Cold Chain Monitoring Market Report Scope & Overview:

Get More Information on Cold Chain Monitoring Market - Request Sample Report

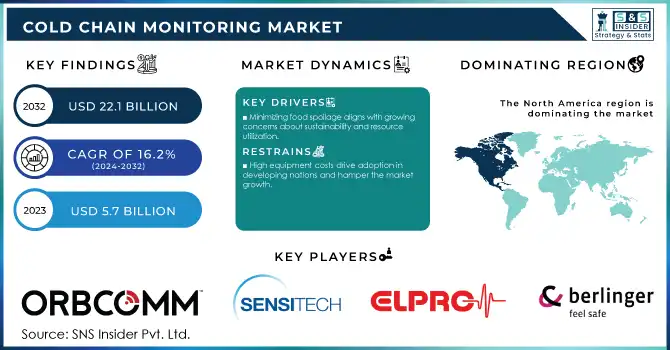

The Cold Chain Monitoring Market Size was USD 5.7 Billion in 2023 and is expected to reach USD 22.1 Billion by 2032 and grow at a CAGR of 16.2% over the forecast period of 2024-2032.

The growth in the cold chain monitoring market is primarily driven by the rise in demand for temperature-sensitive products. Pharmaceutical, Biotechnological, Food and Beverage, etc. industries depend on maintaining tight-temperature specific controls in their processes to ensure product quality and safety in a controlled environment. Likewise, the food industry has seen an increase in consumer demand for less processed and organic offerings; thus, driving the need for cold chain systems to prevent spoilage and increase shelf life. The market also benefits from regulatory standards like the ones enforced by the U.S. FDA and WHO that further emphasize the need for maintaining certain temperature ranges. Especially, in emerging economies, the growing middle-class population, urbanization trends, and increased consumption of perishable goods are establishing a critical need for advanced cold chain monitoring solutions that can cater to the requirements on-the-go.

In the pharmaceutical sector, the global vaccine market was valued at approximately USD 60 billion in 2021, as reported by the World Health Organization (WHO), with a significant portion comprising temperature-sensitive biologics and mRNA vaccines. In the food industry, the United Nations Food and Agriculture Organization (FAO) estimates that around 14% of the world’s food is lost post-harvest, often due to inadequate cold chain systems, emphasizing the need for advanced monitoring.

IoT (Internet of Things) and Sensor technologies have come a very long way in evolving the functions of cold chain monitoring systems making them more efficient & effective. IoT devices, RFID tags, and real-time tracking systems empower the monitoring of essential elements like temperature, humidity, and location in the supply chain. Access to this real-time data permits stakeholder to note discrepancies like temperature increases and remedy them before products are compromised. Bluetooth-connected sensors and cloud-based analytics enhance cold chain performance by enabling connectivity, remote data access, and predictive insights. Making this possible helps to manage proactively, limits human error, and increases operations efficiency with alerts, and data collection automated.

The FDA's Drug Supply Chain Security Act (DSCSA) also mandates that temperature-sensitive pharmaceuticals be continuously monitored, driving the adoption of IoT-based solutions to meet compliance standards. This technology-driven shift ensures greater reliability and cost-effectiveness, particularly in protecting perishable goods and pharmaceuticals, as evidenced by growing government investments in cold chain infrastructure.

Cold Chain Monitoring Market Dynamics

Drivers

-

Minimizing food spoilage aligns with growing concerns about sustainability and resource utilization.

-

Growth in the pharmaceuticals sector drives the growth of the cold chain monitoring market.

The growing pharmaceuticals sector is one of the major factors driving the cold chain monitoring market. The rising need for biologics, vaccines, and other temperature-sensitive medicines drives the critical risk of accurate temperature storage and transportation, where uncontrolled temperature leads to a decrease in product efficacy and safety. The U.S. FDA on the other hand, requires the shipping of certain biologics, such as vaccines and insulin, to be monitored at an appropriate temperature, hence increasing the need for reliable cold chain monitoring solutions. As these products become increasingly complex and valuable, temperature control becomes necessary, leading to IoT-based sensors, RFID tags, and real-time tracking systems for tracking/regulatory compliance and spoilage prevention. Moreover, guidelines issued by regulatory bodies including the FDA Drug Supply Chain Security Act (DSCSA) and the European Medicines Agency (EMA) have created a framework for real-time and continuous monitoring of temperature-sensitive products which will further increase acceptance of state-of-the-art cold chain technology within the pharmaceutical industry. Such growing dependence on cold chain solutions is driving the growth of the cold chain monitoring market, especially as pharmaceutical companies continue to prioritize safety, compliance, and efficiency.

Restraint

-

High equipment costs drive adoption in developing nations and hamper the market growth.

