Battery Electrolyte Market Report Scope & Overview:

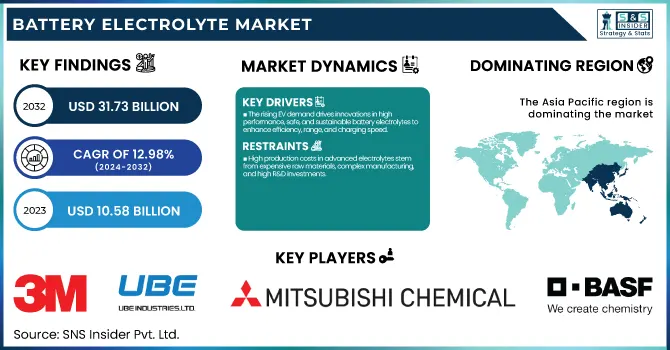

The Battery Electrolyte Market Size was esteemed at USD 10.58 billion in 2023 and is supposed to arrive at USD 31.73 billion by 2032 with a growing CAGR of 12.98% over the forecast period 2024-2032. This report provides unique insights into the Battery Electrolyte Market by analyzing manufacturing output and utilization rates across key regions, highlighting production efficiency and capacity trends. It evaluates maintenance and downtime metrics, offering a comparative view of operational resilience in leading markets. Technological adoption rates are assessed, focusing on advancements in next-generation electrolytes and emerging alternatives. The report also presents export/import data, revealing shifts in global trade dynamics and supply chain strategies. Additionally, it explores sustainability trends, including innovations in electrolyte recycling and eco-friendly production practices shaping the industry's future.

To Get more information on Battery Electrolyte Market - Request Free Sample Report

Battery Electrolyte Market Dynamics

Drivers

-

The rising EV demand drives innovations in high-performance, safe, and sustainable battery electrolytes to enhance efficiency, range, and charging speed.

The rising demand for electric vehicles (EVs) is significantly driving the need for high-performance battery electrolytes, as automakers push for longer range, faster charging, and enhanced battery safety. As the world moves away from fossil fuels and toward sustainable forms of transportation, lithium-ion batteries continue to be the battery of choice and drive research into new electrolyte formulations. It shows how battery makers increasingly target those two areas, solid-state and high-voltage electrolytes, to boost battery efficacy and longevity. And more competitive R&D in fluorine-free and non-flammable electrolytes from the industry to increase the safety for strict regulation. With EV sales skyrocketing, electrolyte producers are ramping up output and investing in domestic supply chains with the aim of decoupling dependence on key raw materials. Market participants are also witnessing a move towards recyclable & eco-friendly electrolyte solutions in line with sustainability goals.

-

Government incentives and policies are boosting domestic battery production and sustainable energy solutions, driving growth in the battery electrolyte market.

Government incentives and policies are playing a crucial role in accelerating the growth of the battery electrolyte market by supporting domestic battery manufacturing and promoting sustainable energy solutions. Countries offering tax credits, subsidies, and R&D grants to local supply chains to decrease reliance on imports More robust environmental regulations also are driving the development of low-toxicity or recyclable electrolytes, which meet worldwide sustainability goals. And, supporting policies for electric vehicle (EV) adoption, renewable energy storage, and grid modernization are boosting demand for advanced battery technologies. The resulting solid-state and next-generation electrolyte solutions are also heavily incentivized by state-sponsored innovation programs. Such initiatives are increasing market opportunities while ensuring sustainable energy storage ecosystem in the long run.

Restraint

-

High production costs in advanced electrolytes stem from expensive raw materials, complex manufacturing, and high R&D investments.

High production costs remain a significant barrier in the battery electrolyte market, particularly for advanced formulations like solid-state and fluorinated electrolytes. These new electrolytes need raw materials like lithium salts, ionic liquids, and fluorinated compounds that are not only costly but also associated with wild supply chains. Moreover, complexities associated with the synthesis and purification processes elevate the manufacturing cost, rendering it "economically" challenging to produce in bulk. R&D costs also drive up the price; companies spend millions on refining electrolyte stability, and conductivity, and ensuring compatibility to growing battery chemistries. This creates an additional financial burden from the rigorous quality control, safety testing, and regulatory compliance that must be followed. Although these high-performance electrolytes can afford superior thermal stability, longer cycle life, and improved safety, their cost-effectiveness still needs to be debated compared to the traditional liquid electrolytes, potentially hindering extensive application until the scalability and cost-effective preparation can be achieved.

Opportunities

-

The demand for eco-friendly electrolytes is driving innovation in fluorine-free and recyclable formulations, promoting sustainability in battery technology.

