Endocrine Testing Market Report Scope & Overview:

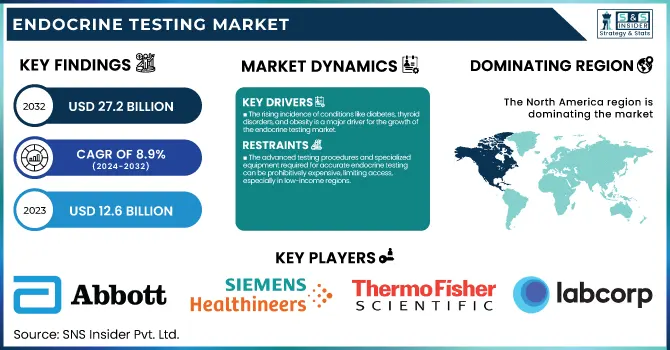

The Endocrine Testing Market Size was valued at USD 12.6 Billion in 2023 and is expected to reach USD 27.2 Billion by 2032, growing at a CAGR of 8.9% over the forecast period 2024-2032.

To Get more information on Endocrine Testing Market - Request Free Sample Report

The Endocrine testing market explores the increasing incidents of endocrine diseases to unveil the need for endocrine testing in clinical diagnosis. It analyzes testing demand and volume, highlighting growth in regions. The report examines the adoption of Immunoassays, PCR, and Mass Spectrometry. It also examines healthcare spending with a focus on government, private insurance, and out-of-pocket spending. The review encompasses global regulatory trends FDA approvals and CE markings, as well as adoption trends by region, with a particular emphasis on growth in emerging markets and improvements in healthcare infrastructure. The Endocrine Testing Market is experiencing significant growth driven by the increasing prevalence of endocrine disorders worldwide. The U.S. Department of Health and Human Services has introduced some programs to improve the screening and management of endocrine disorders which in turn is boosting the market growth.

Endocrine Testing Market Dynamics:

Drivers

-

The rising incidence of conditions like diabetes, thyroid disorders, and obesity is a major driver for the growth of the endocrine testing market.

The rising incidence of diabetes, thyroid disorders, and obesity has led to the rapid expansion of the endocrine testing market. Diabetes has a growing incidence in India, where 31 million new cases were reported. This troubling trend is primarily due to poor diets and lack of exercise, contributing to higher obesity rates. According to the Economic Survey 2024, 54% of the disease burden in India is attributable to unhealthy diets, reflecting the dire need for preventive action. A major risk factor for both diabetes and thyroid disorders, obesity has more than tripled among adults in India. The obesity rate rose from 18.9% to 22.9% among men and from 20.6% to 24% among women, according to data released by the National Family Health Survey (NFHS). A recent study indicates that over 800 million people worldwide now have diabetes, a disease that has doubled within the last 30 years. This increase is mainly because of the growing prevalence of obesity and an aging population, emphasizing the important demand for endocrine testing and treatment. These figures highlight the importance of endocrine testing in the diagnosis and management of diseases such as diabetes, thyroid dysfunction, and obesity, which in turn is propelling the market growth.

Restraints:

-

The advanced testing procedures and specialized equipment required for accurate endocrine testing can be prohibitively expensive, limiting access, especially in low-income regions.

Proper endocrine testing is critical for the diagnosis and treatment of hormonal disorders. However, these tests require complicated procedures as well as specific equipment, which can be too costly and make them inaccessible particularly in low-income areas. For instance, test kits for endocrine testing alone can cost between $100 to $700–$800, making them unaffordable for many healthcare facilities in underdeveloped regions. Most developing countries have poorly established healthcare systems that rely on traditional methods of diagnostic testing. Relying on these legacy methods leads to low-quality testing, with an unreliable power supply or fluctuations in temperature impacting the accuracy of the results. Furthermore, the absence of trained personnel and quality control material reduces the credibility of the endocrine tests in these countries. The scarcity of trained endocrinologists exacerbates the situation. For example, in Sub-Saharan Africa, the estimated endocrinologist-to-population ratio is 0.03 per 100,000 people, compared to 0.89 in the Americas and 4.84 in Europe. The shortage of expert providers results in delayed diagnosis and suboptimal management of endocrine disorders, leading to increased morbidity and mortality.

Opportunities:

-

Advancements in genetic testing and molecular diagnostics allow for tailored treatment plans based on an individual’s genetic makeup and hormonal profile.

