Dental Biomaterials Market Size & Overview:

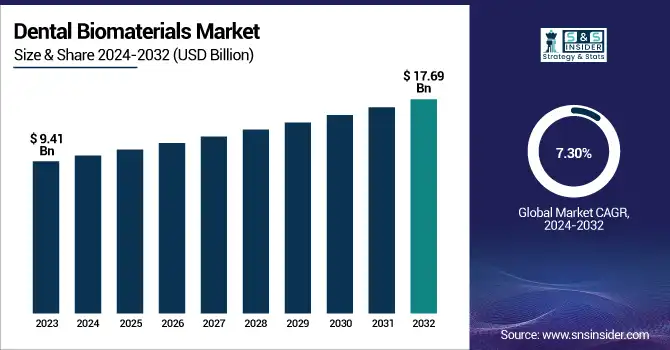

The Dental Biomaterials Market Size was valued at USD 9.41 billion in 2023 and is expected to reach USD 17.69 billion by 2032, growing at a CAGR of 7.30% from 2024-2032.

Get More Information on Dental Biomaterials market - Request Sample Report

The Dental Biomaterials Market Report provides unique statistical insights through the analysis of incidence and prevalence data for dental disorders, including regional differences in tooth loss, periodontitis, and implant procedures in 2023. It explores regional trends in treatments and experience in the use of biocompatible materials, CAD/CAM-based solutions, and regenerative biomaterials. The report also describes healthcare expenditure categories, detailing government, private, and out-of-pocket spending on dental biomaterials. Another unique feature is the innovation and adoption trends aspect, covering emerging bioactive materials, smart polymers, and 3D printed biomaterials, with an in-depth analysis of the technological evolution that is driving the market.

Dental Biomaterials Market Dynamics

Driver:

-

Rising demand for biocompatible and sustainable dental materials fuels growth in the dental biomaterials market

The increasing focus on biocompatibility and sustainability in dental materials is a major driver of the dental biomaterials market. Health-conscious and environment-friendly products by patients and dental practitioners are in high demand for materials such as bioactive ceramics, resin, and sustainable composites. These sources bring benefits like better patient outcomes and reduced environmental impact, leading manufacturers to produce products that cater to both clinical and environmental demands. This shift toward sustainable and biocompatible options is increasing market growth and is attracting investment in research and development.

Restraint:

-

High cost of advanced dental biomaterials hinders widespread adoption in price-sensitive markets

The high cost associated with advanced dental biomaterials, such as zirconia and bioceramics, remains a significant restraint for the market, particularly in price-sensitive regions. These materials, while offering superior quality and durability, are expensive to produce and require specialized knowledge for proper application, which limits them to a narrower population, mainly in developing economies where affordability is preferred. These materials are quite expensive, hence limiting their large-scale application, and this causes problems for dentists and their patients, therefore limiting the complete realization of this market in particular areas.

Opportunity:

-

Technological advancements in digital dentistry open new opportunities for growth in the dental biomaterials market

Technological innovations in digital dentistry, such as 3D printing, CAD/CAM systems, and computer-assisted design, present significant opportunities for growth in the Dental Biomaterials Market. Advances enable the accuracy and efficiency of creating dental restoration and prostheses, including their fitment and functionality capabilities, in developing biomaterial for teeth. At an advanced pace with the digitalization of dentistry, manufacturers take on these tools for creating novel tailored solutions. Such a revolution to customized treatment plans and better ways of creating items is bound to increase new, high-edge demand for these biomaterials by the companies interested in finding ways to such demands.

Challenge:

-

Regulatory hurdles and approval delays for new dental biomaterials limit market expansion

One of the key challenges in the dental biomaterials market is navigating regulatory hurdles and approval delays for new materials and technologies. The regulatory requirements set by regulatory agencies such as the FDA and European Medicines Agency (EMA) for safety, effectiveness, and biocompatibility can sometimes slow the launch of new products into the market. This is associated with delays in product launches and increased costs in research and development. In trying to achieve regulatory compliance, the long procedures involved in seeking approval can limit the speed at which new dental biomaterials are introduced to the market, thereby hindering the general advancement of the industry.