The growing emphasis on sustainability and environmental regulations is driving the development of eco-friendly battery electrolytes, particularly fluorine-free and recyclable formulations. Traditional electrolytes can contain toxic fluorinated compounds, which have disposal risks and environmental concerns. Consequently, researchers and manufacturers are investigating alternative chemistries with reduced toxicity, enhanced recyclability, and decreased carbon footprint, including water-based, ionic liquid, and bio-derived electrolytes. Innovations also focus on closed-loop recycling systems to recover components and reusable independent. This drive is being accelerated by governments and regulatory bodies increasingly advocating for greener battery solutions. A core area of focus and growth opportunity for companies that invest in next-generation energy storage solutions. Eco-friendly electrolytes are set to pave the way toward a sustainable future as industries look for low-impact yet high-performance alternatives.

Challenges

-

Solid-state electrolytes face commercialization challenges due to low ionic conductivity, complex manufacturing, and integration difficulties.

Solid-state electrolytes face significant technical barriers that hinder their commercialization, primarily due to low ionic conductivity and manufacturing complexities. While liquid electrolytes enable rapid ion transport, solid-state versions tend to slow down ion diffusion, which is detrimental to battery performance. Researchers are working on material innovations to improve conductivity, but performing at high efficiency while emphasizing stability and safety has proven difficult. Moreover, the complexity of the fabrication and integration processes can lead to scalability issues, as solid electrolytes need to be precisely engineered to maintain uniform contact with electrodes. The very high processing temperatures, as well as the need for specialized equipment, lead to high infrastructure and production costs that prevent at-scale manufacturing from being economically feasible as of the time of writing. For example, existing lithium-ion battery designs generally are not compatible and will require significant reengineering of battery architectures. However, these obstacles can be overcome by the development of novel ceramic, polymer, and sulfide-based solid electrolytes, which may open the door to the next generation of safer, high-performance batteries.

Battery Electrolyte Market Segmentation Analysis

By Battery Type

The lead-acid batteries segment dominated with a market share of over 62% In 2023, primarily owing to their widespread application in automotive, industrial, and backup power applications. These batteries have dominated the market for decades and will continue to be a major player due to their cost-effectiveness, reliability, and recyclability. Lead-acid batteries are commonly employed in uninterruptible power supplies (UPS), telecommunications, and grid storage to provide stable functionality during power outages. That said, the most rapidly expanding segment is lithium-ion batteries, fueled by the increasing adoption of electric vehicles (EVs), consumer electronics, and renewable energy storage. However, lithium-ion technology provides superior energy density, longevity, and efficiency, leading to its dominance in contemporary energy storage solutions, thus driving unprecedented market growth and technological innovation.

By Type

The gel electrolyte segment dominated with a market share of over 44% in 2023, owing to its outperforming, stable, and safe benefits compared to liquid electrolytes. Gel electrolytes have improved ionic conductivity, lower risk of leakage, and enhanced thermal stability which are essential for lithium-ion batteries in consumer electronics, electric vehicles, and energy storage systems. Its semi-solid state reduces the likelihood of problems like dendrite growth that lead to battery failures. Gel electrolytes also improve battery lifespan and efficiency with design flexibility. The increasing need for high-performance, long-term, and safer batteries in automotive and renewable energy sectors has played a crucial role in the rising adoption of gel electrolytes, which is one of the leading segments of the battery electrolyte market.

By End-User

The Electric Vehicle (EV) segment dominated with a market share of over 38% in 2023, primarily driven by the global shift toward sustainable transportation. Increased adoption of EVs with government incentives, subsidies, and stringent emission regulations coupled with volumetric energy density demand is driving the market for high-performance battery electrolytes. Enhancements in lithium-ion battery technology, such as increased energy density, improved safety, and faster charging capabilities, also drive market expansion. With consumers increasingly demanding long-range and fast-charging EVs, major automakers are investing an enormous amount of money into electrolyte innovations to improve the efficiency and lifespan of their batteries. Moreover, the increase in electric vehicle charging infrastructure and reduction of battery costs further enable market penetration. The transition is mainly led by countries such as China, the U.S., and European nations, solidifying the EV sector’s hold over the battery electrolyte market.

Battery Electrolyte Market Regional Outlook

Asia-Pacific region dominated with a market share of over 36% in 2023, owing to rapid industrialization and urbanization and the presence of battery manufacturers in the region. In terms of product end-users, the electric vehicle (EV), consumer electronics (CE), and energy storage system (ESS) sectors serve as growth drivers for the region, with China, Japan, and South Korea being particularly influential. Of course, China is ahead in the market with its huge investments in lithium-ion battery manufacturing, government subsidies for EVs, and a well-structured supply chain. Japan and South Korea participate with their advanced battery technology and R&D capabilities. Market dominance is further fortified by the presence of major battery manufacturers, including CATL, LG Energy Solution, and Panasonic. Furthermore, facilitating government initiatives, increasing adoption of renewable energy, and rising demand for sustainable energy solutions are expected to drive market growth in this region.