The evolution of genetic testing and molecular diagnostics has transformed personalized medicine, allowing for therapies individualized for a person's unique genetic makeup and hormonal composition. According to recent research, genetic screening can prevent up to 25% of premature deaths from preventable diseases such as breast cancer, diabetes, and hypertension. NHS hospitals in the UK have started a world-first trial to identify more than 200 genetic diseases in newborns using whole genome sequencing in a bid to improve diagnosis and treatment. Likewise, Genomics Australia has been instituted in Australia, to incorporate genomic medicine into a national healthcare framework, beginning with cancer care, by offering to tailor medical care to the individual characteristics of each patient, including genomic data. The India molecular diagnostics market growth is supported by growing rates of predictive medicine, early diagnosis & treatment tracking. These developments underscore the transformative potential of genetic testing and molecular diagnostics in delivering personalized, effective, and timely medical interventions, thereby improving patient outcomes and advancing healthcare globally.

Challenges:

-

The complex nature of endocrine systems can lead to diagnostic errors, including false positives and negatives, potentially compromising patient outcomes.

Challenges due to the complexity of the endocrine system make it a challenging task resulting in potential false positives and false negatives that may harbour consequences on patient management and outcomes. Common endocrine disorders like thyroid dysfunctions, diabetes, and adrenal imbalances are typically diagnosed through hormone-level tests in the blood. These hormone levels, however, can vary based on multiple reasons including age, medication, and even stress, making diagnosing these conditions more complicated. For example, new data from the American Thyroid Association shows that around 20 million Americans have some type of thyroid disease, but up to 60 percent are undiagnosed, in part because lab results are not being interpreted correctly. A study published in the Journal of Clinical Endocrinology & Metabolism in 2024 found that nearly 15% of those who have hypothyroidism will receive a false positive on routine screening tests and that 10% of those with the condition are misdiagnosed as having other disorders. Such test errors have the potential to lead to unnecessary treatments or missed diagnoses, which can bring serious long-term health consequences. Additionally, endocrine dysfunctions like polycystic ovary syndrome (PCOS) are frequently misdiagnosed; according to the latest findings from the Endocrine Society, about 70% of women with PCOS remain undiagnosed due to overlapping symptoms with other conditions. Because hormone regulation is complex, the reliance on high-quality, accurate diagnostic tests is essential in performing excellent care for patients.

Endocrine Testing Market Segmentation Analysis:

By Test Type

The thyroid stimulating hormone (TSH) test segment dominated the market and held the largest share in terms of revenue, at 27% in 2023. The dominance can be explained with the high prevalence of thyroid disorders and the importance of TSH testing in the diagnosis and management of those diseases. There are an estimated 20 million Americans with some form of thyroid disease, and up to 60% of people with thyroid disease are unaware of their disease, according to the American Thyroid Association. The TSH test is known to have the highest sensitivity and specificity for diagnosing primary thyroid disorders and is commonly used as a first-line screening test for thyroid disease.

The recommendation from the U.S. Preventive Services Task Force to perform TSH screening among all adults aged 35 and older every five years has further spurred demand. Moreover, the growing prevalence of autoimmune thyroid diseases including Hashimoto's thyroiditis and Graves' disease has driven the segment's growth. Hashimoto’s disease, affects about 5 in 100 Americans, according to the National Institute of Diabetes and Digestive and Kidney Diseases. Owing to its high sensitivity and specificity, as well as its ability to recognize subclinical thyroid dysfunction, TSH tests have become a staple of clinical practice, forming the basis for their market leadership.

By Technology

In 2023, the tandem mass spectrometry segment dominated the market with the largest revenue share of 25% The widespread use of this technology in endocrine testing is primarily driven by its sensitivity and specificity and also by the fact that multiple analytes can be analyzed simultaneously. Tandem mass spectrometry has revolutionized the field of endocrine testing by offering superior analytical performance compared to traditional immunoassays. There has been a recent increase in the adoption of tandem mass spectrometry-based tests for common endocrine disorders by the U.S. Food and Drug Administration (FDA), which hailed their reliability and accuracy.

Newborn screening programs, which utilize tandem mass spectrometry extensively, cover 99% of all babies born in the United States, according to the Centers for Disease Control and Prevention (CDC). It enables the screening of more than 30 metabolic and endocrine disorders from a single blood spot. NIH also has put funding into research to scale up to different types of endocrine testing the same technologies of tandem mass spectrometry. For example, the Newborn Screening Translational Research Network, which is funded by the NIH, has been conducting research on new tandem mass spectrometry-based methods for expanding the panel to include additional endocrine disorders. Its dominance in the market is in part due to the performance of the technology to deliver accurate measurements of steroid hormones, thyroid hormones, and vitamin D metabolites.

By End-use

The hospitals segment held the largest revenue share at 68% in 2023. The considerable market share is attributed to the full range of hospital services, higher diagnosis capabilities, and a growing number of hospital admissions related to endocrine disease. In 2022, there were approximately 577,000 inpatient discharges with a principal diagnosis of endocrine, nutritional, and metabolic diseases in the United States, according to data from the Healthcare Cost and Utilization Project (HCUP) of the Agency for Healthcare Research and Quality.

