AMOLED Display Market Size & Trends:

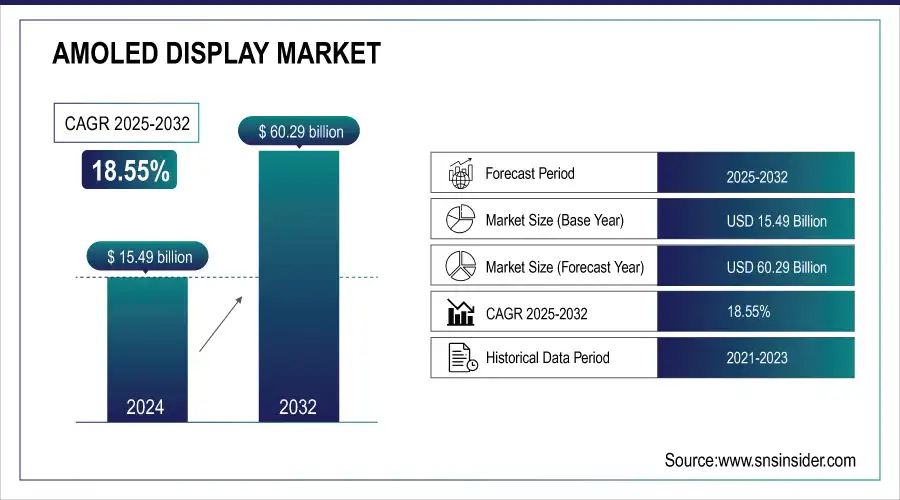

The AMOLED Display Market size was valued at USD 15.49 billion in 2024 and is expected to reach USD 60.29 billion by 2032, growing at a CAGR of 18.55% over the forecast period of 2025-2032. AMOLED display market trends include increasing adoption in foldable smartphones, automotive displays, and wearable devices. Advancements in flexible and transparent panel technologies are also driving innovation and premium device integration. Growing usage of high-resolution, energy-efficient, and lightweight display solution among consumer electronics including smartphones, smartwatches, laptops, and TVs is expected to drive demand for AMOLED display market. Growing demand for foldable and flexible devices, and utilization of the AMOLED panels in automotive digital dashboards and infotainment systems, is propelling the expansion further. Between technological improvements, better contrast ratios, faster refresh rates and thinner form factors, AMOLED displays are already the technology of choice for smartphones; slumping production costs just might accelerate their adoption across more categories of device.

To Get more information on AMOLED Display Market - Request Free Sample Report

AMOLED smartphone display shipments reached 784 million units in 2024, a growth of over 160 million units from the previous year.

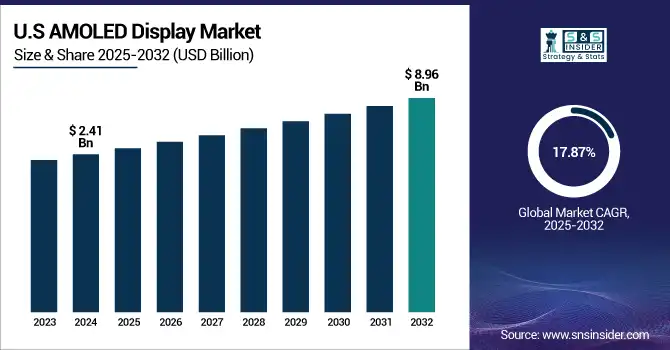

The U.S. AMOLED display market size was valued at USD 2.41 billion in 2024 and is expected to reach USD 8.96 billion by 2032, growing at a CAGR of 17.87% over the forecast period of 2025-2032. Driven by the increase in demand for premium smartphones, smartwatches, automotive displays, and the efficient speed of quick adoption of flexible screens and a domestically cultivated ecosystem of technical innovation, The U.S. AMOLED display market is able to witness significant growth.

AMOLED Display Market Dynamics:

Drivers:

-

Flexible AMOLED Adoption Accelerates with Rising Demand for High Performance Displays Across Consumer and Automotive Markets

Growing demand for high-performance display technologies in smartphones, wearables, televisions, and automotive applications is poised to drive the global AMOLED display market growth. AMOLED panels have long been the preferred choice for consumers due to superior image quality, energy efficiency, deep contrast ratios, and faster response times compared to LCDs. They are also driving demand, well the major shift to foldables and flexible electronics will undoubtedly lead to this demand, these panels have the flexibility needed for new types of products. At the same time, lowering production costs and improving manufacturing capabilities particularly in Asia are speeding widespread adoption.

Samsung Display shipped 1.64 million automotive OLED displays in 2024, up from 600,000 units in 2023 (+273%), confirming expansion into automotive digital dashboards

Restraints:

-

Durability Challenges Limit Growth Potential of Flexible Foldable AMOLED Panels in Consumer and Automotive Sectors

Flexible and foldable AMOLED panels are the most desirable category these days, however, lack of durability acts as one of the essential restraints in the AMOLED display market. These displays are more vulnerable to damage in the form of creasing, delamination, or burn-in over time and would impact user experience and reliability of consumer electronics and automotive applications. Apart from these issues, panel fragility during manufacturing and end-use, elevates rejection rates and maintenance issues.

