Biofilter Market Size Overview:

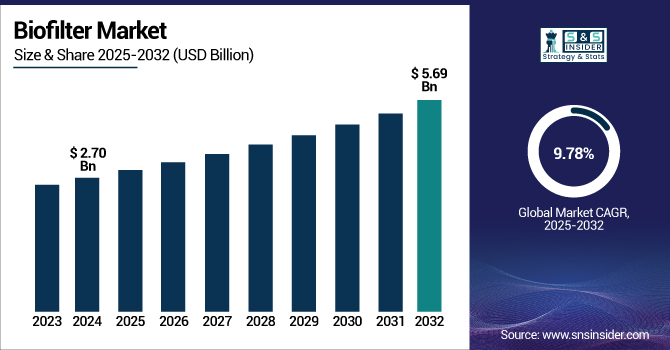

The Biofilter Market size was valued at USD 2.70 billion in 2024 and is expected to reach USD 5.69 billion by 2032, growing at a CAGR of 9.78% over the forecast period of 2025-2032.

To Get more information on Biofilter Market - Request Free Sample Report

Rising industrial emissions, wastewater reuse initiatives, and growing regulatory pressure are driving the global biofilter market growth. Treating wastewater and controlling volatile organic compounds (VOCs) demand biofilter systems more and more. Installations in food processing, urban stormwater management, and aquaculture are among those benefiting from biofilters. EPA recommendations state that biofiltration enhances water and air quality, so it directly impacts new project financing. Rising interest is shown by major R&D expenditures, including PSU's methane-reducing biofilter grant and technologies like EcoPure biofilters by advanced drainage systems.

Sustainable agriculture and aquaculture depend mostly on biofiltration. For instance, recirculating aquaculture systems (RAS) depend mostly on biofilters for water reuse and control of air pollution. VOC compliance rules and the necessity of biological air filtration help the industrial biofilters industry, thereby improving the situation of the U.S. biofilter market share. Rising awareness of technology for the biological air filtration market, government funding, and EPA regulatory approvals will help to drive demand even further.

For instance, Advanced Drainage Systems (ADS) launched its EcoPure Biofilter in 2024, providing an environmentally friendly option for water quality compliance in urban stormwater management.

Biofilter Market Drivers:

-

The Regulatory, Environmental, and Technological Factors Accelerating Market Momentum

Strict air and water quality standards, industrial development, and a need for greener treatment technologies are driving fast expansion in the global biofilter market growth. Particularly since businesses are under more pressure on VOC and ammonia emissions, demand for biofiltration and biofilter wastewater treatment systems is growing. According to the EPA, regulatory changes for clean air act compliance are highly appealing sectors towards biological alternatives, which are expanding the market share of biofilters in sectors like chemicals, food processing, and livestock husbandry.

Large biofilter companies are increasing R&D spending. For instance, the EPA's clean air technology center underlined as essential of the VOC emission control using biofilters program improvements in biofilters. Moreover, as shown by Newterra's and Envirogen's projects aiming at wastewater reuse, increasing investment in distributed treatment plants helps to drive the industrial biofilters industry. Global supply chains are developing quickly as the biofiltration business is backed more and more by green certification programs and eco-infrastructure subsidies. Growing odor control needs in urban and agricultural uses help to drive rapid biofilter market growth by boosting the biological air filtration industry as well. Including IoT technology into monitoring systems also marks a smart evolution of biofilter market trends, therefore confirming their importance in many sectors.

Biofilter Market Restraints:

-

The High Maintenance Requirements, Operational Variability, and Technological Limitations to Hamper the Market Growth

One of the main challenges in critical applications like VOC emission control and air pollution control using biofilters is that these systems are highly sensitive to changes in temperature, humidity, and pollutant concentrations, resulting in varying levels of efficiency. A water research foundation study reveals that at fluctuating loads, the effectiveness of biofilters at degrading can be impaired by as much as 30%, thus constraining their usage in dynamic industrial settings. Further, initial capital investments in robust industrial biofilter market solutions are expensive since there is limited access to skilled designers and maintenance personnel, which also impacts acceptance. There are also regulatory issues, although agencies such as the EPA favor green infrastructure, permit and certification delays can delay projects, which impacts the size of the biofilters market and slows down its growth. As they appear more reliable, operators in the biological air filtration industry sometimes opt for mechanical or chemical scrubbers instead of biofilters. The need for expert bio-media replacement and system downtime when in service still deters some customers, thus making the entire biofilter market analysis even more complicated, even when biofilter companies are investing in automation and resilience.

