Isopropyl Alcohol Market Report Scope & Overview:

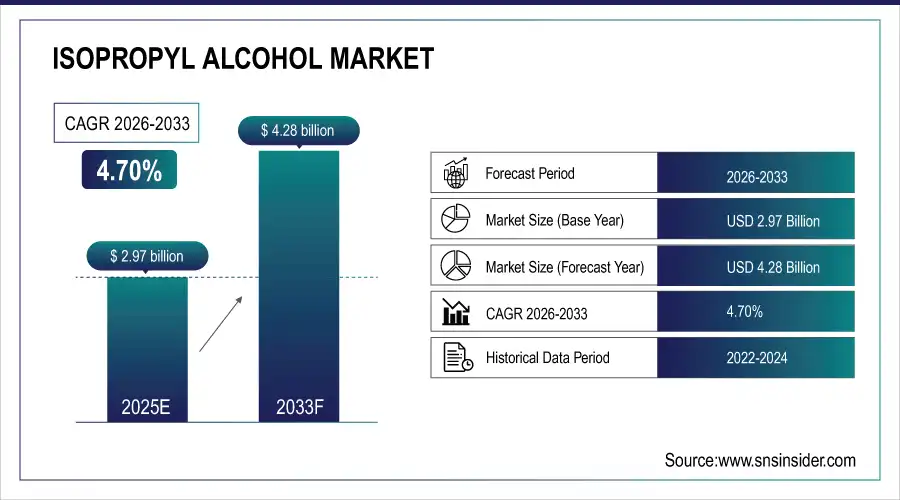

The Isopropyl Alcohol Market Size is valued at USD 2.97 Billion in 2025E and is projected to reach USD 4.28 Billion by 2033, growing at a CAGR of 4.70% during the forecast period 2026–2033.

The Isopropyl Alcohol Market analysis report of the market provides comprehensive knowledge of its performance and future potential. Moreover, increasing usage in pharmaceuticals, personal care, and industrial cleaning applications is speculated to drive up market demand and enable regular growth for the time to come.

Isopropyl alcohol consumption reached 2.1 million tons in 2025, driven by rising use in disinfectants, solvents, and cleaning applications across key industrial sectors.

Market Size and Forecast:

-

Market Size in 2025: USD 2.97 Billion

-

Market Size by 2033: USD 4.28 Billion

-

CAGR: 4.70% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information On Isopropyl Alcohol Market - Request Free Sample Report

Isopropyl Alcohol Market Trends:

-

Growing electronics and semiconductor cleaning applications high demand for high-purity isopropyl alcohol is changing production considerations.

-

Rising preference for eco-friendly, bio-based IPA formulations in manufacturing activities has an impact on inventions.

-

Following pandemic, higher demand for IPA-based disinfectants in healthcare and hygiene industry has subsequently driven the economy.

-

Increasing demand in cosmetic and personal care formulations has expanded product range.

-

Strategic cooperation of chemical manufacturers and pharmaceutical enterprises expand the stability supply chain.

-

Improved refinement and distillation technology will increase IPA productivity and quality.

U.S. Isopropyl Alcohol Market Insights:

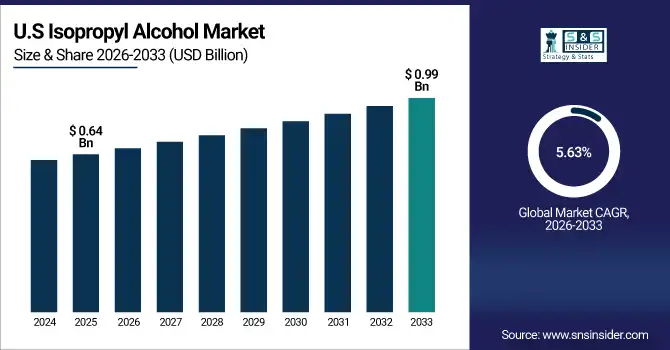

The U.S. Isopropyl Alcohol Market is projected to grow from USD 0.64 Billion in 2025E to USD 0.99 Billion by 2033, at a CAGR of 5.63%. Growth is being fueled by increased demand for disinfectants, pharmaceuticals and high-purity solvents, coupled with modern production facilities and growing health-consciousness in healthcare and industrial applications.

Isopropyl Alcohol Market Growth Drivers:

-

Growing demand for disinfectants and sanitizers across healthcare and industry is rapidly accelerating isopropyl alcohol consumption.

