Antenna, Transducer, and Radome Market Size & Growth:

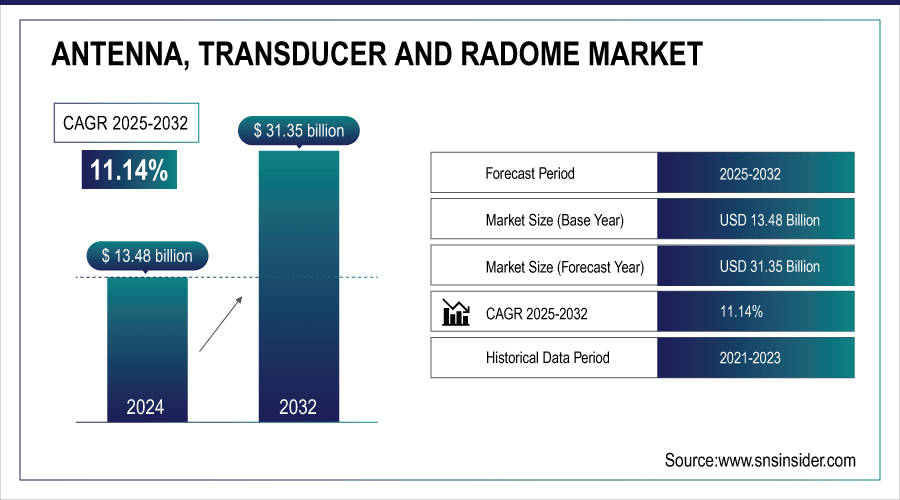

The Antenna, Transducer, and Radome (ATR) Market size was valued at USD 13.48 billion in 2024 and is expected to reach USD 31.35 billion by 2032 and grow at a CAGR of 11.14% over the forecast period 2025-2032.

The global market is broadly segmented so as to highlight the region-wise performance, the growth drivers, emerging trends, opportunity and key challenges. Antenna, Transducer and Radome market growth is being driven by the increasing need for miniaturized, low-volume, and low-profile antenna systems at high frequency in many sectors including aerospace, defense, telecommunications and satellite communication. The rapid adoption of advanced material science with the miniaturization of RF devices is enabling increased performance with reduced size and weight in next-generation communicators and detectors throughout key industries globally.

For instance, over 65% of new radar and satcom systems now operate above 30 GHz, reflecting the rapid move to high-frequency bands.

To Get More Information On Antenna, Transducer and Radome Market - Request Free Sample Report

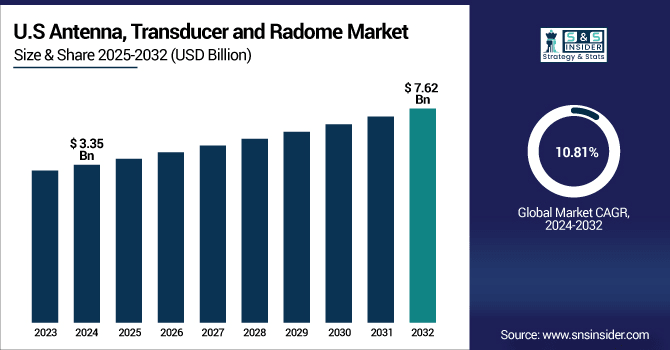

The U.S. Antenna, Transducer and Radome Market size was USD 3.35 billion in 2024 and is expected to reach USD 7.62 billion by 2032, growing at a CAGR of 10.81% over the forecast period of 2025–2032. The US market is supported by high levels of defense spending, early adoption of next-generation radar and communications systems, and the presence of large civil and military aerospace players. A growing number of investments in UAVs, space technologies and homeland security projects are intensifying demand for high-frequency antennas, advanced transducers, and rugged radomes. These techs are key for bolstering surveillance, navigation and secure communications capability of vital defense and aerospace platforms in the nation. Antenna, Transducer and Radome Market analysis reveals robust defense-driven innovation.

For instance, over 70% of newly developed radar platforms in the U.S. operate above 20 GHz for enhanced resolution and tracking capabilities.

