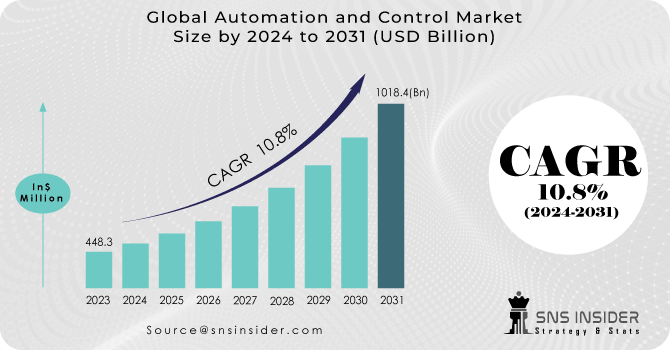

Automation and Control Market Size was valued at USD 448.3 billion in 2023 and is expected to reach USD 1018.4 billion by 2031, growing at a CAGR of 10.8% over the forecast period 2024-2031.

The Automation and Control Market comprises a diverse range of technologies and solutions aimed at automating and optimizing industrial processes across multiple sectors. Core technologies like robotics and sensors streamline operations, enhancing productivity and efficiency by automating tasks previously done by humans, leading to cost savings and reduced errors. Deployed across industries such as manufacturing, automotive, energy, and pharmaceuticals, automation solutions cover various applications like production line automation and predictive maintenance. Key components such as PLCs, SCADA systems, and HMIs collaborate to create tailored solutions, addressing industry-specific needs. Market growth is driven by factors such as the demand for operational efficiency, Industry 4.0 adoption, and technological advancements in AI and IoT, shaping its evolution towards sustained innovation to meet global industry demands.

Get more information on Automation and Control Market - Request Sample Report

KEY DRIVERS:

The increasing demand for industrial automation stems from the diverse requirements for efficiency, productivity, and competitiveness in contemporary business settings. Technologies such as robotics, sensors, and advanced control systems cater to these needs by automating tasks traditionally undertaken by human workers. This transition is imperative for firms aiming to streamline operations, curtail expenses, and bolster overall performance. Furthermore, automation facilitates the real-time monitoring, analysis, and optimization of production processes, facilitating swift adaptation to market fluctuations and customer preferences. Moreover, the emphasis on sustainability acts as a catalyst for automation adoption, enabling companies to optimize resource usage, minimize waste, and comply with regulations. Embracing industrial automation ultimately empowers companies to attain heightened efficiency, agility, and competitive edge amidst today's dynamic business environment.

RESTRAINTS:

OPPORTUNITIES:

Adoption of Industry 4.0 in a variety of industries.

Increase in industrial robotics.

Integrating artificial intelligence (AI) and advanced analytics into automation systems is driving innovation and efficiency, enabling predictive maintenance, optimization, and informed decision-making in the automation and control market.

CHALLENGES:

Integrating automation solutions with existing legacy systems presents a formidable challenge for organizations, necessitating meticulous planning and substantial investment to ensure smooth compatibility and functionality while modernizing operations within the automation and control market. Legacy systems, often characterized by outdated technologies and architectures, may lack the necessary interoperability and flexibility to seamlessly integrate with modern automation solutions. This integration process demands careful consideration of factors such as data formats, communication protocols, and system interfaces to ensure cohesive operation across disparate systems. Additionally, organizations must allocate resources for system upgrades, software integration, and employee training to facilitate a successful transition to integrated automation solutions. Despite the complexities involved, overcoming these integration challenges is crucial for organizations seeking to leverage the benefits of automation while maximizing the value of existing infrastructure investments.

IMPACT OF RUSSIAN-UKRAINE WAR

The Russia-Ukraine Crisis has significant implications for the Automation and Control Market across several key areas. Firstly, the conflict has disrupted global supply chains for essential components, leading to shortages and price hikes in automation systems. Moreover, sanctions on Russia have limited access to crucial technologies, hindering domestic automation progress and potentially affecting export capabilities.

Additionally, the crisis has triggered a talent drain in Russia, as skilled professionals depart, impacting the development and deployment of automation solutions. As a response to potential workforce instability, there's a predicted rise in demand for automation technologies to mitigate reliance on human labor, especially in critical sectors. Furthermore, nations may prioritize domestic manufacturing of automation technologies to reduce dependency on global markets affected by the conflict.

