Topical Drugs Market Size Overview:

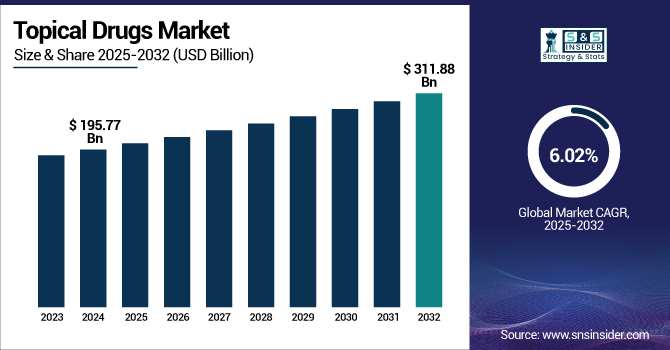

The Topical Drugs Market size was valued at USD 195.77 billion in 2024 and is expected to reach USD 311.88 billion by 2032, growing at a CAGR of 6.02% over the forecast period of 2025-2032.

To Get more information on Topical Drugs Market - Request Free Sample Report

The rising prevalence of chronic diseases and skin ailments, as well as developments in drug delivery technologies, are driving the strong expansion of the topical drugs market.

For instance, the World Health Organization estimates that diabetes and skin conditions are major causes of 74% of global deaths attributed to chronic diseases.

Reflecting great regulatory backing, the U.S. Food and Drug Administration (FDA) keeps approving creative topical formulations. Rising with a CAGR of 5.96% during the forecast period, the U.S. topical drugs market was valued at USD 62.26 billion in 2024 and is expected to reach USD 98.71 billion by 2032, thereby accounted for a significant share of the global topical drugs market. North America leads in market share because of its high concentration of topical drug companies, modern healthcare infrastructure, and large R&D expenditure. Government figures show a rising desire for non-invasive treatments; topical drug delivery technologies are becoming more and more favored for their focused action and low systemic adverse effects. These elements are guiding the present topical drugs market trends and driving the market growth.

Convenience and efficacy of topical therapies are being enhanced by developments in medication delivery, including nanotechnology and transdermal patches. These developments improve skin absorption and enable regulated release, hence increasing patient compliance. Because they are non-invasive, almost 60% of North American patients choose topical treatments. China and India also show similar patterns, whereby tailored topical medications are becoming more easily available due to advancements in healthcare.

Topical Drugs Market Dynamics

Drivers

-

Rising Global Prevalence of Skin Disorders and Chronic Diseases Is Hastening the Expansion of the Topical Drug Market

The need for topical medications is being driven by the explosion in skin conditions, including psoriasis, eczema, and atopic dermatitis, as well as by the worldwide increase in chronic diseases such as diabetes.

The National Center for Biotechnology Information (NCBI) reports that psoriasis affects almost 1.92% of Europeans and 1.5% of North Americans, so stressing a sizable patient pool needing continuous topical treatments.

With almost 75% of those affected living in low-and middle-income nations, the International Diabetes Federation (IDF) estimates global diabetes cases to rise from 643 million in 2030 to 783 million by 2045. This epidemiological trend directly fuels the expansion of the market since topical drug delivery systems are employed more and more to treat diabetic foot ulcers and neuropathic pain, therefore avoiding hepatic first-pass metabolism and enhancing patient outcomes.

The topical pharmaceuticals market is being revolutionized by fast developments in drug delivery technologies, including nanostructured lipid carriers, microemulsions, and transdermal patches. Predicting formulation behaviour, optimizing nanocarrier design, and developing customized topical treatments depending on patient-specific data, including skin type and medical history, depends on artificial intelligence (AI), which is today playing a vital role.

Restraints

-

Topical Drug Adoption is Significantly Hampered by Adverse Skin Reactions and Patient Sensitivities

Widespread use of topical drugs is often limited by the risk of skin irritation, allergic reactions, and sensitization, which can cause mild pain to severe responses needing medical intervention, often limiting the widespread use of topical medications. The variation in personal skin types and sensitivity makes it more difficult to create generally safe formulas, so the manufacturers' burden of doing comprehensive safety and compatibility testing is raised. The regulatory environment reflects this difficulty as authorities, including the European Medicines Agency (EMA), have developed new rules on the quality and equivalency of locally applied, locally acting cutaneous products, effective from April 2025. These rules stress strict in vitro release and permeation testing to guarantee product safety and efficacy, therefore adding to the difficulty and expense of introducing novel topical medications to the market. Such negative consequences and regulatory scrutiny might cause delays in product introductions and restrict patient adoption, restraining overall market growth.

