Protein Chip Market Size Analysis

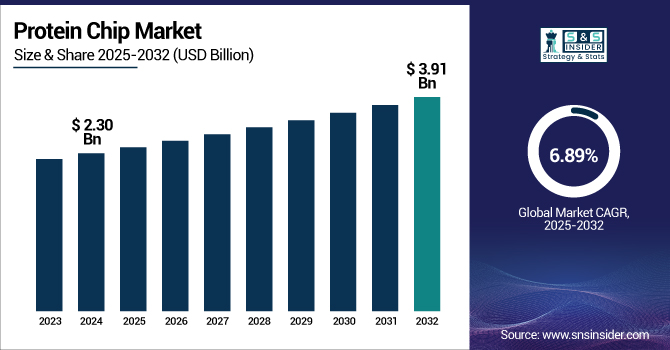

The Protein Chip Market size was valued at USD 2.30 billion in 2024 and is expected to reach USD 3.91 billion by 2032, growing at a CAGR of 6.89% over the forecast period 2025-2032.

To Get more information on Protein Chip Market - Request Free Sample Report

Protein chip technologies have become essential instruments in biomedical research, diagnostics, and personalized treatment, particularly for the identification of disease-specific biomarkers and autoimmune antibodies.

For instance, the diagnostic value of these platforms is shown by a new protein chip designed to find hepatocellular carcinoma-related autoimmune antibodies in HCV-positive individuals. High-throughput and real-time analytical features of label-free detection methods and advanced antigen microarrays, such as GeneCopoeia's OmicsArray inspire acceptance in both clinical and research spheres.

Major forces driving the market expansion are growing applications in oncology, infectious diseases, and neurology, as well as growing demand for precision diagnostics and biomarker discovery. Furthermore, the combination of nanotechnology and artificial intelligence is simplifying chip design and data interpretation.

Reflecting the use of protein chips in pandemic response, a 2021 study published in ACS Sensors, emphasizes nanomaterial-enhanced detection sensitivity, while a 2020 Scientific Reports article proposes a protein microarray enabling rapid SARS-CoV-2 antibody detection. Rising investments and technological innovation keep enhancing the direction of growth in this industry.

For instance, researchers created a nanomaterial-based protein chip in 2021 with extremely sensitive biomarker detection, hence enhancing early disease diagnosis (ACS Sensors, 2021). Similarly, a 2020 Scientific Reports study revealed a SARS-CoV-2-specific protein microarray during the COVID-19 epidemic, allowing fast antibody screening and facilitating investigation of large-scale immune response.

Protein Chip Market Dynamics

Drivers:

-

Advancements in Proteomics and Disease Diagnostics Drive Protein Chip Adoption Globally

The increasing width of proteomics and the need for rapid, multiplex diagnostics are propelling the acceleration in the protein chip market growth. Protein chips are becoming more and more essential to efficiently analyze complex biological samples, considering the increasing demand in both the microarray market and the microarray analysis market. Clinically diagnosing autoimmune antibodies in Hepatitis C patients, a pioneering study on these devices unveiled their potential.

As per a news article, technological advancements, such as label-free detection, have increased sensitivity while reducing running costs, thus significantly contributing to the protein chip market share. The demand for accurate biomarker detection drives the market growth in oncology and neurology. In addition, enhanced development includes more integration into research procedures and collaborations between academics and protein chip market companies. These technologies are poised to grow the total protein microarray market potential and sustain the market size globally with their high-throughput capabilities and increasing adoption in customized medicine.

For instance, a 2021 ACS Sensors article reported greater sensitivity in protein microarrays on nanostructured surfaces. Nature Scientific Reports documented rapid protein biomarker profiling with protein chips in 2022 for early-stage cancer detection.

Restraints

-

Cost Constraints and Performance Limitations are Impeding the Market Expansion

While the growth trend of the protein chip market is high, technological challenges and cost limitations place significant restraints. Small research labs have little demand for the expensive equipment required for protein chip manufacturing and use, such as sophisticated software and laser scanners. According to the Pure Portal of Johns Hopkins University, issues including protein degradation, non-reproducible immobilization, and high background signals degrade performance and reproducibility. These factors compromise confidence and acceptance, thus affecting the market share of protein chips despite high demand.

