Autonomous Multifunctional Agriculture Robot Market Size Analysis:

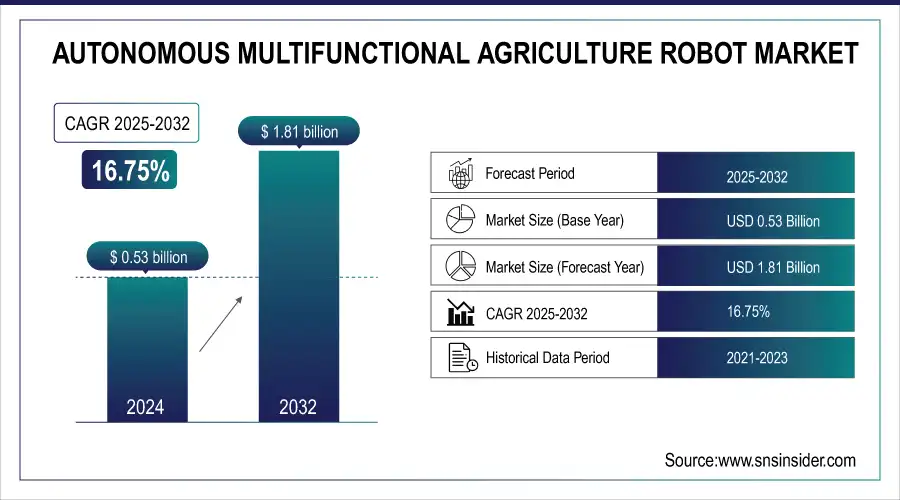

The Autonomous Multifunctional Agriculture Robot Market was valued at USD 0.53 billion in 2024 and is expected to reach USD 1.81 billion by 2032, growing at a CAGR of 16.75% over the forecast period 2025-2032.

The Autonomous Multipurpose Agriculture Robot Market is progressing rapidly, attributed to the rising adaptation of AI-driven automation to enable better farming. Deployment is expanding on small and large farms, and advancements in precision navigation, real-time crop monitoring, and autonomous harvesting are enhancing performance. Some, like manufacturing, are grappling with their dependence on the supply chain, the ongoing shortage of semiconductors, and the infusion of higher-level sensors and AI modules. Moreover, the increasing demand for automation is transforming the agricultural employment landscape, necessitating the need for new skills to operate and maintain robots as well as analyze data to improve yields, which means there are very little to no requirements for manual labor and makes agricultural robots undoubtedly a fundamental solution for modern-day sustainable agriculture practices.

Autonomous Multifunctional Agriculture Robot Market Size and Forecast:

-

Market Size in 2024: USD 0.53 Billion

-

Market Size by 2032: USD 1.81 Billion

-

CAGR: 16.75% from 2025 to 2032

-

Base Year: 2024

-

Forecast Period: 2025–2032

-

Historical Data: 2021–2023

Get More Information on Autonomous Multifunctional Agriculture Robot Market - Request Sample Report

Autonomous Multifunctional Agriculture Robot Market Highlights:

-

Rising precision farming demand is increasing adoption of AI-powered robotics, driving efficiency, crop yield, and cost reduction amid labor shortages

-

Labor shortages are fueling automation, especially in North America and Europe, accelerating adoption of autonomous multifunctional agriculture robots

-

Technological advancements such as AI, IoT, and machine learning enable real-time data collection, automated decision-making, and predictive maintenance for agricultural robots

-

Adoption barriers for small farmers include limited technology awareness, lack of technical know-how, and training requirements

-

Data privacy and security concerns arise as farmers are reluctant to share information over cloud platforms, posing challenges for AI-driven farming systems

-

Growth opportunities exist through AI and cloud integration, enabling predictive farm management solutions and adoption of drones and autonomous machinery in developing regions

Autonomous Multifunctional Agriculture Robot Market Drivers:

-

Rising Demand for Precision Farming and AI-Powered Robotics Transforming Agriculture Amid Labor Shortages

The demand for precision farming is increasing along with labor shortages in the agricultural sector, driving the growth of the autonomous multifunctional agriculture robot market. Agricultural automation adoption is growing worldwide and helps farmers by enhancing crop yield, minimizing costs, and using resources efficiently. For decades the rising cost of farm labor, as well as the shrinking availability of it, has been driving an increase in the use of robotics, especially among farms in North America and Europe. The development of AI, IoT, and machine learning also has contributed significantly to the increase of efficiency of agricultural robots by allowing the machines to collect data in real-time, make automated decisions, and perform predictive maintenance.

