CSP MOSFET Market Size & Trends:

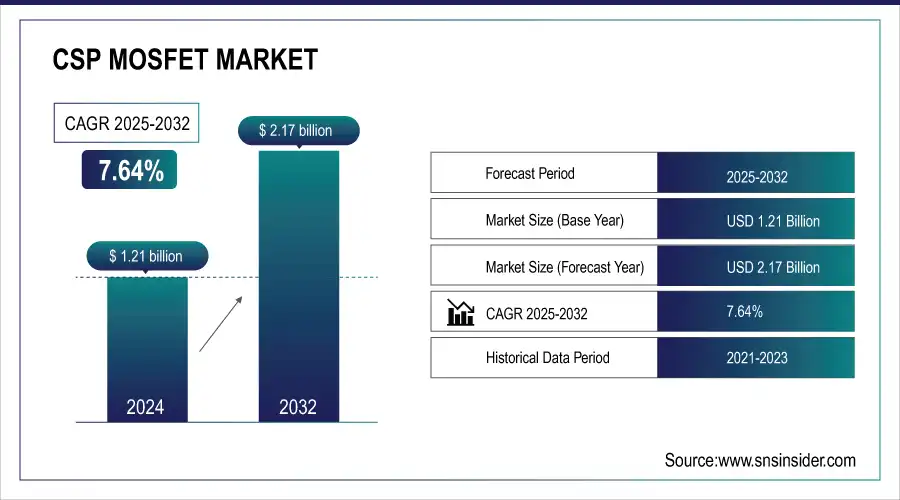

The CSP MOSFET Market size was valued at USD 1.21 billion in 2024 and is expected to reach USD 2.17 billion by 2032, growing at a CAGR of 7.64% over the forecast period of 2025-2032.

To Get more information On CSP MOSFET Market - Request Free Sample Report

The main factors driving the CSP MOSFET market are the increasing popularity of electric vehicles and portable electronics that require compact and high-efficiency power devices. The reduced form factor, improved thermal performance, and quicker switching of CSP packaging are suited to provide many benefits in foldable use cases, as well as high-density automotive use as well and in consumer electronics and industrial devices.

Increasing demand for compact electronics requiring efficient ultra-low thermal impedance and on-resistance performance is responsible for the rapid growth seen in the CSP MOSFET market. This push for compact circuit designs to fit into devices such as IoT devices, smartphones, and wearable technology is driving the popularity of the technology. Another major factor responsible for driving the market growth is the rise in the integration of power electronics with renewable energy systems, as well as industrial automation. Higher efficiency and lower power losses from CSP MOSFETs aimed at energy-conscious applications.

-

In September 2024, NOVOSENSE Microelectronics launched the NPM12023A, a 12V N-channel dual MOSFET using proprietary CSP technology, offering ultra-low on-resistance (0.9–5.5 mΩ).

Market Size and Forecast

-

CSP MOSFET Market Size in 2024: USD 1.21 Billion

-

CSP MOSFET Market Size by 2032: USD 2.17 Billion

-

CAGR: 7.64% from 2025 to 2032

-

Base Year: 2024

-

Forecast Period: 2025–2032

-

Historical Data: 2021–2023

CSP MOSFET Market Trends

-

Rising demand for energy-efficient power electronics is driving the CSP MOSFET market.

-

Growing adoption in automotive, consumer electronics, industrial, and renewable energy applications is boosting growth.

-

Advancements in compact, high-performance, and low-resistance MOSFET designs are enhancing efficiency and thermal management.

-

Increasing use in DC-DC converters, power supplies, and electric vehicle inverters is expanding applications.

-

Focus on miniaturization and high-density packaging is shaping product development trends.

-

Expansion of electric mobility and smart grid infrastructure is fueling market adoption.

-

Collaborations between semiconductor manufacturers, device integrators, and automotive OEMs are accelerating innovation and deployment.

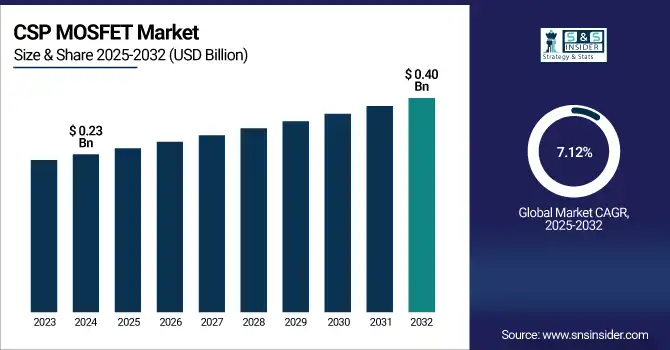

The U.S. CSP MOSFET market size is estimated to be valued at USD 0.23 billion in 2024 and is projected to grow at a CAGR of 7.12%, reaching USD 0.40 billion by 2032. The U.S. CSP MOSFET Market growth can be attributed to the rising industrial automation with assurance for reliability, an increase in demand for high-efficiency power supplies, and an increase in data centers. Growth is also driven by the presence of a robust semiconductor ecosystem in the country and early adoption of advanced packaging technologies.