In addition, chips applied in the market for microarray analysis necessitate a lot of technician training, hence presenting operational hurdles. Despite the accuracy offered by fluorescent microarrays, their complexity and lengthy experiment durations deter application in point-of-care environments. Affordability continues to create a bottleneck despite innovation by companies in the protein chip market. These limitations restrict the complete utilization of the protein microarray market and retard the development of the global protein chip market by preventing less-funded organizations and emerging countries from entering the market.

For instance, Molecular & Cellular Proteomics published a study in 2021 highlighting challenges in protein chip performance, particularly related to signal variability and reproducibility across batches, which can impact data consistency in large-scale proteomic studies. According to a 2023 Analytical Chemistry paper, the greatest adoption challenges include long preparation time and high costs.

Protein Chip Market Segmentation Insights

By Type

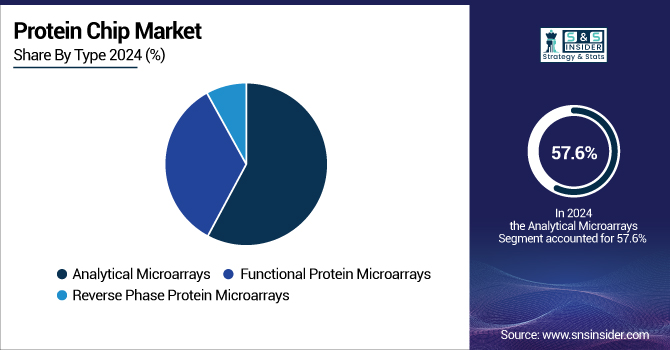

Analytical microarrays dominated the market in 2024, accounting for 57.6% of the revenue, as they are used extensively for rapidly analyzing protein interactions, gene expression, and biomarker discovery. Their high sensitivity and ability to screen thousands of proteins simultaneously have established them as a cornerstone of academic and commercial proteomic platforms, thus raising the overall market share.

Accordingly, functional protein microarrays are anticipated to be the fastest growing segment throughout the forecast period due to their wide use in activity-based assays, post-translational modification research, and enzyme-substrate profiling. This segment is increasingly significant as research progresses toward functional characterization as opposed to mere detection to facilitate advancements in drug development and disease modeling, and thus contributes to the enlargement of the market size, thereby contributing largely in the market growth.

By Application

The antibody characterization market accounted for the largest share of 62.5% in 2024 due to its significant contribution to validating therapeutic antibodies, cross-reactivity checks, and immune response analysis. This dominance has a direct impact on the market share as it proves its critical application in clinical and scientific settings.

The clinical diagnostics segment is expected to grow the fastest in the market. The need for precision medicine, pandemic preparedness, and early detection of illness is propelling the clinical diagnostics segment growth in the market. Protein chips are ideal for diagnostic laboratories attempting to boost patient results and offer additional services as they possess low sample volume and multiplex characteristics. Especially in the personalized healthcare field, the extension of this application instantly enlarge the size of the protein chip market and sets new avenues for market expansion.

By End-use

Academia and research institutions segment represented the largest market share of 55.6% in 2024 due to their large application of protein chips for basic research, target identification for therapeutic purposes, and biomarker creation. Public and private funding for life science research and including advanced proteomics in university courses, has significantly elevated the market share in this segment.

On the other hand, the diagnostic laboratories segment is anticipated to increase at the fastest rate in the market as they readily adopt high-throughput protein microarray technology for real-time, cost-effective, and accurate diagnostics. Protein chip market expansion is anticipated to be fueled by their growing application in disease monitoring and customized diagnostics, thus significantly contributing to the market size determination in the future.