Antenna, Transducer and Radome Market Key Drivers:

-

Surge in Defense Spending and Global Military Modernization Programs Across Key Economies Boost Market Demand Significantly

Geopolitical tensions are becoming more serious, national security concerns in which countries including the U.S., China and India have to increase their budgets on defense are rising. Those funds are increasingly dedicated to radar systems, missile guidance, electronic warfare, and satellite communications – which all utilize high-performance antennas, transducers, and radomes. Advancements in RF components are also needed to facilitate upgrades in airborne and naval platforms. The transition from traditional militaries to next-gen technologies such as 5G-enabled battlefield communication and drone-based surveillance drives demand for specialized and rugged RF components across major economies, propelling the market growth.

For instance, over 75% of defense communication systems in major economies are being upgraded to support high-bandwidth, secure RF channels.

Antenna, Transducer and Radome Market Restraints:

-

High Cost of Advanced Materials and Manufacturing Processes Hampers Adoption Among Price-Sensitive End-Users

High-performance antenna, transducer, and radome systems need specialty materials, including advanced composites, ceramics, and precision-engineered metals. These parts are fabricated together, including complex processing such as molding, thermal testing, and aerodynamic checking. Increasing their prices to the point were they are still out of reach for most low-budget defense programs, small-scale telecom operators, or developing markets. This high price barrier creates a disincentive for larger-scale deployment even when ROIs over one or two years could be achieved. Given this cost sensitivity, market penetration is hampered especially within segments outside aerospace and high-tier defense.

Antenna, Transducer and Radome Market Opportunities:

-

Proliferation of Unmanned Aerial Vehicles (UAVs) and Space-Based Missions Unlocks New Commercial and Defense Applications

With the growing network of UAV applications including surveillance, cargo delivery, disaster monitoring, and military operations the potential space for antenna and transducer systems are expected to be significant. The requirements of these platforms in terms of communication and detection systems are highly efficient low weight and thermally stable due to which they are adopting radomes and advanced materials. At the same time, commercial and national space programs are increasing launch services, which is creating new opportunities for long-life, small-size and high-frequency RF solutions. These fast emergence or high-investment sectors are promising opportunities for companies developing space-grade or UAV-optimized components.

For instance, more than 65% of newly launched satellites now fall under the small-satellite category, requiring compact RF and antenna assemblies.

Antenna, Transducer and Radome Market Challenges:

-

Advancing Smartphone Video Capabilities Creating Significant Substitution Risk for Casual Action Camera Users

Aerospace, defense, and satellite antenna and radome systems must withstand high heat, pressure, radiation and environmental extremes. Over prolonged exposure, materials — even high-tech composites are subjected to microcracking, signal loss, and thermal fatigue. Maintaining a lightweight design while ensuring durability is a recurring engineering dilemma. Catastrophic failures can occur when components degrade during a mission, when subjected to harsh climates. As a result, there are increasing demands on manufacturers to improve their thermal tolerance and transparency to electromagnetic irradiation at the same time without increasing the cost or weight of the units.

Antenna, Transducer and Radome Market - Key Segmentation

Antenna, Transducer and Radome Market, By Material

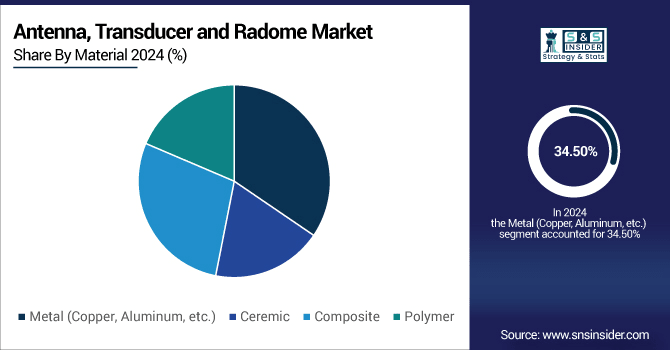

Metal segment held the largest share of 34.50% market in 2024 due to the exceptional electrical conductivity and mechanical strength. Both materials are still vital for the production of traditional antennas and transducers in defence and telecommunications sectors. As described here, aluminium based components are utilized within aerospace antenna assemblies from a major producer, Honeywell International, which further illustrates why metal-based systems are cost-effective, reliable, and proven in numerous critical missions and communication networks.

