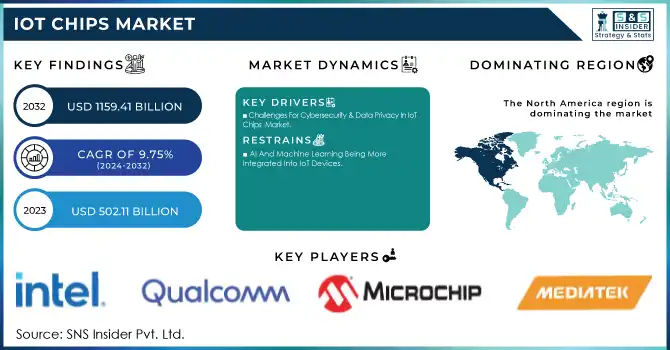

IoT Chips Market Size & Overview:

The IoT Chips Market Size was valued at USD 502.11 billion in 2023, is expected to reach USD 1159.41 billion by 2032, growing at a CAGR of 9.75% over the forecast period 2024 to 2032.

Increased market penetration of IoT systems, the evolution of connectivity technologies, and higher demands for low-power, performance-effective chips that accelerate smart solutions deployed across various industrial platforms have amassed this growth.

Get more information on IoT Chips Market - Request Sample Report

IoT Chips Market Dynamics

Drivers:

-

Increasing Requirement For Application-Oriented Mcus And Adaptable Soc Layouts In IoT Chips Industry

Applications for interconnected enhanced devices in the form of application-specific microcontrollers (MCUs) and flexible system-on-chip (SoC) designs are driving double-digit market growth in the IoT semiconductor type. These chips provide custom solutions that improve performance, minimize power use, and maintain space efficiency for IoT devices. As an example, Nordic Semiconductor's nRF54H20 SoC includes multiple Arm Cortex-M33 processors and RISC-V coprocessors, achieving an ULPMark-CM score of 170, with 515 Core Mark, when configured for best processing efficiency, and a score of 132, with 1290 Core Mark, when configured for best performance. Such processing efficiency combined with performance allows replacing separate general-purpose MCUs and wireless SoCs with compact ones to create smaller and energy-efficient IoT products. The demand for such specialized and flexible chips is rising with the industrial diversity and complexity of IoT Progressions in silicon manufacturing technology are driving the trend.

Restraints:

-

Challenges For Cybersecurity & Data Privacy In IoT Chips Market

Security and privacy issues are major challenges for the IoT semiconductor market due to the large-scale usage of IoT chips among different industries. Research also indicates that 98% of IoT traffic remains unencrypted, which leaves devices open to multiple cyber threats like malware, data breaches and unauthorized access, with 43% of IoT devices carrying medium to high risk vulnerabilities. While PUF-based RoT (root-of-trust) and RISC-V security chips provide additional security, achieving adequate embedded security is still a complex problem. Also, complying with global data privacy requirements adds to the costs, hindering the adoption of IoT chips. To address evolving cyber risks, strengthening your runtime security posture is crucial.

Opportunities:

-

AI And Machine Learning Being More Integrated Into IoT Devices

This growing convergence of AI and ML with IoT devices presents a massive opportunity within the IoT chip market particularly for chips capable of executing AI workloads directly at the edge. Demand for AI-powered IoT chipsets is increasing as organizations from diverse sectors embrace these advanced capabilities. More than 50% of chip-dependent, organizations fear that there will be a shortage of supply of semiconductors by 2027 resulting in a higher demand for the custom IoT chips that are capable of handling AI workloads. Work on providing next-generation AI chip to the world is currently in progress, which by this month includes new chips like Tiny AI chips capable of providing 6x better battery life for smart gadgets, IBM's latest innovations and more. Proliferation of Generative AI applications has also led to the increased demand for specialized IoT chips that can enable real-time data processing, predictive analytics, and automation, making it a lucrative market opportunity for IoT chip manufacturers.

