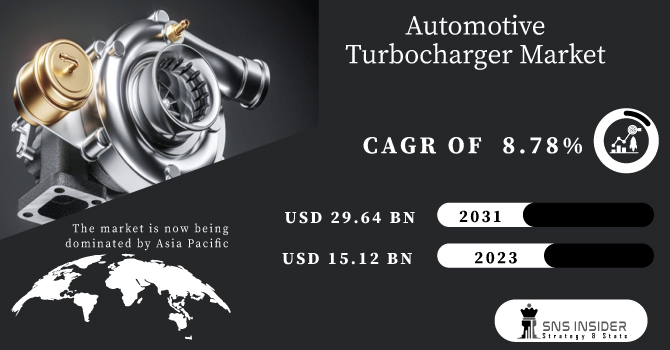

The Automotive Turbocharger Market is expected to grow at a CAGR of 8.78% to USD 29.64 billion by 2031, up from USD 15.12 billion in 2023. The automotive turbocharger industry will be driven by stricter emission regulations and increased usage of TGDI (Turbocharged Gasoline Direct Injection) technology.

A turbocharger is a turbine-driven forced induction device that boosts the efficiency and energy output of an internal combustion (IC) engine by injecting additional compressed air into the combustion chamber. The automotive turbocharger market study examines the usage of turbochargers in passenger cars and commercial vehicles, as well as recent product innovations, government rules governing the use of turbochargers, and market shares of industry participants.

Get More Information on Automotive Turbocharger Market - Request Sample Report

KEY DRIVERS:

As the demand for gasoline engines grows, diesel car sales are dropping. As a result, turbocharger production has soared.

Petrol engines are migrating from naturally aspirated to turbocharged engines faster than ever before.

Turbochargers are increasingly being employed in diesel engines to improve fuel efficiency and engine performance.

RESTRAINTS:

Adding a turbocharger to an engine has its advantages, but it also causes the system to work harder, resulting in increased wear and tear.

The turbocharger is critical to circulate cooling oil as frequently as possible in order to keep the turbocharger cool.

Turbochargers with poor maintenance might fail prematurely, increasing the load on the engine cooling oil.

OPPORTUNITIES:

Electric turbochargers deliver more power and better fuel efficiency because turbo lag is eliminated.

Electric turbos have a number of advantages and provide less technological obstacles.

CHALLENGES:

Turbo lag is a big issue. The time it takes a turbocharger to develop positive pressure is known as turbo lag.

It takes time for a turbocharger to generate adequate pressure to suck the air in because of frictional and thermal losses.

If a turbocharger is not installed properly, it can cause leaks, which will exacerbate turbo lag.

Vehicle production has decreased as a result of COVID-19, which is directly proportional to the whole turbocharger market. On the other hand, the pandemic effect is predicted to aid the growth of the gasoline turbocharger category over diesel, as diesel engines are expensive, and the introduction of new pollution laws adds to the expense of diesel engines, particularly in light duty cars.

Furthermore, the impact of COVID-19 would limit buyers' purchasing power, thereby leading to the purchase of gasoline vehicles over diesel vehicles. As a result, a transition toward gasoline engines or GDI is possible. As a result, the turbocharger market will have a better chance of expanding.

The global turbocharger market is divided into four types: new energy engines, diesel engines, gasoline engines,and Alternate Fuel/CNG.

In terms of volume and value, the gasoline sector will lead the market over the projection period. The segment's growth is being aided by the rising use of petrol engine turbochargers in passenger vehicles.

The global turbocharger market is divided into commercial cars and passenger cars based on application. Over the projection period, passenger vehicles will dominate the market in terms of both volume and value. The growing demand for passenger automobiles among a large population, combined with the expansion of global automakers into new emerging markets, is propelling the segment forward. The commercial automobile segment, on the other hand, is expected to grow at a fast rate because to the rise in commercial operations such as commodities and public transit around the world.

By Fuel Type

New Energy Engine

Diesel

Gasoline

Alternate Fuel/CNG

By Vehicle Type

Passenger Vehicles

Commercial Cars

Construction Equipment

By Material

Cast Iron

Aluminium

Others

By Turbo Type

VGT/VNT

Wastegate

Twin-Turbo

Others

By Component

Turbine

Compressor

Housing

The worldwide automotive turbocharger market study divides the market into four regions: Europe, Asia Pacific (APAC), North America, and the Rest of the World. Over the projection period, the APAC region will lead the market. By 2023, it is expected to increase at a CAGR of 8.15 percent. Rising car production in China and India, large population bases, burgeoning demand for diesel vehicles, economic shifts and upcoming emission norms, rising disposable income, growing demand for automobiles, demand for cars with compact engine sizes, strict vehicle emission regulations, consumers' growing purchasing power in China and India, and high penetration of light vehicles and diesel passenger cars in India are all contributing to the global automotive market.