Opportunities:

-

Transparent and Rollable AMOLED Unlock New Growth Avenues Across EV Healthcare Smart Homes and Aerospace

The growing adoption of AMOLED displays in the electric vehicle and augmented reality device markets, and growing opportunities in healthcare data monitoring, also play a critical role in this market growth. Transparent and rollable AMOLED technologies open up new use-cases in commercial signage, smart homes, and aerospace as research and commercialize futuristic design aesthetics while utilizing space-saving advantages.

AR/VR headset display shipments are projected to climb, with 124 million displays forecast by 2028, driven by premium hardware launches such as Apple Vision Pro and Meta Quest 3

Challenges:

-

Design Complexity and Material Dependency Pose Challenges to AMOLED Expansion in Emerging Technology Applications

Ongoing risks to production timelines are dependent on supply chain disruptions experienced to date and availability of some critical material dependencies (e.g., organic compounds, encapsulation, etc.) Additionally, the high onus of precision in design to fit AMOLED panels inside small devices such as smartwatches or medical wearables creates trouble for OEMs who need to meet certain quality to fill in the components in the overall design which slows down wide adoption of AMOLED panels in emerging applications such as in AR/VR and industrial monitoring.

AMOLED Display Market Segmentation Outlook:

By Product Type

Smartphones remained the largest application of AMOLED displays with a 60.3% market share in 2024, as demand for high-resolution, energy-efficient displays continued to grow for flagship and mid-range devices. AMOLED panels are very popular among the major smartphone brands such as Samsung, Apple and Xiaomi, thanks to high contrast ratio, bright colors output, and thinner form factors make better device design and user experience. This in itself was bolstered by the prevailing trend in bezel-less and foldable phone designs.

During 2025 to 2032, smartwatches and wearables are anticipated to be at the highest CAGR due to the growing consumer need for health-dependent functions, and the popularity of always-on displays and small devices with more energy-efficient consumption methods. AMOLED displays in fitness bands and smartwatches enhance outdoor visibility, cosmetic appeal, and personalised biometric monitoring.

By Technology Type

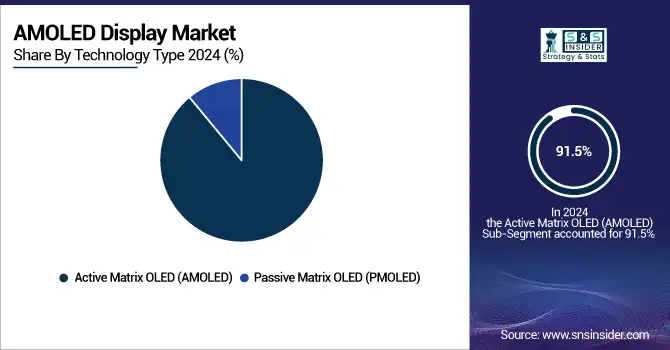

Active Matrix OLED (AMOLED) technology continued to command a dominant 91.5% share of the total mobile phone display area in 2024, thanks to high display quality, fast refresh rates, and efficient power consumption. AMOLED panels are common for smartphones, televisions, automotive displays, and high-end wearables thanks to their outstanding color reproduction, inky blacks, and a higher touch-response fluidity. AMOLED is the blanket technology of choice for the majority of consumer electronics manufacturers, as its uses for flexible and foldable displays are only increasing.

The Passive Matrix OLED (PMOLED) is expected to grow at the highest CAGR during the forecasted period (2025-2032). The growth is being fueled by cost-effectiveness and suitability for small, simple displays in devices such as fitness bands, industrial equipment, and simple consumer electronics where full-motion video is not required.

By Panel Type

Rigid AMOLED panels hold the largest share of 40.5% of the total AMOLED panel market share in 2024, which are widely used in mid-range smartphones along with tablets and automotive infotainment display applications. This results in durable, high-performance devices at an affordable price, and as such are ideal for products that do not need flexible form factors. Their development of a mature manufacturing ecosystem and established supply chain has already guaranteed quality, and at scale.

During the forecast period from 2025 to 2032, Foldable AMOLED displays are anticipated to record the fastest CAGR, owing to the increasing demand for novel and space-efficient devices in premium consumer electronics. Leading manufacturers are investing heavily in foldable smartphones, foldable tablets and even foldable laptops which are designed to increase screen size while maintaining portability. Improved materials and life expectancy of panels are expanding commercial roll-out globally.

By End-Use Industry

Consumer electronics held an 80.2% share in the AMOLED display market in 2024, primarily due to widespread commercialization in smartphones, smartwatches, tablets, laptops, and televisions. Due to the need for high-resolution, efficient, and good-looking displays AMOLED is now the best technology for high, and even middle-end consumer electronics. AMOLED displays found their way deep into consumer electronics, driven by visual enhancement features and construction flexibility, and top manufacturers such as Samsung, Apple, and Huawei still combine AMOLED panels to increase the quality of viewing experience and provide unique designs.

