Membrane Separation Technology Market Size & Trends

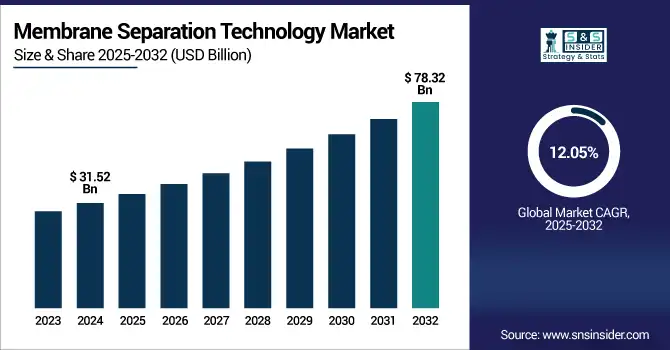

The Membrane separation technology Market size was valued at USD 31.52 billion in 2024 and is expected to reach USD 78.32 billion by 2032, growing at a CAGR of 12.05% over the forecast period of 2025-2032.

The component embedded with membrane separation technology market analysis report highlights that the growing adoption among the food and beverage processing sector will be an instrument boosting the market development. The need for these energy-efficient, non-thermal separation techniques to protect product integrity, shelf-life stability, and food safety requirements has driven this trend. Ultrafiltration, reverse osmosis, and nanofiltration are some of the most common membrane technologies used in industries for applications including the concentration of milk proteins, the clarification of juice, the removal of salt and small organic molecules from water, and the stabilization of wine. To address the increasing consumer demand for clean-label, organic, and food and beverages with high nutrient retentivity, manufacturers are progressively incorporating membrane systems to optimize production processes and meet health standards, driving the membrane separation technology market growth.

To Get more information on Membrane Separation Technology Market - Request Free Sample Report

The U.S. EPA is endorsing membrane technologies (in its Drinking Water Treatment models), which provides a backdrop for membrane applications in many current industrial water treatment outlets, including food & beverage applications. The Drinking Water State Revolving Fund received a total of more than USD 11.7 billion from the EPA under the 2021 Bipartisan Infrastructure Law, including the separate infusion of USD 4 billion for emerging contaminants, such as PFAS. Such funds are available to assist in the upgrading of drinking water systems to install new treatment technologies, such as membrane filtration, to meet the stricter standards.

Membrane Separation Technology Market Dynamics

Drivers:

-

Increasing Demand for Clean and Safe Water Drives the Market Growth

Global need for clean and safe drinking water is one of the key factors driving the membrane separation technology market. Increasing rates of urbanization, industrialization, and population growth are putting immense demands on current freshwater resources. Membrane technologies are used for municipal water treatment, seawater desalination, and water reuse for their high removal efficiency of dissolved solids, pathogens, and chemical contaminants (reverse osmosis (RO), ultrafiltration (UF), and nanofiltration (NF)). The rise in water quality regulations imposed by governments and environmental agencies, especially in developing areas, is also contributing to faster adoption of membrane solutions in municipal and industrial applications.

Restraints:

-

High Operational and Maintenance Costs May Hamper the Market Growth

Even though membrane separation systems show a lot of benefits, they require a huge amount of capital expenditure to be installed and significant running and maintenance costs. The energy-intensive processes, the need for regular cleaning of the membranes, fouling control, and replacement of the membranes are among them. Such costs can be prohibitive, especially for small and medium-scale industries located in low-income regions. Maintenance also needs technicians who can operate membrane systems, which adds to the operational burden. For instance, the energy requirements to run RO systems are among the major contributors to the overall cost-efficiency of RO, and thus, this aspect plays a notable role for applications including desalination or high-salinity wastewater treatment. This sensitivity to cost remains one of the key hindrances to the more widespread implementation of membrane separation technologies across cost-sensitive markets.

Opportunities:

-

Technological Advancements in Membrane Materials Creates an Opportunity in the Market

Membrane materials and process designs are viewed as areas for growth in the market. Innovations including graphene-based membranes, ceramic membranes, and polymeric blends are improving performance factors, including permeability, selectivity, chemical stability, and longevity. Moreover, polymer membranes, hybrid membrane systems, which combine different sorts of membranes, are under development to more efficiently meet complicated separation requirements. These innovations, in turn, are driving down operational costs, reducing fouling, and lowering energy demand, which are making membrane solutions more cost-competitive. This trend toward sustainable and energy-saving solutions complements the global environmental agenda and extends the scope of applications of advanced membrane systems driving the membrane separation technology market trends.