IMPACT OF ECONOMIC SLOWDOWN

The ongoing global economic slowdown is expected to significantly affect the automation and control market. Firstly, reduced capital expenditures may lead companies to postpone or scale back investments in new automation systems due to diminished profits and economic uncertainty.

Secondly, there may be a shift towards short-term cost-cutting measures rather than long-term automation projects as businesses prioritize immediate financial gains.

Additionally, developing economies might experience slower adoption of automation technologies due to constrained resources amidst the economic downturn. Moreover, companies may demand clearer returns on investment before implementing new systems, potentially leading to increased scrutiny of automation projects.

Furthermore, a weaker economy could tilt bargaining power towards buyers, potentially resulting in lower prices for automation equipment and services. Despite these challenges, there are opportunities for companies to enhance efficiency and productivity through automation, especially for cost reduction and labor optimization purposes.

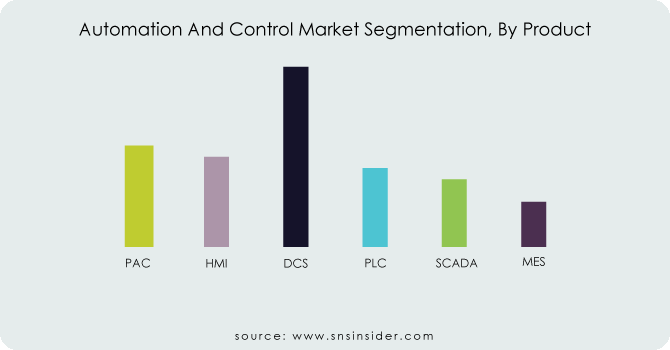

BY PRODUCT

PAC

HMI

DCS

PLC

SCADA

MES

In terms of products like SCADA, PAC, PLC, HMI, MES, and DCS, the DCS segment emerged as the market leader, capturing approx. 32% of the market share. The rapid industrialization in developing nations and the expansion of existing plants, along with their capacity, are expected to drive significant demand for DCS in the projected period.

Get a Customized Report as per your Business Requirement - Request For Customized Report

BY APPLICATION

Safety & Security

Lighting

HVAC

Others

In applications such as HVAC, Safety & Security, and Lighting, the Safety & Security segment commands the largest market share, approx. 52% in 2023. Automated systems are poised to reduce processing time and error rates, with software or technology enabling minimal human intervention, particularly advantageous within the Safety & Security category.

BY END-USE

Commercial

Hospitality

Retail

Residential

Industrial

Enterprise

Oil & Gas

Mining & Metals

Automotive & Transportation

Electrical & Electronics

Manufacturing

Aerospace & Defense

Others

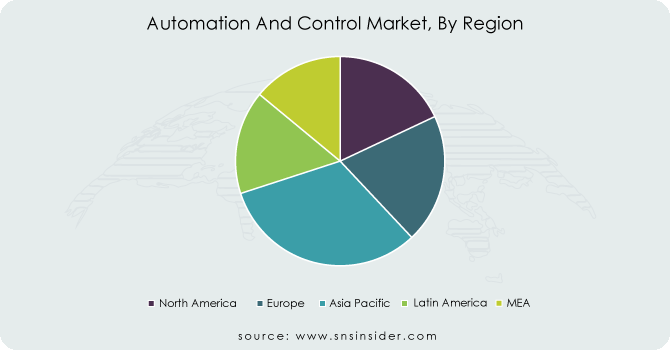

The automation and control market in the Asia-Pacific region is poised for dominance, driven by burgeoning demand within the automotive industry and substantial investments in the region.

North America follows closely, securing the second-highest market share fueled by a surge in demand for semiconductor chips.

Meanwhile, Europe's automation and control market is anticipated to experience rapid growth with a high compound annual growth rate (CAGR) in the foreseeable future.

REGIONAL COVERAGE:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

The key players in the automation and control market are ABB Group, Emerson Electric, General Electric Company, KUKA, Rockwell Automation, Bosch Rexroth, Fanuc Corporation, Honeywell International, SIEMENS AG, Schneider Electric & Other Players.

