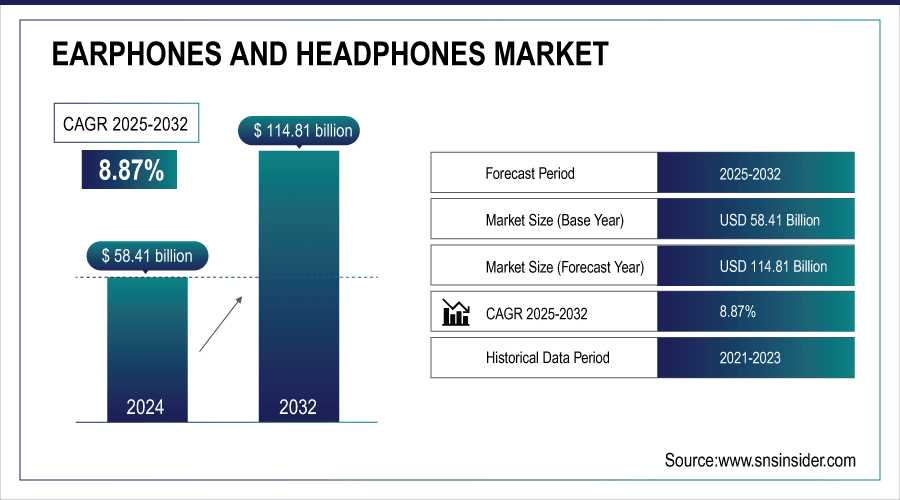

Earphones and Headphones Market Size & Growth:

The Earphones and Headphones Market size was valued at USD 58.41 billion in 2024 and is expected to reach USD 114.81 billion by 2032 and grow at a CAGR of 8.87% over the forecast period of 2025-2032.

The global market report provides a comprehensive overview of pricing trends, technology development, manufacturing dynamics, R&D innovations, sustainability trends, and changing distribution patterns. The changing patterns in the landscape of consumer behavior that influences their purchase decisions are also analyzed. The report further includes uncertainties, opportunity map analysis, and competitive landscape analysis along with their corresponding market share analysis, segmented on the basis of product type, application area, distribution channel, end-users, and regions to provide a comprehensive analysis of the key trends with potential future opportunities in the earphones and headphones market.

For instance, 58% prefer in-ear buds for daily use, while 42% lean toward over-ear headphones for immersive experiences.

To Get More Information On Earphones and Headphones Market - Request Free Sample Report

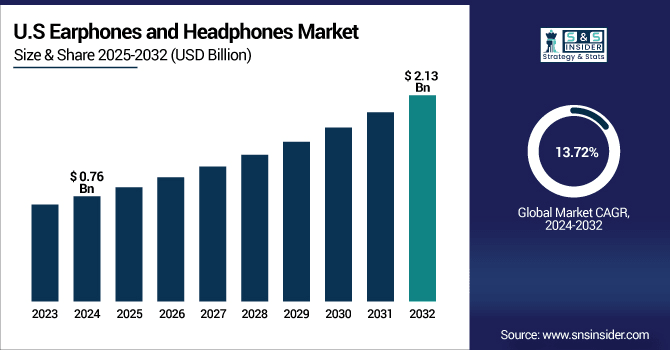

The U.S. Earphones and Headphones Market size was USD 0.76 billion in 2024 and is expected to reach USD 2.13 billion by 2032, growing at a CAGR of 13.72% over the forecast period of 2025–2032.

The U.S. is expected to continue growing at a strong pace, driven by an increasing number of smartphones being used, higher remote work trends and a rapid rise in the use of wireless audio devices. The need for premium audio, and noise-cancelling, have kept consumers upgrading often as well. Moreover, high volume sales through offline and online retail channels due to the presence and dominance of leading brands such as Apple, Bose and Beats further solidifies the dominancy of the country within the global earphones and headphones market space.

For instance, approximately 28% of the U.S. workforce operates remotely full-time or in hybrid setups, increasing demand for work-friendly audio devices.

Earphones and Headphones Market Dynamics:

Key Drivers:

-

Proliferation of Wireless Technology and TWS Earbuds Is Fueling Mass Market Consumer Adoption Across Age Groups and Income Levels

High proliferation of wireless audio devices, particularly true wireless stereo (TWS) earbuds, are driving the market growth at an unparalleled rate. The market is witnessing a growing trend towards untethered, portable listening that is being adapted to fit our smartphone and smartwatch lifestyles. The TWS earbuds have taken over the user convenience with the Bluetooth 5.0+, active noise cancellation (ANC), and smart assister support. Well-known brands are adding to their stable of wireless headphones while providing entry-level prices. With everything from fitness enthusiasts, commuters to students and professionals moving away from wired solutions, the market for wireless earphones and headphones continues to grow, providing a key growth engine for both developed and developing economies.

For instance, multi-device pairing has become a must-have, with over 45% of TWS models in 2024 supporting simultaneous connections to phone and laptop.