In 2023, Toray Industries announced an investment that over USD 100 million in high-performance membrane manufacturing expansion in Asia and North America to support the market for water treatment and food-grade filtration systems.

Membrane Separation Technology Market Segmentation Analysis

By Technology

Reverse Osmosis held the largest Membrane separation technology market share, around 44%, in 2024 owing to the better efficiency offered by this technology for the removal of dissolved solids, contaminants, and microorganisms in water. As they are capable of treating a wide range of water sources, seawater, brackish water, and wastewater, RO membranes are used in nearly all municipal water treatment, industrial processing, and desalination plants. They are known for high separation precision and ideal ultra-pure water generation, which makes them a perfect find for segments, such as food & beverage, pharmaceuticals, and power generation.

Microfiltration held a significant membrane separation technology market share. It is owing to widespread use in low-pressure filtration applications, such as the food & beverage, pharmaceutical, and water treatment industries. MF membranes can eliminate suspended impurities, microorganisms, and other macro pathogens with no significant energy consumption, providing a cost-effective and operationally simple solution. They are typically applied for the clarification of drinks, sterilization of liquids, and as a pre-treatment step for ultra-filtration and reverse osmosis devices. Microfiltration (MF) is being progressively used in municipal water treatment for turbidity removal and for preventing clogging of membrane systems located downstream.

By Application

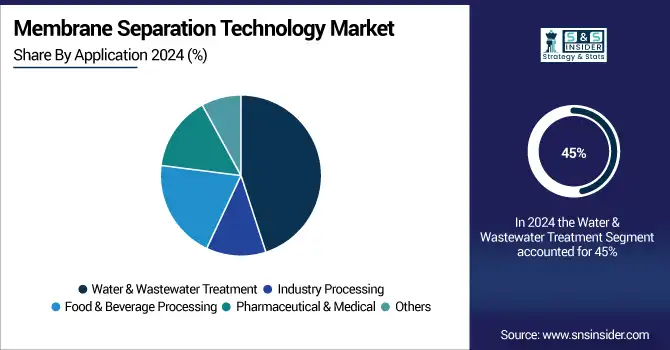

Water & Wastewater Treatment segment held the largest market share, around 45%, in 2024. The growth attributed to increasing municipal and industrial needs for clean water, drinking water, and safe, reusable water globally. The global government and environmental regulatory agencies are adopting stricter water quality regulations, in turn requiring industry and municipalities to embrace advanced membrane-based treatment systems. They are very good at eliminating contaminants, pathogens, and chemicals from drinking water and wastewater. Further, the increase in urbanization and industrialization in emerging economies, joined with the increased emphasis on zero-liquid discharge (ZLD) and water reuse systems, has positively impacted the expansion of membrane systems as well.

Food & Beverage Processing holds a significant market share in the Membrane separation technology market due to the rising demand for high-purity, efficient, and non-thermal separation methods in this industry. Membrane technologies (ultrafiltration, nanofiltration, reverse osmosis) offer non-thermal approaches for applications, such as milk protein concentration, juice clarification, wine stabilization, and removal of microorganisms with minimal impact on flavor or nutritional composition. These systems allow manufacturers to comply with stringent food safety regulations and improve product quality while minimizing energy consumption and waste generation.