Topical Drugs Market Segmentation Analysis

By Route Of Administration

With a 55% share, the dermal medication delivery retained the highest topical medicines market share in 2024. The great frequency of skin illnesses and the efficiency of dermal formulations in offering localized therapy help to explain this predominance. The American Academy of Dermatology estimates that skin problems impact over 85 million Americans yearly, which fuels demand for improved dermal treatments. The U.S. FDA has approved several novel dermal products, therefore demonstrating regulatory support for innovation in recent years. One prominent topical drugs market trend is artificial intelligence-driven formulation development; AI tools now forecast ideal nanocarrier compositions for improved drug penetration and stability.

For instance, using microencapsulation technology, Sol-Gel Technologies and Galderma introduced Epsolay (benzoyl peroxide cream), for which FDA clearance was granted in April 2022.

The ophthalmic drug delivery segment is predicted to grow at high pace, driven by the rising frequency of eye diseases. The CDC notes the need for efficient ophthalmic therapies since 12 million Americans forty years of aged and above suffer vision problems. Improving drug retention and patient outcomes, recent advancements include the introduction of nanotechnology-based delivery methods and sustained-release ophthalmic formulations.

For instance, reflecting the area's dedication to creative therapies, Germany became the first nation in October 2024 to introduce LEO Pharma's Anzupgo (delgocitinib) cream for severe hand eczema.

By Type

With a 60% revenue share in 2024, the semi-solid formulations segment dominated the topical drug market. These formulations are preferred for their simplicity of application, adaptability, and capacity to deliver continuous targeted treatment. Reflecting strong regulatory support, the U.S. FDA and EMA have fast-tracked semi-solid goods. Cost savings and rising demand for dermatology goods are driving the Asia Pacific region, especially India and China, as a manufacturing hub due to cost efficiencies.

For example, LGM Pharma spent more than USD 6 million in March 2025 to expand its Texas facility, so increasing capacity for semi-solid and liquid medication manufacture obvious indication of Topical Drugs Market Growth.

Particularly in ophthalmic and wound care uses, liquid formulations should show a notable increase. These formulations are appropriate for elderly and young individuals and show quick absorption. Supported by legislative changes and more healthcare expenditure, the Asia Pacific region is seeing a surge in liquid formulation manufacturing. Upperton Pharma Solutions completed a new sterile manufacturing plant in the UK in January 2025 to improve the capacity of the area to provide liquid topical treatments.

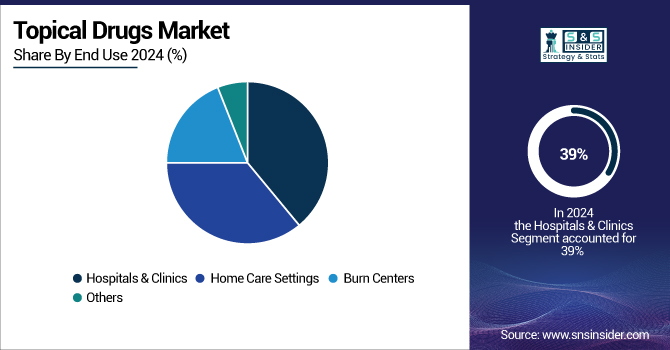

By End Use

Hospitals and clinics held the largest topical drugs market share 39%, in 2024. This is a result of the great number of individuals needing specific treatment for ocular and dermatological diseases. The global hospital services market was valued at USD 4.38 trillion in 2023 with North America owning a 38.56% of global share. Although public and community hospitals predominate, their emphasis on advanced and specialized treatment is helping private hospitals to gaining share.

Driven by growing burn injury cases and more investment in specialist care, burn centers are expected to see significant growth of topical drugs market. Government programs aimed at enhancing emergency care help to explain the rising number of specialists burn units. Reflecting continuing infrastructure investment, Tampa General Hospital opened a new regional burn center in March 2023.

Topical Drugs Market Regional Outlook

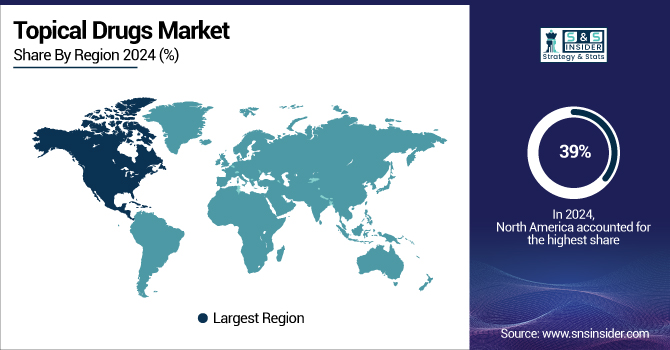

In 2024, North America accounted for approximately 39% of the global topical drug market. While a supportive reimbursement system promotes the acceptance of premium and patented topical medicines, strict regulatory criteria guarantee product safety and efficacy. Remarkably strong over-the-counter (OTC) sales reflect a health-conscious populace and great consumer awareness. Increased R&D expenditure and the acceptance of new technologies such as nanotechnology and microencapsulation for better drug delivery are driving the North America's contract development and manufacturing organization (CDMO) market is thriving. These factors collectively drive sustained topical drugs market growth and reinforce North America’s leadership in the global landscape.