Biofilter Market Segmentation Analysis

By Type

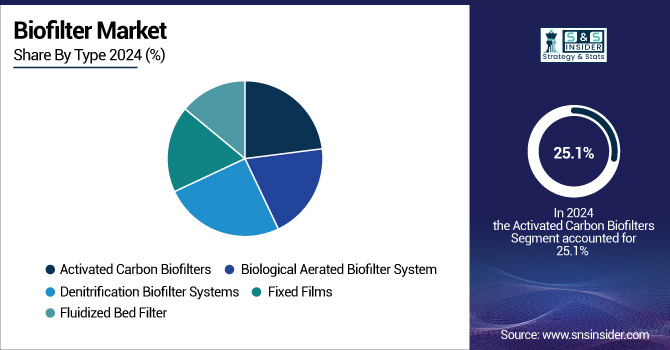

Comprising 25.1% of the biofilter market share, the activated carbon biofilters segment led in 2024. Especially in chemical, food, and biopharma sectors, activated carbon biofilters are preferred for their efficacy in adsorbing a broad spectrum of volatile organic compounds (VOCs). Their industry standard is based on their capacity to efficiently manage different pollution loads, therefore supporting their long-standing reputation in air and water purification.

The biological aerated biofilter system (BAFs) is the fastest-growing sub-segment of the market. BAFs, especially in distributed facilities, are gaining traction since they effectively treat wastewater and improve oxygen delivery and biological degradation of pollutants. Their small size, great efficiency, and scalability are driving decisions for municipalities and businesses with strict effluent treatment needs.

By Filter Media

Ceramic Rings held 34.2% of the biofilter market share in 2024. With their great surface area, hardness, and durability for long periods, which help biofilm development, ceramic rings are ideally suited for wastewater treatment and aquaculture uses. Appropriate for both industrial and municipal biofilter uses, ceramic materials are strong enough to sustain demanding environmental conditions.

Bio Balls are expected to be the fastest-growing filter media because of their growing application in recirculating aquaculture systems (RAS) and small-scale wastewater treatment systems. They are lightweight and simple to clean, ensuring better circulation of water, with less clogging and better biofilm growth. As more adoption of RAS and decentralized systems takes place, the application of bio balls in biofiltration systems is expected to grow significantly.

By Application

VOC treatment dominated the biofilter market in 2024, capturing 31.1% of the total market share. Strict laws like the Clean Air Act in the U.S. still drive demand for biofilters able to manage and lower volatile organic compound (VOC) emissions in industrial environments. Using natural biological processes to eliminate dangerous pollutants from air streams, these filters offer an eco-friendly, reasonably priced substitute for chemical scrubbers.

Odor abatement is the most rapidly growing application in the market, as a result of increasing interest in air quality and public health. Increased population density and stricter waste management and emissions regulations in urban, rural, and industrial settings are inducing companies to apply odor control systems. Especially in waste treatment facilities, landfills, and animal husbandry, where odor control is necessary to meet environmental standards and public health, biofilters are a sustainable and efficient means of odor control.

By End Use

The aquaculture sector led the biofilter industry in 2024, representing 24.2% market share. Biofilters are heavily utilized in recirculating aquaculture systems (RAS), where they assist in achieving ideal water quality by eliminating excess nutrients such as ammonia and nitrogen. As production of fish across the globe grows to satisfy rising demand for seafood, aquaculture continues to be a key consumer of biofiltration technology.

The most rapidly growing end-use segment is water and wastewater collection, especially for decentralized and municipal systems. Inclining investment in green urban infrastructure and enforceable wastewater treatment policies are fueling growth in the market. Governments globally are giving importance to wastewater recycling system development, which is in need of advanced biofiltration solutions to make treated water comply with regulations for reuse. Furthermore, the incorporation of IoT in monitoring devices improves the efficiency and dependability of biofiltration, contributing to the growth of the segment.

Biofilter Market Regional Outlook

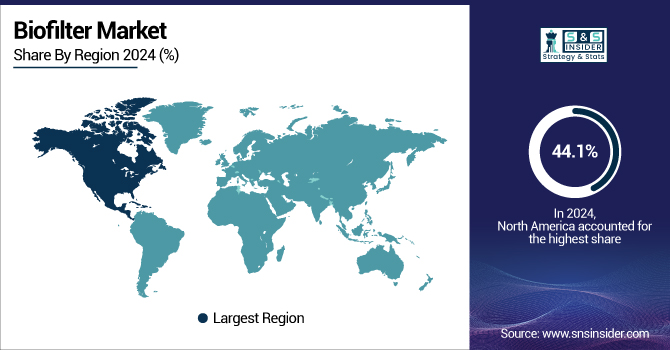

North America held a major share of 44.1% in the biofilters market in 2024, driven by strict environmental rules and extensive use of biofiltration across industrial sectors. Strong EPA rules aiming at VOC emission control using biofilters and incentives for green infrastructure help the U.S. to rule the area. The U.S. biofilter market size was valued at USD 0.90 billion in 2024 and is expected to reach USD 1.73 billion by 2032, growing at a CAGR of 8.57% over the forecast period of 2025-2032.

