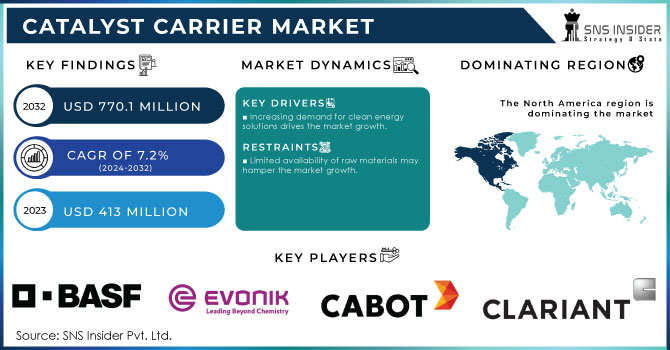

Catalyst Carrier Market Key Insights:

The Catalyst Carrier Market size was valued at USD 413 Million in 2023. It is expected to grow to USD 770.1 Million by 2032 and grow at a CAGR of 7.2% over the forecast period of 2024-2032.

The catalyst carrier market has seen a considerable rise in recent years, with the increase in petrochemical production. Such produce is vital for a variety of applications throughout the industry, including the production of plastics, resins, and synthetic fibers. According to the information provided by the U.S. Energy Information Administration, global petrochemical production will increase significantly in the years to come, with the demand for consumer goods and packaging materials pushing the rise. Catalyst carriers are used in a wide variety of industrial refining processes, enabling and boosting the performance of the catalyst carrier market.

Catalyst Carrier Market Size and Forecast

-

Market Size in 2023: USD 413 Million

-

Market Size by 2032: USD 770.1 Million

-

CAGR: 7.2% from 2024 to 2032

-

Base Year: 2023

-

Forecast Period: 2024–2032

-

Historical Data: 2020–2022

Get More Information on Catalyst Carrier Market - Request Sample Report

Catalyst Carrier Market Trends

-

Rising global petrochemical production is driving demand for catalyst carriers used in refining and industrial processes.

-

Increasing adoption of clean energy solutions, including hydrogen production, biofuels, and fuel cells, is boosting demand.

-

Shift toward lightweight, bio-based, and recyclable carrier materials to comply with environmental regulations and circular economy principles.

-

Carbon-based carriers, especially activated carbon, dominate due to their high surface area, cost efficiency, and versatility.

-

Oil & gas remains the largest end-use segment, with applications in hydrocracking, hydrotreating, and catalytic reforming.

-

North America leads regionally, supported by strong industrial presence, advanced R&D, and regulatory incentives promoting green and efficient catalytic processes.

-

Technological innovations, such as improved silica, alumina, and zirconia carriers, are enhancing catalyst efficiency, stability, and application performance.

The U.S. Energy Information Administration (EIA) reports that U.S. petrochemical production capacity has been on an upward trend, with a nearly 7% increase in ethylene production capacity from 2020 to 2023. Ethylene is a foundational component in petrochemicals, widely used in plastics and other industrial materials, indicating robust growth in the sector.

The current trend in the catalyst carrier market is the shift to lightweight and green materials following the increasing focus of industries on environmental protection and proper resource use. As such, manufacturers are turning towards bio-based and renewing materials that can be recycled, namely, biopolymers, silica, advanced ceramics, and others instead of non-sustainable materials to reduce the environmental burden. This tendency serves to solve the problem of global warming and to comply with a variety of strict environmental regulations on the part of many industries. These materials provide both reduced dependency on fossil fuels and a means of material reuse and recycling characteristic of those following the principles of the circular economy; therefore, such companies are more likely to use these materials.

According to the U.S. Department of Agriculture, the bio-based products industry contributes approximately USD 369 billion to the U.S. economy and supports over 4 million jobs. The USDA's BioPreferred Program encourages the use of bio-based materials, promoting the growth of sustainable product markets, including catalyst carriers.

Drivers

-

Increasing demand for clean energy solutions drives the market growth.