Growing demand for disinfectants and sanitizers across healthcare and industrial sectors is a major driver of the Isopropyl Alcohol Market growth. The rise in hygiene awareness after the pandemic and the expansion of pharmaceutical and cleaning products manufacturing, have driven IPA consumption. Hospital sanitation requirements, industrial surface cleaning, and household hygiene measures have all supported growth. Moreover, regulatory-focused workplace safety and infection control have also made a strong contribution to market demand.

Isopropyl alcohol sales grew 5.2% in 2025, fueled by rising sanitizer production and increasing demand from pharmaceutical and electronics manufacturing industries.

Isopropyl Alcohol Market Restraints:

-

Volatile raw material prices and stringent environmental regulations are constraining stable production and profitability in the Isopropyl Alcohol Market.

Volatile raw material prices and stringent environmental regulations are key restraints for the Isopropyl Alcohol Market. The rise and fall of propylene price overly impact IPA production outlay. This results in reduced margins for producers. Furthermore, stringent environmental reparation enforcement and penalties costs as regards chemical discharges and hazardous refuse remove non-conformance margins. Indeed, this results in highly unstable efficient production and restrained operational production capacity advances and hence, forcing producers to encourage cost-reduction alleviation approaches and beyond sustainable manufacturing to remain competitive.

Isopropyl Alcohol Market Opportunities:

-

Rising adoption of bio-based isopropyl alcohol offers lucrative opportunities for sustainable production and eco-friendly industrial applications.

Rising adoption of bio-based isopropyl alcohol presents a major opportunity for sustainable market growth. The growing environmental consciousness and regulatory pressure to minimize carbon footprints necessitate manufacturers to rely on renewable raw materials for IPA manufacturing. By offering similar performance and less environmental repercussions, bio-based alternatives are favored among the eco-friendly industries – from pharmaceuticals to cosmetics and cleaning products. Simultaneously, the switch allows complying with the green chemistry principles and eliminating product commoditization through the sustainability-oriented innovation in the long run.

Bio-based isopropyl alcohol accounted for 18% of new launches in 2025, driven by rising demand for sustainable chemical solutions.

Isopropyl Alcohol Market Segmentation Analysis:

-

By Grade, Industrial Grade held the largest market share of 47.36% in 2025, while Pharmaceutical Grade is expected to grow at the fastest CAGR of 5.16% during 2026–2033.

-

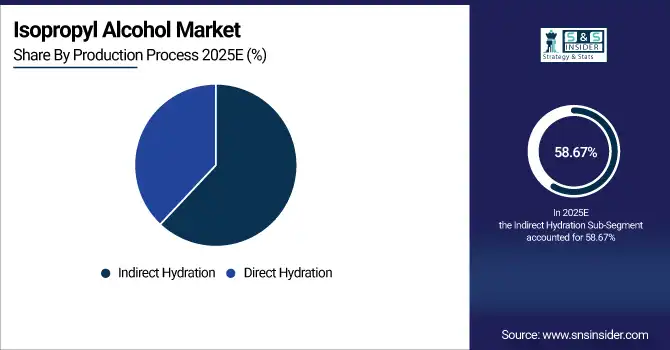

By Production Process, Indirect Hydration dominated with a 58.67% share in 2025, while Direct Hydration is projected to expand at the fastest CAGR of 4.92% during the forecast period.

-

By Application, Solvent accounted for the highest market share of 35.82% in 2025, while Disinfectant is anticipated to record the fastest CAGR of 5.27% through 2026–2033.

-

By End Use Industry, Pharmaceuticals held the largest share of 32.41% in 2025, while Cosmetics & Personal Care is expected to grow at the fastest CAGR of 5.33% during 2026–2033.

By Grade, Industrial Grade Dominates While Pharmaceutical Grade Expands Rapidly:

The Industrial Grade segment dominated the market. As a solvent and cleaning agent in paints, coatings and industrial processes for manufacturing, our industrial grade methanol is an economical and effective solution for medium to large-scale applications among various industries. Its Pharmaceutical Grade is the fastest growing segment as demand shot up for sanitizer and disinfectant during the pandemic. In 2025, over 1.1 million tons of industrial-grade IPA were consumed globally, reflecting its leading position.

By Production Process, Indirect Hydration Leads While Direct Hydration Grows Swiftly:

The Indirect hydration segment dominated the market owing to its widespread industrial adoption, bringing with it infrastructure and high-purity IPA production capability. The economy of it, and its material throughput has entrenched this method in the manufacturing industries. The Direct Hydration is the fastest growing segment owing to technological advancements and sustainability benefits especially in countries that have increasing petrochemical production. In 2025, indirect hydration contributed to nearly 59% of total IPA production.