Regional Outlook

North America Protein Chip Market Trends

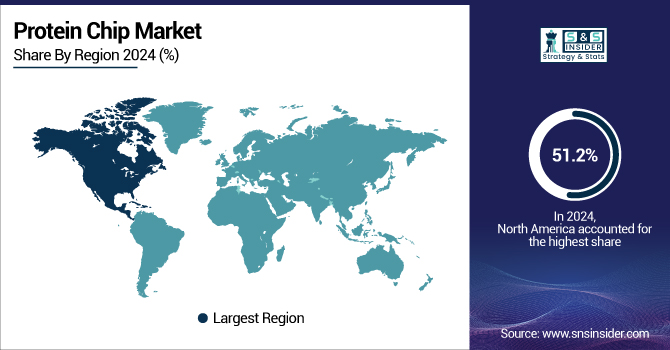

North America dominated the protein chips market in 2024 with the highest share of 51.2%. The market was fueled by enhanced healthcare infrastructure, high R&D investment, and widespread adoption of proteomic technologies. A strong network of major companies within the protein chip market, adequately funded academic centers, and robust clinical research networks have enabled the U.S. to lead the region. Protein microarrays have been embraced in clinical and pharmaceutical applications faster in the country as a result of their focus on individualized therapy and the detection of diseases early. The U.S. protein chip market size was valued at USD 0.89 billion in 2024 and is expected to reach USD 1.33 billion by 2032, growing at a CAGR of 5.26% over the forecast period of 2025-2032.

Europe is the second fastest-growing region in the protein chip industry, with Germany emerging as the top country due to its strong biotech environment and clinical study potential. The development of the market is heavily reliant on government support for established pharmaceutical companies and precision diagnostics. The share of the market for the region has increased as it focuses on translational research and employs innovative microarray market technologies within oncology and infectious disease diagnosis.

Asia Pacific Protein Chip Market Trends

The Asia Pacific region is expected to be the fastest-growing market for protein chips during the forecast period due to the fast growth in health-related infrastructure and life sciences research investment. Supported by robust government support in biotechnology innovation and growth in precision medicine initiatives, China is the leading country in the market. The rising incidence of chronic diseases and demand for low-cost, high-throughput diagnostic devices have driven the market growth worldwide. Growing proteomics research in nations, such as India and South Korea further provides favorable conditions for a growing segment of the protein chip market.

LAMEA is expected to maintain steady market growth due to the increasing demand for diagnostic innovation and enhanced healthcare infrastructure support. With national-level visions encouraging diversification in research and digital health integration, the UAE and Saudi Arabia are leading biotechnology in the Middle East. Sub-Saharan Africa is leading in research partnerships and proteomics spending to manage infectious diseases, Brazil stands out among Latin American nations due to its robust biomedical research programs and increasing need for clinical diagnosis in infectious diseases and cancer.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players in the Protein Chip Market

The major players operating in the market are Agilent Technologies, PerkinElmer, Bio-Rad Laboratories, Thermo Fisher Scientific, Sigma-Aldrich (Merck), Illumina, Shimadzu Corporation, Roche Diagnostics, RayBiotech, and Danaher Corporation.

Recent Developments in the Protein Chip Industry

-

February 2025 – Illumina launched a pilot proteomics program in collaboration with UK Biobank and major biopharma companies to analyze 50,000 biological samples, advancing large-scale protein profiling for research and diagnostics.

-

January 2025 – Illumina unveiled new multi-omic research technologies designed to deepen the understanding of complex biological interactions by integrating advanced proteomic and genomic data.

-

July 2024 – Danaher Corporation announced the opening of two innovation centers dedicated to diagnostics and precision medicine, aiming to accelerate development in proteomics and personalized healthcare technologies.

-

April 2024 – Agilent Technologies introduced the ProteoAnalyzer System, a next-generation solution for protein quality assessment that enhances analytical precision in proteomics and supports high-throughput protein chip applications.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 2.30 Billion |

| Market Size by 2032 | USD 3.91 Billion |

| CAGR | CAGR of 6.89% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type [Analytical Microarrays, Functional Protein Microarrays, Reverse Phase Protein Microarrays] • By Application [Antibody Characterization, Clinical Diagnostics, Proteomics, Others] • By End-use [Hospitals & Clinics, Diagnostic Laboratories, Academic & Research Institutes, Pharmaceutical & Biotechnology Companies] |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Agilent Technologies, PerkinElmer, Bio-Rad Laboratories, Thermo Fisher Scientific, Sigma-Aldrich (Merck), Illumina, Shimadzu Corporation, Roche Diagnostics, RayBiotech, and Danaher Corporation. |