Emerson Electric-Company Financial Analysis

RECENT DEVELOPMENT

In October 2022: Cognito, a provider of industrial data software, announced a partnership with Rockwell Automation, Inc. This collaboration aims to integrate Cognito Data Fusion®, an Industrial DataOps platform, with Rockwell's FactoryTalk® software suite, enabling connectivity to industry-specific analytics and operations management applications. Together, they will develop an industrial data hub designed to facilitate scalable organization operations.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 448.3 Billion |

| Market Size by 2031 | US$ 1018.4 Billion |

| CAGR | CAGR of 10.8% From 2024 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (PAC, HMI, DCS, SCADA, PLC, MES) • By Application (Safety & Security, Lighting, HVAC, Others) • By End-Use (Commercial, Hospitality, Retail, Residential, Industrial, Enterprise, Oil & Gas, Mining & Metals, Automotive & Transportation, Electrical & Electronics, Manufacturing, Aerospace & Defense, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | ABB Group, Emerson Electric, General Electric Company, KUKA, Rockwell Automation, Bosch Rexroth, Fanuc Corporation, Honeywell International, SIEMENS AG, and Schneider Electric. |

| Key Drivers |

•Technological advancements, such as the integration of AI and IoT, are revolutionizing the automation and control market, enabling more efficient and intelligent systems. • The increasing demand for industrial automation across various sectors is driving significant growth in the automation and control market, as businesses strive to improve efficiency and remain competitive in today's rapidly evolving landscape. |

| RESTRAINTS |

• Concerns regarding data security in automation and control systems have intensified as companies seek to balance the benefits of connectivity and data accessibility with the need to protect sensitive information from cyber threats and unauthorized access. |

The Automation and Control Market was valued at USD 448.3 billion in 2023.

The expected CAGR of the global Automation and Control Market during the forecast period is 10.8%.

The Europe region is anticipated to record the Fastest Growing in the Automation and Control Market.

The Safety & Security segment is leading in the market revenue share in 2023.

The Asia-Pacific region with the Highest Revenue share in 2023.