For instance, the green infrastructure program of the EPA keeps increasing acceptance of wastewater and stormwater uses. Leading biofilter companies like Pentair and Veolia North America are headquartered in the U.S. While Mexico is implementing affordable biofilter systems for wastewater treatment due to increasing urbanization, Canada is fast increasing expenditures in distributed water treatment. High R&D expenditure and extensive use of biological air filtration market technologies in food processing and chemical industries help to reinforce the leadership of North America.

Europe is the second fastest-growing market, supported by strong environmental policies under the EU green deal and great awareness of air and water contamination. Driven by its industrial base and industrial biofilters market technology innovation, Germany leads the area. Strict VOC emissions rules and wastewater reuse policies from Germany have created great demand for biofilters for air pollution control. Advanced biofiltration is being used in public infrastructure and agricultural odor reduction in France and the UK. The growth in the biofilter market in this area is being accelerated by the increase in smart city initiatives and regulatory financing for green technology. Furthermore, the EU's ammonia and NOx lowering regulations force businesses to use biofilters, therefore increasing the market share of these products.

The Asia Pacific area is the fastest-growing market, driven by fast industrialization, escalating pollution levels, and government-led sustainability projects. With vast uses in aquaculture, chemical processing, and urban wastewater treatment initiatives, China rules the market. Under China's "Blue Sky" program, government rules have led to significant application of biofilter systems for wastewater treatment and VOC emission control using biofilters. Under the "Namami Gange" initiative, India is fast funding municipal and industrial treatment facilities; Japan and South Korea are concentrating on odor and gas emission reduction, employing biological air filtration market technologies.

Rising awareness of water reuse and pollution management would help the LAMEA area show promising development. Due to public-private network initiatives, Brazil leads Latin America in implementing biofilter systems, especially for aquaculture and wastewater reuse. Through rural sanitation programs, Argentina is seeing more people get interested in distributed systems. With biofilters included in green building rules, Saudi Arabia and the UAE are investing in green stormwater solutions in the Middle East & Africa in the face of growing urbanization. In the mining and industrial sectors, South Africa is using biological air filtration market solutions to help with air and water quality issues. The region's development is driven by global alliances and funds for climate adaptation, thereby solidifying its position in the global biofilters market analysis.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players in the Biofilter Market

Key players in the market include Aquael, Aquaneering Inc., AZOO BIO Corporation, EHEIM GmbH & Co. KG, Pentair Aquatic Eco-Systems Inc., Veolia Water Technologies, Aqua Design Amano Co. Ltd., Premier Tech Water and Environment, Zoo Med Laboratories Inc., and Waterlife Research Industries Ltd.

Recent Developments in the Biofilter Industry

-

In July 2024, Waterloo Biofilter expanded its technological portfolio by acquiring RH2O, strengthening its position in the decentralized wastewater treatment sector and enhancing its range of advanced biofiltration solutions.

-

In March 2024, Premier Tech launched its Linear Biofilter for decentralized water treatment systems. This innovation is designed to enhance pollutant removal efficiency and promote sustainable stormwater management, aligning with the company’s broader commitment to green infrastructure solutions.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 2.70 Billion |

| Market Size by 2032 | USD 5.69 Billion |

| CAGR | CAGR of 9.78% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Biological Aerated Biofilter System, Denitrification Biofilter Systems, Activated Carbon Biofilters, Fixed Films, Fluidized Bed Filter) • By Filter Media (Ceramic Rings, Bio Balls, Moving Bed Filter Media, Others) • By Application (VOC Treatment, Nitrification, Denitrification, Odor Abatement, Others) • By End Use (Storm Water Management, Water & Wastewater collection, Chemical processing, Food & Beverage, Aquaculture, Biopharma industry, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Aquael, Aquaneering Inc., AZOO BIO Corporation, EHEIM GmbH & Co. KG, Pentair Aquatic Eco-Systems Inc., Veolia Water Technologies, Aqua Design Amano Co. Ltd., Premier Tech Water and Environment, Zoo Med Laboratories Inc., and Waterlife Research Industries Ltd. |