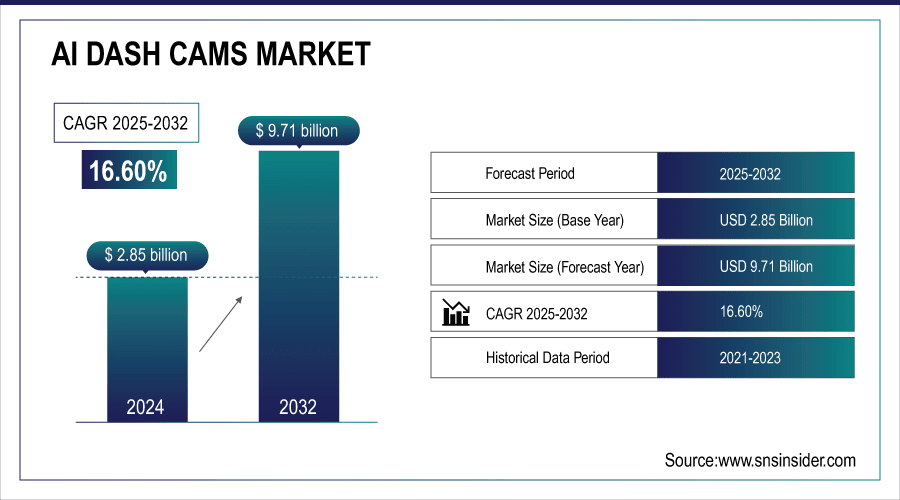

The AI Dash Cams Market Size was valued at USD 2.85 Billion in 2024 and is expected to reach USD 9.71 Billion by 2032 and grow at a CAGR of 16.60% over the forecast period 2025-2032.

The AI Dash Cams market is primarily driven by the rising demand for road safety, accident prevention, and driver behavior monitoring across both personal and commercial vehicles. Increasing road accidents and insurance fraud cases have encouraged fleet operators, ride-hailing services, and individual consumers to adopt AI-enabled dash cams with advanced features such as collision detection, lane departure warnings, and real-time alerts. The integration of GPS tracking and cloud connectivity further enhances accountability, helping businesses reduce liability risks and improve compliance with regulatory standards. According to study, India’s Ministry of Road Transport confirmed AI-enabled dash cams helped authorities detect 35% more insurance fraud cases compared to traditional surveillance methods.

To Get More Information On AI Dash Cams Market - Request Free Sample Report

AI Dash Cams Market Trends

-

Increasing adoption of AI dash cams as an active safety measure to prevent accidents, analyse driver behaviour and combat insurance fraud.

-

Further infusion of AI dash cams with ADAS, IoT platforms, and connected vehicle ecosystem for predictive safety.

-

Increasing popularity of AI dash cameras for fleet management to enhance accountability, liability risk mitigation, and compliance with regulations.

-

Growth of on-device and with-partner incentives, such as premium discounts provided by the insurer for drivers and fleets installing and activating an AI dash cam

-

Changing Role of AI dash cams from traditional recorders to pro-active safety companions with alerts and cloud connectivity

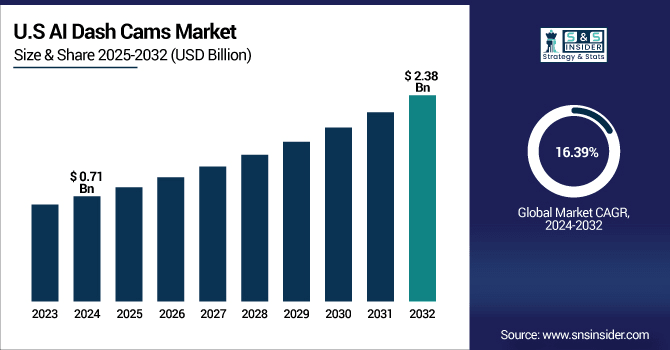

The U.S. AI Dash Cams Market size was USD 0.71 Billion in 2024 and is expected to reach USD 2.38 Billion by 2032, growing at a CAGR of 16.39% over the forecast period of 2025-2032. driven by Advancements in AI and machine learning technologies have led to the development of more sophisticated dash cams. These devices offer features like real-time hazard detection, lane departure warnings, and driver behaviour analysis, enhancing overall driving safety and efficiency.

