Aircraft Engine Market Report Scope & Overview:

The Aircraft Engine Market Size was valued at USD 143.45 billion in 2023 and is expected to reach USD 279.6 billion by 2032 and grow at a CAGR of 7.7% over the forecast period 2024-2032. Various factors, such as the growing commercial aviation industry and rising demand for fuel-efficient aircraft engines, are driving the market. An aircraft engine is a component of an aircraft's propulsion system that generates mechanical power. Air is drawn in through an inlet at the front of an aircraft engine, compressed by a fan, mixed with fuel, combusted, and then fired out as a hot, fast-moving exhaust at the back, propelling the Aeroplan forward. The growing demand for more comfortable and time-efficient passenger and cargo transportation drives the growth of this market. The use of aircraft engines in the military sector to combat terrorism, illegal infiltration, drug trafficking, and other threats is also a major driver of the aircraft engine market. However, factors such as high manufacturing and maintenance costs, as well as a lack of production facilities, limit the market's growth.

Get a Sample Report on Aircraft Engine Market - Request Free Sample Report

MARKET DYNAMICS

KEY DRIVERS

-

Drug trafficking

-

Illegal infiltration

-

High Operational cost

RESTRAINTS

-

High manufacturing cost

-

High maintenance cost

OPPORTUNITIES

-

Growing demand for Unmanned Aerial Vehicle (UAV)

-

Electric vehicle

CHALLENGES

-

Pandemic

-

Maintenance

-

Safety

THE IMPACT OF COVID-19

General Electric Company, Safran SA, Honeywell International Inc, MTU Aero Engine, and Rolls Royce PLC are among the major players in the aircraft engine market. These companies have expanded their operations to North America, Europe, Asia Pacific, the Middle East, Africa, and Latin America. COVID-19 has had an impact on their companies as well. According to industry experts, COVID-19 will have an impact on the aviation industry's production and services globally in 2020. The COVID-19 pandemic has had a negative impact on the industrial verticals, resulting in a sudden drop in 2020 aircraft engine orders and deliveries. This is expected to have a short-term negative impact on the aircraft engine market.

By End-user

The aircraft engine market is segmented based on commercial and military aviation

During the aircraft engine market forecast period, the commercial segment is expected to be the largest and fastest-growing segment. The increase can be attributed to the rising demand for technologically advanced engines to replace conventional engines. Furthermore, the growing number of passengers has increased the demand for new commercial aircraft.

The military segment is also expected to contribute significantly to growth, owing to increased military aircraft procurement by the US DoD and the Indian government.

By Type

The conventional aircraft engine segment is expected to grow at the fastest CAGR for the aircraft engine market during the forecast period, based on technology. A traditional aircraft is also known as an aero engine. It is the primary power source for the aircraft's propulsion system. The majority of aircraft engines are either piston engines or gas turbine engines. Some of the most common types of aircraft engines are turboprop engines, turbofan engines, turboshaft engines, and piston engines.

By Wing Position

The aircraft engine market is segmented based on Two types Rotary Wing and Fixed Wing. Because of the increased demand for Aircraft engine market, the rotary-wing segment is expected to grow significantly during the projected period. Aircraft engine are employed for a variety of military purposes, including military logistics, air assault, command and control, and troop transport.

By Component

The turbine is forecasted to grow at the fastest CAGR rate in the aircraft engine market during the expected period. A turbine is a type of rotary engine that extracts energy from a flow of combustion gases. As a result, a turbine converts the kinetic energy of these gases into rotational motion. A turbine in an aircraft engine is made up of a series of blades that allow gases to flow into the turbine and push the blade. This causes a rotational motion, after which the less energetic gases are ejected.

KEY MARKET SEGMENTATION

By End-user

-

Commercial Aviation

-

Military Aviation

-

Others

By Type

-

Turboprop

-

Turbofan,

-

Turboshaft

-

Piston Engine

By Wing Position

-

Rotary Wing

-

Fixed Wing

-

UAV

By Component

-

Compressor

-

Turbine

-

Exhaust Nozzle

-

Fuel System

-

Gear Box

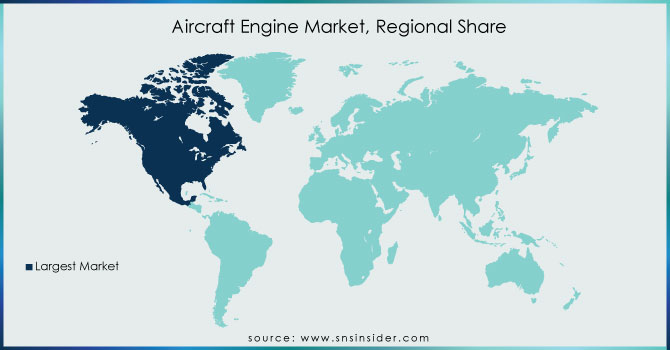

North America is expected to be the largest region of the aviation engine market region at the time of forecasting. An important issue facing North America, which is leading the aircraft engine market due to the rapid growth of the most technologically advanced aircraft engine in the region. In North America, the rise of the manufacturing industry and the growing aerospace and defense aviation industry are encouraging aircraft engine manufacturers to introduce highly advanced and efficient products for a wide variety of aircraft. The growing demand for aircraft engine and the presence of some of the leading players in the market, such as General Electric Company, Honeywell International Inc., Collins Aerospace, and Textron Inc. is expected to drive the aircraft engine market in North America. These players are focused on R&D to grow their product lines and utilize advanced systems, sub-systems, and other components of aircraft engine manufacturing.

Need any customization research on Aircraft Engine Market - Enquiry Now

REGIONAL COVERAGE

-

North America

-

USA

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

The Netherlands

-

Rest of Europe

-

-

Asia-Pacific

-

Japan

-

south Korea

-

China

-

India

-

Australia

-

Rest of Asia-Pacific

-

-

The Middle East & Africa

-

Israel

-

UAE

-

South Africa

-

Rest of Middle East & Africa

-

-

Latin America

-

Brazil

-

Argentina

-

Rest of Latin America

-

KEY PLAYERS

The major players are Rolls-Royce Motor Cars Limited, Honeywell International Inc., Safran, Boeing, United Technologies Corporation, Pratt & Whitney Division, General Electric Company, Snecma S.A, Hindustan Aeronautics Limited, JSC "Klimov"-United engine corporation & other players.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 143.45 Billion |

| Market Size by 2032 | US$ 279.6 Billion |

| CAGR | CAGR of 7.7% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By End-User (Commercial Aviation, Military Aviation, Others) • By Type (Turboprop, Turbofan, Turboshaft, Piston Engine) • By Wing Position (Rotary Wing, Fixed Wing, UAV) • By Component (Compressor, Exhaust Nozzle, Gear Box, Turbine, Fuel System) |

| Regional Analysis/Coverage | North America (USA, Canada, Mexico), Europe (Germany, UK, France, Italy, Spain, Netherlands, Rest of Europe), Asia-Pacific (Japan, South Korea, China, India, Australia, Rest of Asia-Pacific), The Middle East & Africa (Israel, UAE, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Rolls-Royce Motor Cars Limited, Honeywell International Inc., Safran, and Boeing, United Technologies Corporation-Pratt & Whitney Division, General Electric Company, Snecma S.A, Hindustan Aeronautics Limited, JSC "Klimov"-United engine corporation. |

| DRIVERS | • Drug trafficking • Illegal infiltration • High Operational cost |

| RESTRAINTS | • High manufacturing cost • High maintenance cost |