By 2032, the U.S. topical drugs market is expected to reach USD 98.71 billion. Major topical medicine companies, strong research and development infrastructure, and a favourable regulatory environment headed by the U.S. Food and Drug Administration (FDA) are driving this rise. The region is a hub for innovation, with so many startups and established companies creating innovative delivery methods, including micro-needles, patches, and gels to improve drug absorption and efficacy.

The Asia Pacific region is expected to be the fastest-growing region with a CAGR of 6.53% over the forecast period in the global topical drug market. Cost-effective production, a developing pharmaceutical sector, and large patient pools in nations including China, India, and Indonesia help to explain this expansion. The growing middle class in the area, rising disposable incomes, and rising healthcare costs have driven demand for both generic and creative topical medications. Driven by increasing urbanization, legislative changes, and a sizable population base, China especially stands out as the fastest-growing nation in the sector. Given that most multinational medicine companies run production facilities in India, the country's global supply of reasonably priced topical generics is especially important.

Europe holds a prominent position in the topical drugs market. Strong regulations, strict standards of quality for manufacturing, and an emphasis on invention define the market. Leading pharmaceutical companies and CDMOs guarantee product safety and efficacy by using modern technology and upholding strict compliance with EU rules. With the NCBI noting a psoriasis incidence of 1.92% in Europe, skin illnesses, including psoriasis and eczema, continue to be rather common. This is in line with a consistent flow of new product introductions and strategic alliances since Novartis AG's acquisition of Kedalion Therapeutics for ocular medication delivery technology keeps driving market expansion.

Supported by increasing government investment in healthcare facilities and growing pharmaceutical spending, the LAMEA area is seeing a consistent topical drug market expansion. Leading market in Latin America, Brazil gains from a rising middle class and increased access to healthcare facilities. Saudi Arabia and other Middle Eastern nations are making major progress in pharmaceutical manufacture and healthcare modernization, drawing both local and foreign topical medicine companies. LAMEA is likely to become more and more significant in the worldwide topical medications market as these nations keep spending on healthcare infrastructure and implementing global best practices.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players in the Topical Drugs Market

The key topical drugs companies are Bayer AG, MedPharm Ltd., Encore Dermatology Inc., GSK plc, Johnson & Johnson Services, Inc., Cipla, Novartis AG, Bausch Health Companies Inc., Crescita Therapeutics Inc., Merck KGaA, GLENMARK PHARMACEUTICALS LTD., Hisamitsu Pharmaceuticals Co., Inc., Taro Pharmaceutical Industries Ltd., Valeant Pharmaceuticals International Inc., Sanofi, and others.

Recent Developments in the Topical Drugs Industry

-

Targeting the IL-23 protein, Astellas Pharma launched a novel prescription topical foam called Skyrizi in April 2023 for treating plaque psoriasis in adults.

-

Acting by blocking the JAK1 protein, Novartis introduced Xeljanz Cream, a topical therapy for adult plaque psoriasis, in March 2023.

-

Supporting pharmaceutical formulation innovation in Asia Pacific, Clariant debuted eight new excipients at CPHI India in November 2024.

| Report Attributes | Details |

| Market Size in 2024 | USD 195.77 Billion |

| Market Size by 2032 | USD 311.88 Billion |

| CAGR | CAGR of 6.02% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Route of Administration (Dermal Drug Delivery, Vaginal Drug Delivery, Nasal Drug Delivery, Ophthalmic Drug Delivery, Rectal Drug Delivery) • By Type (Semi-solid Formulations, Solid Formulations, Liquid Formulations, Transdermal Products) • By End Use (Home Care Settings, Burn Centers, Hospitals & Clinics, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Bayer AG, MedPharm Ltd., Encore Dermatology Inc., GSK plc, Johnson & Johnson Services, Inc., Cipla, Novartis AG, Bausch Health Companies Inc., Crescita Therapeutics Inc., Merck KGaA, GLENMARK PHARMACEUTICALS LTD., Hisamitsu Pharmaceuticals Co., Inc., Taro Pharmaceutical Industries Ltd., Valeant Pharmaceuticals International Inc., Sanofi, and others |