Restraints:

-

Frequent Product Replacement and Short Life Cycles Pose Challenges to Brand Loyalty and Environmental Sustainability

The earphones and headphones segment has been facing an ever-increasing pace of technology upgrades and design innovations, which have in turn accelerated product life cycles. Consumers now more often replace devices as batteries degrade, the devices are lost or simply because better devices with new features and designs come on the market. The rapid churn makes it difficult for brands to breed loyalty, with users often jumping from one brand to another based on price or the latest shiny thing. On top of that, disposable or non-repairable audio devices create heaps of electronic waste, which is not really sustainable. It further adds to the pressure on manufacturers to deliver repairability, recycling programs, and sustainable product lines.

Opportunities:

-

Integration of AI, Voice Assistants, and Health Monitoring Capabilities Offers Product Differentiation and Expansion Into Smart Wearables Market

As consumers demand beyond audio playback, premium earphones, and headphones integrated with advanced technologies such as AI-powered voice assistants (Alexa, Google, and Siri) and health monitoring (helping users track heart rate, the number of steps, and alert them), are big opportunities. These intelligent capabilities take the top of the line devices and turn them into more empowered wearable devices That presents a strong case for biometric tracking and contextual audio optimization — more fitness-focused users and professionals will do so with the feature. This will position companies with intelligent features alongside sound quality, making gains in market share from both legacy audio device playbook players and the wearable tech segment.

For instance, 60% of TWS earbud users in the U.S. reported using their devices during fitness activities where biometric feedback is desired.

Challenges:

-

Increasing Regulatory Pressures Around E-Waste Management, Battery Safety, and Wireless Frequency Standards May Affect Cost and Time to Market

Due to earphones and headphones being somewhat of an electronic device that has a battery, plastic parts, and contains a radio transmitter, regulatory inspection around the world is growing. Manufacturers spend a chunk of their budget on testing, certifications, and documentation to comply with RoHS, WEEE, FCC, CE, and battery safety norms. Political uncertainty and frequent policy changes increase the time taken to launch EVs and increase production costs. Similarly, environmental groups and governments alike are applying pressure on companies to report carbon footprints, to eliminate toxic materials and to embed circular design principles. But smaller brands and fast fashion labels will likely have a much harder time keeping up with these new benchmarks — and that could threaten their competitiveness.

Earphones and Headphones Market Segmentation Analysis:

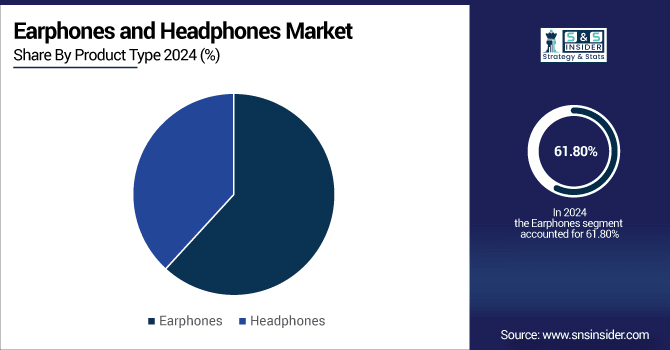

By Product Type

In 2024, earphones accounted for the majority share of revenue at roughly 61.80%, on account of their ease of portability and relatively lower cost, along with their most prevalent application in everyday and sports-related use. True wireless stereo (TWS) earbuds were hugely popular thanks to their ease of use, offer of portability, and seamless smartphone integration which also contributed to this dominance. The AirPods, which are in a free air-breeding ecosystem of their own due to its stylish design, iOS user experience, and innovation-oriented package holds at the forefront of the segment due to this ownership by Apple.

The headphones segment is expected to witness the highest CAGR of approximately 9.07 during 2024 to 2032 owing to the increasing need for immersive sound, noise cancellation, and higher sound reproduction among gamers and professionals. Sony is a key player in this trend with its flagship WH-1000XM series, featuring adaptive sound control and incredible battery life. With more people working in a hybrid manner and consuming media for extended periods, the demand for premium headphone models has remained unbated.

By Application

Music & Entertainment segment dominates the earphones and headphones market share, capturing 48.18% of the market in 2024, driven by more streaming activity on platforms such as Spotify, YouTube, and Apple Music. Samsung brings good audio performance for entertainment with its Galaxy Buds range. End users expect high-quality audio reproduction for their daily usage for leisure purpose, and increasing demand for wireless audio in transit and home office audio is expected to support the growth of this segment.

Virtual Reality (VR) segment is expected to grow at a CAGR of 11.78% during 2024 to 2032, due to the ongoing technological advancements in AR/VR technology along with immersive gaming experiences. By September 2021, demand for spatial audio and 360-degree soundscapes in VR headsets soared. Meta is a major player putting this immersive audio tech into its Quest hardware. With VR moving into educational and collaborative virtual environments, they will need headphones able to deliver more complex sound.

By Distribution Channel

The online segment accounted for the largest share of around 56.60% in 2024 and is also estimated to witness the fastest growth at a CAGR of 9.39% during 2024 to 2032 owing to increasing penetration of e-commerce, exclusive online launches, and convenience-driven purchasing behavior. Realme has also gained solid traction with an online-first sales focus and flash deals. This dominant retail segment relies on influencers and digital reviews for decision making, resulting in expanded product selection and faster fulfillment of consumer benefit.