Dental Biomaterials Market Segmentation Analysis

By Type

In 2023, the Ceramic Biomaterials segment held the largest revenue share of 39% in the dental biomaterials market, driven by their biocompatibility, durability, and aesthetic appeal in dental restorations. Ceramic materials, particularly zirconia and porcelain, are preferred for dental crowns, bridges, and implants due to their natural appearance, strength, and ability to withstand wear and tear.

For instance, Dentsply Sirona launched the Celtra Duo, a high-performance ceramic for dental restorations, combining aesthetics with advanced strength. Meanwhile, Ivoclar Vivadent introduced IPS e.max ZirCAD as part of their new portfolio, which offers greater translucency and excellent fit, setting a new standard for ceramic-based restorations.

These advancements have been crucial in solidifying the position of ceramic biomaterials in the market to the current trend of patient inclinations for aesthetic, durable dental options. The segment's expansion is anticipated to persist, driven by innovations in material characteristics and production techniques, thereby enhancing the Dental Biomaterials Market's adoption and market share in the upcoming years.

By Application

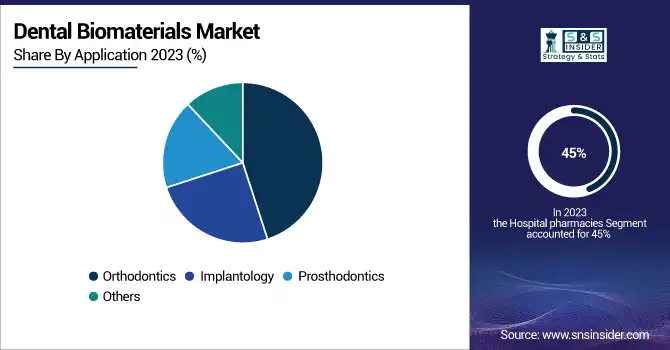

In 2023, the Orthodontics segment dominated the dental biomaterials market with the largest revenue share of about 45%, driven by the increasing demand for advanced orthodontic treatments, including braces, aligners, and other corrective devices. Increased recognition of dental aesthetics along with more patients looking for even more unobtrusive and powerful orthodontic treatments is enhancing the usage of high-performance biomaterials on this end.

For example, Align Technology expanded its Invisalign system, launching new clear aligners that feature cutting-edge materials for better comfort and more predictable outcomes.

Moreover, 3M Oral Care launched the Clarity Ultra Self-Ligating Bracket system to better serve a more effective treatment procedure and to provide comfort for patients. These innovations not only make orthodontic services more efficient and comfortable but also fill the growing demand for aesthetic and less-invasive dental procedures.

By End-use

In 2023, the Dental Laboratories segment held the largest revenue share of about 40% in the dental biomaterials market, driven by the increasing demand for customized and high-quality dental restorations. Dental labs are at the forefront of using advanced biomaterials such as ceramics, composites, and metals to create crowns, bridges, and dentures. Additionally, Dentona introduced Dentona Denture Teeth, a new line of aesthetically pleasing and long-lasting materials for denture production, which meets consumer demands for beauty and durability.

The Dental Hospitals and Clinics segment is poised to experience the largest CAGR during the forecasted period, driven by the rising number of dental procedures performed in hospitals and outpatient clinics. As dental care continues to evolve with advanced technologies, there is an increasing demand for specialized biomaterials in various procedures such as implants, orthodontics, and cosmetic dentistry.

Furthermore, Nobel Biocare has developed NobelActive implants, which provide better stability and shorter healing periods, making them ideal for clinical use. The rise in dental hospitals and clinics that are embracing digital technologies, including 3D imaging, CAD/CAM, and digital impressions, is further fueling the demand for advanced dental biomaterials.

Dental Biomaterials Market Regional Outlook

In 2023, North America dominated the dental biomaterials market, holding a significant market share of approximately 39%. The dominance of this region is attributed to the high adoption of advanced dental technologies, robust healthcare infrastructure, and the growing demand for cosmetic and restorative dental procedures. Additionally, North America is a region with high disposable income and a rising awareness of dental aesthetics among consumers, which has increased the demand for the high-end dental biomaterials market.

