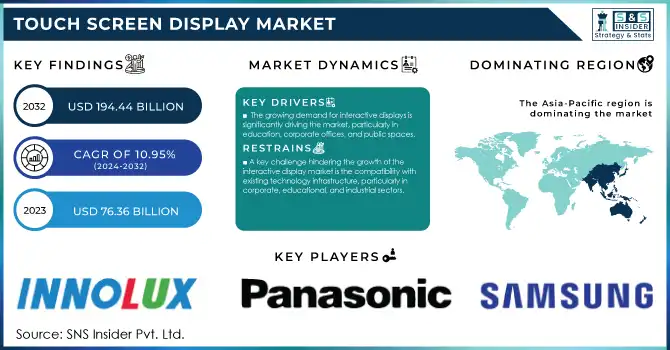

Touch Screen Display Market Size & Overview:

The Touch Screen Display Market Size was valued at USD 76.36 billion in 2023 and is expected to reach USD 194.44 billion by 2032, growing at a robust CAGR of 10.95% during the forecast period of 2024-2032.

The Touch Screen Display Market is experiencing substantial growth driven by the escalating demand for consumer electronics, particularly smartphones, tablets, and other touch-enabled devices. As technology continues to evolve, OLED and AMOLED display technologies are becoming more prevalent, offering superior color accuracy, better energy efficiency, and thinner form factors, which further fuel adoption in mobile devices and wearables.

Get More Information on Touch Screen Display Market - Request Free Sample Report

IoT and Big Data are transforming industries by enabling smart devices to collect and transmit vast amounts of real-time data, creating more demand for advanced touch interfaces to interact with these systems. Beyond consumer devices, sectors like automotive, retail, healthcare, and education are increasingly leveraging touch screen displays to provide more interactive, user-friendly experiences, further expanding the market.

The automotive sector is one of the most notable examples of touch screen integration, with 97% of vehicles sold in the United States now featuring at least one touchscreen. While the National Highway Traffic Safety Administration (NHTSA) mandated backup cameras in 2018 to save approximately 70 lives per year, the public's obsession with touchscreens in vehicles has grown far beyond just safety. Currently, 60 million vehicles are equipped with a center stack display, and that number is expected to increase to 75 million units by 2025, reaching 80 million units. The size of these screens is also expanding rapidly; in 2022, about 12 million vehicles had displays larger than 11 inches, and this number is expected to nearly double to 25 million by 2025 and 35 million, signaling a significant shift toward larger, more advanced touch interfaces in vehicles. While this demographic shift may alleviate some wage pressures from the higher salaries commanded by experienced workers, it also signals a steady drain of critical knowledge and skills from the workforce. Industries must act quickly to capture and disseminate this valuable knowledge before it is lost, as the demand for new technology, including advanced touch displays, continues to grow.The rising need for automation and remote access is also pushing demand in the enterprise sector. Touch screen displays are integral to self-service kiosks, point-of-sale (POS) systems, interactive digital signage, and smart home devices like thermostats and kitchen appliances, which are becoming central in modern homes. In conclusion, technological innovations and the integration of touch screens across a broad range of sectors are driving rapid expansion in the touch display market, with major advancements in display technologies like OLED and AMOLED being key contributors.

Touch Screen Display Market Dynamics

Drivers

-

The growing demand for interactive displays is significantly driving the market, particularly in education, corporate offices, and public spaces.

The shift towards more engaging and dynamic environments, where touch-enabled screens enable seamless communication, collaboration, and interaction, is a key factor in this rise. Interactive touchscreens are replacing traditional whiteboards, allowing for better student engagement through multimedia content and real-time collaboration, which is enhancing learning experiences and academic outcomes., this shift is particularly evident in the retail sector, where high-street experiences are being transformed with interactive touch displays that enhance customer engagement, enabling users to interact with the content and access tailored product information directly from the screen. these displays are becoming increasingly ubiquitous in smart retail, with more retail environments adopting touchscreens for point-of-sale (POS) systems and digital signage, which improves customer interaction and purchasing decisions. Design Reuse highlights how the evolution of small- and medium-sized AMFPD (Active Matrix Flat Panel Display) technologies has led to fluctuating revenue projections by application, particularly in educational and corporate sectors, due to their high adoption rate and ability to cater to diverse needs. The ability to interact with these screens is enhancing user experience, driving efficiency, and offering businesses more opportunities for brand interaction. The ongoing technological advancements, coupled with the growing demand for improved communication and engagement, are making interactive touch displays indispensable in these sectors, propelling significant growth in the market.

Restraints

-

A key challenge hindering the growth of the interactive display market is the compatibility with existing technology infrastructure, particularly in corporate, educational, and industrial sectors.

