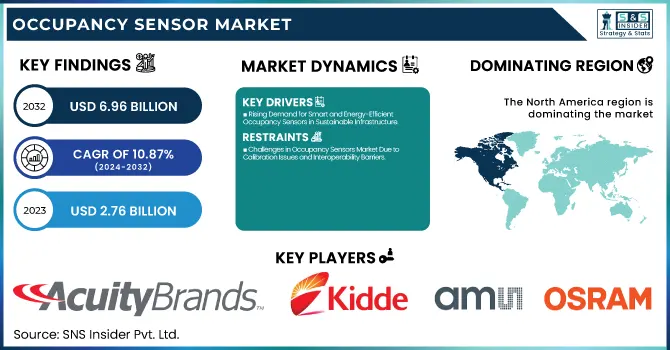

Occupancy Sensor Market Size & Growth Trends:

The Occupancy Sensor Market Size was valued at USD 2.76 billion in 2023 and is expected to reach USD 6.96 billion by 2032, growing at a CAGR of 10.87% over the forecast period 2024-2032. Technological evolution continues to influence the occupancy sensor market, promising enhanced performance such as increased accuracy, fast response, and AI-based adaptive sensing capabilities as compared to previous generations. Innovation is in multi-sensor integration (thermal imaging, radar), machine learning, and precision.

To Get more information on Occupancy Sensor Market - Request Free Sample Report

Sensors are used in smart buildings that generally focus on automatic lighting, HVAC optimization, and security systems that enable energy efficiency. Seamless connectivity using Zigbee, Wi-Fi, Bluetooth, and LoRaWAN is expanding the ecosystem of sensors and their integration with IoT for real-time data analytics. All of these efforts catalyze integrated occupancy sensor adoption in residential, commercial, and industrial infrastructures, integrating automation with energy management.

Occupancy Sensor Market Dynamics

Key Drivers:

-

Rising Demand for Smart and Energy-Efficient Occupancy Sensors in Sustainable Infrastructure

Increasing focus on energy efficiency and smart building solutions are driving the occupancy sensor market. With governments across the globe tightening the noose around energy conservation laws, forces are pushing several other industries and commercial environments into the matrix of advanced occupancy sensors for both lighting and HVAC control. The increasing popularity of smart homes that are connected to IoT and automated elements of the home has been pushing the market forward. Emerging technologies such as Ethernet-like motion detection driven by AI, ensuring the sensor's accuracy, and wireless sensor networks enhancing the responsiveness of sensors render them appealing for commercial, residential, and industrial applications. Moreover, this surge growth of occupancy sensors in different sectors is also fueled by the trend of green buildings and sustainable infrastructure development.

Restrain:

-

Challenges in Occupancy Sensors Market Due to Calibration Issues and Interoperability Barriers

The calibration of sensors and the issue with accuracy is one of the major restraints for the market of occupancy sensors at present. False triggering because of airflow, temperature changes, or a pet moving can cause inefficiencies in controlling Lighting or HVAC. Others such as Passive Infrared (PIR) need an unobstructed line of sight; therefore, their efficiency is compromised in places where obstacles or partitions exist. Improving accuracy through integrated sensors, including dual-technology sensors (such as PIR and ultrasonic), increases system complexity and presents maintenance issues. Interoperability issues also arise, as different manufacturers may use their proprietary protocols, which can make it challenging to integrate occupancy sensors with an existing smart home or building automation system.

Opportunity:

-

Expanding IoT Integration and Smart City Development Unlock Growth Opportunities for Occupancy Sensors

The growing adoption of sensor integration with IoT and AI technologies, which built the ground to provide predictive analytics and real-time energy management capabilities, provides opportunities for occupancy sensor manufacturers in the coming years. The increase in the share of wireless and battery-powered sensors provides scalable, easier-to-install (especially for retrofit projects) systems. Emerging economies offer high growth potential on account of the rising urban population and smart city development plans. Furthermore, the growing security and surveillance systems demand for occupancy sensors, as there is an increasing requirement for safety solutions in commercial and residential buildings here by this market is estimated to create lucrative opportunities for the growth of the occupancy sensors market. Ongoing R&D and innovations in sensor accuracy and multi-technology integration will open up further new market opportunities.

