Electronic Shelf Label Market Size:

Get more information on Electronic Shelf Label Market - Request Sample Report

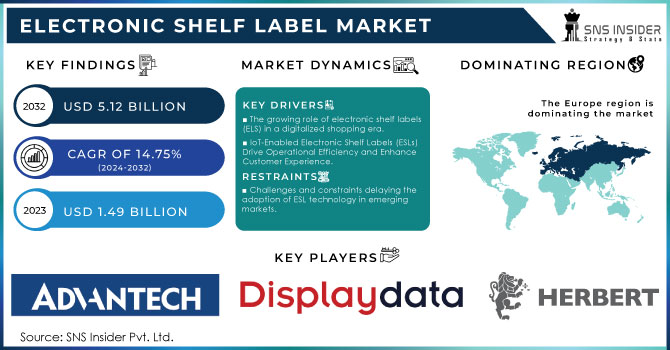

The Electronic Shelf Label Market size was valued at USD 1.49 Billion in 2023. It is estimated to reach USD 5.12 Billion by 2032, growing at a CAGR of 14.75% during 2024-2032.

The electronic shelf label (ESL) market has seen rapid growth due to the rise in automation demand, improved retail experiences, and the necessity for precise pricing. ESLs can show promotions, product information, and stock availability, enhancing operational efficiency and customer satisfaction. The merging of ESLs with Internet of Things (IoT) technology has advanced the market's expansion even more. In 2023, approximately 30% of major retail chains in the U.S. have integrated ESL systems, leading to a significant rise in the adoption of IoT-enabled ESLs in the retail sector. More and more retailers are expected to realize the advantages of real-time price updates and improved inventory management, causing this rate to increase. IoT-enabled electronic shelf labels allow instant communication between the central system of the store and the digital labels. This improves stock control and guarantees customers consistently have access to current product details, enhancing their shopping experience.

ESLs are mainly used in the retail sector, with supermarkets and hypermarkets reaping significant advantages from implementing this technology. Handling a large number of products in big stores results in time-consuming and error-prone manual price updates. In 2023, the U.S. retail supermarket industry is worth around USD 800 billion and is an important part of the retail sector, with an expected growth rate of 3% over the projected period. ESLs solve this problem by offering centralized control over pricing. For example, large international retailers such as Walmart and Carrefour have introduced ESL solutions in their stores, showcasing how the technology can enhance store operations and enhance the shopping experience. Moreover, Electronic Shelf Labels (ESLs) can aid retail establishments in adhering to legal pricing guidelines, guaranteeing that the prices shown to consumers are accurate and current.

| Report Attributes | Details |

|---|---|

| Key Segments |

• by Component (Displays, Batteries, Transceivers, Microprocessors, Others) |

| Regional Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Advantech Inc, Altierre Corporation, Displaydata Limited, E Ink Holdings Inc, Herbert Retail Limited, M2COMM, Opticon Sensors Europe B.V, Diebold Nixdorf Incorporated, Teraoka Seiko Co Ltd, SoluM, SES-imagotag, Samsung Electronics Co. Ltd |

Electronic Shelf Label Market Dynamics:

Drivers

-

The growing role of electronic shelf labels (ELS) in a digitalized shopping era.

The retail industry is experiencing a major change due to the growing demand for automation, which aims to boost efficiency and enhance the overall shopping experience. ESLs are essential for automation as they enable instant price changes, decrease mistakes, and simplify in-store tasks. Using a centralized system to change prices instantly for thousands of products can greatly decrease the workload for retail employees and reduce inefficiencies related to manual price tagging. The growing desire for automated retail solutions is fueled by the necessity to remain competitive in a more digitalized world. Retailers are always looking for ways to improve their operations, and ESLs provide a solution that decreases operational expenses in the long run. Automated systems, such as ESLs, can connect with inventory management systems, leading to enhanced stock control, increased inventory accuracy, and quicker responses to changes in stock levels. Retailers can free up resources by automating price updates and inventory management, allowing them to focus on customer service and in-store experiences that boost sales. Additionally, the worldwide shift towards digitalizing various industries, such as retail, is driving the need for ESLs even more. With online retailers posing strong competition, traditional stores can set themselves apart by incorporating advanced technologies like ESLs to provide a sleek, effective, and smooth shopping experience.

-

IoT-Enabled Electronic Shelf Labels (ESLs) Drive Operational Efficiency and Enhance Customer Experience.

