Automotive Collision Avoidance System Market Size & Overview:

Get More Information on Automotive Collision Avoidance System Market - Request Sample Report

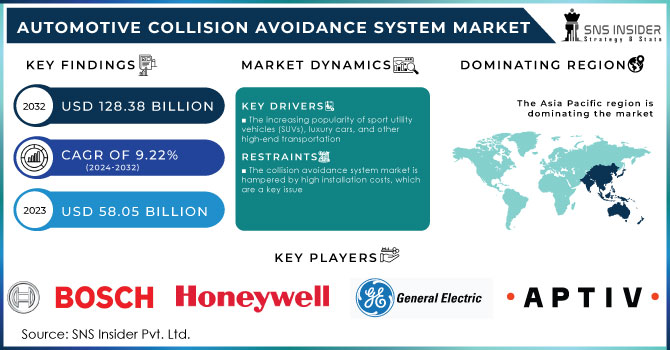

The Automotive Collision Avoidance System Market size was valued at USD 58.05 billion in 2023 and is expected to reach USD 128.38 billion by 2032 and grow at a CAGR of 9.22% over the forecast period 2024-2032.

Government regulations are pushing for the integration of advanced safety features in vehicles. For instance, the European Union has mandated the inclusion of Emergency Lane Keeping Assist (ELKA) and Autonomous Emergency Braking (AEB) systems in all new vehicles by 2022, as per UNECE regulations. Similar mandates are anticipated in other regions. Concurrently, increasing consumer awareness about safety, along with rising disposable incomes, is fueling demand for advanced driver-assistance systems (ADAS) like Collision Avoidance Systems (CAS). Furthermore, technological advancements in sensors, cameras, and LiDAR (Light Detection and Ranging) are driving down costs and enhancing efficiency in CAS development. This has led to substantial investments in the sector, exemplified by Mobileye securing $840 million in 2020 for the advancement of autonomous driving technologies. With mounting government regulations, heightened consumer demand, and ongoing technological innovation, the CAS market is positioned for a resilient and prosperous future.

MARKET DYNAMICS:

KEY DRIVERS:

-

The increasing popularity of sport utility vehicles (SUVs), luxury cars, and other high-end transportation

-

A rise in interest in self-driving cars

-

Growth in the demand for vehicles with automated driving systems

-

Visibility and safety enhancements like blind-spot collision prevention aid increase market growth

The course of the Automotive Collision Avoidance System (CAS) market is poised to be heavily influenced by advancements in features aimed at bolstering driver visibility and safety. A prime example is the burgeoning technology of blind-spot collision prevention, which employs radar or camera sensors to detect vehicles in a driver's blind spot. It issues audible or visual warnings to avert potential collisions, marking a swiftly evolving facet of automotive safety systems.

RESTRAINTS:

-

The collision avoidance system market is hampered by high installation costs, which are a key issue

-

Due to automobile sales and production being cyclical, market growth is stifled

OPPORTUNITIES:

-

An increase in the minimum safety standards for motor vehicles

-

Integration of electronic components in an automobile

-

Advanced driver assistance systems in passenger cars should boost the collision avoidance business

The emergence of Advanced Driver-Assistance Systems (ADAS) in the realm of passenger vehicles is poised to revolutionize the Automotive Collision Avoidance System (CAS) market. ADAS functionalities, such as automatic emergency braking and lane departure warnings, serve as catalysts for collision avoidance technology. By swiftly identifying potential hazards and prompting corrective actions, ADAS is paving the path towards a future with significantly fewer accidents. This momentum is further fueled by governmental mandates like the European Union's directive requiring AEB systems in all new vehicles by 2022. In the United States, the National Highway Traffic Safety Administration (NHTSA) estimates that the adoption of AEB alone could potentially prevent up to 40% of all police-reported crashes. Acknowledging this immense potential, automotive manufacturers are channeling substantial investments into advancing ADAS capabilities.