Autonomous Multifunctional Agriculture Robot Market Restraints:

-

Limited Technology Awareness and Data Security Concerns Slowing Adoption of Autonomous Farming Robots for Small Farmers

The key factor hampering the growth of the Autonomous Multifunctional Agriculture Robot Market is the lack of technology awareness and adoption entry barrier, especially for small to medium-sized farmers. Large commercial farms may be quickly adopting robotics, but smallholders in developing countries have trouble grasping and accessing the latest automation. Barriers to adoption come from a lack of technical know-how, unwillingness to change, and the necessity of training labor to operate and maintain autonomous farm robots. Moreover, with the farmers being hesitant to share their confidential agricultural data over cloud-based platforms, the data privacy and cyber security risks associated with AI-driven robotics systems pose challenges for the robotic systems market.

Autonomous Multifunctional Agriculture Robot Market Opportunities:

-

AI Robotics Cloud Computing and Automation Driving Growth Opportunities in Global Agriculture Technology Market

One of the big opportunities in this market is the combined power of autonomous robotics, analytics, and cloud computing. The vast agricultural data that we can collect and analyze for predictive insights creates opportunities for AI-powered solutions for farm management systems. Moreover, the increasing adoption of drones, robotic harvesters, and autonomous tractors in developing countries, particularly in the Asia-Pacific and Latin America regions, is poised to create lucrative growth opportunities in the market in the coming years. Businesses that offer low-cost, scalable, and tailor-made robotic solutions will find themselves in a position of power, providing services for both extensive industrial farms and farmers who want to automate and increase their productivity at small-holder scales.

Autonomous Multifunctional Agriculture Robot Market Segment Analysis:

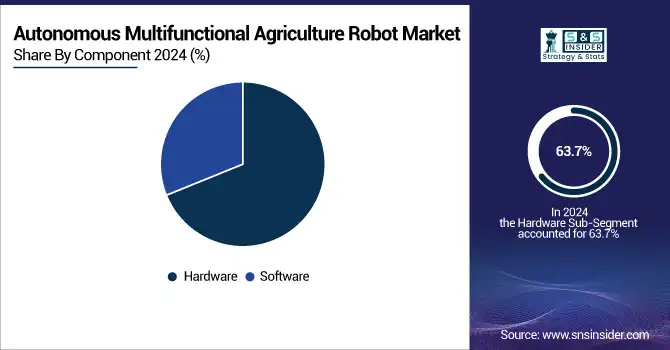

By Component

Hardware dominated the autonomous multifunctional agriculture robot market, with a total market share of 63.7% in 2024. The need for robotic arms, sensors, LiDAR, GPS modules, autonomous tractors, and UAVs (drones) combined, was a major driver for this dominance as these products are essential for automating agricultural activities such as planting, harvesting, spraying, and monitoring. This has led to continuous innovations in hardware in the form of higher adoption of AI-enabled robotics integrated with advanced robotics, IoT, and machine vision, thereby extending the hardware segment. Furthermore, the growing demand for precision agriculture that depends on advanced machines for efficient resource use has boosted investments in agricultural automation. High labor costs and government incentives promoting the adoption of smart farming technologies have driven this growth in North America and Europe, which have been the major regional markets in this respect.

The Software sector is expected to attain the highest CAGR from 2025-2032. The rise in demand for precision farming software solutions is driven by a growing penetration of integrated AI-powered analytics, cloud-based farm management platforms, and machine learning algorithms. Real-time data processing, predictive analytics, automated decision-making, and the ability to monitor, all help farmers optimize yield and reduce operational costs with these solutions. This is expected to propel swift adoption as agriculture trends in SMARTER, connected farming ecosystems where robotics work hand in hand with AI-powered Software. In addition, developments in autonomous navigation software, fleet management systems, and digital twin technologies will fuel growth in the market, especially in the Asia-Pacific and Latin America regions, where digital agriculture is increasing.