CSP MOSFET Market Growth Drivers:

-

Rising Demand for Compact and Energy-Efficient Devices Drives Global CSP MOSFET Growth

The major factor that is expected to accelerate the Global CSP MOSFET market trends is the increasing demand for compact-sized and energy-efficient electronic devices. Consumer electronics components are becoming smaller and smaller, from smartphones, to wearables, to everything Internet of Things, and with these devices trend comes the need for low components that can provide ultra-low thermal impedance and on-resistance. Furthermore, as a direct result of better power efficiency and thermal performance, the widespread adoption of CSP MOSFETs is also accelerating in electric vehicles (EVs).

-

The global EV market is anticipated to reach 30 million units by 2030, with a significant portion of these vehicles adopting advanced power electronics, including MOSFETs. EVs are integrating MOSFETs for better power efficiency and faster switching, with Tesla incorporating SiC MOSFETs into its powertrain, improving overall system performance by 5-10%

CSP MOSFET Market Restraints:

-

Integration Challenges and Technical Constraints Hinder Growth in CSP MOSFET Development and Adoption

The global CSP MOSFET market faces significant challenges in terms of technical constraints and integration complexities. However, CSP MOSFETs suffer from integration being difficult due to the design of specialized circuits and compatibility with old components. The ongoing technological advancements demand continuous updates and changes, which create a huge challenge for manufacturers to remain competitive while ensuring interoperability across different platforms.

CSP MOSFET Market Opportunities:

-

Industrial Automation and Renewable Energy Systems Drive Growing Demand for Efficient CSP MOSFET Technology

The fast-growing industrial automation and renewable energy systems are becoming key market opportunities. Perhaps most importantly, CSP MOSFETs enhance power performance in robotic and industrial applications, and in solar and wind energy storage systems. This will lead to burgeoning demand for sustainable energy and efficient power delivery. As a result, the continuously evolving semiconductor production and assembly technologies will fuel the CSP MOSFET use in different market segments with further growth opportunities.

-

Global solar energy capacity is set to reach 2,500 GW by 2025, driven by both utility-scale solar farms and distributed solar systems. The efficiency of power conversion in solar systems is a key factor, with CSP MOSFETs playing a critical role in minimizing power losses in inverters, energy storage systems, and power electronics

CSP MOSFET Market Challenges:

-

Raw Material Constraints and Complex Manufacturing Processes Hinder CSP MOSFET Production Scalability and Growth

The other significant restraint is the raw material and the complexity of the process involved in manufacturing the product. The supply chain of advanced materials such as silicon carbide (SiC) and gallium nitride (GaN), typically advantageous for CSP MOSFETs to achieve high performance, is constrained, creating a bottleneck for production delays and scalability issues. Additionally, the packaging and assembly methods demand high precision, requiring specialized equipment and know-how, which poses a barrier for new entrants and the capacity to scale while maintaining the stringent quality standards.

CSP MOSFET Market Segment Analysis

By Product Type, N-Channel MOSFETs dominated in 2024 with 51.6% share. Dual N-Channel expected fastest CAGR, 2025–2032.

N-channel segment held the majority share of 51.6% of the CSP MOSFET market in 2024. The reason for this dominance is the use of N-Channel MOSFET everywhere because N-Channel MOSFET provides the best switching speed, efficiency, and thermal stability. This makes these MOSFETs suitable for high-power and high-speed applications like power supply circuits, automotive, and industrial systems. The devices are very compact and energy-efficient due to their ability to operate high voltage capacities and their low on-resistance characteristic.

From 2025 to 2032, the Dual N-Channel segment is expected to witness the highest growth rate, with the fastest CAGR. This is a result of rising demand for compact, space-saving, energy-efficient solutions for power management systems, renewable energy, and electric vehicles (EVs), among other applications, which is driving this growth. Specifically designed for high-power electronics applications where the efficiency and thermal constraints are more relaxed, the Dual N-Channel MOSFETs are the most difficult parts to mass fabricate and come at high costs.

By Application, Consumer Electronics led in 2024 with 38.3% share. Automotive segment growing fastest, 2025–2032.