CHALLENGES:

-

Rigid barriers are less effective because more of the impact energy is passed to the car occupants, causing more injuries

-

Low-cost automobile makers avoid adding these systems, which could slow market growth

IMPACT OF RUSSIA-UKRAINE WAR:

The recent conflict in Ukraine has introduced challenges to the Automotive Collision Avoidance System (CAS) market, which previously showed a promising trajectory with a projected 10.4% Compound Annual Growth Rate (CAGR). Immediate repercussions of the war present a mixed scenario. Supply chain disruptions, particularly concerning essential components such as semiconductors often procured from Eastern Europe, are leading to production delays. Concurrently, escalating material costs due to sanctions and global energy price hikes are anticipated to inflate CAS prices. Nevertheless, amidst these challenges, there is a glimmer of hope.

Governments are redirecting their attention towards safety regulations, evident in the US government's injection of an additional $1 billion into the research and development of Advanced Driver-Assistance Systems (ADAS), a category encompassing CAS. Similar endeavors are underway in Europe and China. This renewed governmental commitment to safety, combined with increasing consumer demand for advanced driver assistance features, is poised to drive long-term market growth. While the current conflict poses immediate obstacles, it may inadvertently expedite the advancement and adoption of CAS technologies, ultimately fortifying the market in the years ahead.

IMPACT OF ECONOMIC SLOWDOWN:

An economic downturn could cast uncertainty over the automotive collision avoidance system (CAS) market, though its effects may vary. While decreased consumer spending might lead to fewer overall car purchases and potentially diminish demand for high-end CAS features in new vehicles research indicates a 10% reduction in car sales during such downturns there could be a counterbalancing increase in retrofitting existing cars with CAS features. As consumers prioritize cost-effective safety upgrades for their current vehicles over investing in new cars with advanced CAS pre-installed.

Moreover, government mandates in certain regions are driving CAS adoption. For instance, the European Union's mandate for Emergency Lane Keeping Assist (ELKA) systems in all new cars since 2022 ensures a steady demand, with similar regulations emerging elsewhere. This regulatory momentum, alongside substantial investments in CAS development reaching approximately USD 17.8 billion globally in 2023 implies that the CAS market may experience slower growth rather than a complete halt during an economic slowdown.

Market, By Product:

Get Customized Report as per Your Business Requirement - Request For Customized Report

The global market has been divided into Adaptive Cruise Control (ACC), Autonomous Emergency Braking (AEB), Lane Departure Warning System (LDWS), Parking assistance, and Others Based on the product segment. Blind-spot detection and lane departure warning systems that use cameras and radar have become more popular because their prices have gone down.

The rising need for urban parking solutions is expected to bolster the demand for parking assistance systems, while advanced features such as blind spot detection and night vision are anticipated to see increased adoption. Government mandates, like the EU's requirement for AEB implementation in new vehicles by 2022, will notably impact the distribution of market segments. According to our research, ACC currently holds a 35% market share, closely followed by AEB at 30%. LDWS and parking assistance systems are forecasted to secure approximately 20% and 15% of the market share respectively, with the remaining 10% attributed to emerging technologies.

Market, By Technology:

Government mandates, such as the US NHTSA's requirement for automatic emergency braking implementation in new vehicles by 2023, are poised to accelerate the adoption of Collision Avoidance Systems (CAS). Although precise market share projections may vary, analysts indicate that camera systems presently dominate, trailed by RADAR and LiDAR, while ultrasonic and other technologies occupy a more specialized niche. This dynamic landscape is expected to undergo continuous evolution as technology advances and regulatory standards become more stringent.

Market, By Application:

The global market has been divided into Rail, Automotive, Aerospace and Defense, and Marine based on the application segment. The automotive industry was the most significant user of this technology, followed by the smart railway and the construction and mining industries.

The future trajectory of the Automotive Collision Avoidance System (CAS) market will be significantly influenced by its diversified applications across various sectors. Within the automotive industry, which dominates with an estimated 60% market share as of 2023, market expansion will be propelled by stringent regulations and the escalating demand for Advanced Driver-Assistance Systems (ADAS). Notably, initiatives such as the European Union's mandate requiring ADAS functionalities like Automatic Emergency Braking (AEB) in new vehicles by 2035 will notably stimulate market growth.