Challenges:

-

High Power Consumption In IoT Chips Straitening Efficient Performance Of Devices

The issue of high power consumption from connected devices is a major hindrance for IoT chips market. Such continuous connectivity is a necessity for IoT devices, leading to high-energy consumption. To save battery life in a range of applications, the adoption of low power chips that require very little energy is essential, yet the development of such chips has proven to be a significant barrier. As internal energy-saving technologies like the dual-core processor help, reduce the energy consumption of IoT devices by up to 3 times. Even new entrants like Mind grove are working on cheap, high-performance chips targeting smart devices, but power management remains an issue in IoT SoC designs. Although there have been real breakthroughs around enabling flexible connectivity IP, great power management is still one of the main challenges across everything and definitely within devices with connectivity constraints.

IoT Chips Market Segment Insights:

By Product

In 2023, processors segment dominated the IoT chips market, with 33% market share. fueled by increasing demand for advanced sensors in the healthcare, automotive and smart home sectors. And this trend underscores both sensors and processors being critical enablers of the performance and innovation of IoT devices.

The fastest-growing segment of the IoT chips market over the Forecast period (2024-2032) is sensors, driven by rising demand for sophisticated sensors in smart homes, healthcare, autonomous vehicles, and industrial IoT. Real-time monitoring, automation and decision making has become pervasive business models leading to market growth for these sensors.

By Connectivity

In 2023, the Wi-Fi segment led the IoT chips market with a 35% market share as Wi-Fi's popularity in IoT devices offers stable, high-speed connectivity. It does it for the applications in smart homes, healthcare, industrial automation and automotive. Wi-Fi 6 and 7 innovations also help performance-wise these newer standards allow for higher speeds, lower latency, and better security.

Cellular Networks segment is anticipated to grow fastest from 2024 to 2032, which is primarily a result of long-range, reliable connectivity demand. Cellular 5G technologies can enable high-speed, low-latency, and high-capacity applications in healthcare, automotive and smart cities IoT applications.

By End-user

In 2023, the largest segment of the IoT chips market was Consumer Electronics with an estimated 25% market share. The growth is to the increasing incorporation of IoT chips in devices like smartphones, smart wearables, and home appliances, reflecting consumers' desire for connected, efficient solutions. Low power consumption and better connectivity are among chip technologies that will continue to strengthen this segment.

The healthcare segment is the most developed in the market during the forecast span of 2024 to 2032, which is primarily attributed to the increasing utilization of IoT-enabled medical devices and wearables to provide real-time monitoring, diagnostics, and personalized care, thereby improving healthcare efficiency and accessibility.

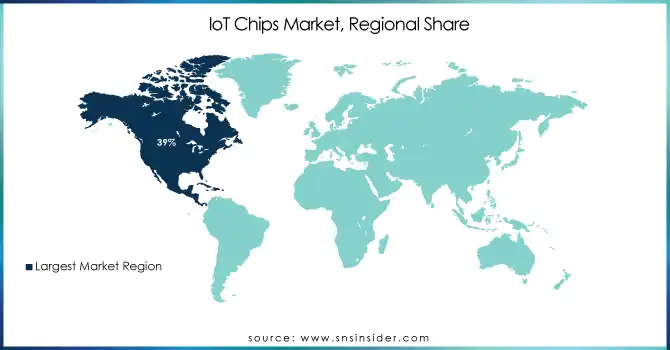

IoT Chips Market Regional Analysis:

North America dominated the IoT chips with a 39% share of the total revenue in 2023. This is attributed to the advanced technology infrastructure in the region, high R&D investments, and demand for connected devices across various sectors, including healthcare, automotive, and consumer electronics. Countries such as the United States and Canada are major contributors, as the U.S. is a global leader in smart city initiatives, industrial automation, and healthcare innovators. The region's rapid adoption of 5G, AI and IoT technologies is likely to continue to propel market growth in the region and also hold a considerable share of the global IoT chips market.

The Asia-Pacific region is expected to grow the most quickly in the IoT chips market over the forecast period (2024-2032). The growth of IoT platform market is driven by the rapid advancement in technology, increasing adoption of IoT devices across different domains and supportive government programs in countries like China, India and Japan for digital transformation initiatives. The increasing adoption of IoT devices in smart homes, industrial automation, healthcare, and connected transportation in the region is also contributing to the market. Moreover, the deployment of 5G networks coupled with developments in semiconductor technologies drives the adoption of IoT chip applications across different establishments in the region.