The main driver of the rapid growth of the catalyst carrier market is the increasing demand for clean energy solutions. At the industrial and governmental levels, the main focus is on sustainable energy sources that help to prevent climate change and reduce carbon emissions. With the ongoing trend of the global shift to the use of renewable energy, more and more applications are emerging in such spheres as hydrogen production, biofuels, and fuel cells. In turn, catalyst carriers play an enabling role, allowing for the improvement of catalyst efficiency and effectiveness. For example, as hydrogen is the most promising form of clean energy, more and more countries implement relevant projects and pilot the deployment of catalyst carriers used in such applications as steam methane reforming and electrolysis, crucial processes that enable the production of clean hydrogen. According to the International Energy Agency, the rate of hydrogen demand is projected to account for 20 million tons per year by 2030.

Furthermore, the more countries introduce policies and plans of action that develop the transition to widespread clean energy adoption, the higher the demand for catalyst carriers in the majority of catalytic applications. One example is the European Union Green Deal plan that requires all European countries to be climate-neutral by 2050. On the one hand, it is a significant market driver. On the other hand, it is an opportunity for manufacturers to maintain rapid and sustainable growth by introducing new materials and technologies to the market that improve and enable catalytic processes.

Restraint

-

Limited availability of raw materials may hamper the market growth.

The major restraint in the catalyst carrier market is the competition from alternative technologies. Different industries are constantly exploring new methods of increasing their efficiency and reducing emissions. As a resultant factor, novel technologies such as enzymatic processes, bioengineering, and new chemical synthesis methods may not require a traditional catalyst carrier. For example, biocatalysis employs natural enzymes to improve the rates of chemical reactions. The process is safer for the environment and can proceed in milder conditions. As a result, the total rate of energy consumption and the absolute efficiency of the given method are higher. Similarly, a rapid development of direct conversion technologies like plasma and microwave-assisted processes may provide a completely new path for a given chemical transformation which may not require a catalyst carrier or use a significantly smaller amount of it in a modified way of action. As the other technologies become more established and popular, their growing use may impact the demand for traditional catalyst carriers.

Market Segmentation Analysis

By Type

Carbon-based products held the largest market share around 44% in 2023. There are several applications where carbon is mostly used. One of the examples is industries controlling liquids and gases that will be converted to end-use products or intermediates. In general, carbon use falls under the application of petrochemicals and chemicals. In general, among others of carbon usage, activated carbon has become one of the most highly applied on the market. According to the activated carbon, as a material, has several strategic advantages over other catalyst carriers such as alumina, or silica. The major ones are the significant increase in internal surface area, huge cost reduction per cubic meter, and the adequate suitability for the majority of shapes, specifically powder, granular, or extruded shapes.

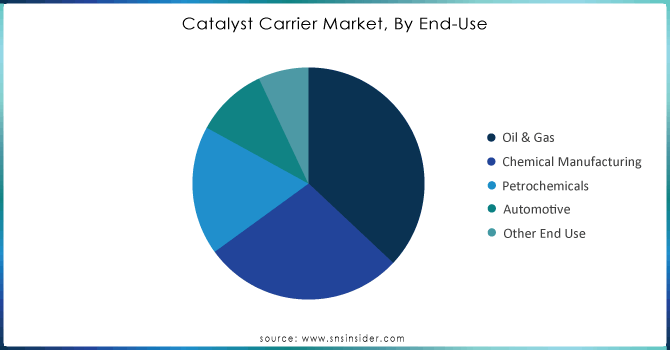

By End-Use

Oil & gas held the largest market share around 37% in 2023. The oil and gas industry holds the largest market share in the catalyst carrier market primarily due to its substantial reliance on catalytic processes for refining and petrochemical production. As one of the most critical sectors in the global economy, oil and gas companies utilize catalyst carriers to enhance the efficiency and effectiveness of various processes, such as hydrocracking, catalytic reforming, and hydrotreating. These processes are essential for converting crude oil into valuable products like gasoline, diesel, and other petrochemicals. The growing global demand for energy and the continuous need for high-quality fuels drive investments in advanced catalytic technologies. However, the highest share of oil & gas in the global market is primarily due to the vast application of the product in the oil & gas industry to increase the product performance and mechanical resistance.