The widespread growth of the Internet of Things (IoT) has greatly influenced different industries, such as retail. IoT technology allows ESLs to communicate with each other and back-end systems effortlessly, offering real-time updates and insights. The incorporation of ESLs into IoT systems is becoming a crucial factor for the market, as retailers transition to smart retail solutions to boost operational efficiency and elevate the customer experience. By using IoT-enabled ESLs, retailers can receive immediate information on stock levels, pricing patterns, and customer buying habits, allowing for improved decision-making and focused marketing tactics. Retailers can utilize ESLs to modify prices depending on various factors like changes in demand, competitor pricing, or promotions, for instance. Integration of IoT also enables remote management of numerous store locations, simplifying the task of maintaining pricing consistency in various regions for large retail chains. Furthermore, incorporating IoT technology in ESLs allows for the introduction of new functions like customized pricing and exclusive deals tailored to individual customer preferences and loyalty information. In the shift towards a personalized shopping experience, ESLs combined with IoT technology are essential for providing customized solutions instantly.

Restraints

-

Challenges and constraints delaying the adoption of ESL technology in emerging markets.

ESL technology is more commonly used in advanced areas, where retail automation and digitalization are already firmly established. Nevertheless, in underdeveloped areas, where retail activities are typically more conventional, the adoption of ESLs is still restricted. The slow growth of the market is due to factors such as limited technological infrastructure, economic restrictions, and insufficient understanding of the advantages of ESLs. In emerging markets, retailers might focus on pressing needs like growing their brick-and-mortar presence or building essential infrastructure instead of integrating sophisticated technologies such as ESLs. Consequently, the slower growth of the ESL market in these areas acts as a limitation on the global market's overall expansion.

-

The hurdles of merging electronic shelf label systems with outdated retail infrastructure.

The integration of Electronic Shelf Label (ESL) systems with existing retail infrastructure poses a significant limitation. Many retailers continue to use outdated systems for managing inventory, sales, and pricing, which are often incompatible with modern ESL technology. Merging these systems requires specialized knowledge, leading to additional costs and potential disruptions during the transition process. The complexity of this integration is particularly challenging for large retail chains with multiple locations, where maintaining consistent pricing and synchronization across stores becomes critical. These technical hurdles, combined with a lack of in-house expertise or funds to hire external support, can deter retailers from adopting ESL systems.

Electronic Shelf Label Market Segment Overview:

By Component

The displays held a 32% market share in 2023 and dominated the market. These screens, frequently utilizing e-ink or LCD technologies, provide easy-to-read, eco-friendly, and customizable pricing labels that cut down on manual work and mistakes. As retailers move towards dynamic pricing, the need for high-quality and functional displays has increased. SES-image tag and Pricer utilize high-resolution, low-power e-ink displays in large retail chains to improve visibility and operational efficiency. These screens are also connected to Internet of Things (IoT) systems for wireless upgrades, allowing centralized management of pricing in various places.

The microprocessors segment is expected to have a faster growth rate during 2024-2032 driven by improvements in smart and connected devices. These chips allow ESL systems to carry out intricate operations like instant data processing, wireless communication, and adaptive pricing adjustments. Their growing connection with AI and IoT technology enables ESL operations to be smarter and more effective, leading to increased market demand. Businesses such as SOLUM utilize strong microprocessors in their ESL systems for advanced features like data analytics, inventory control, and tracking customer behavior.

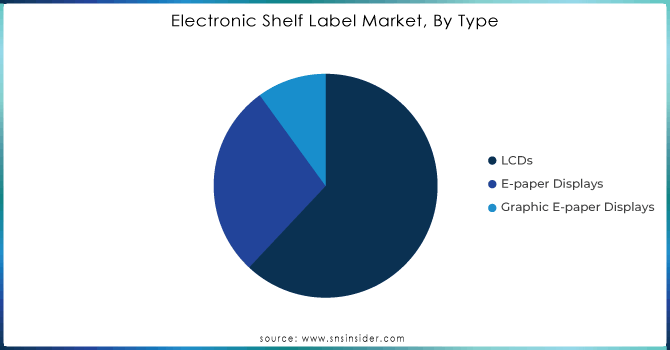

By Type

LCDs dominated the market with a 60% market share in 2023. LCDs provide excellent visibility, transparency, and the capability to show detailed pricing, product details, and promotional messages. Retailers can use wireless networks to update dynamic content in real-time with LCDs, highlighting their adaptability. LCDs also provide color choices, increasing customer involvement through showcasing discounts or special offers. For instance, Carrefour uses LCD ESLs in its stores to show pricing and product information, enhancing operational efficiency by decreasing manual pricing mistakes.

E-paper displays are experiencing a rapid growth rate during the forecast period 2024-2032 in the ESL market because of their energy efficiency, extended battery life, and paper-like readability. These types of displays are typically seen in black-and-white or grayscale versions and only use power when new content is being shown, making them perfect for places where prices change often but don't need constant screen refreshes. E-paper ESLs are visible even in direct sunlight, making them a preferred option for outdoor retail establishments or eco-friendly businesses seeking sustainable alternatives. For example, Amazon Fresh utilizes E-paper ESLs for displaying pricing and stock information clearly, aiding in effective stock control and customer contentment.