Need any customization research on IoT Chips Market - Enquiry Now

Key Players

Some of the major players in IoT Chips Market along with their product:

-

Qualcomm Technologies (U.S.) (Snapdragon IoT Chips)

-

Samsung Electronics Co., Ltd. (South Korea) (Exynos IoT Chips)

-

Intel Corporation (U.S.) (Atom IoT Chips)

-

MediaTek Inc. (Taiwan) (Dimensity IoT Chips)

-

Texas Instruments (U.S.) (SimpleLink IoT Chips)

-

STMicroelectronics (Switzerland) (STM32 IoT Chips)

-

NXP Semiconductors (Netherlands) (i.MX IoT Chips)

-

Broadcom (U.S.) (Broadcom IoT Chips)

-

Huawei (China) (Kirin IoT Chips)

-

Microchip Technology Inc. (U.S.) (PIC32 and SAM IoT Chips)

-

Marvell Technology Group Ltd. (Bermuda) (Arm-based IoT Chips)

-

Cypress Semiconductor Corporation (U.S.) (PSoC IoT Chips)

-

Renesas Electronics Corporation (Japan) (RX and RL78 IoT Chips)

-

NVIDIA Corporation (U.S.) (Jetson IoT Chips)

-

Advanced Micro Devices (U.S.) (AMD Ryzen IoT Chips)

-

TE Connectivity Ltd (Switzerland) (IoT Sensors and Connectivity Solutions)

-

Nordic Semiconductor (Norway) (nRF IoT Chips)

-

GainSpan (U.S.) (Wi-Fi IoT Solutions)

-

Expressif Systems (China) (ESP IoT Chips)

-

Dialog Semiconductor (U.K.) (SmartBond IoT Chips)

-

Silicon Labs (U.S.) (Wireless Gecko IoT Chips)

List of suppliers in the IoT chips market who provide raw materials:

-

BASF

-

Dow Inc.

-

LG Chem

-

Sumitomo Chemical

-

Wacker Chemie AG

-

Mitsubishi Chemical

-

DuPont

-

Eastman Chemical Company

-

SABIC

-

Henkel AG & Co. KGaA

-

Toray Industries

-

3M

-

Ferro Corporation

-

Kraton Polymers

-

Asahi Kasei Corporation

Recent Development

-

January 30, 2025, Samsung shares tumble over memory chips market weakness concerns Samsung posted a steep decline in operating profit as costs surge in its chip division, but earnings beat expectations.

-

October 1, 2024 Qualcomm Acquires Sequans’ 4G IoT Technology for USD 200 Million Qualcomm announced today that it has completed its acquisition of Sequans Communications' 4G IoT technology for USD 200 million, strengthening its semiconductor portfolio. The Monarch chips will deliver higher performance, lower power consumption, and smaller size

-

August 14, 2024 Intel aims squarely at China’s EV market with new AI chip Intel introduced a new GPU meant for use in vehicle AI applications as it seeks a play for China’s rapidly growing electric vehicle sector, even as Washington pushes to limit high-tech sales to China.

| Report Attributes | Details |

| Market Size in 2023 | USD 502.11 Billion |

| Market Size by 2032 | USD 1159.41 Billion |

| CAGR | CAGR of 9.75% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Processors, Connectivity Integrated Circuits (ICs), Sensors, Memory Devices, Logic Devices) • By Connectivity (Wi-Fi, Bluetooth, RFID, Cellular Networks, Others (ZigBee, LPWAN technologies)) • By End-user (Healthcare, Consumer Electronics, Automotive, BFSI, Retail, Building Automation, Others (Manufacturing)) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Qualcomm Technologies (U.S.), Samsung Electronics Co., Ltd. (South Korea), Intel Corporation (U.S.), MediaTek Inc. (Taiwan), Texas Instruments (U.S.), STMicroelectronics (Switzerland), NXP Semiconductors (Netherlands), Broadcom (U.S.), Huawei (China), Microchip Technology Inc. (U.S.), Marvell Technology Group Ltd. (Bermuda), Cypress Semiconductor Corporation (U.S.), Renesas Electronics Corporation (Japan), NVIDIA Corporation (U.S.), Advanced Micro Devices (U.S.), TE Connectivity Ltd (Switzerland), Nordic Semiconductor (Norway), GainSpan (U.S.), Expressif Systems (China), Dialog Semiconductor (U.K.), Silicon Labs (U.S.). |