TABLE OF CONTENTS

1. Introduction

1.1 Market Definition

1.2 Scope

1.3 Research Assumptions

2. Industry Flowchart

3. Research Methodology

4. Market Dynamics

4.1 Drivers

4.2 Restraints

4.3 Opportunities

4.4 Challenges

5. Impact Analysis

5.1 Impact of Russia-Ukraine Crisis

5.2 Impact of Economic Slowdown on Major Countries

5.2.1 Introduction

5.2.2 United States

5.2.3 Canada

5.2.4 Germany

5.2.5 France

5.2.6 UK

5.2.7 China

5.2.8 Japan

5.2.9 South Korea

5.2.10 India

6. Value Chain Analysis

7. Porter’s 5 Forces Model

8. Pest Analysis

9. Automation and Control Market, By Product

9.1 Introduction

9.2 Trend Analysis

9.3 PAC

9.4 HMI

9.5 DCS

9.6 PLC

9.7 SCADA

9.8 MES

10. Automation and Control Market, By Application

10.1 Introduction

10.2 Trend Analysis

10.3 Safety & Security

10.4 Lighting

10.5 HVAC

10.6 Others

11. Automation and Control Market, By End-Use

11.1 Introduction

11.2 Trend Analysis

11.3 Commercial

11.4 Hospitality

11.5 Retail

11.6 Residential

11.7 Industrial

11.8 Enterprise

11.9 Oil & Gas

11.10 Mining & Metals

11.11 Automotive & Transportation

11.12 Electrical & Electronics

11.13 Manufacturing

11.14 Aerospace & Defense

11.15 Others

12. Regional Analysis

12.1 Introduction

12.2 North America

12.2.1 USA

12.2.2 Canada

12.2.3 Mexico

12.3 Europe

12.3.1 Eastern Europe

12.3.1.1 Poland

12.3.1.2 Romania

12.3.1.3 Hungary

12.3.1.4 Turkey

12.3.1.5 Rest of Eastern Europe

12.3.2 Western Europe

12.3.2.1 Germany

12.3.2.2 France

12.3.2.3 UK

12.3.2.4 Italy

12.3.2.5 Spain

12.3.2.6 Netherlands

12.3.2.7 Switzerland

12.3.2.8 Austria

12.3.2.9 Rest of Western Europe

12.4 Asia-Pacific

12.4.1 China

12.4.2 India

12.4.3 Japan

12.4.4 South Korea

12.4.5 Vietnam

12.4.6 Singapore

12.4.7 Australia

12.4.8 Rest of Asia Pacific

12.5 The Middle East & Africa

12.5.1 Middle East

12.5.1.1 UAE

12.5.1.2 Egypt

12.5.1.3 Saudi Arabia

12.5.1.4 Qatar

12.5.1.5 Rest of the Middle East

11.5.2 Africa

12.5.2.1 Nigeria

12.5.2.2 South Africa

12.5.2.3 Rest of Africa

12.6 Latin America

12.6.1 Brazil

12.6.2 Argentina

12.6.3 Colombia

12.6.4 Rest of Latin America

13. Company Profiles

13.1 ABB Group

13.1.1 Company Overview

13.1.2 Financial

13.1.3 Products/ Services Offered

13.1.4 SWOT Analysis

13.1.5 The SNS View

13.2 Emerson Electric

13.2.1 Company Overview

13.2.2 Financial

13.2.3 Products/ Services Offered

13.2.4 SWOT Analysis

13.2.5 The SNS View

13.3 General Electric Company

13.3.1 Company Overview

13.3.2 Financial

13.3.3 Products/ Services Offered

13.3.4 SWOT Analysis

13.3.5 The SNS View

13.4 KUKA

13.4.1 Company Overview

13.4.2 Financial

13.4.3 Products/ Services Offered

13.4.4 SWOT Analysis

13.4.5 The SNS View

13.5 Rockwell Automation

13.5.1 Company Overview

13.5.2 Financial

13.5.3 Products/ Services Offered

13.5.4 SWOT Analysis

13.5.5 The SNS View

13.6 Bosch Rexroth

13.6.1 Company Overview

13.6.2 Financial

13.6.3 Products/ Services Offered

13.6.4 SWOT Analysis

13.6.5 The SNS View

13.7 Fanuc Corporation

13.7.1 Company Overview

13.7.2 Financial

13.7.3 Products/ Services Offered

13.7.4 SWOT Analysis

13.7.5 The SNS View

13.8 Honeywell International

13.8.1 Company Overview

13.8.2 Financial

13.8.3 Products/ Services Offered

13.8.4 SWOT Analysis

13.8.5 The SNS View

13.9 SIEMENS AG

13.9.1 Company Overview

13.9.2 Financial

13.9.3 Products/ Services Offered

13.9.4 SWOT Analysis

13.9.5 The SNS View

13.10 Schneider Electric

13.10.1 Company Overview

13.10.2 Financial

13.10.3 Products/ Services Offered

13.10.4 SWOT Analysis

13.10.5 The SNS View

14. Competitive Landscape

14.1 Competitive Benchmarking

14.2 Market Share Analysis

14.3 Recent Developments

14.3.1 Industry News

14.3.2 Company News

14.3.3 Mergers & Acquisitions

15. Use Case and Best Practices

16. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

The Energy Management Systems Market size was valued at USD 41.03 billion in 2023. It is expected to hit USD 110 billion by 2031 and grow at a CAGR of 13.1% over the forecast period of 2024-2031.

The Vacuum Sensor Market Size was valued at USD 556.3 million in 2023 and is estimated to reach USD 920.6 million by 2031 and grow at a CAGR of 6.5% over the forecast period 2023-2031.

RFID Tags Market size was valued at USD 15.8 Bn in 2023 and is expected to reach USD 36.93 Bn by 2031 and grow at a CAGR of 11.2% over the forecast period 2024-2031.

Embedded Security Market Size was valued at USD 6.77 billion in 2022 and is expected to reach USD 10.88 billion by 2030 and grow at a CAGR of 6.1% over the forecast period 2023-2030.

The IO-Link Market size was valued at USD 13.5 billion in 2022 and is expected to grow to USD 58.43 billion by 2030 and grow at a CAGR of 20.1 % over the forecast period of 2023-2030.

The Rugged Electronics Market size was valued at USD 14.2 billion in 2022 and is expected to grow to USD 28.50 billion by 2030 and grow at a CAGR of 9.1% over the forecast period of 2023-2030.

Hi! Click one of our member below to chat on Phone