Challenges:

-

Lack of Awareness and Technical Barriers Hinder Occupancy Sensor Adoption in Developing Regions

Awareness and standardization in developing regions is another important restraint. Adoption, according to one industry source, is slow, as many businesses and residential users are unaware of the benefits of occupancy sensors. Another limitation is the technical sophistication required to install and place sensors properly a significant hurdle in parts of the world where skilled labor is not readily available. This dependency on stable connectivity creates challenges, particularly for wireless sensors that need an adequate network infrastructure. To maintain market growth these issues will need to be addressed through greater education, efforts towards standardization, and improved self-learning sensor technology.

Occupancy Sensor Market Segment Analysis

By Type

The passive infrared (PIR) sensors held the largest revenue share of over 44.1% in 2023 & are anticipated to grow at the fastest CAGR over the forecast period from 2024 to 2032. A large part of this growth can be attributed to the increasing demand for energy-efficient solutions in smart home, commercial, and industrial applications. Passive Infrared (PIR) sensors are the most popular ones because of their low cost, low power consumption, and high reliability. The market adoption is further propelled by the growing government regulations to stimulate energy conservation as well as initiatives related to the growth of smart infrastructure. Moreover, AI-powered motion detection and IoT integration are also improving the efficiency of the sensor technology and contributing to the future growth of the sensor technology.

By Connectivity

The market share of wired occupancy sensors accounted for 57.2% in 2023, owing to their reliability, stable connectivity, and extensive use in commercial and industrial applications. Ideal in areas with consistent performance and secondary signals such as office buildings, manufacturing facility, and Internet scale infrastructure.

The fastest growth rate (CAGR) from 2024 to 2032 is anticipated for wireless occupancy sensors owing to increasing emphasis on smart buildings and automation under the IoT paradigm. Due to their simplicity, scalability, and flexibility, buildings can add them easily to existing structures, which maximizes energy use.

By Application

Lighting Control accounted for the highest market share of 41.6% in 2023 and will retain its dominance by growing at the fastest CAGR from 2024 to 2032. The rising adoption of energy-saving smart lighting solutions in smart homes, commercial buildings, and industrial plants is a major factor fueling market expansion. Adoption is also spurred by government regulations promoting energy conservation and sustainability. From IoT-enabled lighting systems to AI-based automation, features to improve efficiency and user convenience blended seamlessly into the ecosystem. Apart from this, increasing awareness regarding minimizing energy usage and operational costs is propelling organizations and households to collaborate occupancy sensors with lighting control systems, which will act as a major growth contributor for the market during the forecast period.

By End Use

The market share was dominated by the commercial sector with 38.9% in 2023 owing to the widespread adoption of occupancy sensors in office buildings, shopping malls, hotels, and smarter commercial spaces. The rising focus on energy efficiency, saving money, and complying with the government has pushed the market for automated lighting, HVAC (heating, ventilation, and air conditioning) control, and security systems in commercial buildings.

From 2024 to 2032, the fastest growing sector in terms of CAGR will be the industrial sector, as industries continue to focus more on automation, workplace safety, and energy management. Demand for occupancy-wise smart sensors is following the trend of rising uptake in warehouses, manufacturing plants, and logistics settings.