By Application, Solvent Segment Dominates While Disinfectant Usage Rises Rapidly:

The Solvent Segment dominated the market. The solvency of paints, coatings, inks and chemical formulations has been significantly improved with the critical application if this segment that is compatible with various compounds. The Disinfectant is the fastest growing segment owing to rise in hygiene consciousness and implementation of huge sanitation projects. In 2025, disinfectant-grade IPA consumption surpassed 780 thousand tons, underscoring its expanding relevance and growing industrial significance.

By End Use Industry, Pharmaceuticals Lead While Cosmetics & Personal Care Flourish Quickly:

The Pharmaceuticals segment dominated the market, with considerable consumption share owing to its necessity in sterilization, drug making and laboratories cleaning. Rising expenditure on healthcare and better drug outputs will aid the growth of the pharmaceuticals sector in the coming years. The Cosmetics & Personal Care is the fastest-growing segment in value with the immediate high demand of IPA found in fragrances, lotions and cleaners. In 2025, pharmaceutical-grade usage represented nearly 32% of total IPA demand globally.

Isopropyl Alcohol Market Regional Analysis:

Asia-Pacific Isopropyl Alcohol Market Insights:

The Asia-Pacific Isopropyl Alcohol Market dominated the landscape, accounting for a 41.92% share in 2025. The regional leadership is orchestrated by rampant industrialization and robust demand emanating from pharmaceuticals, electronics, and chemicals manufacturing in countries including Japan, China, and India. Rise in production capacities, access to raw material and increasing healthcare infrastructure contribute toward regional dominance. Growing consumption is driving demand for disinfectants and solvents and strengthening Asia-Pacific’s role as the world hub both for production and use of IPA.

Get Customized Report as per Your Business Requirement - Enquiry Now

China Isopropyl Alcohol Market Insights:

China Isopropyl Alcohol Market is driven by expanding pharmaceutical and electronics manufacturing, rising hygiene awareness, and robust domestic production capacity. Increasing demand for disinfectants, solvents, and cleaning agents strengthens market growth. China remains a key hub in the Asia-Pacific IPA industry due to large-scale output and growing export potential.

North America Isopropyl Alcohol Market Insights:

The North America Isopropyl Alcohol Market is the fastest-growing region, projected to expand at a CAGR of 5.71% during 2026–2033. Growth is primarily fueled by the increasing requirement of disinfectants, sanitizers, and high-purity solvents in healthcare, pharmaceuticals, electronics. Rising spending across hygiene products, cutting-edge manufacturing technologies and growing pharmaceutical production in the U.S. & Canada is further supporting regional expansion of north America and making it a pivot in IPA market.

U.S. Isopropyl Alcohol Market Insights:

The U.S. Isopropyl Alcohol Market is transforming from the petrochemical industry into pharmaceuticals and healthcare, fueled by robust demand for disinfectants and upgrade of chemical plants. Strong emphasis on hygiene, environmental friendly production and high-purity solvent applications drives the growth. The addition of latest technology and domestic capacity expansion have consistently augmented the U.S. stature into the IPA industry.

Europe Isopropyl Alcohol Market Insights:

The Europe Isopropyl Alcohol Market is characterized by strong demand from pharmaceutical, cosmetics, and chemical manufacturing industries. Consumption is highest in countries such as Germany, France and the U.K. due to the developed industrial infrastructure and strict hygiene norms. Increased focus on sustainable manufacturing, alternative solvents and environmentally friendly formulations further drives market growth whereas research and development in high-purity IPA production rewarded the European region to attain a major role as a regional hub for chemical processing.

Germany Isopropyl Alcohol Market Insights:

Germany has a significant position in the Isopropyl Alcohol Market due to modern chemical production facilities and strict industry norms. Growth is coming from strong demand in the pharmaceuticals, automotive and electronics industries. A focus on quality and precision production and sustainable chemical processes are keeping Germany as a leading IPA producer in Europe.

Latin America Isopropyl Alcohol Market Insights:

The Market Isopropyl Alcohol Latin America market is standing along with the augmenting in healthcare, pharmaceutical and industrial cleaning applications. Growing urbanization and domestic production in Brazil, Mexico and Argentina underpin demand. Higher sensitivity toward hygiene, domestic production capacity and enhanced supply links are fuelling further regional demand for IPA and market expansion.

