Bromobenzene Market Report Scope & Overview:

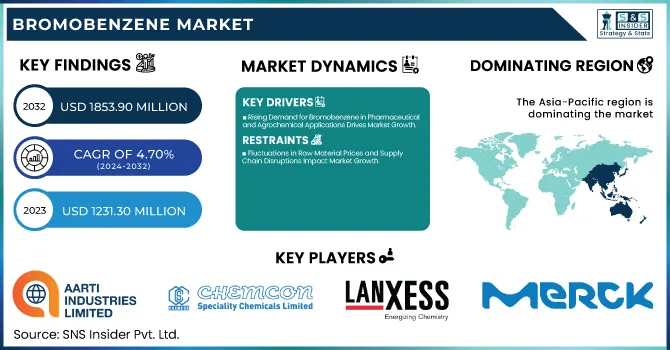

The Bromobenzene Market Size was valued at USD 1,231.30 Million in 2023 and is expected to reach USD 1,853.90 Million by 2032, growing at a CAGR of 4.70% over the forecast period of 2024-2032.

To Get more information on Bromobenzene Market - Request Free Sample Report

The Bromobenzene Market is expanding due to its rising demand in pharmaceuticals, agrochemicals, and chemical synthesis. Our report provides an in-depth cost structure analysis, detailing raw material, production, and logistics expenses to assess profitability. A raw material analysis explores sourcing trends and price fluctuations of benzene and bromine. Key regulatory and compliance requirements shaping the industry, including environmental and safety standards, are thoroughly examined. The report highlights investment and funding trends, showcasing mergers, acquisitions, and capital flows driving market expansion. Additionally, end-user consumption trends are analyzed to understand demand patterns across industries. This comprehensive assessment delivers valuable insights, enabling businesses to navigate challenges and capitalize on emerging opportunities in the evolving bromobenzene market.

Bromobenzene Market Dynamics

Drivers

-

Rising Demand for Bromobenzene in Pharmaceutical and Agrochemical Applications Drives Market Growth

The increasing use of bromobenzene in pharmaceutical synthesis and agrochemical formulations is a significant driver of market expansion. In the pharmaceutical industry, bromobenzene serves as a key intermediate in drug synthesis, particularly in the production of analgesics, antiseptics, and other medicinal compounds. With the rising prevalence of chronic diseases and the growing demand for advanced pharmaceuticals, the need for high-quality bromobenzene continues to grow. Additionally, bromobenzene plays a crucial role in agrochemicals, particularly in the synthesis of pesticides and herbicides. As global agricultural output rises to meet the demands of a growing population, the need for effective crop protection chemicals increases. Stringent regulations promoting sustainable farming practices further drive innovation in agrochemical formulations, increasing the adoption of bromobenzene-based compounds. The expansion of these end-use industries, coupled with continuous research and development efforts, contributes to the long-term growth of the bromobenzene market.

Restraints

-

Fluctuations in Raw Material Prices and Supply Chain Disruptions Impact Market Growth

The volatility in raw material prices, particularly benzene and bromine, significantly affects the bromobenzene market by increasing production costs. Price fluctuations are influenced by factors such as crude oil variations, geopolitical tensions, and supply chain disruptions. Additionally, transportation constraints and trade restrictions further exacerbate supply chain challenges, leading to production delays and inconsistent availability of bromobenzene. Manufacturers often face difficulties in securing stable raw material supplies, impacting profit margins and overall market stability. The dependency on specific geographic regions for raw material sourcing also makes the market vulnerable to geopolitical risks and regulatory changes. These uncertainties create financial and operational challenges for industry players, affecting the long-term growth of the bromobenzene market.

Opportunities

-

Growing Demand for High-Purity Bromobenzene in Emerging Applications Creates Market Opportunities

The increasing demand for high-purity bromobenzene in specialized applications such as electronics, biotechnology, and advanced material synthesis presents significant growth opportunities. High-purity bromobenzene is crucial for precision chemical reactions, where contamination must be minimized. In the electronics industry, it is used in the development of semiconductor materials and specialty coatings. Additionally, the expanding field of biotechnology relies on high-purity brominated compounds for drug synthesis and diagnostic applications. As research institutions and industries invest in high-performance materials, the need for ultra-pure bromobenzene continues to rise. Companies focusing on advanced purification techniques and high-grade production processes can tap into this lucrative segment, driving market expansion.