Autonomous Multifunctional Agriculture Robot Market Regional Analysis:

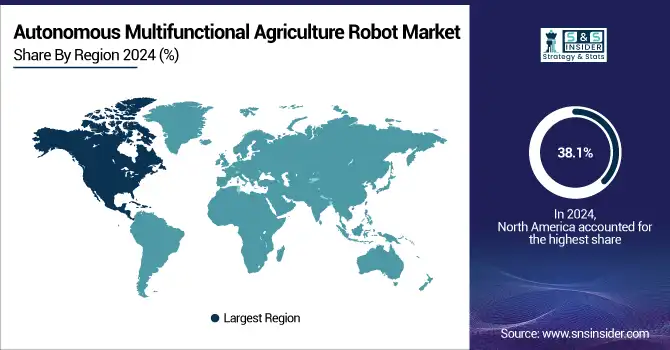

North America Autonomous Multifunctional Agriculture Robot Market Trends:

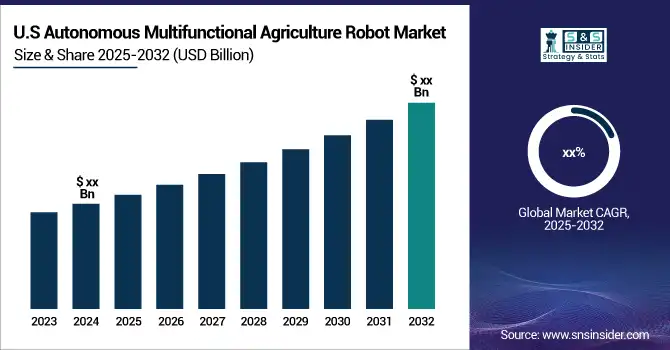

North America held the largest share of the Autonomous Multifunctional Agriculture Robot Market in 2023, accounting for 38.1% of the market, while the region is also anticipated to register the highest growth rate for the period 2024 to 2032. The high labor costs, greater adoption of precision farming, and high investments in agri-tech innovations are boosting this growth. Both the U.S. and Canada belong to the top countries leading the advancements in agricultural technology including, AI features, machine learning, and robotics for increasing the efficiency and sustainability of the agricultural or agri-food industry. Programs like the USDA’s Precision Agriculture Initiative and other agri-tech funding programs are also giving SMP a boost as they look to further popularize smart farming solutions for the agriculture industry. Here are some companies that are changing the way agriculture is done in North America with robotics. For instance, John Deere has created autonomous tractors and See & Spray technology powered by artificial intelligence to reduce the use of herbicides and minimize waste. Carbon Robotics has launched an autonomous laser welding system that destroys weeds without chemical herbicides, making it a more environmentally preferable choice. Additionally, Agtonomy and Bear Flag Robotics have been working on self-driving tractors and fleet automation, allowing farmers to run a tractor and do fieldwork with little to no human presence. And a new wave of high-tech farms is implementing drones, automated irrigation systems, and AI-powered analytics in California's Central Valley and the Midwest Corn Belt.

Need any customization research on Autonomous Multifunctional Agriculture Robot Market - Enquiry Now

Europe Autonomous Multifunctional Agriculture Robot Market Trends:

Europe held a significant share of the Autonomous Multifunctional Agriculture Robot Market in 2024 and is expected to grow steadily through 2032. High labor costs, a focus on sustainable agriculture, and strong government support for agri-tech adoption are driving growth. Germany, France, and the Netherlands are leading advancements in agricultural technology, including AI, machine learning, and robotics for efficient and sustainable farming. Programs such as the European Innovation Partnership for Agricultural Productivity and Sustainability (EIP-AGRI) are promoting smart farming solutions. Companies like Fendt, Bosch, and Naïo Technologies are developing autonomous tractors, robotic weeders, and AI-based crop monitoring systems. Modern farms in the Netherlands and France are increasingly implementing drones, automated irrigation, and AI-driven analytics to improve productivity and reduce resource use.

Asia-Pacific Autonomous Multifunctional Agriculture Robot Market Trends:

Asia-Pacific is projected to register the highest growth rate in the Autonomous Multifunctional Agriculture Robot Market from 2025 to 2032, driven by labor shortages, mechanization, and supportive government initiatives. China, Japan, and Australia are emerging as leaders in agricultural robotics, AI-driven solutions, and precision farming. Initiatives like China’s Agricultural Mechanization Development Plan and Japan’s Smart Agriculture Promotion Program are accelerating adoption. Companies such as Kubota, Hitachi, and Ecorobotix are deploying autonomous tractors, robotic harvesters, and AI-powered crop monitoring systems. High-tech farms in Japan, China, and Australia are also using drones, automated irrigation, and AI analytics to optimize yields and improve resource efficiency.