By End-User

In 2024, personal users held the largest revenue share at over 85.20% due to the increasing usage of audio devices for entertainment, fitness, travel and daily communication. Xiaomi has tapped into that demand and sold affordable, multifunctional earbuds which suits most consumers. This category of end-user continues to be the backbone of the market due to increasing music streaming, mobile gaming and personalized gadgets.

Corporate end-users are projected to grow at the highest CAGR of 9.35% during 2024–2032, on account of increased demand for communication headsets for remote & hybrid work environments. Professional-grade headsets with a major in noise cancellation and focused on Unified communication are delivered by Jabra, a leading Enterprise audio solution brand. To boost productivity and for effortless collaboration in global working locations, organizations are opting for such solutions.

Earphones and Headphones Market Regional Overview:

North America continues to be a key region for earphones and headphones market, supported by high consumer spending, accelerated adoption of smart devices coupled with demand for wireless audio. With the top guns such as Apple, Bose and Beats in action, the innovation and brand loyalty can be easily guaranteed. Sales of audio devices is also further supported by rising fitness interest, gaming and hybrid work lifestyles.

Get Customized Report as per Your Business Requirement - Enquiry Now

-

The U.S. leads the North American market due to strong consumer purchasing power, early technology adoption, and the presence of global audio giants like Apple and Bose, driving large-scale sales through both online and retail channels.

In 2024, Asia pacific had led the market and was accounted for 32.20% of total revenue and is expected to register the fastest growth with a CAGR of 9.88% over the forecast period, owing to a huge population, increasing disposable incomes, and high penetration of smartphones. China, India, and the South Korean market are primary contributing continents along with regional manufacturing hubs and low-end TWS demand as well. The region has youth population statistics, urbanization rates, and increasing digital content consumption that are unrivalled and make Asia Pacific the leading volume sales and brand penetration market.

-

China dominates Asia Pacific owing to its massive population, booming electronics manufacturing sector, and rising urban middle class demanding affordable and premium earphones and headphones, supported by companies such as Huawei and Xiaomi.

Europe is expected to witness high demand for wireless and smart audio devices, particularly earphones and headphones, owing to the high consumption of these audio devices among consumers across various countries, such as Germany, the UK, and France. The increasing focus on smart fitness wearables, streaming services and immersive entertainment experiences is boosting adoption. Furthermore, presence of strong distribution channels and premium brands such as Sennheiser, Sony contributes to the Earphones and Headphones market growth in this region significantly.

-

Germany dominates the European earphones and headphones market due to its strong consumer electronics sector, high demand for premium audio products, and presence of major brands like Sennheiser. Its robust retail and online channels further support consistent market expansion.

In the Middle East & Africa, we have the UAE on top of the list where there are growing trends for consumer tech as well as premium lifestyle trends helping the earphones and headphones short term SAAR market see high growth. Brazil leads the way for digital system growth, as evidence by the increasing growth of the smartphone market, and the growing trends around behaviours of music consumption and gaming across Latin America.

Earphones and Headphones Companies are:

Major Key Players in Earphones and Headphones Market are Apple Inc., Samsung Electronics Co., Ltd., Sony Corporation, Bose Corporation, Sennheiser Electronic GmbH & Co. KG, Skullcandy Inc., Jabra (GN Audio), Beats Electronics LLC, Logitech International S.A., Xiaomi Corporation, Harman International Industries, Inc., Shure Incorporated, OnePlus Technology (Shenzhen) Co., Ltd., Anker Innovations, Realme, Philips, Panasonic Corporation, Beyerdynamic GmbH & Co. KG, Plantronics, Inc. and Technics and others.

Recent Developments:

-

In September 2024, Apple launched AirPods Max updated with USB‑C and upgraded AirPods Pro 2 featuring advanced hearing health tools and enhanced noise cancellation.

-

In February 2024, Samsung rolled out Galaxy AI features for its Buds line (including interpreter, 360° audio, Auto Switch), enhancing integration with Galaxy S24 devices.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 58.41 Billion |

| Market Size by 2032 | USD 114.81 Billion |

| CAGR | CAGR of 8.87% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type (Earphones and Headphones) • By Application (Fitness, Gaming, Virtual Reality and Music & Entertainment) • By Distribution Channel (Online and Offline) • By End-User (Personal and Corporate) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia,Taiwan, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Apple Inc., Samsung Electronics Co., Ltd., Sony Corporation, Bose Corporation, Sennheiser Electronic GmbH & Co. KG, Skullcandy Inc., Jabra (GN Audio), Beats Electronics LLC, Logitech International S.A., Xiaomi Corporation, Harman International Industries, Inc., Shure Incorporated, OnePlus Technology (Shenzhen) Co., Ltd., Anker Innovations, Realme, Philips, Panasonic Corporation, Beyerdynamic GmbH & Co. KG, Plantronics, Inc. and Technics. |