The cold chain monitoring market is growing on a large scale, but one of the restraints is the high cost of equipment for banks, especially in developing countries. The more advanced cold chain monitoring systems, including IoT-based sensors, RFID tags, real-time trackers, and cloud-based analytics, involve significant initial investment. The cost of setting up a temperature-controlled storage and transport infrastructure in addition to advanced monitoring devices is however quite high. However, due to the high cost of this type of equipment, low- and middle-income countries find it particularly challenging to obtain the required funding, which restricts the growth of advanced cold chain solutions. In particular, in regions where cold chain technologies are early in development or financial resources are limited, these characteristics have acted as an obstacle to the expansion of ice infrastructure.

Cold Chain Monitoring Market Segmentation Analysis

By Component

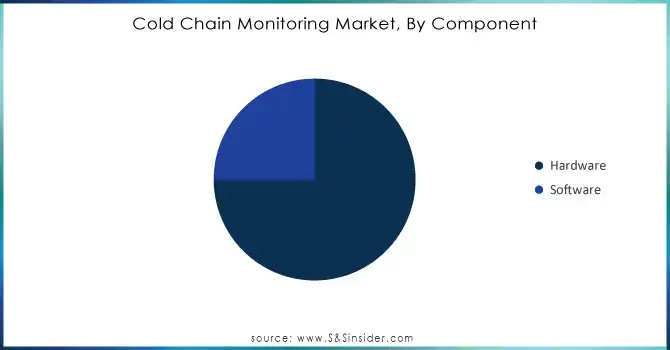

The Hardware sub-segment dominated in the cold chain monitoring market, capturing a massive 78.6% revenue share in 2023 by component. This segment encompasses various devices like sensors, RFID tags, telematics devices, and networking equipment. These workhorses gather crucial data such as temperature and location of products within the cold chain. Armed with this real-time information, businesses can make informed decisions to optimize cold chain operations. Companies like Samsara Inc. and Laird Connectivity are leading players in this space, offering cutting-edge hardware solutions for cold chain monitoring. The increasing need to ensure the integrity of temperature-sensitive products is a key factor propelling the growth of this hardware segment.

Get Customized Report as per Your Business Requirement - Request For Customized Report

By Temperature Type

In terms of temperature type, the frozen area accounts for the highest market share in the cold chain Monitoring market due to its extensive use in both the food and professional areas. The frozen items in the food industry, several of which are meat, seafood, greens, and ready-to-eat meals, want to be preserved at low temperatures constantly to keep great quality, taste, and dietary values. An increase in demand for ready-to-eat meals and meals that offer long shelf-life time is expected to support the frozen segment, further contributing to its dominance. The frozen food market, in the U.S. alone, was valued at more than USD 60 billion by the U.S. Department of Agriculture (USDA) in 2023 and is expected to grow substantially in the upcoming years. The dependence of the pharmaceutical industry on frozen storage for vaccines, biologics, and other temperature-sensitive drugs only adds to the need for cold chain monitoring in this sector as well.

By Application

The food and beverages sector dominated the cold chain monitoring market in terms of market share owing to the critical demand for temperature-controlled supply chains for perishables. In a world where consumer demand for fresh, frozen, and processed foods is extremely high and growing made worse by rising online grocery shopping, and the ever-growing trend of ready-to-eat meals the necessity for cold chain solutions is more important than ever. The Food and Agriculture Organization (FAO) estimates that 14 percent of food produced globally is lost post-harvest, and much of this can be attributed to insufficient cold chain infrastructure, signifying the need for such reliable monitoring systems. Cold chain technologies like IoT sensors, RFID tags and real-time tracking systems are used for the preservation of temperature-sensitive food items like dairy, meat, seafood, fruits, and vegetables by ensuring they are stored and transported in the right conditions to avoid spoilage, contamination, and waste.