North America

USA

Canada

Mexico

Europe

Germany

UK

France

Italy

Spain

The Netherlands

Rest of Europe

Asia-Pacific

Japan

south Korea

China

India

Australia

Rest of Asia-Pacific

The Middle East & Africa

Israel

UAE

South Africa

Rest of Middle East & Africa

Latin America

Brazil

Argentina

Rest of Latin America

Garrett Motion Inc. (US), Continental AG (Germany), Mitsubishi Heavy Industries (Japan), BorgWarner Inc. (US), IHI Corporation (Japan), Fengcheng Xindongli Turbocharger Co. Ltd (China), Precision Turbo and Engine (US), Bullseye Power LLC (US), Bosch Mahle (Germany), Cummins Inc. (the US), Continental AG (Germany), IHI Corporation (Japan), Mitsubishi Heavy Industries Ltd (Japan), BorgWarner Inc. (US), Honeywell International Inc. (US). Through supply contracts, expansion initiatives, partnerships, and mergers and acquisitions, these corporations have maintained their competitive position in the worldwide market.

| Report Attributes | Details |

| Market Size in 2023 | US$ 15.12 Bn |

| Market Size by 2031 | US$ 29.64 Bn |

| CAGR | CAGR of 8.78% From 2024 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Fuel Type (New Energy Engine, Diesel, Alternate Fuel/CNG, Gasoline) • By Vehilce Type (Passenger Vehicles, Commercial Cars, Construction Equipment) • By Material (Cast Iron, Aluminium, Others), By Turbo Type (VGT/VNT, Wastegate, Twin-Turbo, Others) • By Component (Turbine, Compressor, Housing) |

| Regional Analysis/Coverage | North America (USA, Canada, Mexico), Europe (Germany, UK, France, Italy, Spain, Netherlands, Rest of Europe), Asia-Pacific (Japan, South Korea, China, India, Australia, Rest of Asia-Pacific), The Middle East & Africa (Israel, UAE, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Garrett Motion Inc., Continental AG, Mitsubishi Heavy Industries, BorgWarner Inc., IHI Corporation, Fengcheng Xindongli Turbocharger Co. Ltd, Precision Turbo and Engine, Bullseye Power LLC, Bosch Mahle, Cummins Inc., Continental AG, IHI Corporation, Mitsubishi Heavy Industries Ltd, BorgWarner Inc., Honeywell International Inc. |

| Key Drivers | • Petrol engines are migrating from naturally aspirated to turbocharged engines faster than ever before. • Turbochargers are increasingly being employed in diesel engines to improve fuel efficiency and engine performance. |

| Challenges | • Turbo lag is a big issue. The time it takes a turbocharger to develop positive pressure is known as turbo lag. • It takes time for a turbocharger to generate adequate pressure to suck the air in because of frictional and thermal losses. |

Ans:- The Automotive Turbocharger Market Size was valued at USD 15.12 billion in 2023.

Ans:- A turbocharger is a turbine-driven forced induction device.

Ans:- The APAC region is anticipated to be the primary driver of the market.

Ans:- Demand for gasoline engines grows, and petrol engines are migrating to turbocharged engines.

Ans:- Raw material vendors, Distributors, and Regulatory authorities, including government agencies and NGOs, are the stakeholder who has contributed to this report.

Table of Contents:

1. Introduction

1.1 Market Definition

1.2 Scope

1.3 Research Assumptions

2. Research Methodology

3. Market Dynamics

3.1 Drivers

3.2 Restraints

3.3 Opportunities

3.4 Challenges

4. Impact Analysis

4.1 COVID-19 Impact Analysis

4.2 Impact of Ukraine-Russia War

5. Value Chain Analysis

6. Porter’s 5 forces model

7. PEST Analysis

8. Global Automotive Turbocharger Market Segmentation, by Fuel Type

8.1 New Energy Engine

8.2 Diesel

8.3 Alternate Fuel/CNG

8.4 Gasoline

9. Global Automotive Turbocharger Market Segmentation, by Vehicle Type

9.1 Passenger Vehicles

9.2 Commercial Cars

9.3 Construction Equipment

10. Global Automotive Turbocharger Market Segmentation, by Material

10.1 Cast Iron

10.2 Aluminium

10.3 Others

11. Global Automotive Turbocharger Market Segmentation, by Turbo Type

11.1 VGT/VNT

11.2 Wastegate

11.3 Twin-Turbo

11.4 Others

12. Global Automotive Turbocharger Market Segmentation, by Component

12.1 Turbine

12.2 Compressor

12.3 Housing

13. Regional Analysis

13.1 Introduction

13.2 North America

13.2.1 USA

13.2.2 Canada

13.2.3 Mexico

13.3 Europe

13.3.1 Germany

13.3.2 UK

13.3.3 France

13.3.4 Italy

13.3.5 Spain

13.3.6 The Netherlands

13.3.7 Rest of Europe

13.4 Asia-Pacific

13.4.1 Japan

13.4.2 South Korea

13.4.3 China

13.4.4 India

13.4.5 Australia

13.4.6 Rest of Asia-Pacific

13.5 The Middle East & Africa

12.5.1 Israel

12.5.2 UAE

12.5.3 South Africa

12.5.4 Rest

12.6 Latin America

13.6.1 Brazil

13.6.2 Argentina

13.6.3 Rest of Latin America

14. Company Profiles

14.1 Garrett Motion Inc. (US)

14.1.1 Financial

14.1.2 Products/ Services Offered

14.1.3 SWOT Analysis

14.1.4 SNS View

14.2 Fengcheng Xindongli Turbocharger Co. Ltd (China)

14.3 Precision Turbo and Engine (US)

14.4 Bullseye Power LLC (US)

14.4 Bosch Mahle (Germany)

14.5 Cummins Inc. (the US)

14.6 Continental AG (Germany)

14.7 IHI Corporation (Japan)

14.8 Mitsubishi Heavy Industries Ltd (Japan)

14.8 BorgWarner Inc. (US)

14.9 Honeywell International Inc. (US)

15. Competitive Landscape

15.1 Competitive Benchmarking

15.2 Market Share analysis

15.3 Recent Developments

16. Conclusion

Table of Contents:

1. Introduction

1.1 Market Definition

1.2 Scope

1.3 Research Assumptions

2. Research Methodology

3. Market Dynamics

3.1 Drivers

3.2 Restraints

3.3 Opportunities

3.4 Challenges

4. Impact Analysis

4.1 COVID-19 Impact Analysis

4.2 Impact of Ukraine-Russia War

5. Value Chain Analysis

6. Porter’s 5 forces model

7. PEST Analysis

8. Global Automotive Turbocharger Market Segmentation, by Fuel Type

8.1 New Energy Engine

8.2 Diesel

8.3 Alternate Fuel/CNG

8.4 Gasoline

9. Global Automotive Turbocharger Market Segmentation, by Vehicle Type

9.1 Passenger Vehicles

9.2 Commercial Cars

9.3 Construction Equipment

10. Global Automotive Turbocharger Market Segmentation, by Material

10.1 Cast Iron

10.2 Aluminium

10.3 Others

11. Global Automotive Turbocharger Market Segmentation, by Turbo Type

11.1 VGT/VNT

11.2 Wastegate

11.3 Twin-Turbo

11.4 Others

12. Global Automotive Turbocharger Market Segmentation, by Component

12.1 Turbine

12.2 Compressor

12.3 Housing

13. Regional Analysis

13.1 Introduction

13.2 North America

13.2.1 USA

13.2.2 Canada

13.2.3 Mexico

13.3 Europe

13.3.1 Germany

13.3.2 UK

13.3.3 France

13.3.4 Italy

13.3.5 Spain

13.3.6 The Netherlands

13.3.7 Rest of Europe

13.4 Asia-Pacific

13.4.1 Japan

13.4.2 South Korea

13.4.3 China

13.4.4 India

13.4.5 Australia

13.4.6 Rest of Asia-Pacific

13.5 The Middle East & Africa

12.5.1 Israel

12.5.2 UAE

12.5.3 South Africa

12.5.4 Rest

12.6 Latin America

13.6.1 Brazil

13.6.2 Argentina

13.6.3 Rest of Latin America

14. Company Profiles

14.1 Garrett Motion Inc. (US)

14.1.1 Financial

14.1.2 Products/ Services Offered

14.1.3 SWOT Analysis

14.1.4 SNS View

14.2 Fengcheng Xindongli Turbocharger Co. Ltd (China)

14.3 Precision Turbo and Engine (US)

14.4 Bullseye Power LLC (US)

14.4 Bosch Mahle (Germany)

14.5 Cummins Inc. (the US)

14.6 Continental AG (Germany)

14.7 IHI Corporation (Japan)

14.8 Mitsubishi Heavy Industries Ltd (Japan)

14.8 BorgWarner Inc. (US)

14.9 Honeywell International Inc. (US)

15. Competitive Landscape

15.1 Competitive Benchmarking

15.2 Market Share analysis

15.3 Recent Developments

16. Conclusion

Table of Contents:

1. Introduction

1.1 Market Definition

1.2 Scope

1.3 Research Assumptions

2. Research Methodology

3. Market Dynamics

3.1 Drivers

3.2 Restraints

3.3 Opportunities

3.4 Challenges

4. Impact Analysis

4.1 COVID-19 Impact Analysis

4.2 Impact of Ukraine-Russia War

5. Value Chain Analysis

6. Porter’s 5 forces model

7. PEST Analysis

8. Global Automotive Turbocharger Market Segmentation, by Fuel Type

8.1 New Energy Engine

8.2 Diesel

8.3 Alternate Fuel/CNG

8.4 Gasoline

9. Global Automotive Turbocharger Market Segmentation, by Vehicle Type

9.1 Passenger Vehicles

9.2 Commercial Cars

9.3 Construction Equipment

10. Global Automotive Turbocharger Market Segmentation, by Material

10.1 Cast Iron

10.2 Aluminium

10.3 Others

11. Global Automotive Turbocharger Market Segmentation, by Turbo Type

11.1 VGT/VNT

11.2 Wastegate

11.3 Twin-Turbo

11.4 Others

12. Global Automotive Turbocharger Market Segmentation, by Component

12.1 Turbine

12.2 Compressor

12.3 Housing

13. Regional Analysis

13.1 Introduction

13.2 North America

13.2.1 USA

13.2.2 Canada

13.2.3 Mexico

13.3 Europe

13.3.1 Germany

13.3.2 UK

13.3.3 France

13.3.4 Italy

13.3.5 Spain

13.3.6 The Netherlands

13.3.7 Rest of Europe

13.4 Asia-Pacific

13.4.1 Japan

13.4.2 South Korea

13.4.3 China

13.4.4 India

13.4.5 Australia

13.4.6 Rest of Asia-Pacific

13.5 The Middle East & Africa

12.5.1 Israel

12.5.2 UAE

12.5.3 South Africa

12.5.4 Rest

12.6 Latin America

13.6.1 Brazil

13.6.2 Argentina

13.6.3 Rest of Latin America

14. Company Profiles

14.1 Garrett Motion Inc. (US)

14.1.1 Financial

14.1.2 Products/ Services Offered

14.1.3 SWOT Analysis

14.1.4 SNS View

14.2 Fengcheng Xindongli Turbocharger Co. Ltd (China)

14.3 Precision Turbo and Engine (US)

14.4 Bullseye Power LLC (US)

14.4 Bosch Mahle (Germany)

14.5 Cummins Inc. (the US)

14.6 Continental AG (Germany)

14.7 IHI Corporation (Japan)

14.8 Mitsubishi Heavy Industries Ltd (Japan)

14.8 BorgWarner Inc. (US)

14.9 Honeywell International Inc. (US)

15. Competitive Landscape

15.1 Competitive Benchmarking

15.2 Market Share analysis

15.3 Recent Developments

16. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

The Automotive Wireless EV Charging Market Size was valued at USD 17 million in 2022 and is expected to reach USD 1.01 billion by 2030 and grow at a CAGR of 66.7% over the forecast period 2023-2030.

Automotive Digital Cockpit Market Size was valued at USD 24.14 billion in 2023 and is expected to reach USD 52.74 billion by 2031 and grow at a CAGR of 10.03% over the forecast period 2024-2031.

Autonomous Vehicle ECU Market Size was valued at USD 35.72 billion in 2023 and is expected to reach USD 56.93 billion by 2031 and grow at a CAGR of 6% over the forecast period 2024-2031.

The Electric Scooter Battery Market Size was valued at USD 3.38 billion in 2023 and is expected to reach USD 15.56 billion by 2031 and grow at a CAGR of 21% over the forecast period 2024-2031.

The E-Scooter Sharing Market Size was valued at USD 22.57 billion in 2022 and is expected to reach USD 40.26 billion by 2030 and grow at a CAGR of 7.5% over the forecast period 2023-2030.

Automotive Engineering Services Outsourcing Market Report Scope & Overview: Automotive Engineering Servic

Hi! Click one of our member below to chat on Phone