AI Dash Cams Market Segment Analysis

-

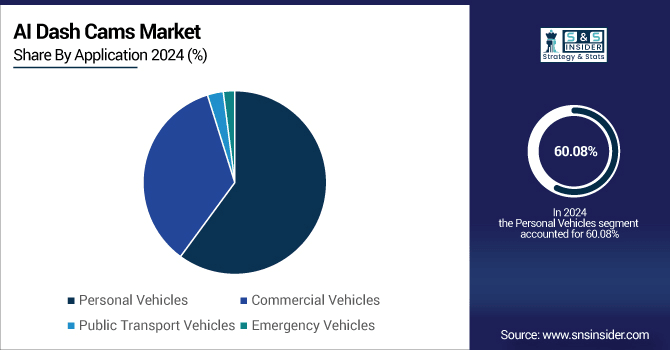

By Application, Personal Vehicles led the market with nearly 60.08% share in 2024, while Commercial Vehicles is projected to grow fastest with a CAGR of 17.29%.

-

By Features, Collision Detection accounted for around 35.20% of the market in 2024, while Lane Departure Warning emerged as the fastest-growing segment with a CAGR of 17.45%.

-

By Technology, Artificial Intelligence (AI) Powered Dash Cams dominated with about 34.20% share in 2024, whereas Machine Learning-Based Dash Cams witnessing the fastest growth at a CAGR of 17.44%.

-

By End User, Individual Consumers held the largest share at 59.70% in 2024, with Fleet Operators to be the fastest-growing vertical at a CAGR of 17.26%.

By Application, Personal Vehicles Leads Market While Commercial Vehicles Fastest Growth

Based on Application, the AI dash cams market is divided into Personal Vehicles, and Commercial Vehicles. The Personal Vehicles segment holds the largest market share in the AI dash cams market owing to increasing consumer awareness about road safety, high adoption of connected car-related technologies, and rise in demand for advanced driver assistance features. For drivers, AI dash cams allow to detect collisions and lane departure and real-time alerts and help to drive safely and document driving incidents. Conversely, the Commercial Vehicles segment is growing at the fastest pace, due to logistics firms, fleet operators, and ride-hailing services installing AI dash cams in their vehicles to monitor their driver's behavior, minimize accident risks, improve route efficiency, and comply with regulatory and insurance mandates.

By Features, Collision Detection Leads Market While Lane Departure Warning Segment Witnesses Fastest Growth

AI Dash Cams Market, by Features indicates demand for advanced safety features the collision detection segment dominates the industry, as the number of road accidents is increasing and fleet operators and individual consumers are adopting these systems demanding for real-time alerts to avoid crashes. The fact that it reduces the liability risk and provides indisputable evidence in case of an accident is what made it the winning feature. However, lane departure warning segment is projected to grow at the fastest rate due to regulatory, drive monitoring technology and arena for integrating these features with Advanced Driver Assistance Systems (ADAS). Increased knowledge about distracted driving and also motivation from insurance companies for vehicles that will possess the AI technologies, is also helping to momentum.

By Technology, AI-Powered Dash Cams Lead Market While Machine Learning-Based Dash Cams Witness Fastest Growth

The rapid growing penetration of technology, the AI Dash Cams Market by Technology has started gaining adoption as the vehicles are becoming more advanced and connected. The growth of AI will be driven by the capabilities of real-time monitoring, facial recognition, object detection and behavioural analysis provided by AI-powered dash cams that currently dominate the market. These solutions are extensively used among the individual consumers as well as the fleet operator in order to increase safety on the road, compliance and the promise of credible proof in cases of insurance claims. However, the fastest-growing segment will be machine learning-based dash cams due to their self-learning capability and improving accuracy with time. With ML integration, things like predictive analytics, adaptive alerts to drivers, and adapters to different driving scenarios and environments become possible.

By End User, Individual Consumers Lead Market While Fleet Operators Segment Witnesses Fastest Growth

End User adoption of AI Dash Cams Market clearly highlights the difference between consumers being personal user as and commercial user. In the present scenario, largest share is occupied by individual consumers due to increase in road safety awareness, adoption to prevent accidents and reduce insurance fraud by personal vehicle owners. AI dash cams belong to another category of add-on solution since consumers insist on features like collision detection, lane departure warning and real-time proof, making AI dash cams a key part of safety and security. On the contrary, fleet operators will be in a fast-growing segment owing to driver accountability, operational efficiency, and strict adherence to safety regulations. As a result, this shift in technology has driven a number of fleet managers to implement AI dash cams for enhanced driver monitoring, risk mitigation, and ultimately insurance cost savings.