Asia Pacific region is the fastest-growing market for Dental Biomaterials, with an expected CAGR of 9.37% over the projected period. This rapid growth is attributed to factors such as an increasing population, rising disposable incomes, and a surge in the requirement for advanced dental treatments. Countries such as China, India, and Japan are experiencing growth in dental tourism, which has a positive effect on the demand for high-quality dental materials.

For instance, in India, there is a growing awareness of oral hygiene, coupled with an increased emphasis on cosmetic dentistry, leading to a rise in demand for biomaterials. As a result, the Asia Pacific region is experiencing rapid growth in the Dental Biomaterials Market, presenting numerous opportunities for market players to expand their presence and offerings.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players in the Dental Biomaterials Market

-

Dentsply Sirona (Ceramco 3, Celtra Duo)

-

3M (Filtek Universal, Ketac Universal)

-

Zimmer Biomet (Trabecular Metal Dental Material, Zfx CAD/CAM Abutments)

-

Straumann Group (Roxolid, Emdogain)

-

Danaher Corporation (NobelProcera, Multilink Automix)

-

Ivoclar Vivadent (IPS e.max, Tetric EvoCeram)

-

GC Corporation (GC FujiCEM, GC Initial LiSi)

-

Kuraray Noritake Dental (Panavia V5, Katana Zirconia)

-

Henry Schein (Bioactive Restorative Material, PerioPatch)

-

Septodont (Biodentine, SeptoPack)

-

Bisco Dental Products (Aelite All-Purpose Body, TheraCal LC)

-

Coltene (Brilliant EverGlow, Affinis Precious)

-

Shofu Dental Corporation (Beautifil II, Super-Snap)

-

Zhermack SpA (Elite HD+, Zetaplus)

-

Kuraray Co., Ltd. (CLEARFIL Universal Bond Quick, ESTECEM II)

-

VITA Zahnfabrik (VITA ENAMIC, VITA SUPRINITY)

-

Tokuyama Dental (Estelite Sigma Quick, OMNICHROMA)

-

Ultradent Products, Inc. (Ultra-Blend Plus, Opalescence PF)

-

Heraeus Kulzer (Charisma Diamond, Venus Pearl)

-

BIOHorizons (MinerOss, Mem-Lok).

Suppliers

-

Mitsui Chemicals, Inc.

-

Evonik Industries AG

-

BASF SE

-

Dupont

-

Arkema Group

-

DSM Biomedical

-

Kuraray Co., Ltd.

-

Denka Company Limited

-

Solvay S.A.

-

Eastman Chemical Company

Recent Developments in the Dental Biomaterials Market

-

February 2024: SprintRay Inc. introduced a new lineup of products developed by its Biomaterial Innovation Lab, including the NanoCure post-curing device, NightGuard Flex 2, NightGuard Firm 2, Apex Base, and Apex Teeth resins. These advancements represent a significant leap forward in dental 3D printing technology, enhancing precision and efficiency in dental treatments.

-

August 2023: RevBio, Inc. announced FDA approval to initiate a 20-patient clinical trial evaluating the safety and efficacy of its next-generation Tetranite bone adhesive. This innovative product is designed to rapidly stabilize dental implants following tooth extractions, offering a groundbreaking solution in implant dentistry.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 9.41 Billion |

| Market Size by 2032 | US$ 17.69 Billion |

| CAGR | CAGR of 7.30% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Metallic Biomaterials, Ceramic Biomaterials, Polymeric Biomaterials, Metal-Ceramic Biomaterials, Natural Biomaterials, Composites Biomaterials) • By Application (Implantology, Orthodontics, Prosthodontics, Others) • By End-Use (Dental Hospitals and Clinics, Dental Laboratories, Dental Academies and Research Institutes, Dental Product Manufacturers) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Dentsply Sirona, 3M, Zimmer Biomet, Straumann Group, Danaher Corporation, Ivoclar Vivadent, GC Corporation, Kuraray Noritake Dental, Henry Schein, Septodont, Bisco Dental Products, Coltene, Shofu Dental Corporation, Zhermack SpA, Kuraray Co., Ltd., VITA Zahnfabrik, Tokuyama Dental, Ultradent Products, Inc., Heraeus Kulzer, BIOHorizons, and other players. |