Further, hospitals often serve as the first point of care for patients with complicated endocrine disorders as they bring multiple testing and treatment modalities to the patient under one roof. Endocrine, nutritional, and metabolic diseases constituted 7.2% (16.9 million visits) of all outpatient department visits in 2021, according to the National Hospital Ambulatory Medical Care Survey. Additionally, hospitals may have access to specialized endocrine testing platforms, such as high-tiered analyzers, skilled personnel, and space that can allow for the exclusion of interfering substances such as hemolysis, icterus, and lipemia. According to data from the Centers for Medicare & Medicaid Services (CMS), greater than 80% of complex endocrine tests were performed at hospital outpatient departments, underscoring that most complex testing occurs at the same institutions that provide advanced care.

Endocrine Testing Market Regional Insights:

In 2023, North America dominated the endocrine testing market with a 39% market share. The dominance of North America can be ascribed to the developed healthcare infrastructure in addition to high healthcare expenditure and the presence of key market players. The region's high prevalence of endocrine disorders also contributes to its market dominance. Another factor that contributes to the high growth of the endocrine disorder market in the region. According to the American Diabetes Association 37.3 million Americans, or 11.3% of the population had diabetes in 2023. According to the National Cancer Institute, thyroid cancer cases in the U.S. increased to 43,800 in 2023, contributing to the need for endocrine testing.

Asia Pacific region growing with the fastest CAGR over the forecast period. The rapid growth of the Asia Pacific region is attributed to rising healthcare spending, improving healthcare infrastructure, and increasing awareness regarding endocrine disorders. The World Health Organization reports that the prevalence of diabetes in Southeast Asia is expected to increase by 74% by 2045, creating a substantial market for endocrine testing. Government programs, including India's NPCDCS (National Programme for Prevention and Control of Cancer, Diabetes, Cardiovascular Diseases, and Stroke) are aiding the market growth by promoting early diagnosis and treatment of endocrine disorders.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players in Endocrine Testing Market:

Key Service Providers/Manufacturers

-

Abbott Laboratories (ARCHITECT i2000SR Immunoassay Analyzer, D-Cellar)

-

Thermo Fisher Scientific (Fisher HealthCare, Immunoassay Analyzer)

-

Siemens Healthineers (ADVIA Centaur XP Immunoassay System, Atellica Solution)

-

Roche Diagnostics (Cobas e411 Immunoassay Analyzer, Elecsys Estradiol)

-

Beckman Coulter (Access Immunoassay Systems, DXI 800)

-

LabCorp (Eclia Technology, Serum TSH Test)

-

Mindray (BC-6800 Chemistry Analyzer, CL-3000i Immunoassay System)

-

Bio-Rad Laboratories (DiaSorin LIAISON, CFX96 Real-Time PCR)

-

Ortho Clinical Diagnostics (VITROS ECiQ Immunodiagnostic System, VITROS 3600)

-

PerkinElmer (Chemagic 360, AutoDELFIA)

Key Users

-

Cleveland Clinic

-

Johns Hopkins Medicine

-

Mayo Clinic

-

Mount Sinai Health System

-

University of California, Los Angeles (UCLA)

-

Stanford Health Care

-

MedStar Health

-

Baylor College of Medicine

-

Children's Hospital Boston

-

Henry Ford Health System

Recent Developments:

-

Abbott Laboratories announced new FDA clearances for its automated immunoassay platform capable of improving the speed and accuracy of endocrine testing for hospital laboratories in June 2024. The system offers a comprehensive menu of endocrine tests, including thyroid, fertility, and diabetes markers.

-

In January 2025, Siemens Healthineers launched a software solution for AI-powered interpretation of endocrine test results, providing additional diagnostic support in complex endocrine disorders. The software is compatible with natively used laboratory information systems, and the programmed assessment has been validated in several clinical trials.

| Report Attributes | Details |

|---|---|

|

Market Size in 2023 |

USD 12.6 Billion |

|

Market Size by 2032 |

USD 27.2 Billion |

|

CAGR |

CAGR of 8.9% From 2024 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2032 |

|

Historical Data |

2020-2022 |

|

Report Scope & Coverage |

Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

|

Key Segments |

• By Test Type (Estradiol (E2) Test, Follicle Stimulating Hormone (FSH) Test, Dehydroepiandrosterone Sulfate (DHEAS) Test, Progesterone Test, Human Chorionic Gonadotropin (hCG) Hormone Test, Luteinizing Hormone (LH) Test, Testosterone Test, Cortisol Test, Thyroid Stimulating Hormone (TSH) Test, Prolactin Test, Insulin Test, Others) |

|

Regional Analysis/Coverage |

North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

|

Company Profiles |

Abbott Laboratories, Thermo Fisher Scientific, Siemens Healthineers, Roche Diagnostics, Beckman Coulter, LabCorp, Mindray, Bio-Rad Laboratories, Ortho Clinical Diagnostics, PerkinElmer. |