Membrane Separation Technology Market Regional Outlook

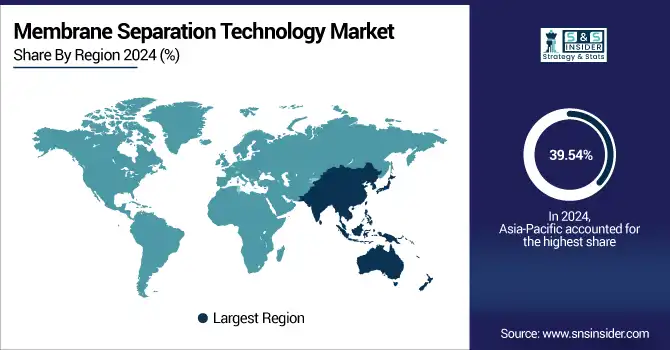

Asia-Pacific Membrane separation technology market held the largest market share, around 39.54%, in 2024 due to factors, such as rapid industrialization, rising urban populations, and growing environmental concerns. China, India, Japan, and South Korea have investment plans regarding water treatment infrastructure owing to increasing water scarcity, pollution, and sustainable industrial processes. Membrane technologies have found substantial usage in municipal water treatment, wastewater recycling, and industrial segments including pharmaceuticals, food & beverage, and chemicals in this region. Meanwhile, government initiatives at both the local and state levels to provide greater access to clean water with reduced to zero discharge from effluent from industrial process streams have further increased demand for technologies, such as reverse osmosis, ultrafiltration, and microfiltration.

In 2024, through the Water Financing Partnership Facility (WFPF), the Facility in partnership with the Asia Development Bank (ADB) has sustained investments in infrastructure sectors in the region. They focus on improving access to safe drinking water and sanitation, and water-efficient use in agriculture.

North America membrane separation technology market held a significant market share and is the fastest-growing segment in the forecast period owing to the presence of a strict regulatory framework, developed industrial infrastructure, and rising concern regarding water quality and sustainability. Canada and the U.S. are leading membrane technology adopters in a number of sectors, including municipal water treatment, food & beverage processing, pharmaceuticals, and oil & gas. The U.S. EPA is keen to push various types of advanced membrane systems, such as reverse osmosis, nanofiltration, and ultrafiltration, for drinking water and industrial wastewater treatment, and is pushing their nationwide adoption.

The U.S. membrane separation technology market size was USD 6.0 billion in 2024 and is expected to reach USD 16.20 billion by 2032 and grow at a CAGR of 13.22% over the forecast period of 2025-2032. It is owing to a developed industrial base, stringent regulations for membrane technologies, and huge capital investments for water infrastructure facilities. Today, millions of drinking water systems in the U.S. treat their water using membrane technologies, such as reverse osmosis, ultrafiltration, and nanofiltration to meet stringent standards set forth by the U.S. Environmental Protection Agency (EPA) for the quality of drinking water and the discharge of industrial wastewater as effluent containing metal ions.

Europe held a significant market share in the forecast period driven by the strong regulatory landscape, goals for environmental sustainability, and a well-developed industrial sector. The strict regulations of the European Union, including the water framework directive and the urban waste water treatment directive, promote the membrane technologies in the municipal and industrial sectors due to the high-quality requirements both for receiving waters and discharges. For instance, large-scale systems that treat wastewater & reuse treated water with tank-based process application are using reverse osmosis, ultrafiltration, and nanofiltration membranes with a net-zero emphasis in countries, such as Germany, France, the U.K., and the Netherlands.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players in the Membrane Separation Technology Market

The major Membrane Separation Technology companies are DuPont, 3M, Toray Industries Inc., Koch Separation Solutions, Pentair plc, SUEZ Water Technologies & Solutions, Hydranautics (A Nitto Group Company), Pall Corporation, GEA Group, and Asahi Kasei Corporation.

Recent Development in the Membrane Separation Technology Market

-

In May 2024, Toray Industries developed a next-generation RO (reverse osmosis) membrane that is characterized by its doubled chemical resistance, halved replacement frequency, and drastic CO₂ emission reduction, contributing to a huge leap in energy-efficient and durable desalination technology.

-

In November 2023, MTR Carbon Capture Pilot plant membrane technology & research (MTR) broke ground on the largest clean membrane-based carbon capture pilot plant globally, which will start up at the Wyoming Integrated Test Center in 2024

| Report Attributes | Details |

| Market Size in 2024 | USD 31.52 Billion |

| Market Size by 2032 | USD 78.32 Billion |

| CAGR | CAGR of12.05% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Technology (Microfiltration, Ultrafiltration, Nanofiltration, and Reverse Osmosis) • By Application (Water & Wastewater Treatment, Industry Processing, Food & Beverage Processing, Pharmaceutical & Medical, and Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | DuPont, 3M, Toray Industries Inc., Koch Separation Solutions, Pentair plc, SUEZ Water Technologies & Solutions, Hydranautics (A Nitto Group Company), Pall Corporation, GEA Group, Asahi Kasei Corporation |