Challenge

-

Increasing Competition from Alternative Chemical Intermediates Poses Market Challenges

The bromobenzene market is facing increasing competition from alternative chemical intermediates that offer similar functionalities with reduced environmental impact. Substitutes such as chlorinated and fluorinated compounds are being developed to replace bromobenzene in various applications. Additionally, industries are exploring greener alternatives that provide comparable performance while ensuring regulatory compliance. This growing preference for substitutes is creating challenges for bromobenzene manufacturers, compelling them to innovate and differentiate their products. Companies must focus on enhancing product efficiency, sustainability, and cost-effectiveness to maintain their market position.

Bromobenzene Market Segmental Analysis

By Grade

Pharmaceutical Grade dominated the bromobenzene market in 2023, holding a market share of 40.2%. The dominance of pharmaceutical-grade bromobenzene is primarily driven by its extensive use as a key intermediate in drug synthesis, particularly in the production of analgesics, antiseptics, and other medicinal compounds. The rising demand for high-purity raw materials in pharmaceutical formulations has further strengthened its position. According to the U.S. Food and Drug Administration (FDA), regulatory approvals for bromobenzene-based drug intermediates have increased, reflecting its critical role in modern medicine. Additionally, the European Medicines Agency (EMA) has emphasized stringent purity standards, encouraging manufacturers to invest in pharmaceutical-grade bromobenzene. The expansion of the global pharmaceutical sector, driven by increased healthcare spending and government-backed R&D initiatives, has further bolstered demand for this segment.

By Derivatives

Phenylmagnesium Bromide dominated the bromobenzene market in 2023, capturing 38.7% of the market share. This compound is widely used in Grignard reactions, making it essential for organic synthesis in pharmaceutical, chemical, and agrochemical industries. The dominance of this derivative is supported by its growing applications in drug development, particularly in the synthesis of active pharmaceutical ingredients (APIs). The U.S. National Institutes of Health (NIH) and pharmaceutical giants like Pfizer and Merck have increasingly relied on phenylmagnesium bromide for innovative drug formulations. Additionally, its role in specialty chemical manufacturing has grown, driven by advancements in material sciences and polymer research. The demand for high-efficiency reagents in laboratory and industrial applications has further solidified the segment’s leadership in the market.

By Purity

Bromobenzene with ≥99% purity dominated the bromobenzene market in 2023, accounting for 52.4% of the market share. The preference for high-purity bromobenzene is fueled by its critical role in pharmaceutical, electronic, and specialty chemical industries, where impurities can affect the quality and performance of final products. Regulatory bodies such as the U.S. Environmental Protection Agency (EPA) and the European Chemicals Agency (ECHA) have enforced stringent purity standards, further driving demand for high-grade bromobenzene. Major pharmaceutical companies, including GlaxoSmithKline and Novartis, have prioritized ≥99% purity bromobenzene in their synthesis processes, ensuring compliance with international quality standards. Additionally, its application in high-precision laboratory experiments and semiconductor manufacturing has strengthened its market position.

By Application

The Solvent segment dominated the bromobenzene market in 2023, securing 34.2% of the market share. Bromobenzene is widely used as a solvent in organic synthesis, facilitating chemical reactions in pharmaceutical, agrochemical, and industrial processes. Its superior solubility properties and ability to act as a reaction medium make it indispensable in large-scale production facilities. The American Chemical Society (ACS) has highlighted its role in enhancing reaction efficiency in drug formulation and specialty chemical synthesis. Furthermore, increased research in green chemistry has led to innovations in solvent recovery and recycling, making bromobenzene a cost-effective and sustainable option for manufacturers. The expansion of pharmaceutical and agrochemical industries has further reinforced the solvent segment’s dominance.

By End-Use Industry

The Pharmaceuticals segment dominated the bromobenzene market in 2023, commanding 43.5% of the market share. The growing pharmaceutical industry, driven by rising global healthcare needs and increased investment in drug development, has significantly boosted demand for bromobenzene. It serves as a crucial intermediate in producing essential drugs, including pain relievers and antiseptics. The World Health Organization (WHO) has reported increased demand for pharmaceutical raw materials, reflecting the segment's expansion. Additionally, government initiatives, such as the U.S. Biomedical Advanced Research and Development Authority (BARDA) funding for novel drug development, have further propelled market growth. The pharmaceutical sector's continued emphasis on high-quality raw materials and stringent regulatory compliance has solidified bromobenzene’s position in this segment.