The composite segment is estimate to witness a fastest growth in terms of the CAGR of 12.14% during 2024-2032 which can be increased by the demand for lightweight structures that also is highly corrosion resistant for the applications of aviation and satellite. The devices are taken to use on high-end defense and space systems, due to their better performance in rugged conditions. Separately, General Dynamics Mission Systems is adding advanced composites to some of its radome designs for military aircraft, achieving significant reductions in weight without sacrificing radar performance or structural integrity.

Antenna, Transducer and Radome Market, By Type

The Aperture Antenna segment held the highest revenue share of 30.60% in 2024, owing to its high directional gain and extensive usage in satellite communications and aerospace, resulting in significant growth of this segment in the coming years. They are popular due to their high accuracy in radar and communication systems. Aperture antennas are another type still used very extensively, and Northrop Grumman heavily uses aperture antennas in their airborne surveillance systems, confirming the type's position on high-performance platforms globally, both military and commercial.

The Traveling Wave Antenna segment is anticipated to be growth at the highest CAGR of 12.83%. The above antennas are all wideband antennas that are critical for modern radar and electronic warfare systems. The growing penetration of these technologies in aerospace and defense is driving their demand. Traveling wave antennas for broadband radar applications are under development by Cobham Advanced Electronic Solutions, and making a significant impact on the speed and effectiveness of the capabilities makeover of this part of the market and the global defense programs that embrace them.

Antenna, Transducer and Radome Market, By Application

In 2024, the Aerospace and Defense segment accounted for the largest Antenna, Transducer and Radome market share of 38.70% due to high defense budgets globally along with the economic and strategic benefits offered by UAVs and radar systems. Such applications require high-reliability RF components suitable for a variety of air, land, and naval platforms. Furthermore, Raytheon Technologies is a key provider of advanced antenna and radar systems for military jets and missile defense, further solidifying the mission-critical applications vertical as the largest for conventional-based systems.

Satellite Communications will grow at a CAGR of 12.30% during 2024 to 2032, with growing global broadband satellite programs and constellations such as LEO and MEO. This will require lightweight and high frequency antennas and radomes. Antennas are currently being delivered by L3Harris Technologies for critical satellite payloads and ground stations that enable high-data-rate space communications and continuous coverage in rural and isolated geographic areas.

Antenna, Transducer and Radome Market, By Frequency

High Band frequencies comprising microwave and millimeter wave are used in many applications (e.g., radar, 5G backhaul, and satellite links), they generated 49.70% of revenue in 2024. This means that these frequencies have increased precision and increased data speed. Keysight Technologies offers important validation solutions for high-band gadgets to enable massive adoption of the segment across defense and telecom applications globally, reinforcing its market leadership in the segment.

The Terahertz segment is estimated to see the highest CAGR of 11.70%, during 2023 to 2032, due to rise in applications of imaging, spectroscopy, and high-data-rate communications. Though relatively new, this set appears promising for use in security scanning and science. As a leading terahertz technology developer, TeraView Ltd. is growing its range of applications for the defense and industrial sectors, driving commercial traction in the segment through innovative first-mover advantages.

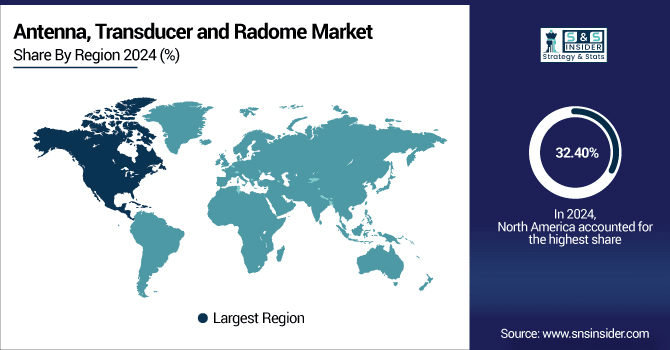

Antenna, Transducer and Radome Market Regional Analysis:

North America accounted for a 32.40% revenue share of the global market in 2024, spurred by the U.S. Underpinned by a high defence expenditure, a mature aerospace ecosystem and high capability in radar, communication and space systems, this leadership. Continued propositions through RF technologies from the companies including Raytheon, Lockheed Martin and Northrop Grumman amongst others, transmit the demand for antennas, radomes, and transducers in military, aviation, and telecom applications.