AI Dash Cams Market Growth Drivers:

-

Rising Road Safety Concerns & Accident Prevention

One of the major factors driving the growth of the global AI dash cams market is the growing global interest in road safety and accident prevention. As road traffic collisions continue to be responsible for high numbers of death and injury and major damage to property across the globe, governments, fleet users and individual consumers are increasingly looking for ways to improve safety on the roads. With collision detection, lane departure warning, real-time alerts, and driver behaviour monitoring, AI dash cams act as proactive safety devices. These dash cams help reduce accident liability, improve driver accountability, and increase insurance compliance for fleets. The rising need to prevent accidents and fraud in terms of insurance is also pushing personal vehicle owners to install these devices, making safety a key growth driver in the market.

Using in-cab alerts, fleets experienced a 42% reduction in safety-related events within one year of AI dash cam deployment.

AI Dash Cams Market Restraints:

-

Data Privacy & Regulatory Compliance Issues

Although AI dash cams have advantages, their penetration is limited due to high initial cost and integration complexities. While advanced AI dash cams featuring a combination of cloud connectivity, ADAS capabilities, and high-resolution ever-costlier for small fleets and individual consumers on a budget. Moreover, the technical challenge of interfacing these systems with current fleet management software, telematics platforms, or vehicle electronics results in more infrastructure, more training, and more maintenance, except that the fleet manager is the one footing the entire bill this time around. Both privacy and data security make organizations reluctant to embrace its widespread adoption after all, dash cams can transmit personal driving and geolocation information.

AI Dash Cams Market Opportunities:

-

Integration with Connected & Autonomous Vehicle Ecosystems

Growing shift of fleet operators along with connected vehicle service gives substantial opportunity to the AI dash cams market. AI dash cams for driver monitoring, route optimization and accident prevention are increasingly utilized in logistics, ride-hailing and commercial transport businesses. These cloud-connected solutions put video in the hands of fleets in real-time, allowing for analytics to coach drivers and improve efficiency. With increasing number of transportation companies adopting telematics-based solutions, AI dash cams can be a central pillar of smart fleet management, facilitating subscription-based recurring revenues for such companies for subscriptions, analytics services, insurance partnerships, etc. The expansion of autonomous vehicle technologies also provides a pathway to future growth for AI dash cams as complementary safety and monitoring devices.

At Snapdragon Auto Day, Qualcomm showcased vehicle-to-cloud, ADAS, and V2X platforms aimed at enabling AI dashcam integration in connected mobility.

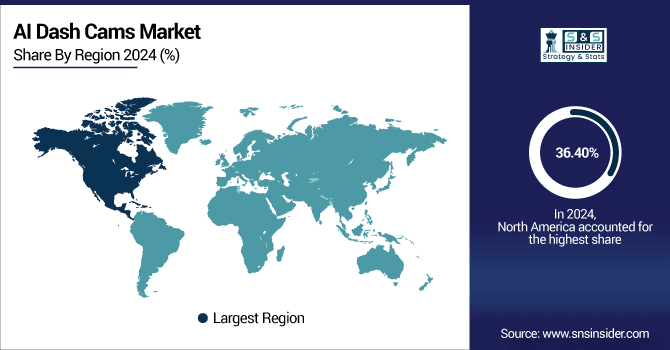

North America Dominates AI Dash Cams Market with Advanced Technology and Early Adoption:

North America is the leading regional segment of AI Dash Cams Market share 36.40%, with an extensive automotive infrastructure, prevalent adoption of connected vehicle technologies, and strict road safety regulations. Increasing adoption, particularly from individual consumers and commercial fleets is pushing this trend further, as AI dash cams provide various features including collision, lane departure, and real-time monitoring to boost driver safety and accountability. Further driving technology in this direction, insurance companies reward usage-based insurance discounts while critical players in the same space continue to innovate safety solutions powered by AI, reinforcing the region as a hotbed for automotive safety systems.

Get Customized Report as Per Your Business Requirement - Enquiry Now

U.S. Leads AI Dash Cams Market with Policy Support and Technological Adoption:

The United States leads North America’s AI dash cam market due to high consumer awareness, advanced automotive technologies, and strict safety regulations, while Canada shows steady growth from fleet adoption, government initiatives, and vendor innovation in connected vehicle solutions.

Asia Pacific Emerges as Fastest-Growing AI Dash Cams Market Driven by Urbanization and Technology Adoption:

AI dash cam market in the Asia-Pacific region is witnessing the highest growth with a CAGR 17.32%, owing to rapid urbanization, soaring vehicle ownership, and growing emphasis towards road safety. The commercial adoption is being accelerated amid the expansion of logistics and public transport and ride-hailing fleets, as well as support from governments for vehicle safety technologies. Low-cost AI hardware, improved digital infrastructure, and escalating consumer awareness will further boost growth. The scenario predicts deployment of AI dashcam equipped with ADAS and telematics platforms for predictive safety alerts, fleet monitoring and operational efficiency. Regulatory support coupled with the adoption of technology leads to a buoyant market.