Many organizations continue to rely on legacy systems, which can create integration issues with new interactive touchscreens. Older devices, platforms, and display interfaces, such as resistive touchscreens, often lack the advanced capabilities found in modern systems, including multi-touch or gesture control features. The introduction of advanced displays—like the Lenovo Yoga Book 9i with dual 4K touchscreens—while offering cutting-edge features, may require significant upgrades or modifications to integrate with older systems, leading to additional costs and time investments. According to Electronics Weekly (2025), several interactive displays, such as 7-inch color touchscreens built to last 20,000 hours, may not align with the existing infrastructure in many businesses or educational institutions, as they may still be operating on outdated hardware or software. Moreover, the need for regular software updates and specialized drivers to ensure compatibility may cause disruptions in multi-device environments, leading to further complications. This issue is even more pronounced in specialized sectors like military applications, where touchscreen technology must meet stringent operational standards which may not align with older, less adaptable systems. These integration challenges present a significant barrier to widespread adoption, as organizations must ensure their current systems can accommodate these advanced interactive displays without large-scale overhauls. Given the increasing need for seamless connectivity across industries, resolving these compatibility issues is crucial for unlocking the full potential of interactive displays, ensuring that businesses and institutions can fully embrace the benefits of modern touch technology.

Touch Screen Display Market Segment Analysis

By Screen Type

In 2023, capacitive touch screens held the largest share of the Touch Screen Display Market, accounting for around 57%. This dominance is driven by their enhanced sensitivity, durability, and ability to support multi-touch functionality, making them a preferred choice for smartphones, tablets, consumer electronics, and automotive applications. Capacitive screens offer high clarity, fast response times, and greater resistance to wear compared to resistive screens. Their ability to detect touch through the electrical properties of the human body, without requiring pressure, improves the overall user experience. With growing, demand for more interactive and intuitive devices across various industries, the adoption of capacitive touch screens is set to continue expanding.

Infrared touch screens are expected to be the fastest-growing segment in the touch screen display market during the forecast period from 2024 to 2032. Their rapid growth is attributed to their versatility and ability to detect touch without physical contact, making them ideal for large displays, public kiosks, interactive signage, and other applications requiring durable, high-performance touch technology. Infrared touch screens offer advantages such as multi-touch capability, high sensitivity, and resistance to wear, making them suitable for a variety of industries, including retail, healthcare, and transportation. Additionally, their cost-effectiveness and ease of integration into large-format displays are further driving their adoption, ensuring continued market expansion.

By End User

In 2023, the residential segment accounted for approximately 59% of the touch screen display market, driven by the growing adoption of smart home technologies and interactive devices. With an increasing number of consumers integrating smart devices such as voice assistants, smart thermostats, and home automation systems into their daily lives, the demand for touch screen displays has surged. These displays provide enhanced user experience, offering intuitive and easy interaction for controlling home appliances, security systems, and entertainment devices. The rise in smart kitchens, where touch-enabled screens are incorporated into appliances like refrigerators and ovens, further boosts market growth. As smart home integration becomes more widespread, the residential segment is poised to continue its dominance in the Touch Screen Display Market, offering seamless connectivity and control.

The commercial segment is poised to be the fastest-growing sector in the Touch Screen Display Market from 2024 to 2032, driven by increasing demand for interactive technology in retail, hospitality, and corporate environments. Businesses are adopting touch screen displays for point-of-sale (POS) systems, digital signage, customer engagement, and collaborative workspaces. These displays enhance user interaction, streamline operations, and improve customer experiences. In retail, digital signage and self-service kiosks are transforming the shopping experience, while in corporate settings, touchscreens are enhancing productivity in meetings and presentations. As the need for efficient and interactive solutions grows, the commercial segment is expected to witness rapid expansion during the forecast period.

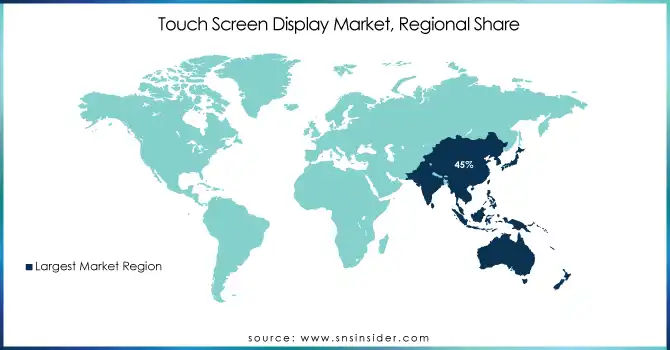

Touch Screen Display Market Regional Outlook

In 2023, the Asia-Pacific region dominates the Touch Screen Display Market, accounting for around 45% of the global share. This dominance is driven by rapid technological advancements, high manufacturing capabilities, and the increasing demand for touch-enabled devices across various industries such as retail, education, automotive, and healthcare. Countries like China, Japan, South Korea, and India play pivotal roles in this growth. China’s position as a manufacturing hub for consumer electronics and displays has significantly contributed to market expansion. Additionally, India’s growing adoption of smart technologies, coupled with South Korea and Japan’s advancements in interactive displays for smart retail and digital signage, is further propelling the region's market dominance. The increasing demand for smartphones, tablets, and industrial automation technologies in these countries also supports the region’s leadership in The Touch Screen Display Market. As Asia-Pacific continues to embrace innovation in consumer electronics and industrial applications, it is expected to retain its dominant position in the market through 2032.