Bromobenzene Market Regional Outlook

Asia Pacific dominated the bromobenzene market in 2023, holding a market share of 41.8%, driven by its strong industrial base, expanding pharmaceutical sector, and growing chemical manufacturing capabilities. Countries such as China, India, and Japan have been at the forefront of bromobenzene production and consumption due to their extensive pharmaceutical, agrochemical, and specialty chemical industries. China, the largest producer and consumer, benefits from well-established chemical manufacturing hubs such as Jiangsu and Shandong provinces, contributing to over 60% of the region’s bromobenzene output. According to the China Petroleum and Chemical Industry Federation (CPCIF), China’s chemical industry grew by 8.5% in 2023, further bolstering demand. India follows closely, with the Indian Pharmaceutical Alliance (IPA) reporting an 11% annual increase in pharmaceutical manufacturing, relying heavily on bromobenzene intermediates. Additionally, Japan's advanced R&D in organic synthesis and specialty chemicals, supported by investments from companies like Sumitomo Chemical and Mitsubishi Chemical, has further strengthened the region’s dominance.

Moreover, North America emerged as the fastest-growing region with a significant growth rate in the bromobenzene market during the forecast period. The growth is primarily driven by the rapid expansion of the pharmaceutical and agrochemical sectors, along with increased investment in specialty chemicals. The U.S. dominates the region, accounting for more than 75% of North America's bromobenzene consumption, driven by the presence of leading pharmaceutical companies such as Pfizer, Merck, and Johnson & Johnson, which extensively use bromobenzene-based intermediates in drug development. The U.S. Food and Drug Administration (FDA) has also increased approvals for bromobenzene-based drug intermediates, accelerating market demand. Canada is emerging as a key player, supported by its growing agrochemical sector, with Statistics Canada reporting a 7.2% rise in pesticide production in 2023. Mexico's chemical industry expansion, driven by trade agreements such as the USMCA, further propels regional growth, with a 5.4% increase in specialty chemical production reported by the National Institute of Statistics and Geography (INEGI).

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

-

Aarti Industries (Bromobenzene, Phenylmagnesium Bromide)

-

Chemcon Speciality Chemicals Limited (Bromobenzene, 1-Bromo-3-Chlorobenzene)

-

Dachang Jinxiu Wanbao New Technology Chemical Co., Ltd. (Bromobenzene, 4-Bromotoluene)

-

Haihang Industry Co., Ltd. (Bromobenzene, 4-Bromoanisole)

-

Hebei Chaozhong Chemical (Bromobenzene, 2-Bromotoluene)

-

Heranba Industries Ltd. (Bromobenzene, Phenylmagnesium Bromide)

-

Jiangsu Dacheng Pharmaceutical and Chemical Co., Ltd. (Bromobenzene, 2-Bromophenol)

-

Lanxess (Bromobenzene, 4-Bromoacetophenone)

-

Merck KGaA (Bromobenzene, 4-Bromoanisole)

-

Pragna Group (Bromobenzene, 4-Bromobiphenyl)

-

Shandong Henglian Chemical Co., Ltd. (Bromobenzene, 4-Bromophenol)

-

Shanghai Wescco Chemical Co., Ltd. (Bromobenzene, 4-Bromotoluene)

-

Shouguang Fukang Pharmaceutical Co., Ltd. (Bromobenzene, 3-Bromoanisole)

-

Shouguang Wuli Chemical Co., Ltd. (Bromobenzene, 1-Bromo-2-Chlorobenzene)

-

SONTARA ORGANO INDUSTRIES (Bromobenzene, 2-Bromonaphthalene)

-

Toyo Chemical Industrial (Bromobenzene, 4-Bromobenzyl Alcohol)

-

Weifang Yonhop Chemical Co., Ltd. (Bromobenzene, 4-Bromophenylacetic Acid)

-

Yancheng Longsheng Chemical Co., Ltd. (Bromobenzene, 2-Bromophenylboronic Acid)

-

Yogi Intermediates PVT. LTD. (Bromobenzene, 4-Bromo-2-Chlorotoluene)

-

Yurui (Shanghai) Chemical Co., Ltd. (Bromobenzene, 3-Bromo-1-Phenylpropane)

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 1,231.30 Million |

| Market Size by 2032 | 1,853.90 Million |

| CAGR | CAGR of 4.70% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Grade (Pharmaceutical Grade, Industrial Grade, Reagent Grade) •By Derivatives (Phenylmagnesium Bromide, Diphenyl Ether, Phencyclidine Precursors, Others) •By Purity (<99%, ≥99%) •By Application (Solvent, Chemical Intermediate, Grignard Reagent, Catalyst & Reagent in Organic Synthesis, Others) •By End-Use Industry (Pharmaceuticals, Agrochemicals, Chemicals, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Chemcon Speciality Chemicals Limited, Aarti Industries, Lanxess, Merck KGaA, Shandong Henglian Chemical Co. Ltd, Heranba Industries Ltd., Weifang Yonhop Chemical Co., Ltd., Yancheng Longshen Chemical Co., Ltd., Jiangsu Dacheng Pharmaceutical and Chemical Co., Ltd., Haihang Industry Co., Ltd.and other key players |