Latin America Autonomous Multifunctional Agriculture Robot Market Trends:

Latin America is witnessing rising adoption of autonomous multifunctional agriculture robots, particularly on large-scale commercial farms, to improve productivity amid labor shortages. Brazil and Argentina are the leading countries in implementing precision farming and AI-based solutions. Government programs and agri-tech funding initiatives are supporting automation and smart agriculture adoption. Companies such as Agrosmart, Solinftec, and Jacto are developing autonomous tractors, robotic sprayers, and AI-based crop monitoring technologies. Modern farms in Brazil’s Mato Grosso region and Argentina’s Pampas are integrating drones, automated irrigation systems, and AI-powered analytics to increase operational efficiency and sustainability.

Middle East & Africa Autonomous Multifunctional Agriculture Robot Market Trends:

The Middle East & Africa region is an emerging market for autonomous multifunctional agriculture robots, with growth driven by water scarcity, labor challenges, and the need for highly efficient farming solutions. Israel, UAE, and South Africa are leading adoption of AI-driven robotics, precision farming, and smart irrigation systems. Initiatives such as Israel’s AgriTech Hub and South Africa’s Smart Farming Programs promote advanced agricultural technologies. Companies like Netafim, RoboCrop, and AgriTask are providing autonomous irrigation systems, crop monitoring robots, and AI-powered farm management solutions. Modern farms in Israel and South Africa are leveraging drones, automated irrigation, and AI analytics to improve yields while conserving resources.

Autonomous Multifunctional Agriculture Robot Companies are:

-

John Deere – Autonomous Field Tractor, Autonomous Orchard Tractor

-

SwarmFarm Robotics – 'Robbie' Autonomous Robot, 'Bottomley Potts' Autonomous Robot

-

FarmWise Labs, Inc. – Titan FT-35 Automated Weeding Robot

-

Solinftec – Solix Ag Robotics

-

Lely Industries N.V. – Lely Astronaut A5 Milking Robot, Lely Vector Feeding System

-

Naio Technologies – Naio OZ Autonomous Weeding Robot, Naio TED Vineyard Robot

-

Monarch Tractor – Monarch MK-V Electric Smart Tractor

-

Muddy Machines – Sprout Harvesting Robot, Squirrel Transport Robot

-

Niqo Robotics – RoboSpray Precision Spraying Robot, RoboThinner Lettuce Thinning Robot

-

Robotics Plus – ProSpray Autonomous Spraying System

-

SAMI AgTech – SAMI Robot for Crop Monitoring

-

Bonsai Robotics – Autonomous Tree Shaker, Autonomous Sprayer

-

Rotor Technologies – Sprayhawk Autonomous Helicopter

-

Smart Apply – Intelligent Spray Control System

-

Agtonomy – Self-Driving Tractors, Fleet Automation

-

Bear Flag Robotics – Autonomous Tractor Platform

-

Ecorobotix – Autonomous Weeding Robot

-

Kubota – Autonomous Tractors and Smart Farm Solutions

-

Hitachi – AI-Powered Autonomous Farming Equipment

-

Netafim – Autonomous Irrigation and Crop Management Systems

Autonomous Multifunctional Agriculture Robot Market Competitive Landscape:

John Deere, established in 1837, is a global leader in agricultural and construction machinery. In January 2025, the company introduced advanced autonomous tractors, an AI-powered dump truck, and a battery-electric mower, aiming to enhance operational efficiency and address labor shortages. John Deere continues to drive innovation through smart farming solutions, robotics, and sustainable machinery worldwide.

-

In January 2025, John Deere introduced advanced autonomous tractors, an AI-powered dump truck, and a battery-electric mower, enhancing efficiency and addressing labor shortages in agriculture and construction.

Solinftec, established in 2007, is a leading provider of digital agriculture solutions. Its Solix Ag Robotics system integrates AI and autonomous technologies to optimize farm operations, including planting, monitoring, and harvesting. Solinftec focuses on increasing productivity, reducing labor dependency, and promoting sustainable agriculture through innovative smart farming solutions across Latin America and other key markets.

-

In November 2024, Solinftec's Solix Ag Robotics, an autonomous AI-driven robot, monitors crop health, detects pests, and reduces herbicide use by up to 98%, enhancing farm efficiency and sustainability.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 0.53 Billion |

| Market Size by 2032 | USD 1.81 Billion |

| CAGR | CAGR of 16.75% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Hardware, Software, Services |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | John Deere, SwarmFarm Robotics, FarmWise Labs, Inc., Solinftec, Lely Industries N.V., Naio Technologies, Monarch Tractor, Muddy Machines, Niqo Robotics, Robotics Plus, SwarmFarm Robotics, SAMI AgTech, Bonsai Robotics, Rotor Technologies, Smart Apply. |