China and South Korea Drive Rapid Growth in Asia Pacific AI Dash Cams Market:

China leads Asia-Pacific’s AI dash cam market with rapid urbanization, rising vehicle sales, and AI/ADAS adoption. India shows high potential from expanding ride-hailing and logistics sectors, while Japan and South Korea adopt AI dash cams in premium vehicles. Affordable hardware, fleet digitization, and growing consumer awareness drive regional growth.

Europe Strengthens AI Dash Cams Market through Safety Regulations and Fleet Adoption:

In Europe, the AI dash cam market is driven by stringent regulatory mandates for vehicle safety, widespread fleet adoption, and insurance collaborations. Growth is fueled by integration with ADAS and telematics platforms, as businesses and individual consumers increasingly adopt AI dash cams to enhance driver accountability, reduce accidents, and improve operational efficiency.

Germany Leads Europe in AI Dash Cams Market with Industry 4.0 and Smart Manufacturing Initiatives

Germany focuses on Industry 4.0 and smart manufacturing, integrating AI inference into robotics, predictive maintenance, and industrial automation. Government initiatives support AI research and deployment.

Latin America and Middle East & Africa Witness Steady AI Dash Cams Market Growth Driven by Digital Transformation and Safety Initiatives:

The growth in the Latin America and Middle East & Africa AI dash cam market is expected, following increasing adoption in fleet management, ride-hailing and commercial vehicle safety. The growing awareness of the need to avoid accidents, increase digitization pertaining to safety programs by the government and market expansion due to domestic manufacturers are expected to provide long-term growth opportunities for the providers of AI dash cam solutions in these emerging regions.

AI Dash Cams Market Competitive Landscape

Viofo is a technology company specializing in high-performance dash cams and automotive recording solutions. Known for innovation in video quality and storage capabilities, Viofo’s products cater to both individual consumers and fleet operators. The A329 model exemplifies their commitment to advanced recording features, including 4K at 60fps, Wi-Fi 6, and external SSD support.

-

In October 2024, Viofo introduced the A329 dash cam, featuring 4K at 60fps recording, Wi-Fi 6 connectivity, and external SSD support for extended footage storage.

Samsara provides IoT and AI-driven solutions for fleet management and industrial operations. Its AI-powered Multicam system enhances driver safety by delivering real-time 360° visibility and AI-based hazard detection, helping organizations improve situational awareness, reduce accidents, and optimize fleet performance.

-

In August 2025, Samsara launched its AI-powered Multicam system, offering real-time 360° visibility and AI-driven hazard detection to enhance fleet safety and situational awareness.

Nauto focuses on AI-driven dash cam solutions to improve road safety and driver behavior monitoring. Recognized for high accuracy and rapid alert capabilities, Nauto’s systems are widely adopted by commercial fleets and ride-hailing services to minimize risks, prevent accidents, and support insurance compliance.

-

In December 2024, Nauto’s AI dash cam system was recognized for superior accuracy and rapid alert capabilities in a Virginia Tech Transportation Institute study, demonstrating enhanced driver safety.

AI Dash Cams Companies are:

-

Nauto

-

KeepTruckin

-

Viatech

-

Nexar

-

AnyConnect

-

MiX Vision

-

Azuga

-

Lytx

-

Viofo

-

Garmin

-

Nextbase

-

70mai

-

Vantrue

-

Miofive

-

Garmin DriveCam 76

-

BYD

-

Tesla

-

Nvidia

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 2.85 Billion |

| Market Size by 2032 | USD 9.71 Billion |

| CAGR | CAGR of 16.60% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Features (Collision Detection, Lane Departure Warning, GPS Tracking, Real-Time Alerts, and Parking Monitoring) •By Technology (Artificial Intelligence (AI) Powered Dash Cams, Machine Learning-Based Dash Cams, Advanced Driver Assistance Systems (ADAS) Dash Cams, and Cloud-Connected Dash Cams) •By Application (Personal Vehicles, Commercial Vehicles, Public Transport Vehicles, and Emergency Vehicles) •By End User (Individual Consumers, Fleet Operators, Ride-Hailing Services, and Law Enforcement Agencies) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Samsara, Nauto, KeepTruckin, Viatech, Nexar, Magic Earth, AnyConnect, MiX Vision, Azuga, Lytx, Viofo, Garmin, Nextbase, 70mai, Vantrue, Miofive, Garmin DriveCam 76, BYD, Tesla, Nvidia, and Others. |