Get Customized Electronic Shelf Label Market - Request For Customized Report

By Display Size

The ≤ 3 Inches segment dominated the market with a 45% market share in 2023, which is widely used in retail settings, particularly in grocery stores, supermarkets, and convenience stores. These tags are favored for their small size, making them perfect for showing prices, barcodes, and promotions on tiny shelves. Their compact size also makes it simple to incorporate them into current retail designs without occupying a lot of space. Businesses such as SES-image tag and Pricer utilize these small ESLs to assist retailers in improving inventory management and changing product prices in real-time.

The ≥ 10-inch is accounted to have a faster CAGR during 2024-2032, driven by their growing popularity in various retail settings like department stores, warehouses, and electronics stores. These bigger screens provide improved visibility and can display in-depth product details, prices, promotions, and multimedia content, which makes them ideal for high-end product categories. The increasing need for improved customer interaction and advanced product showcasing features in upscale retail settings is fueling the fast expansion of this sector. Enterprises such as E Ink Holdings and Displaydata offer retail chains big-sized ESLs, allowing them to provide more engaging content and enhance the customer experience in stores.

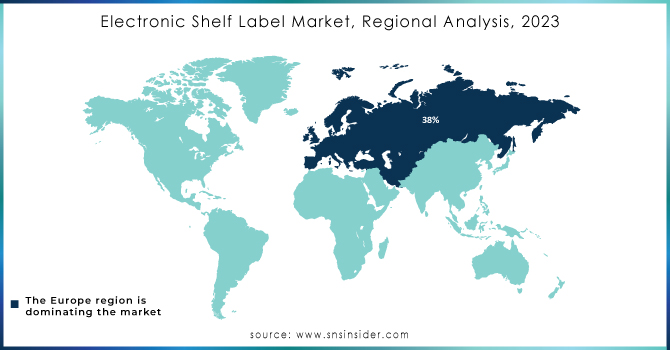

Electronic Shelf Label Market Regional Analysis:

Europe led the market in 2023 with a market share of 38% because of the quick integration of automation in retail settings. Major retailers like Carrefour, Metro AG, and Tesco have adopted ESL systems to improve price accuracy and operational efficiency. The growth is being driven by the region's emphasis on upgrading retail infrastructure and incorporating digital technologies. Governments in various European countries also promote the use of ESLs, particularly in supermarkets, hypermarkets, and specialty stores. Key players such as SES-imagotag and Pricer AB, offer sophisticated ESL solutions with real-time updates and data integration. Europe remains as the leading region in the worldwide ESL market due to its strong retail presence and focus on innovation.

The APAC region is to experience rapid growth during the forecast period in the ESL market due to the growth of retail industries in countries such as China, Japan, and South Korea. With the increase in urbanization, retailers are prioritizing enhancing the shopping experience by incorporating ESL methods. The increasing popularity of online shopping and the rise of organized retail also drive the need for effective shelf-labeling solutions. Samsung Electro-Mechanics and Displaydata are actively engaged in offering ESL technology in the APAC region. The rising retail sector and growing curiosity in automation make APAC the most favorable market for ESL implementation in the future.

KEY PLAYERS

The key players in the Electronic Shelf Label market are Advantech Inc, Altierre Corporation, Displaydata Limited, E Ink Holdings Inc, Herbert Retail Limited, M2COMM, Opticon Sensors Europe B.V, Diebold Nixdorf Incorporated, Teraoka Seiko Co Ltd, SoluM, SES-imagotag, Samsung Electronics Co. Ltd, & Other Players.

Recent Development

-

June 2023: Pricer presented their new gen of ESL, offering a higher battery life span, and better readability, with an improved e-paper technology. Those services are meant to enhance the operational efficiency of retailers by providing faster updates and integration with an AI-based pricing strategy.

-

May 2023: SES-imagotag launched the latest version of their VUSION Cloud Platform. This platform is a holistic solution, offering full digital transformation of physical stores, with real-time inventories, automatic price updating, and shopper behavior an alternate-based for Opera monitoring with the use of SES-imagotag’s ESL.

-

March 2023: Samsung publishes their new IoT-based electronic shelf label, with full integration of their Smart Retail solution to help retailers with a segmented targeting of their public, actively and passively. The system relies on minimum operating cost and maximum customer engagement through a high degree of connectivity.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 1.49 Billion |

| Market Size by 2031 | US$ 5.12 Billion |

| CAGR | CAGR of 14.75% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Drivers | • The growing role of electonic shelf labels (ELS) in a digitalized shopping era. |

| Opportunities | • Challenges and constraints delaying the adoption of ESL technology in emerging markets. |