In 2024, the market is expected to be led by the Consumer Electronics segment, which will hold a 38.3% of CSP MOSFET market share. The trend is fuelled by the ongoing reduction in size of electronics like smartphones, wearables, and other IoT types of equipment, all of which demand power devices that are small, energy-saving, and have low thermal resistance. These applications demand ultra-low on-resistance and best-in-class power performance from CSP MOSFETs, both essential attributes for energy-efficient devices.

The automotive segment would grow at the fastest CAGR from 2025 to 2032. The rapid growth is primarily driven by the swift ramp-up of EV adoption and the growing demand for advanced power electronics in vehicles. CSP MOSFETs are an indispensable part of high-performance and high-efficiency power systems, including electric drivetrains, battery management systems, and charging infrastructure. This growing demand within the automotive sector is attributed to their advantage in reducing power losses and improving thermal management.

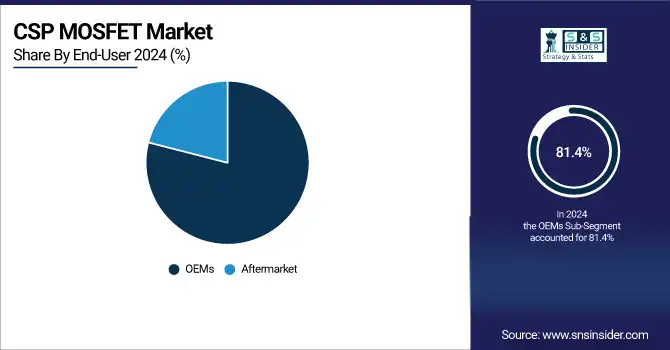

By End Use, OEMs held 81.4% share in 2024 and expected to grow fastest, 2025–2032.

OEMs accounted for a market share of 81.4% in 2024 and are expected to witness the fastest CAGR from 2025 to 2032. The growth is attributed to the growing need for high-performance and energy-efficient components for original equipment manufacturing, mainly in end-use industries, including automotive, consumer electronics, and industrial automation. OEMs consume some of the most CSP MOSFETs, which can provide a smaller, more reliable, and more efficient solution to a wider range of applications. OEMs are adopting CSP MOSFETs to support miniaturization, energy efficiency, and performance as industries are focused on these aspects. This is only likely to become more pronounced as further advances and growth in electric vehicles, Internet of Things (IoT), and renewable energy continue to drive new demand for these sophisticated power elements built into original equipment designs.

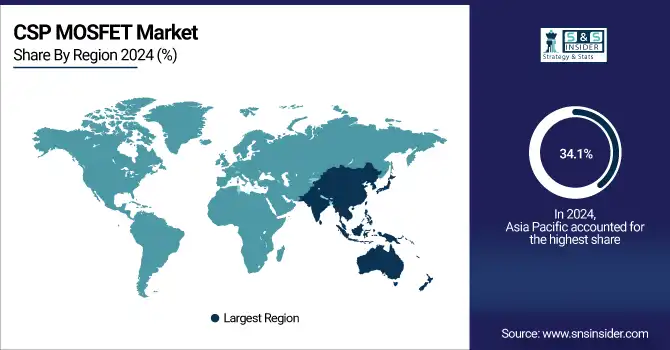

CSP MOSFET Market Regional Analysis

Asia Pacific CSP MOSFET Market Insights

Asia Pacific was the leading market with a market share of 34.1% in 2024 and is likely to be the fastest growing region with the market growing at a rapid CAGR during the projected period from 2025 to 2032. The rapid growth of these industries, especially in consumer electronics, automotive, and industrial automation, is driving the demand for CSP MOSFET due to advantages in power efficiency and thermal management capability, which is propelling the region's dominance. The continuous progression of technology requires devices to be compact, high efficiency, and high performance which is where CSP MOSFETs are popular. Furthermore, the region's further penetration of electric vehicles, renewable energy systems, and industrial automation is adding to the growth of the market. Asia Pacific is leading the CSP MOSFET market across the globe, owing to the strong base in semiconductor manufacturing and a high focus on innovation.

Get Customized Report as per Your Business Requirement - Enquiry Now

China leads in Asia Pacific, thanks to its strong semiconductor manufacturing capabilities, a massive electronics industry, and a rising demand for high-performance components. The growth of electric vehicles, renewable energy, and industrial automation in the country is also rapidly stimulating the need for energy-efficient MOSFETs in several applications.