Simultaneously, the Rail sector, projected to hold a 10% market share by 2031, is poised to experience substantial investments directed towards the implementation of positive train control systems aimed at collision prevention. Likewise, the Aerospace and Defense segment, comprising approximately 15% of the market share, is anticipated to witness a surge in CAS adoption across military vehicles and autonomous drones, driven by the imperative for heightened safety measures.

MARKET SEGMENTATION:

By Product:

-

Adaptive Cruise Control (ACC)

-

Autonomous Emergency Braking (AEB)

-

Lane Departure Warning System (LDWS)

-

Parking assistance

-

Others

By Technology:

-

LiDAR

-

RADAR

-

Ultrasonic

-

Camera

-

Others

By Application:

-

Rail

-

Automotive

-

Aerospace and Defense

-

Marine

REGIONAL ANALYSIS:

The future of the Automotive Collision Avoidance System (CAS) market in APAC and NA is on a fast track, fueled by government regulations and a safety-conscious consumer base. In the Asia Pacific (APAC) region, stricter NCAP (New Car Assessment Program) mandates, like those recently implemented in China, are expected to significantly boost CAS adoption. This, coupled with a rapidly growing middle class prioritizing car safety, will push the APAC market to a projected CAGR of over 9.95% by 2031.

North America (NA), a mature market, will likely see a shift towards advanced CAS features like automatic emergency braking. Government initiatives like the US Department of Transportation's target for all light vehicles to have forward collision warning by 2025 will play a key role. This focus on advanced functionalities, alongside rising demand for luxury vehicles with top-tier safety features, is expected to propel the NA CAS market to a steady CAGR of around 8.77% in the coming years.

REGIONAL COVERAGE:

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

KEY PLAYERS:

Robert Bosch GmbH (Germany), General Electric Company (US), Aptiv Plc (Republic of Ireland), Honeywell International, Inc. (the US), Denso Corporation (Japan), Siemens AG (Germany), Alstom SA (France), Rockwell Collins, Inc. (the US), and Hexagon AB (Sweden) are some of the affluent competitors with significant market share in the Automotive Collision Avoidance System Market.

RECENT DEVELOPMENTS:

-

Companies such as Bosch, Continental, and Mobileye have been at the forefront, introducing cutting-edge advancements aimed at enhancing vehicle safety and reducing accidents.

-

Bosch, for instance, has been focusing on refining its radar and camera-based systems to provide more accurate detection of obstacles and pedestrians, thus enabling quicker responses from vehicles.

-

Continental has been pushing boundaries with its advanced sensor fusion technology, seamlessly integrating data from multiple sensors to create a comprehensive view of the vehicle's surroundings.

-

Mobileye has been pioneering the integration of artificial intelligence and machine learning algorithms into its collision avoidance systems, enabling vehicles to anticipate and avoid potential collisions with unparalleled precision.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 58.05 Billion |

| Market Size by 2032 | US$ 128.38 Billion |

| CAGR | CAGR of 9.22% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • by Product (Adaptive Cruise Control (ACC), Autonomous Emergency Braking (AEB), Lane Departure Warning System (LDWS), Parking assistance, Others) • by Technology (LiDAR, RADAR, Ultrasonic, Camera, Others) • by Application (Rail, Automotive, Aerospace and Defense, Marine) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Robert Bosch GmbH (Germany), General Electric Company (US), Aptiv Plc (Republic of Ireland), Honeywell International, Inc. (the US), Denso Corporation (Japan), Siemens AG (Germany), Alstom SA (France), Rockwell Collins, Inc. (the US), and Hexagon AB (Sweden) |

| Key Drivers | •The increasing popularity of sport utility vehicles (SUVs), luxury cars, and other high-end transportation. •A rise in interest in self-driving cars. |

| RESTRAINTS | •The collision avoidance system market is hampered by high installation costs, which are a key issue. •Due to automobile sales and production being cyclical, market growth is stifled. |