North America is poised to be the fastest-growing region in the touch screen display market over the forecast period from 2024 to 2032. This growth is driven by the increasing adoption of interactive displays across diverse sectors, including retail, healthcare, and education. The U.S. and Canada are key contributors, with significant investments in technological advancements and infrastructure. The region’s high demand for advanced consumer electronics, coupled with the growing trend of smart home devices and digital signage, is boosting the market. Additionally, the rise of AI-driven touch solutions and innovation in automotive displays is further accelerating growth in North America.

Get Customized Report as per your Business Requirement - Request For Customized Report

Key Players

Some of the major key players in Touch Screen Display market along with their product

-

BOE Technology Group Co., Ltd. (LCD, OLED, and Touch Screen Displays)

-

Innolux Corporation (LCD Panels, Touch Screens)

-

AU Optronics Corp. (LCD Panels, Touch Screens, OLED Displays)

-

Panasonic Holdings Corporation (LCD, OLED Displays, Touch Screens)

-

Samsung Corporation (OLED Displays, Touch Screens, LCD Panels)

-

Corning Incorporated (Glass, Touch Screen Panels, Optical Materials)

-

Mouser Electronics, Inc. (Electronic Components, Touch Screen Modules)

-

FUJITSU (Touch Screen Displays, Industrial Displays)

-

NEC Corporation (LCD Displays, Touch Screens, Digital Signage)

-

DISPLAX (Touch Foils, Interactive Touch Displays)

-

Sharp Corporation (LCD, OLED Displays, Touch Panels)

-

LG Display (OLED, LCD, and Touch Screen Panels)

-

Japan Display Inc. (LCD Panels, Touch Screens)

-

ELO Touch Solutions (Interactive Touch Screens, Digital Signage)

-

TruTouch Technologies (Touch Screens, Interactive Display Solutions)

List of raw material suppliers and potential customers for the Touch Screen Display Market without mentioning specific products:

Raw Material Suppliers:

-

Corning Incorporated

-

3M Company

-

DuPont

-

Nitto Denko Corporation

-

Samsung SDI

-

LG Chem

-

Hanwa Total

-

Schott AG

-

BOE Technology Group Co., Ltd.

-

Sharp Corporation

Potential Customers:

-

Apple Inc.

-

Samsung Electronics

-

Microsoft

-

Sony Corporation

-

HP Inc.

-

Dell Technologies

-

Lenovo

-

Tesla Inc.

-

Panasonic Corporation

-

Google LLC

Recent Development

-

On September 2024, BOE Technology Group Co. Ltd. announced on September 5, 2024, that it will invest 63 billion yuan to establish a new AMOLED production line in Chengdu. This investment aims to enhance its production of high-end touch screens for mid-sized laptops and tablets, strengthening its presence in the growing OLED market.

-

On December 2024, Panasonic launched its new Balanced Home Elite and Elite Plus Series of Energy Recovery Ventilators (ERV) offering enhanced efficiency and versatility for single-family homes. The series, featuring models with varying CFM levels and mounting options, integrates Smart Flow technology and meets major building codes, providing professionals with customizable solutions for improving indoor air quality.

| Report Attributes | Details |

| Market Size in 2023 | USD 76.36 Billion |

| Market Size by 2032 | USD 194.44 Billion |

| CAGR | CAGR of 10.95% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Screen Type (Capacitive, Resistive, Optical, Infrared, Others) • By Application (Display Signage, Kiosks, Consumer Electronics) • By End User (Residential, Commercial, Industrial) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | BOE Technology Group Co., Ltd., Innolux Corporation, AU Optronics Corp., Panasonic Holdings Corporation, Samsung Corporation, Corning Incorporated, Mouser Electronics, Inc., FUJITSU, NEC Corporation, DISPLAX, Sharp Corporation, LG Display, Japan Display Inc., ELO Touch Solutions, TruTouch Technologies. |

| Key Drivers | • The growing demand for interactive displays is significantly driving the market, particularly in education, corporate offices, and public spaces. |

| Restraints | • A key challenge hindering the growth of the interactive display market is the compatibility with existing technology infrastructure, particularly in corporate, educational, and industrial sectors. |