Cold Chain Monitoring Market Regional Overview

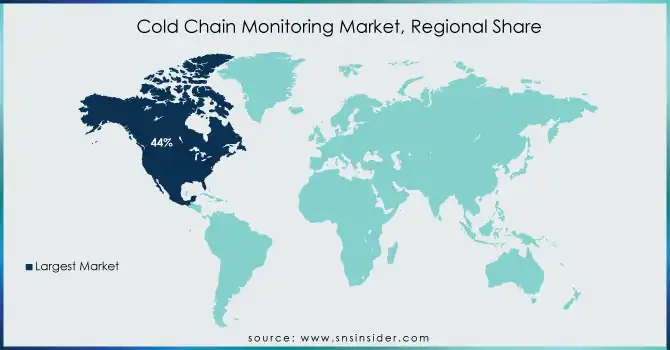

North America held the highest market share around 44% in 2023. This is owing to well-structured infrastructure, wide adoption of advanced technologies in the countries in this region, and stringent regulatory compliance frameworks. The US and the rest of the region are also distinguished by strong cold chain logistics systems tied to numerous industries, from food and beverages to pharmaceuticals and healthcare. In the food industry, demand for frozen, chilled, and perishable goods rises steadily with the popularity of consumer demands for convenience and quality. Temperature-regulated transportation and storage of pharmaceuticals and food products fall under the authority of the U.S. Food and Drug Administration (FDA) and U.S. Department of Agriculture (USDA), with stringent regulations that increase the demand for cold chain monitoring systems. Moreover, the presence of some key market players and innovative companies like Thermo King, Carrier Transicold, and Emerson, which are also some of the established companies, are aggressively investing in new cold chain monitoring technologies, thus impelling the market globally in this region. Additionally, an increase in online food ordering and delivery services and growing cold chain logistics networks across the region in countries such as Canada and Mexico also prevail in the market in this region. All these factors together make North America the largest and most innovative market for cold chain monitoring across the globe.

Key Players in Cold Chain Monitoring Market

-

ORBCOMM (US) – (IoT-based cold chain monitoring solutions, Fleet Management Systems)

-

Sensitech (US) – (TempTale Data Loggers, Cold Chain Monitoring Software)

-

Elpro-buchs (Switzerland) – (ELPRO Monitoring Solutions, e-Transcript System)

-

Berlinger & Co. (Switzerland) – (ThermoTrack Temperature Monitoring, ActiveSense Monitoring System)

-

Monnit (US) – (Monnit Wireless Sensors, Monnit Cloud Platform)

-

Controlant (Iceland) – (Controlant Smart Cold Chain, Real-time Monitoring Solutions)

-

Lineage Logistics Holding – (Cold Storage Solutions, Lineage Link Digital Platform)

-

Tagbox – (Cold Chain IoT Sensors, Tagbox Data Analytics Platform)

-

DAIKIN Industries – (Refrigeration Solutions, Remote Monitoring Systems)

-

Savi Technology – (SaviTrack RFID Solutions, SaviSense Sensor Platform)

-

Safetraces – (TraceX Technology, Blockchain-Based Traceability Solutions)

-

FreshSurety – (FreshSurety Cold Chain Monitoring, Wireless Temperature Sensors)

-

Thermo King – (Thermo King Refrigeration Units, Reefer Units)

-

Carrier Transicold – (Carrier Transicold X4 Series, Monitoring Solutions)

-

Emerson – (Emerson Copeland Scroll, SureTemp Cold Chain Monitoring)

-

Tive – (Tive Solo Tracker, Tive Stream Real-Time Monitoring)

-

Zebra Technologies – (Zebra Data Capture, Temperature Tracking Solutions)

-

Honeywell – (Honeywell Temperature Monitoring, Sensor Data Solutions)

-

Transcore – (TransCore RFID, GPS Tracking Systems)

-

Geotab – (Geotab Fleet Management, Cold Chain Temperature Monitoring)

Recent Development:

-

In 2024, Emergent Cold Latin America made a strategic move by acquiring Frimosa's cold storage business in Montevideo, Uruguay. They wasted no time announcing plans for a significant expansion. The company will be developing a 17,000-pallet addition to the recently acquired facility in Polo Oeste, with an expected completion date of mid-2024.

-

In February 2023: Danfoss and Lizard Monitoring joined forces to combat food spoilage in North America. Lizard's sensors work with Danfoss' system for continuous temperature tracking, giving store managers valuable data to minimize food waste.

-

In June 2023: Orbcomm expanded its UK network with Refrigerated Trailer Services (RTS). As a leading provider of used refrigerated trailers, RTS will offer Orbcomm's temperature dataloggers for real-time monitoring and cold chain compliance in the transport, pharmaceutical, and food industries.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 5.7 Billion |

| Market Size by 2032 | US$ 22.1 Billion |

| CAGR | CAGR of 16.2% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Hardware, Software) • By Temperature Type (Frozen, Chilled) • By Logistics (Transportation, Warehousing) • By Application (Beverages And Foods, Pharmaceuticals, Chemicals, Others) |

| Regional Analysis/Coverage |

North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America |

| Company Profiles | Sensitech, Monnit, Infratab, NXP Semiconductors N.V, Controlant, ORBCOMM, Elpro-Buchs, Berlinger, NEC Corp, Zest Labs, Klinge Corporation, Verigo, Nimble Wireless, SecureRF Corporation, Savi Technology, Lineage Logistics Holding, Tagbox, DAIKIN Industries, Safetraces, FreshSurety and other key players. |

| DRIVERS | • Increased accessibility is driving up demand for generic drugs. • Global demand for temperature-sensitive drugs is increasing. • Rising demand for higher food quality, as well as the need to reduce food waste |

| Restraints | • Rising concerns about greenhouse gas emissions. • High implementation costs. |