Need Any Customization Research On Catalyst Carrier Market - Inquiry Now

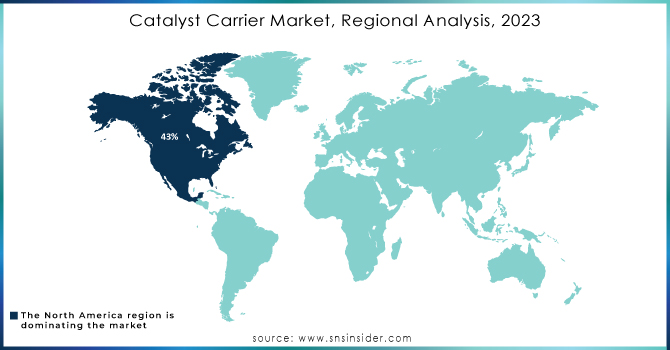

Regional Analysis

North America region held the highest market share around 43% in 2023. the growing demand for advanced catalytic processes is driven by a strong industrial presence, significant investments in research and development, as well as strict environmental regulations. First, the region has numerous petrochemical and refining industries, with the United States being the prominent representative. Companies tend to refine production processes and improve efficiency by replacing catalytic materials and thus reduce waste and lower emissions. Growing demand for better catalytic activity and selectivity triggers interest among companies that look for viable carrier solutions.

Moreover, North America is a region of high innovation and development intensity in the field. There are significant investments in productivity and sustainability, which include the shift from traditional materials to biobased and recyclable catalyst carriers. Finally, the existence of large and competitive players in the chemical and petrochemical industry cements the region’s strong position. Additionally, the governments in North America are highly encouraging the use of green energy and clean energy initiatives, in the example of The American Chemistry Council which makes easily implementable decisions. For these reasons, the market is highly competitive, and the catalyst carriers are key to the company’s ability to maintain leading positions

Key Players

-

BASF SE (Catalyst Carrier Alumina)

-

Evonik Industries AG (AEROPERL)

-

Saint-Gobain NorPro (Denstone)

-

Cabot Corporation (NORIT Activated Carbon)

-

Clariant AG (CATALOX)

-

CeramTec GmbH (Aluminium Oxide Carriers)

-

W. R. Grace & Co. (SYLOID Silicas)

-

Almatis Inc. (Alumina Carrier)

-

Sasol Limited (Activated Alumina)

-

SABIC (KATALCO)

-

Noritake Co., Limited (Catalyst Support Cordierite)

-

Rogers Corporation (Poron Microcellular Urethane)

-

Porocel Industries, LLC (Activated Bauxite)

-

Sinocata (Alumina Carrier)

-

Honeywell UOP (MOLSIV Zeolite)

-

Calgon Carbon Corporation (FILTRASORB)

-

Magang Group (Iron Oxide Catalyst Carrier)

-

Jiangxi Huihua Technology Co., Ltd. (Titanium Dioxide Carrier)

-

Pingxiang Gophin Chemical Co., Ltd. (Inert Alumina Balls)

-

Fujimi Incorporated (Ceramic Catalyst Support)

Key Users

-

Braskem

-

Lotte Chemical

-

Valero Energy Corporation

-

Phillips 66

-

Eastman Chemical Company

-

Mitsubishi Chemical Holdings Corporation

-

Ford Motor Company

-

General Motors

-

Nutrien Ltd.

Recent Developments:

-

In 2023, BASF expanded its catalyst carrier production facilities in Germany, aiming to enhance its manufacturing capabilities and meet the growing demand for alumina-based catalyst carriers, especially in the petrochemical sector.

-

In 2023, Cabot Corporation launched an advanced NORIT-activated carbon catalyst carrier with enhanced adsorption properties, specifically designed for use in air purification and emission control applications.

-

In 2022, Evonik introduced a new generation of its Aeroperl silica-based catalyst carriers, focusing on improving efficiency and stability in high-temperature industrial applications.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 413 Million |

| Market Size by 2032 | USD 770.1 Million |

| CAGR | CAGR of7.2% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Carbon-based, Oxides, Zirconia, Other) • By End-Use (Oil & Gas, Chemical Manufacturing, Petrochemicals, Automotive, Other) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | BASF SE, Evonik Industries AG, Saint-Gobain NorPro, Cabot Corporation, Clariant AG, CeramTec GmbH, W. R. Grace & Co., Almatis Inc., Sasol Limited, SABIC, Noritake Co., Limited, Rogers Corporation, Porocel Industries, LLC, Sinocata, Honeywell UOP, Calgon Carbon Corporation, Magang Group, Jiangxi Huihua Technology Co., Ltd., Pingxiang Gophin Chemical Co., Ltd., Fujimi Incorporated and others |