AMOLED Display Market Regional Analysis:

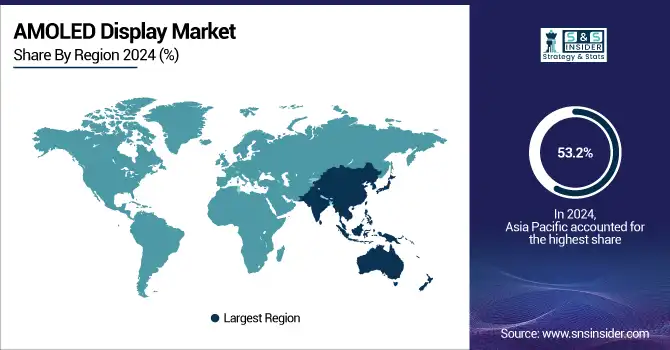

Asia Pacific was the highest revenue contributor to the AMOLED display market in 2024, accounting for 53.2% of the total share, and anticipated to grow with the highest CAGR from 2025-2032. Such growth can be attributed to robust manufacturing capabilities, increasing consumer electronics requirement, and advancement in technology by regional players. South Korea, China, and Japan have continued to pour their technological resources into developing the production lines and the research and development (R&D) that go with them for OLED. Regional Growth We are seeing regional growth as well, driven by wider smartphone and smart device adoption across India and Southeast Asia.

Get Customized Report as per Your Business Requirement - Enquiry Now

The dominant position of South Korea in the Asia Pacific AMOLED market was achieved by the Goliaths of the field, Samsung Display and LG Display, thanks to a deep technological knowhow, strong production infrastructure and the global supply chain ownership in OLED panel manufacturing.

North America continued leading the AMOLED display market in 2024 owing to high demand of premium consumer electronics, smart wearables and advanced automotive display systems in the region. The strong purchasing power along with widespread technology adoption and rising investment in electric vehicles and healthcare devices using AMOLED technology are some of the factors propelling growth in the region. AMOLED panels help U.S.-based tech companies expand their way toward a UI and energy-efficient future, while the strategic collaborations with Asian manufacturers make sure of the steady supply of innovative displays for the smartphones, tablets, and infotainment systems.

Europe contributed significantly to the AMOLED display market share in 2024, with the automotive, healthcare, and industrial sectors embracing this technology. European automakers have begun extensive, aggressive adoption of AMOLED displays in digital dashboards and infotainment to improve the driver experience. Favorable trends are driven by the growing adoption of smartwatches, AR/VR devices, and medical monitoring systems. Countries such as Germany and France are spearheading innovation and adoption underpinned by partnerships with Asian display manufacturers, along with a surge in sustainable, high-performance electronic components.

In 2024, Latin America and the Middle East & Africa represented emerging regions in the AMOLED display market, showing gradual growth fueled by rising smartphone penetration, expanding middle-class populations, and increasing demand for modern consumer electronics. While adoption remains lower than in developed markets, regional investments in digital infrastructure, smart city projects, and automotive modernization are opening new opportunities. Brazil, UAE, and South Africa are key contributors, with growing interest in foldable devices, smart TVs, and AMOLED-equipped wearables driving future market potential.

AMOLED Display Companies are:

The Major Players in AMOLED display Market are Samsung Display, LG Display, BOE, TCL CSOT, Visionox, E3 Display, AUO, Royole, JDI, Sharp, Tianma, Truly, EverDisplay, Govisionox, HKC, Innolux, Kyocera, FlexEnable, Universal Display Corp., and BOET.

Recent Developments:

-

In December 2024, Samsung Display forged a strategic partnership with Dolby Laboratories to offer automotive OLED panels pre-tuned for Dolby Vision HDR, enhancing in-car display quality and easing implementation for automakers.

-

In May 2025, LG Display showcased its Stretchable automotive display capable of expanding up to 50% in fascia areas, alongside its fourth‑generation OLED panels using “Primary RGB Tandem” tech delivering up to 4,000 nits brightness optimized for future mobility and premium monitors.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 15.49 Billion |

| Market Size by 2032 | USD 60.29 Billion |

| CAGR | CAGR of 18.55% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type (Smartphones, Smartwatches & Wearables, Televisions, Laptops & Tablets, and Automotive Displays, Others (digital signage, industrial devices)) • By Technology Type (Passive Matrix OLED (PMOLED), and Active Matrix OLED (AMOLED)) • By Panel Type (Rigid AMOLED, Flexible AMOLED, Foldable AMOLED, and Transparent AMOLED) • By End-Use Industry (Consumer Electronics, Automotive, Healthcare, Industrial & Commercial, and Others (defense, aerospace)) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Taiwan, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Samsung Display, LG Display, BOE, TCL CSOT, Visionox, E3 Display, AUO, Royole, JDI, Sharp, Tianma, Truly, EverDisplay, Govisionox, HKC, Innolux, Kyocera, FlexEnable, Universal Display Corp., and BOET. |