North America CSP MOSFET Market Insights

The CSP MOSFET market in North America is primarily propelled by advanced technological developments and a consolidated presence of key verticals, including automotive, consumer electronics, and industrial automation. Further pockets of market expansion include a commitment to innovative efforts at every level, energy efficiencies, and the quick uptake of electric vehicles and renewable energy solutions throughout the region. At the same time, the rising need for efficient power management systems in the IoT and robotics applications is also fostering the growth and penetration of CSP MOSFETs in the region.

In North America, the United States accounts for the largest share of CSP MOSFET due to the existence of a strong semiconductor manufacturing industry, major technological innovations, and high demand for advanced power management solutions across various industries such as automotive, consumer electronics, and renewable energy.

Europe CSP MOSFET Market Insights

The CSP MOSFET market is strengthened in Europe, owing to the larger automotive, industrial, and renewable energy sectors. The demand for high-performance power components like CSP MOSFETs is driven by the region's increased shift towards electric vehicles, energy-efficient systems, and industrial automation. The drive for sustainable and green energy solutions in Europe is continuing to propel CSP MOSFET deployment in power conversion and energy storage applications.

Germany holds the largest share of the Chip Scale Package MOSFET market in Europe, as electric vehicle manufacturing and industrial automation are two of the country's biggest manufacturing sectors. Demand for advanced power components such as CSP MOSFETs is also driven by the country’s leadership in engineering and technological innovation, as well as by its commitment to sustainability and green energy.

Middle East & Africa and Latin America CSP MOSFET Market Insights

Latin America and the Middle East & Africa (MEA) are other potential emerging markets for CSP MOSFETs, with industrialization, renewable energy power projects, and energy-efficient technologies gaining traction in those regions. Meanwhile, the increasing presence of the automotive and consumer electronics industries within these regions, with demand for a new age power component enabling higher efficiency and efficacy in applications, is also holding a strong position in driving market expansion.

CSP MOSFET Market Competitive Landscape:

Infineon Technologies AG

Infineon Technologies, founded in 1999 and headquartered in Neubiberg, Germany, is a global leader in semiconductor solutions, specializing in automotive, industrial, and power electronics applications. The company focuses on energy-efficient, high-performance semiconductor devices, including power MOSFETs, IGBTs, and microcontrollers. Infineon’s innovations support electrification, renewable energy, and industrial automation, enabling reduced energy consumption, enhanced reliability, and improved system performance across automotive and industrial sectors worldwide.

-

April 2025: Infineon Technologies launched the CoolSiC™ MOSFET 750 V G2 series, offering ultra-low RDS(on) down to 4 mΩ for enhanced efficiency in automotive on-board chargers and industrial power converters.

STMicroelectronics

STMicroelectronics, founded in 1987 and headquartered in Geneva, Switzerland, is a global semiconductor company providing microelectronics and power solutions for automotive, industrial, and consumer applications. The company specializes in energy-efficient devices, including silicon carbide (SiC) MOSFETs, IGBTs, and sensors, aimed at enabling next-generation electric vehicles, industrial automation, and renewable energy systems. STMicroelectronics emphasizes performance, miniaturization, and reliability in high-voltage power electronics.

-

September 2024: STMicroelectronics unveiled its fourth-generation STPOWER silicon carbide (SiC) MOSFETs, optimized for next-gen EV traction inverters, offering enhanced efficiency and reduced size.

Key Players:

Some of the major CSP MOSFET companies are

-

Infineon Technologies

-

Texas Instruments

-

ON Semiconductor

-

Nexperia

-

Vishay Intertechnology

-

Microchip Technology

-

Toshiba Corporation

-

Semikron International

-

Infineon Technologies

-

STMicroelectronics

-

Texas Instruments

-

ON Semiconductor

-

Nexperia

-

ROHM Semiconductor

-

Vishay Intertechnology

-

Microchip Technology

-

Toshiba Corporation

-

Semikron International

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 1.21 Billion |

| Market Size by 2032 | USD 2.17 Billion |

| CAGR | CAGR of 7.64% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type (N-Channel, P-Channel, Dual N-Channel, and Dual P-Channel) • By Application (Consumer Electronics, Automotive, Industrial, Telecommunications, and Others) • By End-User (OEMs, and Aftermarket) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Taiwan, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles |

Infineon Technologies, STMicroelectronics, Texas Instruments, ON Semiconductor, Nexperia, ROHM Semiconductor, Vishay Intertechnology, Microchip Technology, Toshiba Corporation, Semikron International, Infineon Technologies, STMicroelectronics, Texas Instruments, ON Semiconductor, Nexperia, ROHM Semiconductor, Vishay Intertechnology, Microchip Technology, Toshiba Corporation, Semikron International |