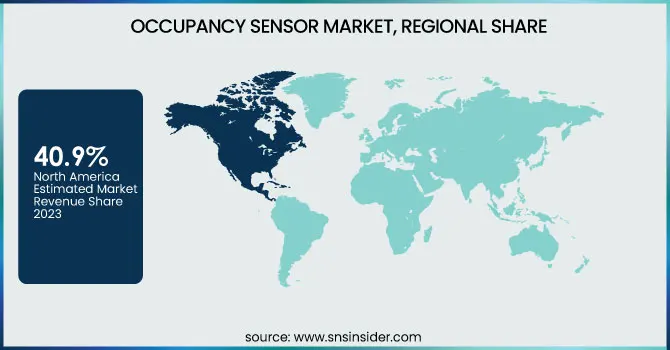

Occupancy Sensor Market Regional Overview

North America held the largest market share of 40.9% in the year 2023. North America is expected to continue its dominance due to stringent energy efficiency standards, rapid adoption of smart building solutions, and increasing investments in commercial infrastructure. Tighter building codes have been enforced over the years in the U.S. and Canada, notably Title 24 in California and the U.S. Department of Energy (DOE) initiatives that have advanced the push for the use of occupancy sensors to save energy. For instance, some of the largest smart office projects from companies like Google and Microsoft, deploy occupancy sensors as key components to gain insights and control over lighting and HVAC systems. Moreover, smart home adoption is growing in the region, with automated sensor solutions from companies such as Lutron and Leviton.

Asia Pacific is estimated to record the highest CAGR during the forecast period from 2024 to 2032, primarily owing to rapid urbanization, rising smart city initiatives, and increased awareness regarding energy efficiency. Heavy investments in smart infrastructure in China, India, and Japan, supported by government initiatives (e.g. India’s Smart Cities Mission) driving the adoption of sensors. One of the better-known instances is in Singapore's smart building projects, where occupancy sensors are integrated into large developments in places like Marina Bay Sands for automated energy management. Likewise, the smart home ecosystem by Chinese tech giants such as Xiaomi and Huawei and home safety needs are reinforcing demand for occupancy sensors.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

Some of the major players in the Occupancy Sensor Market are:

-

Acuity Brands (Sensor Switch nLight Occupancy Sensor)

-

Kidde (Kidde Wireless Smoke and Carbon Monoxide Alarm)

-

AMS-Osram (OSRAM SFH 7776 Digital Proximity Sensor)

-

Pepperl+Fuchs (RPI Series Retroreflective Sensor)

-

System Sensor (System Sensor L-Series Ceiling-Mount Strobe)

-

EnOcean (EnOcean STM 550 Multi-Sensor Module)

-

Legrand (Wattstopper DW-311 Dual Technology Wall Switch Sensor)

-

Lutron Electronics (Lutron Maestro Occupancy Sensor Switch)

-

Schneider Electric (Schneider Electric C-Bus 360° Occupancy Sensor)

-

Honeywell (Honeywell IS335 Wired PIR Motion Detector)

-

Leviton (Leviton ODS10-ID Decora Wall Switch Occupancy Sensor)

-

Eaton (Eaton HALO RL5601 LED Downlight with Motion Sensor)

-

Siemens (Siemens RDG100T Room Thermostat with Occupancy Detection)

-

Panasonic (Panasonic EKMB1201111 Passive Infrared Motion Sensor)

-

Philips (Philips Hue Motion Sensor).

Recent Trends

-

In January 2025, Kidde and Ring partnered to launch advanced smart smoke and CO alarms, offering real-time alerts via the Ring app.

-

In February 2024, Calumino and ams OSRAM partnered to develop next-gen thermal sensors by integrating the Mira050 CMOS sensor into Calumino's platform.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 2.76 Billion |

| Market Size by 2032 | USD 6.96 Billion |

| CAGR | CAGR of 10.87% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Passive Infrared Sensors, Ultrasonic Sensors, Dual Technology Sensors, Photoelectric Sensors) • By Connectivity (Wired, Wireless) • By Application (Lighting Control, HVAC Control, Security Systems, Energy Management) • By End Use (Residential, Commercial, Industrial, Institutional) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Acuity Brands, Kidde, AMS-Osram, Pepperl+Fuchs, System Sensor, EnOcean, Legrand, Lutron Electronics, Schneider Electric, Honeywell, Leviton, Eaton, Siemens, Panasonic, Philips. |