Middle East and Africa Isopropyl Alcohol Market Insights:

Middle East & Africa Isopropyl Alcohol Market is developing with investment in healthcare on rise, surging pharmaceutical manufacturing along with growing hygiene awareness. Increasing demand for industrial cleaning and medical uses will spur growth, with key markets such as Saudi Arabia, the UAE and South Africa benefiting from continued industrial modernisation.

Isopropyl Alcohol Market Competitive Landscape:

Exxon Mobil Corporation, headquartered in Irving, Texas, is an energy and petrochemical leader known for its large-scale refining and chemical manufacturing operations. The Company leads the industry in its strong technology and production capability, strengthened supply chain and vertically-integrated operations with refining and chemical businesses. Dedicated to delivering efficiency, product purity and sustainability for its customers, ExxonMobil has developed external specifications for IPA output to provide reliable supply in pharmaceuticals, industrial and consumer goods segments and other industrial markets.

-

In July 2025, ExxonMobil launched a new chemical complex in Huizhou, China, boosting production of ethylene and advanced performance chemicals. The facility strengthens its presence and supports growing demand for high-purity isopropyl alcohol and downstream derivatives.

The Dow Chemical Company, based in Midland, Michigan, is one of the world’s largest chemical manufacturers, excelling in material sciences and industrial chemicals. Dow´s leadership in isopropyl alcohol is based on innovation and quality and Dow´s strong market position, particularly in end-use industries such a healthcare or coatings. The broad portfolio, strong R&D expertise and focus on sustainability have further enhanced Dow’s competitive position and continued to solidify its leadership in the area of high-performance solvent production.

-

In May 2025, Dow introduced its Decarbia low-carbon silicone elastomer blends and expanded its personal-care portfolio at NYSCC Suppliers’ Day, marking a major step toward sustainability and innovative material solutions for industrial and pharmaceutical-grade IPA applications.

Royal Dutch Shell plc, headquartered in The Hague, Netherlands, is a leading energy and chemical company recognized for its advanced refining capabilities and broad downstream network, read petrochemical network, streamlined production capabilities, and long-standing commitment to serve industrial and pharma-quality IPA needs. With geographic strategies around various continents, plus investments in cleaner technologies, it has increased the reliability, footprints and sustainability of the IPA marketplace.

-

In April 2025, Shell unveiled its Shell Silk Alkane synthetic fluid line at in-cosmetics Amsterdam, targeting advanced personal-care and cleaning formulations. The launch underscores Shell’s innovation in specialty chemicals and high-performance solvents, including isopropyl alcohol derivatives.

Isopropyl Alcohol Market Key Players:

-

Exxon Mobil Corporation

-

The Dow Chemical Company

-

Royal Dutch Shell plc

-

INEOS Group Holdings S.A.

-

LG Chem Ltd.

-

Mitsui Chemicals, Inc.

-

Tokuyama Corporation

-

BASF SE

-

Sasol Limited

-

LCY Chemical Corp.

-

Eastman Chemical Company

-

ISU Chemical Co., Ltd.

-

Deepak Nitrite Limited

-

Zhejiang Xinhua Chemical Co., Ltd.

-

Sinopec Corp.

-

Suzhou Upline Chemicals Co., Ltd.

-

Jiangsu Denoir Technology Co., Ltd.

-

Kellin Chemical

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 2.97 Billion |

| Market Size by 2033 | USD 4.28 Billion |

| CAGR | CAGR of 4.70% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Grade (Industrial Grade, Pharmaceutical Grade, Electronic Grade) • By Production Process (Indirect Hydration, Direct Hydration) • By Application (Solvent, Disinfectant, Cleaning Agent, Coating & Paints, Chemical Intermediate, Others) • By End Use Industry (Pharmaceuticals, Chemicals, Cosmetics & Personal Care, Food & Beverages, Electronics, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Exxon Mobil Corporation, The Dow Chemical Company, Royal Dutch Shell plc, LyondellBasell Industries N.V., INEOS Group Holdings S.A., LG Chem Ltd., Mitsui Chemicals, Inc., Tokuyama Corporation, BASF SE, Sasol Limited, LCY Chemical Corp., Eastman Chemical Company, Ecolab Inc., ISU Chemical Co., Ltd., Deepak Nitrite Limited, Zhejiang Xinhua Chemical Co., Ltd., Sinopec Corp., Suzhou Upline Chemicals Co., Ltd., Jiangsu Denoir Technology Co., Ltd., Kellin Chemical. |