Get Customized Report as Per Your Business Requirement - Enquiry Now

-

The U.S. dominates the North American market due to massive defense spending, advanced aerospace infrastructure, and leading companies such as Lockheed Martin and Raytheon. Strong R&D capabilities and early adoption of high-frequency communication systems further reinforce its leadership.

The Asia Pacific region is expected to register the highest CAGR of 12.35% during the forecast period of 2024 to 2032. The swift defense upgrades in China, India, and South Korea, along with growing telecom & satellite projects are demanding politano advanced antenna systems. Regional adoption is being boosted by government investments in space exploration, smart city infrastructure and indigenous defense manufacturing. The acceleration is further accelerated due to growing private-public partnership or increasing local component manufacturers.

-

China leads the Asia Pacific market through large-scale defense modernization, rapid satellite and telecom infrastructure growth, and government-backed aerospace initiatives. Companies such as CETC and CASIC drive innovation, enabling China to maintain technological and production dominance in this region.

Europe occupies a large market size share in Antenna, Transducer and Radome Market due to strong aerospace industry, strong collaborative defense between individual EU nations and the evolution of satellite communication programs. France, Germany, and the UK are making major contributions, with top businesses including Airbus and Thales. Advances in technology and NATO-directed modernization and expansion are still pulling the region along.

-

Germany dominates the European market due to its advanced aerospace manufacturing, high defense spending, and strong R&D capabilities. Companies including HENSOLDT and Rohde & Schwarz lead innovation in radar and communication systems, supporting Germany’s leadership across military and aerospace applications.

Saudi Arabia leads the Middle East & Africa market owing to high defense budget, military modernization and investments on radar systems. With a robust aerospace industry, dynamic satellite programs, and active support for defense technology development, Brazil is well positioned as a regional growth driver in Latin America, along with the two nations.

Antenna, Transducer and Radome Market Key Players:

-

Raytheon Technologies Corporation

-

Northrop Grumman Corporation

-

L3Harris Technologies, Inc.

-

Thales Group

-

Airbus SE

-

Honeywell International Inc.

-

Cobham Limited

-

General Dynamics Corporation

-

Leonardo S.p.A.

-

Rohde & Schwarz GmbH & Co KG

-

HENSOLDT AG

-

Saab AB

-

Boeing Defense

-

Space & Security

-

CAES (Cobham Advanced Electronic Solutions)

-

Israel Aerospace Industries (IAI)

-

Elbit Systems Ltd., TCOM L.P.

-

Bharat Electronics Limited (BEL).

Antenna, Transducer and Radome Market Recent Developments:

-

In April 2024, Raytheon launched GaN-on-SiC phased-array antennas, delivering over 30% efficiency gains and ~60% weight reductions, advancing military SATCOM and radar system performance.

-

In December 2024, L3Harris partnered with ThinKom and SNC to introduce the ThinAir GT 2517 phased-array antenna for Beyond-Line-Of-Sight (BLOS) airborne connectivity, marking a key milestone in high-speed satcom integration.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 13.48 Billion |

| Market Size by 2032 | USD 31.35 Billion |

| CAGR | CAGR of 11.14% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Aperture Antenna, Lens Antenna, Reflector Antenna, Traveling Wave Antenna and Wire Antenna) • By Application (Aerospace and Defense, Automotive, Telecommunications, Satellite Communications and Medical) • By Frequency (Low Band (LF/MF/HF), Medium Band (VHF/UHF), High Band (Microwave/Millimeter Wave) and Terahertz) • By Material (Metal (Copper, Aluminum, etc.), Ceremic, Composite and Polymer) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia,Taiwan, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Lockheed Martin Corporation, Raytheon Technologies Corporation, Northrop Grumman Corporation, L3Harris Technologies, Inc., Thales Group, BAE Systems plc, Airbus SE, Honeywell International Inc., Cobham Limited, General Dynamics Corporation, Leonardo S.p.A., Rohde & Schwarz GmbH & Co KG, HENSOLDT AG, Saab AB, Boeing Defense, Space & Security, CAES (Cobham Advanced Electronic Solutions), Israel Aerospace Industries (IAI), Elbit Systems Ltd., TCOM L.P. and Bharat Electronics Limited (BEL). |