North America is the fastest-growing region in the battery electrolyte market, driven by the rapid adoption of electric vehicles (EVs), supportive government policies, and continuous advancements in battery technology. In addition, federal and state incentives are encouraging the transition to clean energy across the United States and Canada, contributing to a rise in EV sales in the region. Some countries are making big investments in battery factories and research projects that rapidly develop new technologies that improve battery efficiency and performance. Besides, the increasing requirement for renewable energy storage solutions and consumer electronics, also boosts the market growth. North America is expected to witness significant growth in the battery electrolyte industry in the next few years due to strong industry collaborations and a sustainability focus.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

Some of the major key players in the Battery Electrolyte Market

-

3M Co. (Electrolyte additives, lithium-ion battery materials)

-

UBE Industries Ltd (Electrolytes for lithium-ion batteries, organic solvents)

-

Guangzhou Tinci Materials Technology Co. Ltd (Lithium-ion battery electrolytes, electrolyte additives)

-

Mitsubishi Chemical Holdings Corporation (Lithium-ion battery electrolytes, fluorinated solvents)

-

Targray Industries Inc. (Lithium battery electrolytes, electrolyte solutions)

-

NOHMs Technologies Inc. (Non-flammable electrolytes, ionic liquid electrolytes)

-

Shenzhen Capchem Technology Co. Ltd (Liquid electrolytes, polymer electrolytes)

-

Mitsui Chemicals Inc. (Battery electrolyte materials, functional chemical solutions)

-

NEI Corporation (Solid-state electrolytes, lithium-ion battery coatings)

-

Soulbrain Co., Ltd. (High-purity electrolytes, lithium-ion battery solutions)

-

BASF SE (Electrolyte additives, lithium-ion battery chemicals)

-

Dongwha Electrolyte Co., Ltd. (Electrolytes for lithium-ion and solid-state batteries)

-

GS Yuasa Corporation (Lead-acid and lithium-ion battery electrolytes)

-

Panax-Etec Co., Ltd. (Lithium-ion battery electrolytes, high-performance additives)

-

Entek International LLC (Separator and electrolyte solutions for batteries)

-

Stella Chemifa Corporation (High-purity electrolyte materials, fluorinated compounds)

-

Shin-Etsu Chemical Co., Ltd. (Battery electrolytes, silicon-based materials)

-

LG Chem Ltd. (Lithium-ion battery electrolytes, advanced electrolyte formulations)

-

Solvay S.A. (Fluorinated electrolyte additives, battery performance enhancers)

-

TOMIYAMA Pure Chemical Industries, Ltd. (Electrolytes for lithium-ion and primary batteries)

Suppliers for (High-purity electrolytes for lithium-ion batteries, known for advanced chemical formulations) on Battery Electrolyte Market

-

Mitsubishi Chemical Corporation

-

UBE Corporation

-

3M

-

GS Yuasa International Ltd.

-

Capchem

-

Targray

-

TOB New Energy

-

SSRL Chemicals

-

Hunan Oriental Scandium Co., Ltd.

-

Soulbrain

RECENT DEVELOPMENT

In February 2024: Japan's UBE Corporation revealed plans to invest USD 500 million in establishing the first U.S.-based manufacturing facility for key lithium-ion battery (LiB) components, dimethyl carbonate (DMC), and ethyl methyl carbonate (EMC), essential for electric vehicles (EVs).

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 10.58 Billion |

| Market Size by 2032 | USD 31.73 Billion |

| CAGR | CAGR of 12.98% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Battery Type (Lead-Acid Battery, Lithium-Ion Battery) • By Type (Liquid Electrolyte, Solid Electrolyte, Gel Electrolyte) • By End-User (Electric Vehicle (EV), Consumer Electronics, Energy Storage, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | 3M Co., UBE Industries Ltd, Guangzhou Tinci Materials Technology Co. Ltd, Mitsubishi Chemical Holdings Corporation, Targray Industries Inc., NOHMs Technologies Inc., Shenzhen Capchem Technology Co. Ltd, Mitsui Chemicals Inc., NEI Corporation, Soulbrain Co., Ltd., BASF SE, Dongwha Electrolyte Co., Ltd., GS Yuasa Corporation, Panax-Etec Co., Ltd., Entek International LLC, Stella Chemifa Corporation, Shin-Etsu Chemical Co., Ltd., LG Chem Ltd., Solvay S.A., TOMIYAMA Pure Chemical Industries, Ltd. |